India Concrete Mixer Market Size, Share, Trends and Forecast by Type, Model Type, Capacity, Application, and Region, 2025-2033

India Concrete Mixer Market Overview:

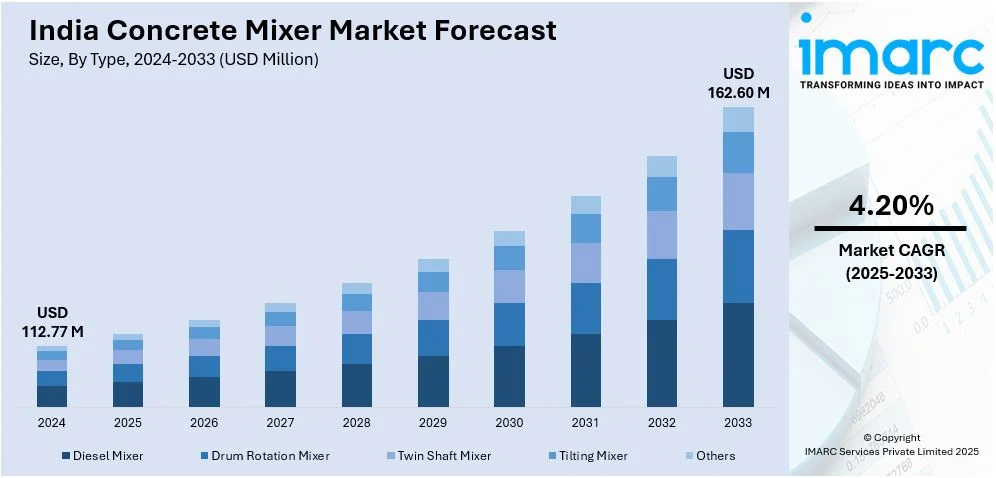

The India concrete mixer market size reached USD 112.77 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 162.60 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The market is driven by rapid urbanization, increasing infrastructure projects, government investments in smart cities, growing demand for affordable housing, ongoing advancements in construction technology, rising foreign direct investments (FDI), and the expansion of the ready-mix concrete (RMC) industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 112.77 Million |

| Market Forecast in 2033 | USD 162.60 Million |

| Market Growth Rate 2025-2033 | 4.20% |

India Concrete Mixer Market Trends:

Rising Adoption of Advanced and Automated Concrete Mixers

The India concrete mixer market is expanding owing to its availability of advanced automated mixing solutions because builders seek higher efficiency with precise results and reduced labor expenses. Modern construction sites increasingly favor self-loading transit mixers with Internet of Things (IoT)-monitoring systems, Global Positioning System (GPS) tracking, and automated batch systems, which have replaced traditional manual techniques of concrete mixing. Moreover, construction sites benefit from these innovations because they create uniform product quality while decreasing material loss and generating higher operational efficiency. The adoption of advanced concrete mixers by the construction industry is further driven by government initiatives such as “Digital India” and “Make in India,” while the adoption of smart construction equipment is spurring the market demand. Volumetric concrete mixers have also emerged as a vital element in the market because these systems let users combine exact amounts of materials directly at project sites. Furthermore, the growing infrastructure sector, tracing from smart cities and public-private partnerships, as well as rapid urbanization, is leading to a substantial boost in the India concrete mixer market share. For instance, in April 2024, Kilsaran introduced two electric concrete trucks, each equipped with five batteries, offering a range of approximately 300 kilometers per charge, depending on the load. This initiative aims to reduce carbon emissions and promote sustainable construction practices in India.

To get more information on this market, Request Sample

Growth in Ready-Mix Concrete (RMC) and Prefabricated Construction

The growth in RMC and prefabricated construction is driving the India concrete mixer market growth, as it encourages manufacturers to produce high-capacity, efficient devices. The expansion of RMC plants is further driven by its increase throughout metropolitan and tier-2 cities because projects involving large-scale infrastructure and real estate require consistent, high-quality concrete. For example, in March 2024, Shree Cement Limited acquired five operational RMC plants in Mumbai from StarCrete LLP for ₹33.50 crore. This strategic move marked Shree Cement's foray into the RMC sector, aiming to leverage the growing demand in metropolitan regions. Moreover, the combination of growing prefabricated construction adoption and modular methods in commercial buildings and highways, and metro projects is spurring the demand for portable concrete mixers that operate on-site. Furthermore, the government promotes sustainable fast construction through initiatives like Pradhan Mantri Awas Yojana (PMAY) and Smart Cities Mission, significantly enhancing the India concrete mixer market outlook. Apart from this, the growing environmental concerns have motivated contractors to choose RMC as it allows for reduced dust pollution and minimizes cement waste. As a result, the rapid growth of infrastructure development will sustain the rising demand for effective concrete mixing solutions throughout India.

India Concrete Mixer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, model type, capacity, and application.

Type Insights:

- Diesel Mixer

- Drum Rotation Mixer

- Twin Shaft Mixer

- Tilting Mixer

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes diesel mixer, drum rotation mixer, twin shaft mixer, tilting mixer, and others.

Model Type Insights:

- Stationary

- Portable

A detailed breakup and analysis of the market based on the model type have also been provided in the report. This includes stationary and portable.

Capacity Insights:

- 0-5 m3

- 5-10 m3

- Above 10m3

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes 0-5 m3, 5-10 m3, and above 10 m3.

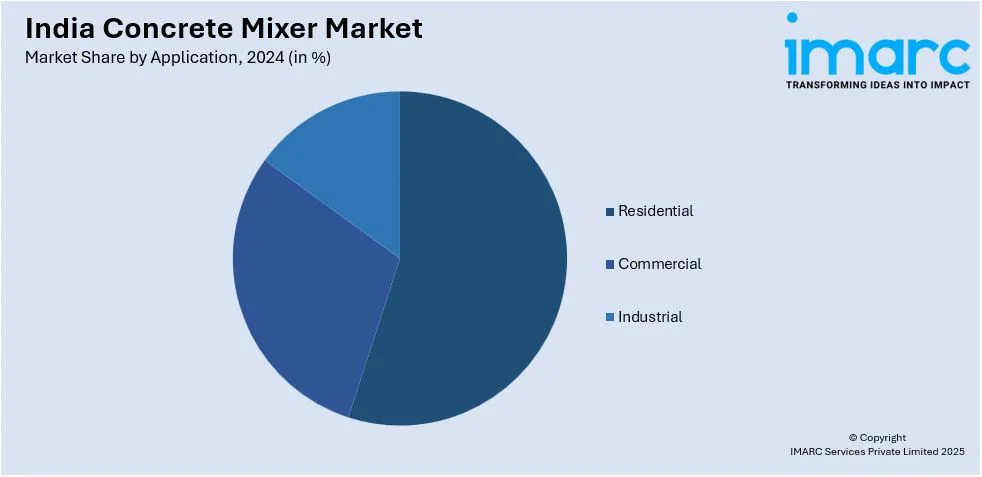

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Concrete Mixer Market News:

- In June 2024, Ajax Engineering Pvt., an Indian concrete equipment manufacturer backed by Kedaara Capital, announced plans for an initial public offering (IPO) to raise approximately $240 million. The IPO aims to fund expansion initiatives and technological advancements in concrete mixer manufacturing, potentially enhancing the availability of advanced mixing solutions in the Indian market.

- In January 2024, Cemen Tech launched its new generation CD2 dual bin volumetric concrete mixer. The model features a unique split bin with individual compartments to transport and blend various supplementary cementing materials, enhancing the efficiency and flexibility of concrete mixing operations in India.

India Concrete Mixer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Diesel Mixer, Drum Rotation Mixer, Twin Shaft Mixer, Tilting Mixer, Others |

| Model Types Covered | Stationary, Portable |

| Capacities Covered | 0-5 M3, 5-10 M3, above 10 M3 |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India concrete mixer market performed so far and how will it perform in the coming years?

- What is the breakup of the India concrete mixer market on the basis of type?

- What is the breakup of the India concrete mixer market on the basis of model type?

- What is the breakup of the India concrete mixer market on the basis of capacity?

- What is the breakup of the India concrete mixer market on the basis of application?

- What is the breakup of the India concrete mixer market on the basis of region?

- What are the various stages in the value chain of the India concrete mixer market?

- What are the key driving factors and challenges in the India concrete mixer?

- What is the structure of the India concrete mixer market and who are the key players?

- What is the degree of competition in the India concrete mixer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India concrete mixer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India concrete mixer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India concrete mixer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)