India Condensing Unit Market Size, Share, Trends and Forecast by Type, Function, Compressor Type, Refrigerant, End User, and Region, 2025-2033

India Condensing Unit Market Overview:

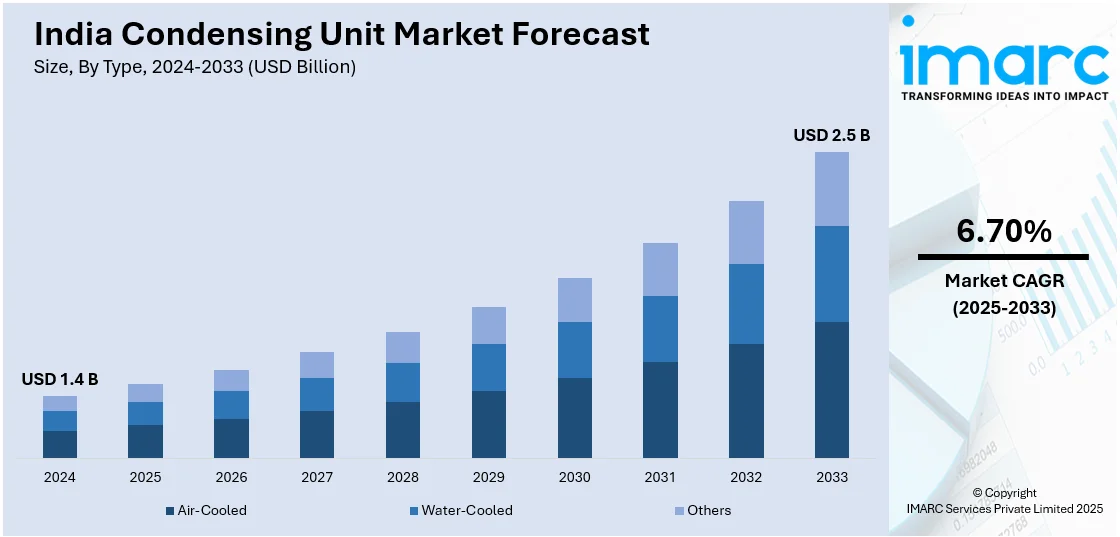

The India condensing unit market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The market is growing with accelerating demand for energy efficiency, sustainability efforts, regulatory favor, technology improvements, and the shift towards environmentally friendly refrigerants, and thus is being adopted across numerous applications and industries on a large scale.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Market Growth Rate 2025-2033 | 6.70% |

India Condensing Unit Market Trends:

Rising Demand for Energy-Efficient Solutions

The India condensing unit market is witnessing a robust transition toward power-efficient solutions, supported by increasing costs of electricity and environmental worries. Companies across various industries are giving high priority to less power-consuming refrigeration systems that provide maximum cooling performance. In April 2024, LG Electronics unveiled its latest air conditioner line in India, with features such as high-end condensing units for better energy efficiency. The series, which includes the Energy Manager, provides smart cooling personalization and energy-saving features, delivering better performance with long-lasting, corrosion-proof elements like copper condensers with Gold Fin coating. Additionally, improved compressor technology, variable speed drives, and improved heat exchangers are being incorporated in advanced condensing units to provide greater energy savings. Moreover, the focus on energy efficiency is finding confluence with India's sustainability efforts, motivating people to utilize eco-friendly refrigerants and intelligent control systems. Greater emphasis on green building ratings for commercial and industrial buildings is also driving high-efficiency coolers' use. Incentives by governments that focus on saving energy are additionally driving the usage. With end consumers in retail, hospitality, food processing, and healthcare searching for long-term saving on operations, the market is likely to significantly boost its need for condensing units with even better energy efficiency in the foreseeable future.

To get more information on this market, Request Sample

Growth of Cold Chain Infrastructure

India's increasing cold chain network is propelling the demand for high-performance, dependable condensing units. For instance, in August 2024, Danfoss India introduced Optyma Pack Condensing Unit at Food Pro 2024, improving efficiency of bulk milk cooling with its twin-fan concept, hydrophilic finish, and meeting RoHS as well as REACH requirements. Moreover, owing to rapid growth in sectors like food processing, pharma, and logistics, refrigeration and temperature control during storage and transportation have assumed significance. On-demand online grocery stores and heightened exports of perishable products further accentuate the demand for an efficient refrigeration system. Government policies for enhancing the cold chain industry through subsidies and other financial incentives are promoting the usage of sophisticated condensing units. Technology advancements in remote monitoring, intelligent temperature controls, and modular refrigeration technology are providing better efficiency and dependability. Also, the movement toward decentralized rural cold storage infrastructure is driving the demand for low-capacity, energy-efficient condensing units. With industries expanding cold storage facilities, demand for refrigeration systems that ensure accurate cooling conditions with minimal energy usage is likely to grow significantly

Adoption of Low-GWP Refrigerants

India's refrigeration sector is swiftly changing to the use of low-global warming potential (GWP) refrigerants, keeping in sync with global efforts toward sustainability and environmental policies. The high-greenhouse gas-emitting traditional refrigerants are being replaced with hydrocarbons, ammonia, and CO₂-based cooling systems. The change is pushed by the policies of the government favoring sustainable solutions along with international efforts toward minimizing carbon prints. Industry applications that depend upon refrigeration, such as retail food, cold storage, and industrial production, are highly applying condensing units that employ low-GWP refrigerants to achieve environmental compliance. Further, next-generation refrigerants are enhancing efficiency of the systems and lowering system operating costs in the long run. The attention towards sustainability also fosters study on next-generation refrigerants of ultra-low environmental footprint. With industries shifting towards ecofriendly cooling options, the adoption of condensing units using climate-friendly refrigerants is likely to pick up speed, scripting India's refrigeration market for the future.

India Condensing Unit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, function, compressor type, refrigerant, and end user.

Type Insights:

- Air-Cooled

- Water-Cooled

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes air-cooled, water-cooled, and others.

Function Insights:

- Air Conditioning

- Refrigeration

- Heat Pumps

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes air conditioning, refrigeration, and heat pumps.

Compressor Type Insights:

- Reciprocating Compressors

- Screw Compressors

- Rotary Compressors

- Others

The report has provided a detailed breakup and analysis of the market based on the compressor type. This includes reciprocating compressors, screw compressors, rotary compressors, and others.

Refrigerant Insights:

- Fluorocarbons

- Hydrocarbons

- Inorganics

A detailed breakup and analysis of the market based on the refrigerant have also been provided in the report. This includes fluorocarbons, hydrocarbons, and inorganics.

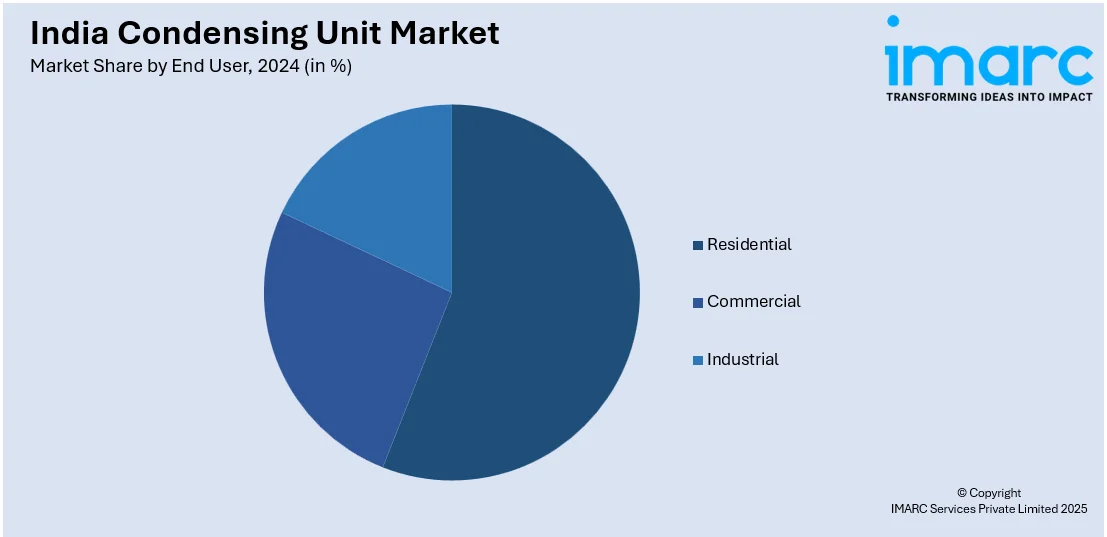

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Condensing Unit Market News:

- In April 2024, LG Electronics introduced its new air conditioner series in India with the Energy Manager for personalized cooling and increased energy efficiency. Supported by smart capabilities, WiFi connectivity, and advanced technologies such as 4-in-1/6-in-1 conversion, the new series offers better performance and longevity, both in split and window options.

- In February 2024, Voltas launched cutting-edge HVAC solutions, such as green Inverter Scroll Chillers, which come with advanced condensing units for effective cooling in commercial environments. These chillers, with IoT technology and ecofriendly refrigerants, deliver improved energy efficiency and dependable performance, in line with Voltas' vision of sustainable and intelligent cooling solutions.

India Condensing Unit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air-Cooled, Water-Cooled, Others |

| Functions Covered | Air Conditioning, Refrigeration, Heat Pumps |

| Compressor Types Covered | Reciprocating Compressors, Screw Compressors, Rotary Compressors, Others |

| Refrigerants Covered | Fluorocarbons, Hydrocarbons, Inorganics |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India condensing unit market performed so far and how will it perform in the coming years?

- What is the breakup of the India condensing unit market on the basis of type?

- What is the breakup of the India condensing unit market on the basis of function?

- What is the breakup of the India condensing unit market on the basis of compressor type?

- What is the breakup of the India condensing unit market on the basis of refrigerant?

- What is the breakup of the India condensing unit market on the basis of end user?

- What is the breakup of the India condensing unit market on the basis of region?

- What are the various stages in the value chain of the India condensing unit market?

- What are the key driving factors and challenges in the India condensing unit?

- What is the structure of the India condensing unit market and who are the key players?

- What is the degree of competition in the India condensing unit market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India condensing unit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India condensing unit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India condensing unit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)