India Computer Aided Design Market Size, Share, Trends and Forecast by Component, Development Model, Application, Technology, End User, and Region, 2025-2033

India Computer Aided Design Market Overview:

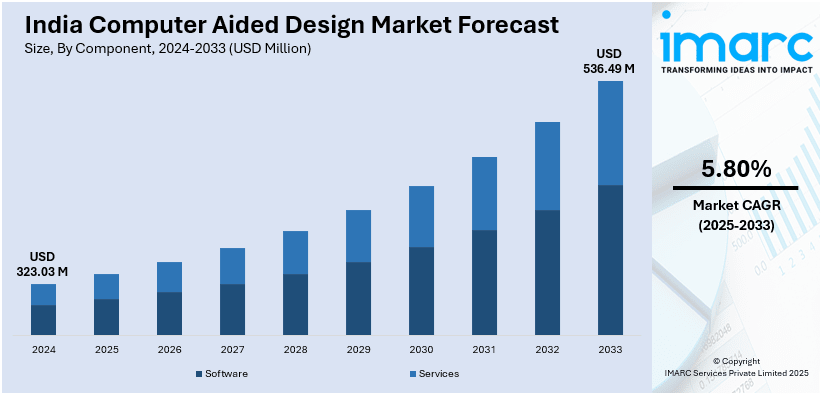

The India computer aided design market size reached USD 323.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 536.49 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The India computer aided design market share is expanding, driven by the rising reliance on advanced design software to develop innovative and efficient vehicles, along with the growing usage of artificial intelligence (AI) that aids in automating repetitive tasks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 323.03 Million |

| Market Forecast in 2033 | USD 536.49 Million |

| Market Growth Rate 2025-2033 | 5.80% |

India Computer Aided Design Market Trends:

Growing vehicle manufacturing

The rising vehicle manufacturing is fueling the India computer aided design market growth. With India becoming a major hub for automobile production, ranging from passenger cars to electric vehicles (EVs) and commercial trucks, computer aided design software is playing a crucial role in designing components, improving aerodynamics, and optimizing structural strength. As per the data released by the Federation of Automobile Dealers Associations (FADA), in 2024, the retail vehicle revenue indicated a 5.18% increase year-on-year (YoY) in India, with overall sales totaling 40,73,843 units, up from 38,73,381 units in CY23. Automakers and suppliers use computer aided design tools for 3D modeling, prototyping, and simulation, helping them to reduce design errors, speed up production, and lower costs. The escalating demand for EVs is further encouraging computer aided design adoption, as manufacturers are developing new battery technologies, lightweight materials, and energy-optimized designs. Additionally, regulatory standards on safety and emissions are motivating companies to refine vehicle structures utilizing computer aided design-based simulations and testing. Automotive startups and research centers are also leveraging computer aided design for futuristic vehicle concepts, including autonomous and connected cars. As India’s vehicle production is rising, the dependence on computer aided design solutions for efficiency and compliance is rising, making it an essential tool in the automotive industry’s rapid evolution.

To get more information on this market, Request Sample

Rising usage of AI

The increasing employment of AI is offering a favorable India computer aided design market outlook. AI-oriented computer aided design software is helping engineers and designers to automate repetitive tasks, generate optimized designs, and detect errors early, saving time and reducing costs. Industries like automotive, aerospace, and architecture are using AI-based computer aided design tools to create complex models with greater precision and less manual effort. AI also enables predictive design, where software suggests modifications and improvements as per real-time simulations and past data. With AI integration, computer aided design systems can analyze large datasets to refine material selection, structural integrity, and energy optimization in designs. The rise of generative design, where AI explores multiple design possibilities based on specific parameters, is further revolutionizing how structures are formed. Government agencies are also investing in AI projects, thereby positively influencing the market. In March 2024, the Cabinet sanctioned an allocation exceeding INR 10,300 Crore for the IndiaAI Mission, representing a crucial advancement in enhancing India’s AI ecosystem. A key element of this initiative was the ‘IndiaAI Compute Capacity’, which was intended to establish a scalable AI computing framework by implementing more than 10,000 graphics processing units (GPUs) via strategic partnerships between the public and private sectors.

India Computer Aided Design Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, development model, application, technology, and end user.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Development Model Insights:

- Cloud

- On-premises

A detailed breakup and analysis of the market based on the development model have also been provided in the report. This includes cloud and on-premises.

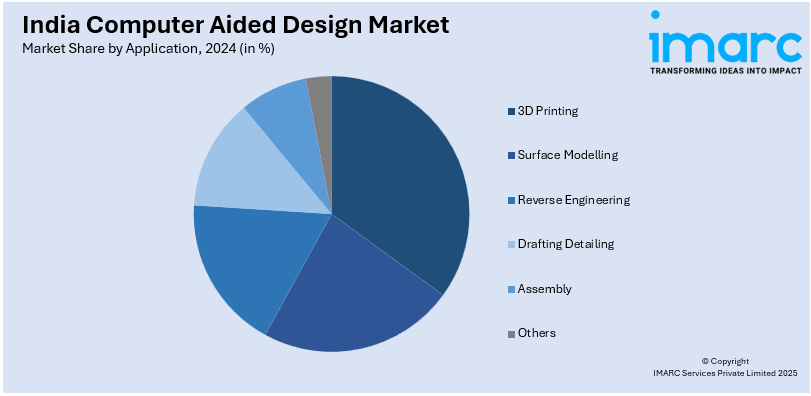

Application Insights:

- 3D Printing

- Surface Modelling

- Reverse Engineering

- Drafting Detailing

- Assembly

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes 3D printing, surface modelling, reverse engineering, drafting detailing, assembly, and others.

Technology Insights:

- 2D

- 3D

The report has provided a detailed breakup and analysis of the market based on the technology. This includes 2D and 3D.

End User Insights:

- Electrical and Electronics

- Automotive

- Civil and Construction

- Energy and Materials

- Industrial Equipment

- Media and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes electrical and electronics, automotive, civil and construction, energy and materials, industrial equipment, media and entertainment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Computer Aided Design Market News:

- In January 2025, the Chief of Army Staff (COAS), General Upendra Dwivedi, toured the advanced facilities at the Artificial Limb Centre (ALC) in Pune, India. The visit showcased the new improvements in prosthetic services, with the General receiving updates on the center’s innovative computer aided design and manufacturing facilities. General Dwivedi also opened the Upper Limb Training Lab, marking a substantial upgrade to the center’s ability to offer customized rehabilitation for upper limb amputees.

- In September 2024, the Government Dental College and Research Institute (GDC&RI), one of India's oldest and most esteemed dental schools, was set for a major upgrade with the implementation of modern equipment and services. The recently opened digital dentistry center represented the first of its kind within a government hospital. The facility featured cutting-edge technology, inculcating computer aided manufacturing systems and computer aided design that transformed restorative dentistry by allowing accurate and efficient creation of dental prostheses.

India Computer Aided Design Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Development Models Covered | Cloud, On-premises |

| Applications Covered | 3D Printing, Surface Modelling, Reverse Engineering, Drafting Detailing, Assembly, Others |

| Technologies Covered | 2D, 3D |

| End Users Covered | Electrical and Electronics, Automotive, Civil and Construction, Energy and Materials, Industrial Equipment, Media and Entertainment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India computer aided design market performed so far and how will it perform in the coming years?

- What is the breakup of the India computer aided design market on the basis of component?

- What is the breakup of the India computer aided design market on the basis of development model?

- What is the breakup of the India computer aided design market on the basis of application?

- What is the breakup of the India computer aided design market on the basis of technology?

- What is the breakup of the India computer aided design market on the basis of end user?

- What is the breakup of the India computer aided design market on the basis of region?

- What are the various stages in the value chain of the India computer aided design market?

- What are the key driving factors and challenges in the India computer aided design market?

- What is the structure of the India computer aided design market and who are the key players?

- What is the degree of competition in the India computer aided design market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India computer aided design market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India computer aided design market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India computer aided design industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)