India Connected Logistics Market Size, Share, Trends and Forecast by Component, Software, Technology, Devices, Transportation Mode, End Use Industry, and Region, 2025-2033

India Connected Logistics Market Overview:

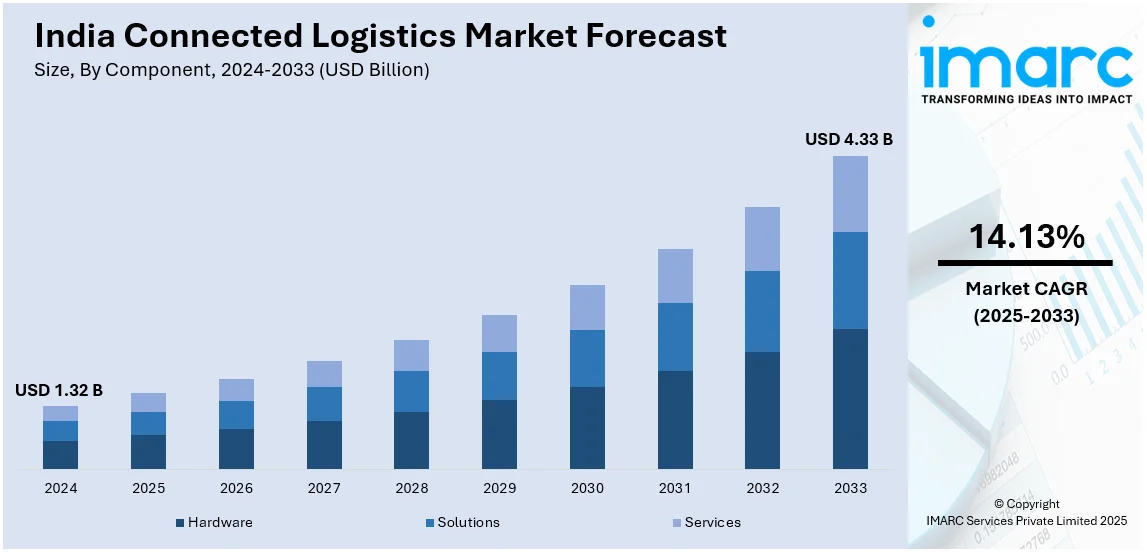

The India connected logistics market size reached USD 1.32 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.33 Billion by 2033, exhibiting a growth rate (CAGR) of 14.13% during 2025-2033. The increasing e-commerce penetration, implementation of government initiatives, growing IoT and AI adoption, rising demand for real-time tracking, enhanced cold chain infrastructure, improved 5G connectivity, and surging investments in automation and telematics are some of the major factors positively impacting India connected logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.32 Billion |

| Market Forecast in 2033 | USD 4.33 Billion |

| Market Growth Rate (2025-2033) | 14.13% |

India Connected Logistics Market Trends:

Expansion of 5G Connectivity to Strengthen Smart Logistics

The rollout of 5G networks is positively influencing the India connected logistics market outlook, as it enables faster and more reliable data transmission between supply chain stakeholders. According to the Ministry of Communications, as of October 31, 2024, 5G services have been deployed in every State and Union Territory (UT) in the country. And 779 of the 783 districts in the nation have 5G service. With ultra-low latency and high-speed connectivity, 5G is enhancing the performance of telematics solutions, smart fleet management systems, and automated guided vehicles (AGVs) in warehouses. The enhanced network capabilities provide instantaneous communication between vehicles (V2V) and infrastructure (V2I), reducing delays and improving fleet coordination. Smart warehouses equipped with 5G-powered robotic process automation (RPA) can streamline sorting, picking, and packaging operations with greater efficiency. Besides this, 5G-driven IoT applications are strengthening last-mile delivery networks by enabling precise geofencing and drone-based logistics operations, reducing congestion in urban centers. E-commerce and third-party logistics (3PL) providers are leveraging 5G-enabled analytics to refine dynamic pricing strategies and optimize delivery routes in real time. As 5G adoption grows across India, connected logistics solutions are becoming more robust, thereby enhancing overall supply chain agility.

To get more information on this market, Request Sample

Expansion of E-Commerce Driving Connected Logistics Growth in India

The rapidly growing e-commerce sector is a key driver of the India connected logistics market growth. According to the India Brand Equity Foundation, the e-commerce industry in India is expected to have grown significantly to a value of USD 325 Billion by 2030. The steady growth in the e-commerce sector is propelling the demand for advanced digital solutions, automation, and real-time tracking technologies. Additionally, the rapid adoption of online shopping, which is fueled by increasing internet penetration, affordable smartphones, and digital payment solutions, is making logistics providers integrate connected technologies to enhance operational efficiency and meet rising consumer expectations for faster deliveries. Also, e-commerce companies are investing in smart warehousing solutions, utilizing AI-driven inventory management systems and automated sorting mechanisms to optimize fulfillment processes. The growing demand for same-day and next-day deliveries further intensifies the need for predictive analytics, route optimization, and last-mile delivery automation. Telematics solutions powered by internet of things (IoT) sensors are enabling real-time shipment tracking, geofencing, and fleet performance monitoring to ensure seamless logistics operations. As e-commerce continues to expand into Tier-2 and Tier-3 cities, connected logistics solutions are playing a crucial role in overcoming last-mile delivery challenges, improving supply chain visibility, and supporting the sector’s rapid growth.

India Connected Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, software, technology, devices, transportation mode, and end use industry.

Component Insights:

- Hardware

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, solutions, and services.

Software Insights:

- Asset Management

- Warehouse IoT

- Security

- Data Management

- Network Management

- Streaming Analytics

A detailed breakup and analysis of the market based on the software have also been provided in the report. This includes asset management, warehouse IoT, security, data management, network management, and streaming analytics.

Technology Insights:

- Bluetooth

- Cellular

- Wi-Fi

- Zig Bee

- NFC

- Satellite

The report has provided a detailed breakup and analysis of the market based on the technology. This includes Bluetooth, cellular, Wi-Fi, zig bee, NFC, and satellite.

Devices Insights:

- Gateways

- RFID Tags

- Sensor Nodes

A detailed breakup and analysis of the market based on the devices have also been provided in the report. This includes gateways, RFID tags, and sensor nodes.

Transportation Mode Insights:

- Roadways

- Railways

- Airways

- Seaways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, railways, airways, and seaways.

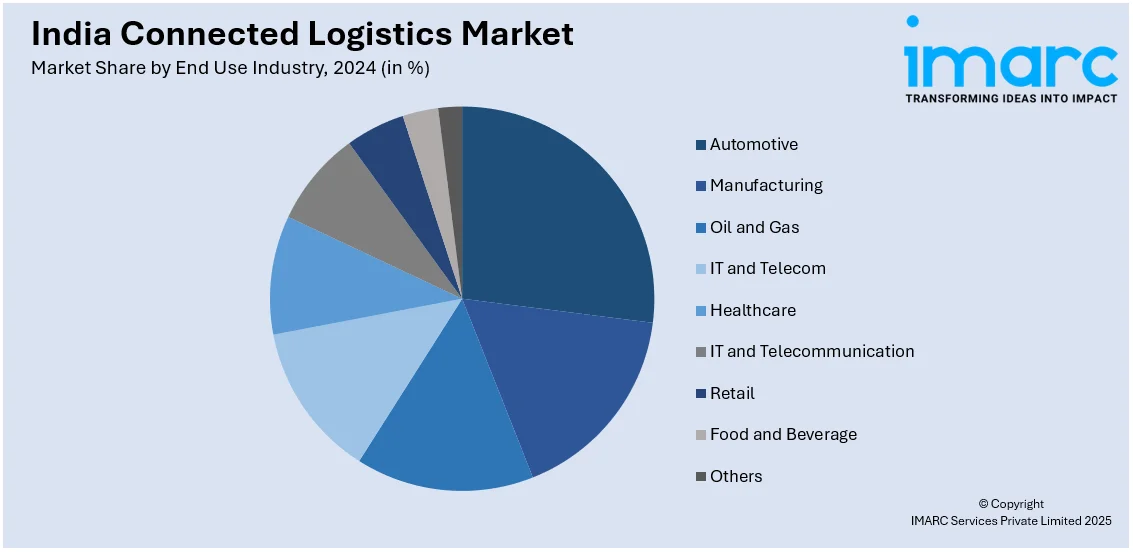

End Use Industry Insights:

- Automotive

- Manufacturing

- Oil and Gas

- IT and Telecom

- Healthcare

- IT and Telecommunication

- Retail

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, manufacturing, oil and gas, IT and telecom, healthcare, IT and telecommunication, retail, food and beverage, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Connected Logistics Market News:

- On January 19, 2025, FedEx unveiled FedEx Surround®, a cutting-edge monitoring and intervention solution designed to improve supply chain management in India. Businesses can benefit from enhanced cargo control and dependability as this platform offers AI-powered predictive analytics, near-real-time visibility, and sophisticated handling capabilities. FedEx Surround® ensures integrity and timely delivery of sensitive items by offering three service levels to a range of industries, including high-tech, healthcare, and aerospace.

- On February 10, 2025, India based logistics technology firm Elixia launched a cold chain logistics marketplace to streamline operations for over 2,000 shippers and numerous transporters handling temperature-sensitive goods. It leverages AI-driven technology, and the platform offers on-demand, temperature-controlled vehicle placement, enhancing efficiency, reliability, and real-time visibility for cold chain businesses. This initiative addresses industry challenges such as fragmented networks and unpredictable pricing, aiming to set a new standard in cold chain logistics.

India Connected Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Solutions, Services |

| Softwares Covered | Asset Management, Warehouse IoT, Security, Data Management, Network Management, Streaming Analytics |

| Technologies Covered | Bluetooth, Cellular, Wi-Fi, Zig Bee, NFC, Satellite |

| Devices Covered | Gateways, RFID Tags, Sensor Nodes |

| Transportation Modes Covered | Roadways, Railways, Airways, Seaways |

| End Use Industries Covered | Automotive, Manufacturing, Oil and Gas, IT and Telecom, Healthcare, IT and Telecommunication, Retail, Food and Beverage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India connected logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the India connected logistics market on the basis of component?

- What is the breakup of the India connected logistics market on the basis of software?

- What is the breakup of the India connected logistics market on the basis of technology?

- What is the breakup of the India connected logistics market on the basis of devices?

- What is the breakup of the India connected logistics market on the basis of transportation mode?

- What is the breakup of the India connected logistics market on the basis of end use industry?

- What is the breakup of the India connected logistics market on the basis of region?

- What are the various stages in the value chain of the India connected logistics market?

- What are the key driving factors and challenges in the India connected logistics market?

- What is the structure of the India connected logistics market and who are the key players?

- What is the degree of competition in the India connected logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India connected logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India connected logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India connected logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)