India Connected Vehicles Market Size, Share, Trends and Forecast by Technology Type, Application, Connectivity, Vehicle Connectivity, Vehicle, and Region, 2025-2033

India Connected Vehicles Market Size and Share:

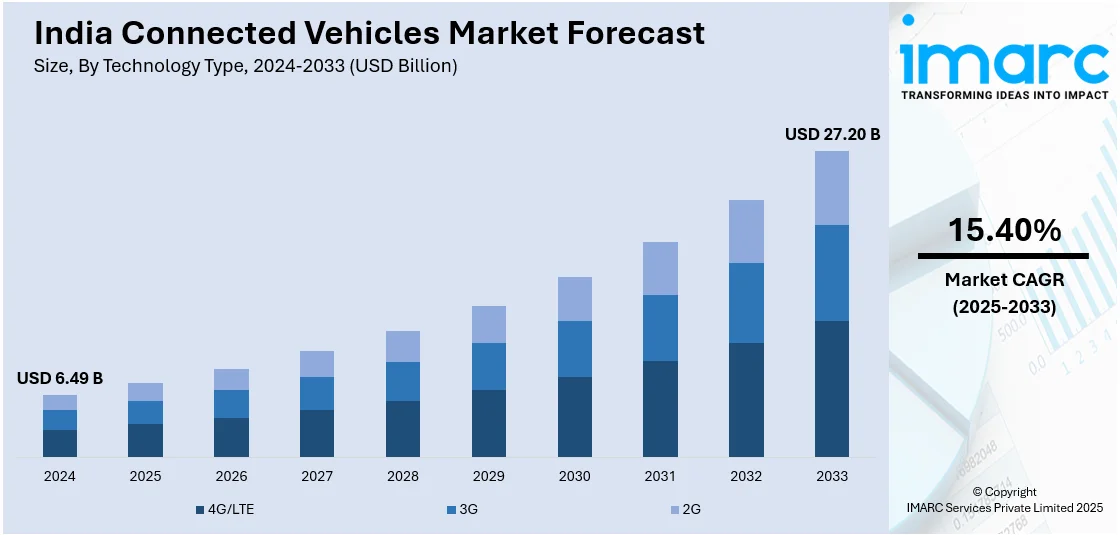

The India connected vehicles market size reached USD 6.49 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.20 Billion by 2033, exhibiting a growth rate (CAGR) of 15.40% during 2025-2033. The India connected vehicles market share is expanding, driven by the increasing adoption of connected vehicle technology that offers real-time monitoring of battery health, charging station availability, and energy usage, along with the growing investments in digital infrastructure to enhance the usage of connected mobility solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.49 Billion |

| Market Forecast in 2033 | USD 27.20 Billion |

| Market Growth Rate (2025-2033) | 15.40% |

India Connected Vehicles Market Trends:

Increasing demand for electric vehicles (EVs)

The rising demand for EVs is offering a favorable India connected vehicles market outlook. EVs rely heavily on modern digital tools for efficiency, safety, and user experience. Unlike traditional fuel-oriented cars, EVs integrate smart connectivity features to optimize battery performance, navigation, and charging management. Connected vehicle technology allows real-time monitoring of battery health, charging station availability, and energy utilization, making EV ownership more convenient. Automakers are equipping EVs with over-the-air (OTA) software updates, advanced driver-assistance systems (ADAS), and remote diagnostics to enhance vehicle performance and security. As the Indian government is encouraging EV adoption with subsidies and infrastructure development, automakers are focusing on seamless connectivity solutions to attract buyers and increase revenue. According to the India Brand Equity Foundation (IBEF), in May 2024, sales of EVs in India rose by 20.88% to reach 1.39 Million units. As of February 2024, there were 12,146 functioning public EV charging stations across the country, with Maharashtra leading in the number of EV charging stations, followed by Delhi and various other states in India. Moreover, ride-sharing and fleet management companies prefer connected EVs for predictive maintenance and route optimization.

To get more information on this market, Request Sample

Advancements in technology

Enhancements in technology are impelling the India connected vehicles market growth. The growth of 5G, artificial intelligence (AI), and the Internet of Things (IoT) allows vehicles to stay connected in real time, improving navigation, diagnostics, and vehicle-to-everything (V2X) communication. Automakers employ advanced sensors to enhance road safety, automate driving functions, and reduce accidents. Cloud computing and big data analytics help to monitor vehicle health, allowing predictive maintenance and minimizing unexpected breakdowns. Smart dashboards, voice assistants, and mobile app controls improve user convenience, making driving more interactive. Blockchain technology enhances cybersecurity by securing vehicle data from hacking threats. Connected technologies improve battery management, optimize charging station connectivity, and refine energy efficiency. The government’s investments in IT and digital infrastructure further accelerate the employment of connected mobility solutions. In July 2024, the Indian government allocated INR 21,936.90 Crore for the Ministry of Electronics and Information Technology (MeitY) for the fiscal year 2024-25. This funding represented a notable rise in revenue and capital spending, highlighting the government's dedication to fast-tracking digital transformation and improving the nation's technological framework. This, in turn, is positively influencing the market.

India Connected Vehicles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology type, application, connectivity, vehicle connectivity, and vehicle.

Technology Type Insights:

- 4G/LTE

- 3G

- 2G

The report has provided a detailed breakup and analysis of the market based on the technology types. This includes 4G/LTE, 3G, and 2G.

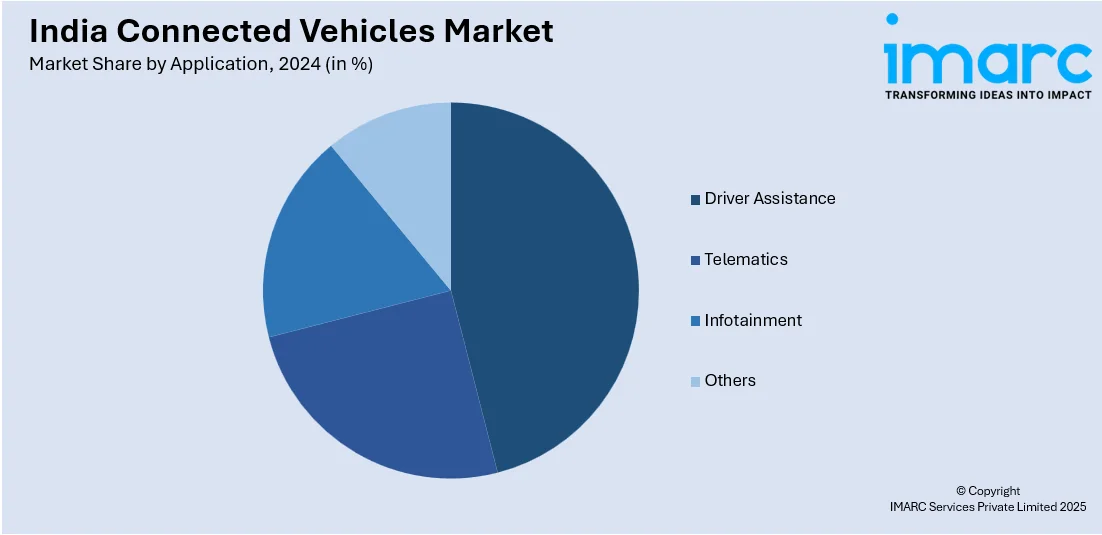

Application Insights:

- Driver Assistance

- Telematics

- Infotainment

- Others

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes driver assistance, telematics, infotainment, and others.

Connectivity Insights:

- Integrated

- Embedded

- Tethered

The report has provided a detailed breakup and analysis of the market based on the connectivity. This includes integrated, embedded, and tethered.

Vehicle Connectivity Insights:

- Vehicle to Vehicle (V2V)

- Vehicle to Infrastructure (V2I)

- Vehicle to Pedestrian (V2P)

A detailed breakup and analysis of the market based on the vehicle connectivity have also been provided in the report. This includes vehicle to vehicle (V2V), vehicle to infrastructure (V2I), and vehicle to pedestrian (V2P).

Vehicle Insights:

- Passenger Cars

- Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicles. This includes passenger cars and commercial vehicle.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Connected Vehicles Market News:

- In January 2025, TVS, the prominent 2-wheeler manufacturing company based in India, unveiled India’s inaugural Bluetooth-connected electric three-wheeler, the King EV MAX, priced at INR 2.95 Lakh. It could be found at select dealerships in Uttar Pradesh, Bihar, Delhi, Jammu & Kashmir, and West Bengal. Equipped with intelligent features, such as TVS SmartXonnect, the product provided users with real-time navigation, alerts, and vehicle diagnostics via their smartphones.

- In November 2024, Kia India, the well-known car manufacturer, revealed its new entry into the premium SUV category by introducing SYROS, its forthcoming model for the Indian market. The SYROS aimed to provide an exceptionally roomy interior outfitted with pioneering connected features. With a yearly production capacity of 300,000 units, Kia positioned itself as a leader in connected car technology, having over 400,000 connected vehicles operating on Indian roads.

India Connected Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types Covered | 4G/LTE, 3G, 2G |

| Applications Covered | Driver Assistance, Telematics, Infotainment, Others |

| Connectivities Covered | Integrated, Embedded, Tethered |

| Vehicle Connectivities Covered | Vehicle to Vehicle (V2V), Vehicle to Infrastructure (V2I), Vehicle to Pedestrian (V2P) |

| Vehicles Covered | Passenger Cars, Commercial Vehicle |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India connected vehicles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India connected vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India connected vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The connected vehicles market in India was valued at USD 6.49 Billion in 2024.

The India connected vehicles market is projected to exhibit a CAGR of 15.40% during 2025-2033, reaching a value of USD 27.20 Billion by 2033.

Key factors driving India’s connected-vehicles market include growing EV adoption with real-time battery/charging monitoring, advancements in 4G/5G, AI, IoT and V2X enabling safety and diagnostics, rising middle-class demand for connected features and convenience, government support via FAME and smart-city infrastructure, and consumer willingness to pay.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)