India Concentrated Photovoltaic Market Size, Share, Trends and Forecast by Product, Concentration, Application, and Region, 2025-2033

India Concentrated Photovoltaic Market Overview:

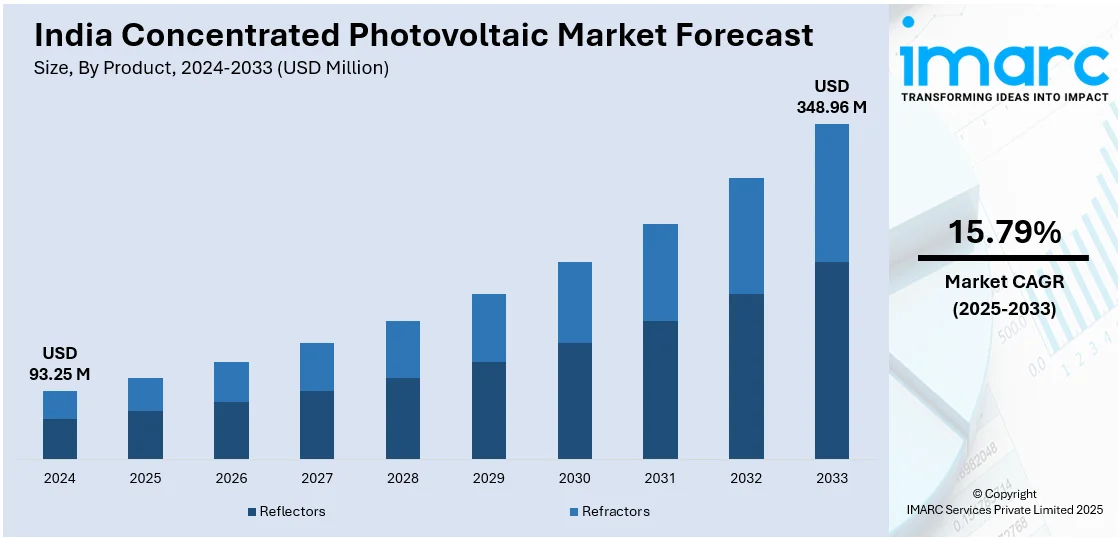

The India concentrated photovoltaic market size reached USD 93.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 348.96 Million by 2033, exhibiting a growth rate (CAGR) of 15.79% during 2025-2033. The rising solar energy adoption, government incentives for renewable power, advancements in high-efficiency multi-junction solar cells, increasing demand for sustainable energy, declining CPV technology costs, and growing investments in solar infrastructure are boosting market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 93.25 Million |

| Market Forecast in 2033 | USD 348.96 Million |

| Market Growth Rate 2025-2033 | 15.79% |

India Concentrated Photovoltaic Market Trends:

Increasing Investments in High-Efficiency Multi-Junction Solar Cells

Multi-junction solar cells (MJSCs), which have a higher conversion efficiency than conventional silicon-based photovoltaic cells, are causing a major change in the concentrated photovoltaic (CPV) industry in India. These sophisticated cells significantly increase energy output by utilizing many semiconductor layers to catch a greater spectrum of sunlight. Increased investments in CPV technology are being driven by MJSCs, which have efficiencies of over 40%, almost double that of traditional silicon solar cells. The Indian government is actively supporting high-efficiency solar innovations through initiatives like the Production-Linked Incentive (PLI) scheme, which has allocated ₹24,000 crore ($2.9 billion) to boost domestic solar cell manufacturing by 2025. This policy push is expected to accelerate CPV adoption, particularly in large-scale solar installations. Additionally, the levelized cost of electricity (LCOE) for CPV systems is projected to decline by 15% by 2025, making it increasingly competitive with traditional solar PV solutions. The combination of efficiency gains, government incentives, and cost reductions positions CPV as a key player in India’s renewable energy expansion, supporting the country’s ambitious clean energy targets.

To get more information on this market, Request Sample

Expansion of CPV in Utility-Scale Solar Projects and Hybrid Systems

India’s push for large-scale solar projects and hybrid renewable energy solutions is accelerating the deployment of concentrated photovoltaic (CPV) technology. CPV is increasingly integrated with energy storage and wind power to enhance grid stability, with hybrid solar projects expected to account for 20% of new solar capacity additions by 2025. Utility-scale CPV installations are gaining traction in high solar-irradiation regions such as Rajasthan and Gujarat, where maximizing energy yield is crucial. As a result, India’s solar capacity is projected to reach 280 GW by 2030, with CPV playing an expanding role in the renewable energy mix. Foreign investments are further driving this growth, with international firms injecting over $1.5 billion in renewable energy FDI in 2023, accelerating CPV adoption. These trends underscore India’s commitment to high-efficiency solar technologies and hybrid renewable solutions, positioning CPV as a key component of the country’s clean energy transition.

India Concentrated Photovoltaic Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, concentration, and application.

Product Insights:

- Reflectors

- Refractors

The report has provided a detailed breakup and analysis of the market based on the product. This includes reflectors and refractors.

Concentration Insights:

- High Concentration Photovoltaic

- Low Concentration Photovoltaic

A detailed breakup and analysis of the market based on the concentration have also been provided in the report. This includes high concentration photovoltaic and low concentration photovoltaic.

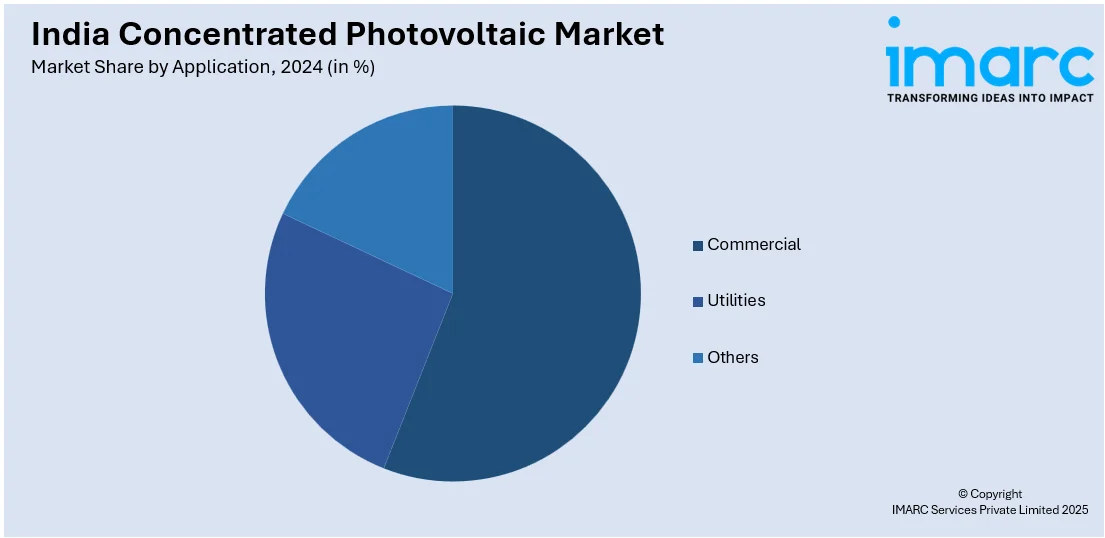

Application Insights:

- Commercial

- Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, utilities, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Concentrated Photovoltaic Market News:

- April 2024: NTPC issued a tender for a 50-MW concentrated solar power plant incorporating a thermal energy storage system. The project will run for eight hours during peak and non-solar hours, connecting to the interstate transmission grid. The developer will build, own, and manage the project, delivering 50 MW of renewable energy generation and assuring yearly availability of 70% of contractual capacity.

- March 2024: The state-owned Solar Energy Corporation of India (SECI) launched a tender for a 500-MW concentrated solar-thermal power (CSP) storage project set to begin next year. The RFP is now being designed and will be published for an initial capacity of 500 MW of green energy available 24 hours a day. The project is planned to be constructed in Gujarat, Rajasthan, or Andhra Pradesh due to their greater solar radiation levels.

India Concentrated Photovoltaic Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reflectors, Refractors |

| Concentrations Covered | High Concentration Photovoltaic, Low Concentration Photovoltaic |

| Applications Covered | Commercial, Utilities, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India concentrated photovoltaic market performed so far and how will it perform in the coming years?

- What is the breakup of the India concentrated photovoltaic market on the basis of product?

- What is the breakup of the India concentrated photovoltaic market on the basis of concentration?

- What is the breakup of the India concentrated photovoltaic market on the basis of application?

- What are the various stages in the value chain of the India concentrated photovoltaic market?

- What are the key driving factors and challenges in the India concentrated photovoltaic market?

- What is the structure of the India concentrated photovoltaic market and who are the key players?

- What is the degree of competition in the India concentrated photovoltaic market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India concentrated photovoltaic market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India concentrated photovoltaic market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India concentrated photovoltaic industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)