India Complementary and Alternative Medicine Market Size, Share, Trends, and Forecast by Type, Disease Indications, Distribution Channel, and Region, 2025-2033

India Complementary and Alternative Medicine Market Overview:

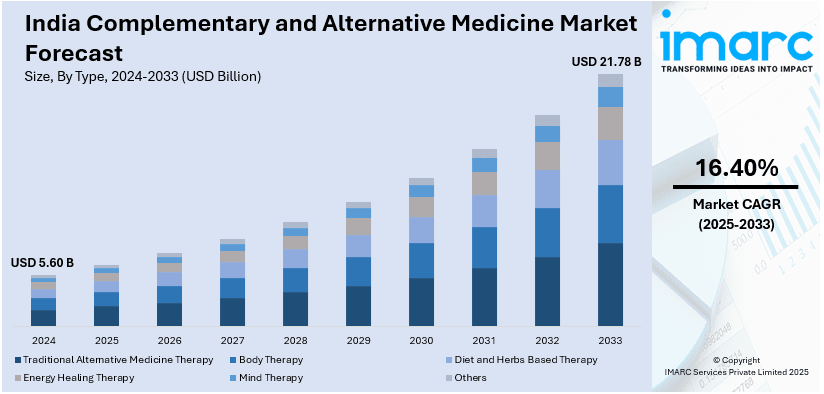

The India complementary and alternative medicine market size reached USD 5.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.78 Billion by 2033, exhibiting a growth rate (CAGR) of 16.40% during 2025-2033. The market is witnessing significant growth, driven by the government initiatives driving the growth of ayurveda and traditional medicine and the rising consumer demand for herbal and natural wellness products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.60 Billion |

| Market Forecast in 2033 | USD 21.78 Billion |

| Market Growth Rate 2025-2033 | 16.40% |

India Complementary and Alternative Medicine Market Trends:

Government Initiatives Driving the Growth of Ayurveda and Traditional Medicine

The market for complementary and alternative medicine (CAM) within India burgeoned with factors largely attributable to government initiatives for Ayurveda, Yoga, Unani, Siddha, and Homeopathy (AYUSH). The Indian Government has been making major investments in research and standardization for the promotion globally of traditional medicine through the Ministry of AYUSH. National AYUSH Mission (NAM) as well as establishing the WHO Global Centre for Traditional Medicine in India are making the country a well-positioned similar-to-modal country for holistic healthcare. For instance, in July 2024, India committed US$ 85 million over 10 years (2022–2032) to support the WHO Global Traditional Medicine Centre’s programming, strengthening global research and promotion of traditional medicine at a Geneva signing ceremony. Increased funding for AYUSH hospitals, research centers, and educational institutions is enhancing the credibility and acceptance of CAM therapies. Furthermore, collaborations between AYUSH and allopathic healthcare providers are fostering integrative medicine practices, allowing patients to access both conventional and alternative treatments. Export demand for Indian herbal medicine and AYUSH-based products is also on the rise, with global markets recognizing their therapeutic potential. The digitalization of AYUSH services through telemedicine and mobile health apps is further expanding accessibility, making traditional medicine more convenient for consumers. With continued policy support, the Indian CAM market is expected to witness strong growth, positioning India as a leader in alternative healthcare solutions.

To get more information on this market, Request Sample

Rising Consumer Demand for Herbal and Natural Wellness Products

The growing consumer preference for herbal and natural wellness products is a key trend shaping India’s complementary and alternative medicine (CAM) market. Increasing awareness of the benefits of plant-based therapies, combined with concerns about the side effects of synthetic drugs, is driving the demand for Ayurvedic formulations, herbal supplements, and functional foods. For instance, as per industry reports, in April 2024, India's Ayurveda product market is projected to grow from $7 billion (Rs 57,450 crore) to $16.27 billion (Rs 1.2 trillion) by FY28, as per a recent study. Consumers are actively seeking immunity-boosting products, stress-relief solutions, and digestive health remedies, particularly in the wake of the COVID-19 pandemic. Major domestic and international companies are expanding their presence in India’s herbal healthcare sector, launching new formulations backed by scientific research. Brands like Patanjali, Dabur, Himalaya, and Baidyanath are leveraging e-commerce platforms to enhance product accessibility and reach a wider audience. The rise of direct-to-consumer (DTC) wellness brands, offering personalized herbal solutions, is also contributing to market growth. Government efforts to standardize herbal medicine quality, through initiatives like the Pharmacopoeia Commission for Indian Medicine & Homoeopathy (PCIM&H), are further boosting consumer confidence. Additionally, the increasing integration of Ayurveda and herbal remedies into mainstream healthcare facilities is reinforcing their acceptance. With rising health consciousness and regulatory advancements, the demand for herbal and natural CAM products in India is expected to grow significantly.

India Complementary and Alternative Medicine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, disease indications and distribution channel.

Type Insights:

- Traditional Alternative Medicine Therapy

- Body Therapy

- Diet and Herbs Based Therapy

- Energy Healing Therapy

- Mind Therapy

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes traditional alternative medicine therapy, body therapy, diet and herbs based therapy, energy healing therapy, mind therapy, and others.

Disease Indications Insights:

- Arthritis

- Cancer

- Asthma

- Diabetes

- Cardiology

- Neurology

- Others

A detailed breakup and analysis of the market based on the disease indications have also been provided in the report. This includes arthritis, cancer, asthma, diabetes, cardiology, neurology, and others.

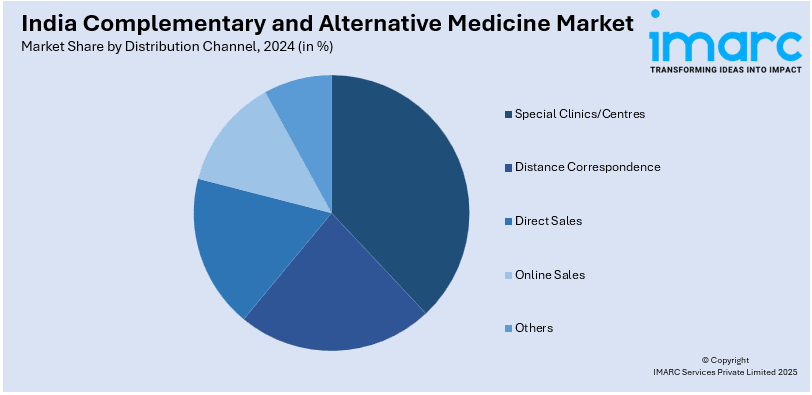

Distribution Channel Insights:

- Special Clinics/Centres

- Distance Correspondence

- Direct Sales

- Online Sales

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes special clinics/centres, distance correspondence, direct sales, online sales, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Complementary and Alternative Medicine Market News:

In December 2024, the Ministry of AYUSH announced the launch of a central sector scheme to promote AYUSH systems globally. It supports international recognition, market development, exports, academic research, and stakeholder interactions, fostering awareness through AYUSH Academic Chairs, training workshops, and international collaborations for Ayurveda, Yoga, Naturopathy, Unani, Siddha, Sowa-Rigpa, and Homeopathy.

India Complementary and Alternative Medicine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Traditional Alternative Medicine Therapy, Body Therapy, Diet and Herbs Based Therapy, Energy Healing Therapy, Mind Therapy, Others |

| Disease Indications Covered | Arthritis, Cancer, Asthma, Diabetes, Cardiology, Neurology, Others |

| Distribution Channels Covered | Special Clinics/Centres, Distance Correspondence, Direct Sales, Online Sales, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India complementary and alternative medicine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India complementary and alternative medicine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India complementary and alternative medicine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in the region was valued at USD 5.60 Billion in 2024.

The India complementary and alternative medicine market is projected to exhibit a CAGR of 16.40% during 2025-2033, reaching a value of USD 21.78 Billion by 2033.

The key drivers include government initiatives supporting Ayurveda and traditional medicine, rising consumer demand for herbal and natural wellness products, and increased awareness of plant-based therapies. The promotion of AYUSH by the Indian government and the growing preference for holistic healthcare solutions are also contributing to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)