India Condom Market Size, Share, Trends and Forecast by Product Type, Gender, Distribution Channel, and Region, 2026-2034

India Condom Market Summary:

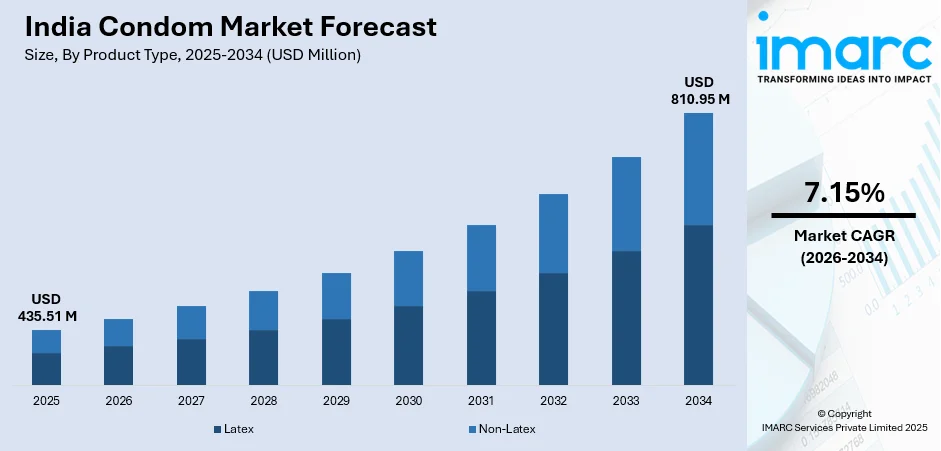

The India condom market size was valued at USD 435.51 Million in 2025 and is projected to reach USD 810.95 Million by 2034, growing at a compound annual growth rate of 7.15% from 2026-2034.

The market is driven by rising awareness about sexual health and family planning, government initiatives promoting safe sex practices, and increasing urbanization across the country. Growing acceptance of contraceptive methods among the youth population, expanding distribution networks through retail and e-commerce channels, and shifting social attitudes toward reproductive health are further propelling demand. The market continues to witness steady expansion as public health campaigns normalize condom usage, supporting the India condom market share.

Key Takeaways and Insights:

-

By Product Type: Latex dominates the market with a share of 76% in 2025, driven by superior elasticity, durability, cost-effectiveness, reliable protection against sexually transmitted infections, widespread availability, and strong consumer preference patterns.

-

By Gender: Male leads the market with a share of 91% in 2025, owing to higher awareness, established usage patterns, affordability, extensive government distribution programs, widespread retail availability, and decades of educational initiatives.

-

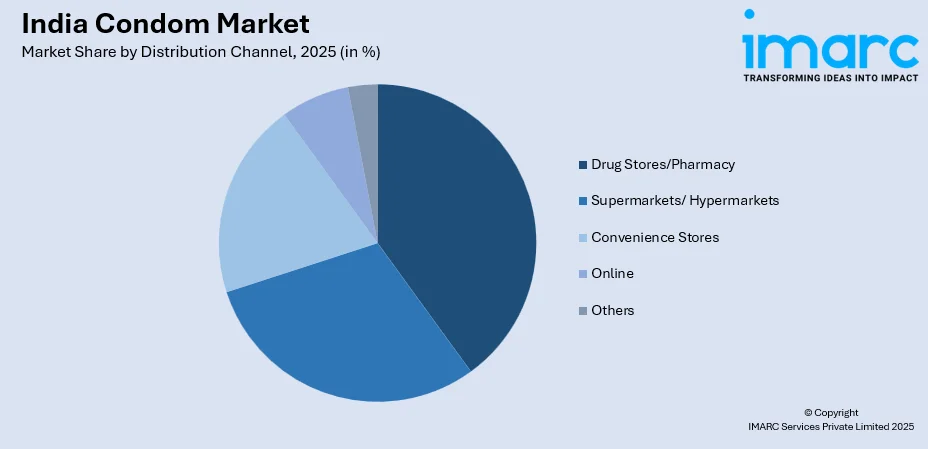

By Distribution Channel: Drug stores/pharmacy represents the largest segment with a market share of 32% in 2025, driven by healthcare-related trust, pharmacist guidance, convenient accessibility, superior product assortment, and professional retail environments.

-

By Region: North India leads the market with a share of 30% in 2025, owing to population concentration in Delhi-NCR, higher disposable incomes, advanced retail infrastructure, and well-developed distribution networks.

-

Key Players: The India condom market exhibits a moderately consolidated competitive structure, with multinational personal care corporations competing alongside established domestic manufacturers across various price segments and product categories, leveraging brand recognition and extensive distribution networks.

To get more information on this market Request Sample

The India condom market is experiencing robust growth driven by multiple converging factors that are reshaping the sexual wellness landscape across the country. Increasing awareness regarding sexual health and reproductive well-being, particularly among the urban youth population, is driving adoption rates. Government initiatives and public health campaigns focused on family planning and prevention of sexually transmitted infections have significantly contributed to normalizing condom usage. The rapid expansion of organized retail networks and e-commerce platforms has enhanced product accessibility, especially in tier-two and tier-three cities. According to sources, in January 2025, Blinkit delivered 1,22,000 condom packs nationwide during New Year celebrations, highlighting strong demand for sexual wellness products via quick-commerce platforms. Moreover, rising urbanization, changing lifestyle patterns, and growing emphasis on personal health management are encouraging consumers to prioritize safe sexual practices. Additionally, the emergence of premium and innovative product variants catering to diverse consumer preferences is further stimulating market expansion.

India Condom Market Trends:

Growing Preference for Premium and Innovative Product Variants

The India condom market is witnessing a significant shift toward premium and innovative product offerings as consumers increasingly seek enhanced experiences and superior quality. Manufacturers are responding by introducing ultra-thin variants, textured designs, flavored options, and products with specialized features to cater to evolving preferences. In September 2024, Durex launched Close Fit Invisible, India’s first close-fit ultra-thin condom, addressing low condom penetration and targeting urban consumers seeking enhanced intimacy, comfort, and premium sexual wellness experiences. Furthermore, this premiumization trend is particularly pronounced among urban consumers who demonstrate willingness to pay higher prices for differentiated products that offer improved comfort and satisfaction. The focus on innovation extends to packaging designs and marketing approaches that resonate with younger demographics seeking modern lifestyle-oriented products.

Rising Adoption of E-commerce and Digital Distribution Channels

Digital transformation is reshaping the distribution landscape of the condom market in India, with e-commerce platforms emerging as a preferred purchasing channel for many consumers. According to reports, in December 2025, Swiggy Instamart reported a Chennai user placed 228 condom orders worth ₹1,06,398, while 1 in every 127 orders included condoms and September purchases surged 24%, indicating strong digital adoption. Furthermore, online retail offers the advantage of privacy and discretion, which addresses social stigma concerns that may deter purchases through traditional retail channels. The proliferation of specialized health and wellness platforms, along with subscription-based delivery services, has enhanced convenience and accessibility. This trend is particularly impactful in reaching consumers in semi-urban and rural areas where physical retail presence may be limited, thereby expanding the market's geographic footprint.

Emergence of Sustainable and Eco-Friendly Product Options

Environmental consciousness is increasingly influencing consumer choices in the India condom market, driving demand for sustainable and eco-friendly alternatives. As per sources, Sirona India’s vegan, 100% natural latex Bleu condoms campaign #ComeClean launched to promote conscious, chemical-free sexual wellness products with sustainably sourced materials. Moreover, manufacturers are responding by developing vegan-certified condoms, products with biodegradable packaging, and formulations free from harsh chemicals. This trend aligns with the broader shift toward conscious consumption among younger demographics who prioritize environmental responsibility alongside product functionality. The emergence of brands specifically focused on sustainable sexual wellness products indicates growing market potential for eco-conscious offerings that appeal to environmentally aware consumers seeking cruelty-free alternatives.

Market Outlook 2026-2034:

The India condom market is poised for sustained revenue growth throughout the forecast period, supported by favorable demographic trends and evolving social attitudes toward sexual wellness. Continued government support through public health programs and free distribution initiatives will maintain baseline demand while premium segment expansion drives revenue enhancement. The integration of digital commerce platforms with traditional retail networks will broaden market reach across geographic segments. Innovation in product formulations and marketing strategies targeting younger demographics will accelerate adoption rates. The market generated a revenue of USD 435.51 Million in 2025 and is projected to reach a revenue of USD 810.95 Million by 2034, growing at a compound annual growth rate of 7.15% from 2026-2034.

India Condom Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Latex | 76% |

| Gender | Male | 91% |

| Distribution Channel | Drug Stores/Pharmacy | 32% |

| Region | North India | 30% |

Product Type Insights:

- Latex

- Non-Latex

Latex dominates with a market share of 76% of the total India condom market in 2025.

Latex maintains a dominant position in the India condom market owing to the material's superior elasticity, durability, and proven effectiveness as a reliable barrier method for contraception and infection prevention purposes. Natural rubber latex sourced from domestic production, particularly from southern Indian states, ensures consistent supply and highly competitive pricing for manufacturers nationwide. As per sources, in July 2025, HLL Lifecare Limited announced annual production of 221.7 Crore condoms across eight factories, reinforcing its position as one of the largest condom manufacturers globally. Furthermore, the well-established manufacturing infrastructure for latex-based products supports widespread availability across all major distribution channels, including pharmacies, retail outlets, supermarkets, convenience stores, and online platforms.

Consumer familiarity with latex, reinforced through decades of public health messaging and extensive government distribution programs, creates strong preference patterns among users nationwide. The inherent cost-effectiveness of latex production enables manufacturers to offer products across various price points, making them highly accessible to diverse consumer segments throughout the country. Continued investment in quality improvement and ongoing product innovation within the latex category sustains its market leadership position, while expanding product options attract new consumers seeking enhanced features and premium experiences.

Gender Insights:

- Male

- Female

Male leads with a share of 91% of the total India condom market in 2025.

Male commands most of the market share due to well-established usage patterns, extensive awareness campaigns, and widespread availability through multiple distribution channels across the country. Government health programs primarily focus on male condom distribution, creating strong baseline demand through free and subsidized supply to various target populations. According to sources, in January 2024, Cupid Limited secured Rs. 16.23 Crore orders from the Central Medical Services Society for male condoms, supporting government health initiatives and national family planning programmes. Moreover, the product category benefits from decades of educational initiatives that have successfully normalized usage among the male population, establishing condoms as essential personal health products for sexually active individuals nationwide.

The affordability and accessibility of male condoms across pharmacies, retail outlets, and online platforms reinforce their dominant market position throughout the country. Manufacturers continue to introduce innovative variants targeting male consumers with enhanced features, textures, and premium offerings designed to improve overall user experience. While female condom awareness is gradually increasing through educational initiatives and targeted campaigns, the established infrastructure, strong consumer acceptance, and extensive distribution networks for male products maintain the significant market share differential between the two categories.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/ Hypermarkets

- Convenience Stores

- Drug Stores/Pharmacy

- Online

- Others

Drug stores/pharmacy exhibits a clear dominance with a 32% share of the total India condom market in 2025.

Drug stores/pharmacy represents the leading distribution channel for condoms in India, benefiting significantly from strong consumer trust in healthcare-associated retail environments and professional settings. Pharmacies offer the distinct advantage of professional guidance and recommendation from trained pharmacists, which many consumers highly value when purchasing personal health products. The widespread presence of pharmacy networks across urban and rural areas ensures convenient accessibility for consumers seeking quality contraceptive products in trusted and familiar retail environments throughout the country.

These typically maintain comprehensive product assortments covering multiple brands and variants, enabling consumers to make well-informed choices based on their specific preferences and requirements. The healthcare context of pharmacy purchases helps effectively overcome social stigma often associated with condom buying in other retail settings. Additionally, pharmacies serve as important touchpoints for public health messaging and product education, reinforcing their critical role as trusted distribution partners for manufacturers while actively supporting broader awareness initiatives and comprehensive consumer education programs.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates with a market share of 30% of the total India condom market in 2025.

North India leads regional market share driven by substantial population concentration in major metropolitan areas including Delhi, the National Capital Region, and surrounding urban centers throughout the northern states. Higher income levels in these areas strongly support premium product adoption and brand-conscious purchasing behavior among urban consumers. The region benefits from advanced retail infrastructure, well-developed distribution networks, and strong presence of organized retail chains that ensure widespread product availability across multiple consumer touchpoints in both urban and semi-urban locations.

Active public health initiatives and awareness programs implemented across North Indian states have contributed significantly to higher adoption rates among the general population. The concentration of educational institutions and young working professionals in urban centers creates highly favorable demographic conditions for sustained market growth. E-commerce penetration in the region further enhances accessibility and supports the rapid expansion of online sales channels, enabling consumers to purchase products conveniently and discreetly while accessing a wider range of brands and product variants.

Market Dynamics:

Growth Drivers:

Why is the India Condom Market Growing?

Increasing Awareness of Sexual Health and Family Planning

The rising awareness regarding sexual health and family planning represents a fundamental driver of market expansion in India. Government-led initiatives and public health campaigns have been instrumental in educating the population about safe sex practices and the importance of contraception. Educational programs implemented through schools, colleges, and community outreach have helped destigmatize discussions around reproductive health. The proliferation of digital media and social platforms has amplified awareness messaging, particularly among younger demographics who are receptive to information about sexual wellness. Healthcare professionals and pharmacists increasingly engage in patient education, reinforcing the importance of consistent condom use for disease prevention and family planning objectives. As per sources, in December 2025, Manforce Condoms partnered with designer Ashley Rebello for a fashion showcase on World AIDS Day, promoting HIV awareness, safe sex, and destigmatizing sexual health conversations across India.

Government Support and Public Health Distribution Programs

Extensive government support through subsidized distribution programs and public health initiatives significantly contributes to market growth. National programs focused on family welfare and infectious disease prevention ensure widespread availability of condoms through public health facilities across the country. Free distribution initiatives targeting vulnerable populations and high-risk groups maintain consistent baseline demand. The integration of condom distribution within broader reproductive health services enhances accessibility, particularly in underserved rural and semi-urban areas. Government procurement and supply chain networks support both domestic manufacturers and distribution partners, creating a stable foundation for market expansion while addressing public health objectives. According to reports, the Central Medical Services Society procured 5.88 Crore condoms for India’s National Family Planning Programme, ensuring adequate stock to support free distribution and public health objectives.

Expanding Retail and E-commerce Distribution Networks

The continuous expansion of organized retail networks and e-commerce platforms is substantially enhancing product accessibility across geographic segments. Modern trade formats including supermarkets, hypermarkets, and convenience store chains provide convenient purchasing environments that reduce purchase hesitancy. E-commerce growth has been particularly transformative, offering privacy and discretion that address social stigma concerns while reaching consumers in areas with limited physical retail presence. Subscription-based delivery services and specialized health and wellness platforms are creating new consumption channels. The omnichannel retail approach adopted by leading manufacturers ensures product availability through multiple touchpoints, supporting market penetration in both urban and emerging market territories.

Market Restraints:

What Challenges the India Condom Market is Facing?

Social Stigma and Cultural Barriers

Persistent social stigma and cultural taboos surrounding discussions of sexual health continue to impede market growth in certain segments of the population. Conservative attitudes in traditional communities create hesitancy in purchasing and openly discussing contraceptive products. This barrier is particularly pronounced in rural areas where community perceptions significantly influence individual behaviour and purchasing decisions.

Competition from Alternative Contraceptive Methods

The availability and promotion of alternative contraceptive methods present competitive pressure on condom adoption rates. Oral contraceptives, intrauterine devices, and sterilization procedures offer options that some consumers perceive as more convenient for long-term family planning. Educational gaps regarding the unique disease prevention benefits of condoms compared to alternative methods may influence consumer choices.

Distribution Challenges in Rural and Remote Areas

Fragmented distribution infrastructure and logistical challenges in reaching rural and remote areas limit market penetration in significant population segments. Limited retail presence in remote locations reduces accessibility and convenience for potential consumers. Supply chain inefficiencies and transportation constraints can result in inconsistent product availability in underserved geographic markets.

Competitive Landscape:

The India condom market exhibits a moderately consolidated competitive structure characterized by the presence of established multinational corporations alongside prominent domestic manufacturers. Competition occurs across multiple dimensions including product innovation, pricing strategies, distribution reach, and brand positioning. Leading players leverage extensive distribution networks, strong brand recognition, and diversified product portfolios to maintain market positions. The competitive environment encourages continuous innovation in product formulations, packaging designs, and marketing approaches. Strategic initiatives including new product launches, channel partnerships, and digital marketing campaigns are common competitive tactics. Manufacturers are increasingly focusing on premiumization strategies while maintaining affordable product lines to address diverse consumer segments.

Recent Developments:

-

In January 2025, Mankind Pharma’s Manforce revealed regional condom flavour preferences in India. Paan remains popular in Uttar Pradesh, jasmine is preferred in southern states, while chocolate and strawberry dominate nationally. The insights underscore diverse consumer tastes and Manforce’s focus on catering to local preferences across different regions of India.

India Condom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Latex, Non-Latex |

| Genders Covered | Male, Female |

| Distribution Channels Covered | Supermarkets/ Hypermarkets, Convenience Stores, Drug Stores/Pharmacy, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India condom market size was valued at USD 435.51 Million in 2025.

The India condom market is expected to grow at a compound annual growth rate of 7.15% from 2026-2034 to reach USD 810.95 Million by 2034.

Latex held the largest share, driven by superior elasticity, proven effectiveness in infection prevention, cost-competitive pricing, widespread consumer familiarity established through decades of public health programs, and extensive availability across distribution channels.

Key factors driving the India condom market include increasing sexual health awareness, government-supported distribution programs, expanding retail and e-commerce networks, shifting social attitudes, rising urbanization, and growing demand for premium product variants.

Major challenges include persistent social stigma and cultural barriers affecting purchase behavior, competition from alternative contraceptive methods, distribution limitations in rural and remote areas, price sensitivity among lower-income consumers, and gaps in sexual health education.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)