India Construction Equipment Market Size, Share, Trends and Forecast by Solution Type, Equipment Type, Type, Application, Industry, and Region, 2026-2034

India Construction Equipment Market Summary:

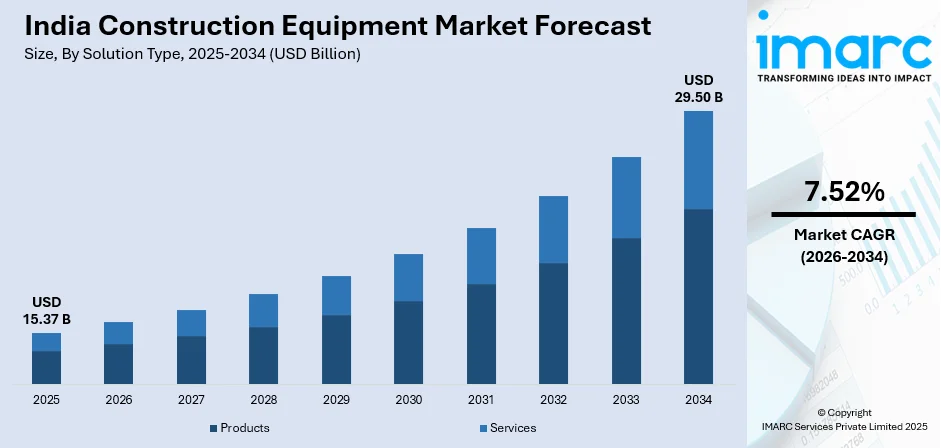

The India construction equipment market size was valued at USD 15.37 Billion in 2025 and is projected to reach USD 29.50 Billion by 2034, growing at a compound annual growth rate of 7.52% from 2026-2034.

The India construction equipment market stands as one of the fastest-growing segments within the broader industrial machinery landscape, driven by rapid infrastructure development and urbanization across the country. The market benefits from government-backed initiatives, rising investments in smart city projects, and increasing construction activities across residential, commercial, and industrial sectors. Growing demand for advanced machinery featuring enhanced efficiency, safety features, and technological capabilities continues propelling market expansion across diverse applications and end-use industries.

Key Takeaways and Insights:

-

By Solution Type: Products dominate the market with approximately 69% share in 2025, driven by strong demand for construction machinery across infrastructure, mining, and real estate development projects requiring advanced earthmoving and material handling capabilities.

-

By Equipment Type: Heavy construction equipment leads the market with a share of 64% in 2025, owing to large-scale infrastructure projects requiring high-capacity machinery for excavation, earthmoving, and heavy lifting operations across highways and industrial construction.

-

By Type: Excavator represents the largest segment with a market share of 30% in 2025, attributed to versatile applications in construction, mining, and infrastructure development where precision digging and material handling capabilities are essential.

-

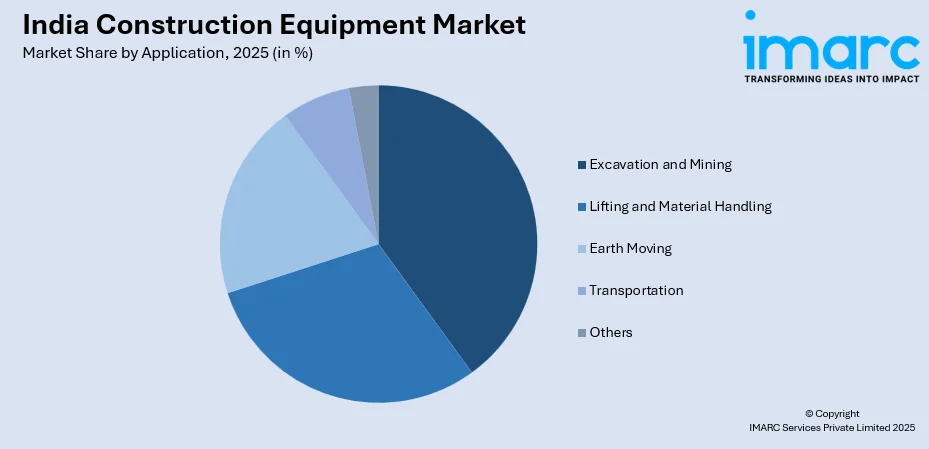

By Application: Excavation and mining lead the market with a share of 28% in 2025, driven by accelerated mining sector reforms, increased coal production targets, and extensive earthwork requirements across highway and railway construction projects.

-

By Industry: Construction and infrastructure dominate with a share of 45% in 2025, fueled by government expenditure on roads, railways, airports, urban infrastructure, and affordable housing programs across the country.

-

By Region: North India leads the market with approximately 30% share in 2025, driven by extensive highway construction, industrial corridor development, and urban expansion projects across Delhi NCR, Punjab, Haryana, and Uttar Pradesh.

-

Key Players: The India construction equipment market exhibits a moderately consolidated competitive landscape, with established multinational corporations competing alongside domestic manufacturers. Key players focus on product innovation, localized manufacturing, dealer network expansion, and after-sales service enhancement to strengthen market positioning.

To get more information on this market Request Sample

India’s construction equipment industry is a rapidly evolving segment within the broader infrastructure landscape, reflecting the country’s ambitious development agenda. The sector spans a wide array of machinery, including excavators, loaders, cranes, forklifts, dozers, and road construction equipment, catering to diverse sectors such as construction, mining, manufacturing, and industrial operations. In 2025, ICEMA reported 3% year-on-year growth in India’s construction equipment sector, with over 1.4 lakh units sold and a 10% export rise, underscoring global competitiveness of domestic machinery. The industry is undergoing a notable transformation driven by technological innovation, sustainability priorities, and enhanced operational efficiency. Adoption of cleaner propulsion systems, automation, telematics, and digital integration is improving equipment performance and fleet management. Additionally, the rise of equipment rental platforms is broadening access for small and medium contractors, enabling more flexible utilization of machinery and expanding market opportunities beyond conventional ownership models.

India Construction Equipment Market Trends:

Electric and Hybrid Equipment Adoption

Environmental regulations and sustainability mandates drive increasing adoption of electric and hybrid construction equipment across urban construction sites and infrastructure projects. At EXCON 2025, Schwing Stetter India showcased India’s first fully electric truck mixer and its first hybrid boom pump, highlighting OEM efforts to bring emission‑compliant solutions to the market. Equipment manufacturers invest substantially in developing emission-compliant machinery featuring electric powertrains and hybrid systems that reduce carbon footprints. This electrification trend accelerates as stricter emission norms take effect and construction companies prioritize sustainable operations to meet environmental compliance requirements and corporate sustainability targets.

Rental and Leasing Market Expansion

The equipment rental segment experiences rapid growth as contractors and infrastructure developers increasingly prefer flexible, pay-as-you-use access to modern construction fleets. In 2025, Haryana-based Aggcon Equipments International filed its DRHP with SEBI to launch an IPO, signaling strong investor confidence and growth ambitions in the construction equipment rental sector. Rising capital costs, technological obsolescence concerns, and project-specific equipment requirements drive small and medium enterprises toward rental platforms offering comprehensive maintenance support. This rental model expansion democratizes access to advanced construction equipment while reducing financial burdens on contractors across diverse project scales.

Technology Integration and Smart Equipment

Integration of telematics, artificial intelligence, and Internet of Things technologies transforms construction equipment into connected smart machines enabling real-time monitoring and predictive maintenance capabilities. At EXCON 2025, Mahindra Construction Equipment showcased its IMAXX telematics on EarthMaster and RoadMaster models, providing real-time tracking, engine health, fuel analytics, and predictive maintenance alerts as standard features. Fleet management systems provide equipment utilization data, fuel consumption analytics, and operator performance insights that optimize operations substantially. Autonomous and semi-autonomous equipment featuring advanced safety systems and precision control represent the emerging frontier of construction technology innovation across the Indian market.

Market Outlook 2026-2034:

The India construction equipment market is poised for robust growth, driven by expanding infrastructure development, accelerating urbanization, and supportive government policies across construction sectors. Initiatives promoting domestic manufacturing and capacity expansion by leading equipment makers are strengthening the industry. Increasing demand for advanced machinery across highways, railways, airports, and smart city projects is sustaining equipment procurement, while technological adoption and modernization are enhancing operational efficiency and productivity, further shaping the market’s growth trajectory. The market generated a revenue of USD 15.37 Billion in 2025 and is projected to reach a revenue of USD 29.50 Billion by 2034, growing at a compound annual growth rate of 7.52% from 2026-2034.

India Construction Equipment Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Solution Type |

Products |

69% |

|

Equipment Type |

Heavy Construction Equipment |

64% |

|

Type |

Excavator |

30% |

|

Application |

Excavation and Mining |

28% |

|

Industry |

Construction and Infrastructure |

45% |

|

Region |

North India |

30% |

Solution Type Insights:

- Products

- Services

The products dominate with a market share of 69% of the total India construction equipment market in 2025.

Products maintain commanding market leadership driven by substantial demand for construction machinery across infrastructure development, real estate construction, and mining operations throughout India. As of October 2025, FADA reported JCB India leading the construction equipment market with a 64.6 % share, reaffirming its dominance. The segment benefits significantly from government initiatives promoting domestic manufacturing and local assembly of construction equipment. Rising investments in highway construction, smart city development, and industrial infrastructure create sustained demand for excavators, loaders, cranes, and earthmoving machinery across diverse project applications nationwide.

The products segment experiences continuous transformation through technological advancement and equipment modernization addressing evolving construction requirements and emission compliance mandates. Growing emphasis on fuel efficiency, operator safety, and productivity enhancement drives equipment upgrades across contractor fleets. Make in India initiatives encourage domestic production capacity expansion while reducing import dependency, creating competitive pricing advantages that benefit construction companies seeking cost-effective equipment solutions for infrastructure projects throughout the country.

Equipment Type Insights:

- Heavy Construction Equipment

- Compact Construction Equipment

The heavy construction equipment leads with a share of 64% of the total India construction equipment market in 2025.

Heavy construction equipment dominates the market driven by extensive utilization in large-scale infrastructure projects requiring substantial earthmoving, lifting, and material handling capabilities across construction sites nationwide. The segment benefits from mega infrastructure initiatives including national highway expansion, dedicated freight corridors, and metro rail projects demanding heavy-duty machinery. Growing investments in mining sector modernization and industrial construction activities further amplify demand for high-capacity equipment across multiple end-use applications.

The heavy construction equipment segment continues setting operational benchmarks through integration of advanced technologies including telematics, GPS navigation, and fuel-efficient powertrains that enhance productivity and reduce operating costs substantially. Rising emphasis on equipment rental models enables smaller contractors to access heavy machinery without significant capital investment requirements. Equipment manufacturers focus on developing emission-compliant machines meeting stricter environmental regulations while maintaining operational performance and reliability across demanding construction environments.

Type Insights:

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

The excavator dominates with a market share of 30% of the total India construction equipment market in 2025.

Excavators maintain market leadership through exceptional versatility across diverse construction applications including excavation, trenching, demolition, and material handling operations throughout India. At EXCON 2025, Volvo Construction Equipment India unveiled its India-focused Made-in-Bharat EC215 excavator, designed for improved productivity, durability, and fuel efficiency, specifically tailored to meet the country’s evolving infrastructure requirements. Growing demand for crawler excavators and mini excavators addresses varied project requirements from large-scale infrastructure initiatives to confined urban construction sites across metropolitan areas.

The excavator segment experiences significant technological advancement through integration of hydraulic systems, GPS guidance, and operator assistance features that enhance precision and productivity substantially. Rising adoption of electric and hybrid excavators addresses emission compliance requirements while reducing operating costs in urban construction environments. Equipment manufacturers continuously expand product portfolios offering varied capacity ranges to address specific application requirements from compact excavators for residential construction to heavy-duty machines for mining operations.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Excavation and Mining

- Lifting and Material Handling

- Earth Moving

- Transportation

- Others

The excavation and mining lead with a share of 28% of the total India construction equipment market in 2025.

Excavation and mining applications maintain market leadership driven by extensive mineral extraction activities, infrastructure excavation requirements, and growing demand for earthmoving operations across construction projects nationwide. The segment benefits from mining sector reforms enabling private participation in coal and mineral extraction that amplifies demand for high-capacity excavators and material handling equipment. Rising investments in tunnel construction, pipeline laying, and foundation works further strengthen equipment demand across excavation applications.

The excavation and mining segment experiences continuous equipment modernization through adoption of advanced machinery featuring improved fuel efficiency, enhanced safety systems, and superior operational capabilities substantially. Growing emphasis on sustainable mining practices drives demand for emission-compliant equipment and electric alternatives addressing environmental compliance requirements. Equipment manufacturers develop specialized machinery addressing specific mining applications including surface mining, underground operations, and quarrying activities across diverse mineral extraction environments throughout India.

Industry Insights:

- Oil and Gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

The construction and infrastructure dominate with a market share of 45% of the total India construction equipment market in 2025.

Construction and infrastructure maintains commanding market leadership driven by massive government investments in national highways, expressways, railways, airports, and urban infrastructure development throughout India. The segment benefits from the PM Gati Shakti National Master Plan, which integrates major infrastructure projects across ministries to streamline planning, improve coordination, and accelerate nationwide project execution. Rising urbanization and population growth create sustained demand for residential, commercial, and industrial construction requiring diverse equipment categories across project lifecycles.

The construction and infrastructure segment continues driving equipment procurement through ambitious project pipelines spanning highways, metro rail networks, dedicated freight corridors, and airport expansion initiatives across the country. Growing emphasis on infrastructure quality and construction speed necessitates advanced machinery offering superior productivity and operational reliability. Public-private partnerships and enhanced private sector participation in infrastructure development diversify equipment demand beyond government-led projects creating competitive market dynamics.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The North India exhibits a clear dominance with a 30% share of the total India construction equipment market in 2025.

North India commands market leadership benefiting from concentration of major infrastructure projects, industrial corridors, and urban development activities across the region. This serves as a central hub with extensive expressway networks, industrial manufacturing clusters, and real estate development driving equipment demand substantially. Delhi-Mumbai Industrial Corridor and Western Dedicated Freight Corridor projects generate sustained equipment procurement requirements throughout the northern region.

The North India region benefits from significant investments in highway expansion, metro rail development, and smart city initiatives across major urban centers creating comprehensive equipment demand patterns. High population density and strong economic activity drive substantial construction volumes requiring extensive machinery fleets throughout the region continuously. Growing expansion into tier two and tier three cities creates additional equipment opportunities while challenging providers to extend distribution networks beyond established metropolitan delivery zones.

Market Dynamics:

Growth Drivers:

Why is the India Construction Equipment Market Growing?

Government Infrastructure Investment Initiatives

Strategic government initiatives significantly drive infrastructure development, boosting demand for construction and heavy machinery nationwide. For instance, in 2025, J Infratech Ltd secured a ₹116.43 crore contract from the National Highways & Infrastructure Development Corporation Ltd to rebuild a key highway section, underscoring how public works directly translate into order books for infrastructure companies. Expansion of highways, expressways, and freight corridors generates sustained procurement requirements for various construction equipment. Additionally, smart city programs and urban modernization projects amplify demand as municipal authorities implement comprehensive development plans. The growth in large-scale infrastructure projects across transport, logistics, and urban facilities continues to create consistent opportunities for equipment manufacturers and service providers.

Urbanization and Real Estate Development

Rapid urbanization fuels extensive construction activity across cities, creating substantial demand for diverse construction machinery. For example, in 2025, Action Construction Equipment Ltd announced a ₹400 crore investment to establish a new crane manufacturing facility in Palwal to strengthen its production capabilities and better serve India’s expanding infrastructure and urban development projects Residential developments, including affordable housing initiatives, require multiple categories of equipment, while commercial and industrial projects further expand procurement needs. Mixed-use developments and large-scale real estate ventures addressing growing urban populations generate consistent demand for heavy and specialized machinery. As cities expand and modernize, the construction equipment sector benefits from a broad spectrum of residential, commercial, and industrial projects.

Mining Sector Reforms and Expansion

Reforms in the mining sector promoting private participation and operational efficiency drive significant demand for excavation and material handling equipment. In 2025, the Ministry of Mines launched India’s first auction of exploration licenses for critical minerals, enabling private exploration of zinc, copper, rare earths, and other resources, boosting mining activity and equipment demand. Development of new mining sites and modernization of existing operations create opportunities for high-capacity machinery, including excavators, dump trucks, and specialized mining equipment. Emphasis on operational safety, efficiency, and technology adoption encourages the use of advanced machinery with telematics and operator assistance systems, enhancing productivity and ensuring compliance with modern mining standards across the industry.

Market Restraints:

What Challenges the India Construction Equipment Market is Facing?

High Equipment Costs and Financing Challenges

Substantial capital investment requirements for construction equipment acquisition create financial challenges for small and medium contractors limiting market expansion. High equipment costs combined with financing complexities and interest rate fluctuations impact purchasing decisions substantially. Working capital constraints and project payment delays further complicate equipment procurement for contractors operating across infrastructure and real estate construction sectors.

Skilled Operator Shortage

Limited availability of trained equipment operators creates operational challenges for construction companies seeking to maximize machinery utilization and productivity. Skilled labor shortages particularly impact advanced equipment categories requiring specialized training and certification for safe operation. Equipment manufacturers and industry associations increasingly invest in operator training programs to address this workforce gap affecting construction efficiency across the industry.

Raw Material Price Volatility

Fluctuations in steel prices and raw material costs significantly impact construction equipment manufacturing expenses and final product pricing substantially. Supply chain disruptions and commodity price volatility create uncertainty for equipment manufacturers affecting production planning and inventory management. Rising input costs pressure profit margins while limiting pricing flexibility in competitive market conditions across equipment categories.

Competitive Landscape:

The India construction equipment market operates within a highly competitive environment characterized by presence of established multinational manufacturers, domestic equipment producers, and emerging players across diverse product categories. Market competition intensifies as manufacturers invest in local production facilities, expand distribution networks, and enhance after-sales service capabilities to strengthen market positioning. Companies focus on product innovation, technology integration, and emission compliance to differentiate offerings while addressing evolving customer requirements. Strategic partnerships, rental fleet expansion, and financing solutions enable manufacturers to capture diverse customer segments across contractor categories and project scales.

Recent Developments:

-

In December 2025, JCB India unveiled a new portfolio of over 10 advanced machines at EXCON 2025 in Bengaluru. The highlight was the company’s largest‑ever 52‑tonne excavator, engineered for both domestic and export markets, marking a major milestone in India‑made heavy construction equipment.

India Construction Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Products, Services |

| Equipment Types Covered | Heavy Construction Equipment, Compact Construction Equipment |

| Types Covered | Loader, Cranes, Forklift, Excavator, Dozers, Others |

| Applications Covered | Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, Others |

| Industries Covered | Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India construction equipment market size was valued at USD 15.37 Billion in 2025.

The India construction equipment market is expected to grow at a compound annual growth rate of 7.52% from 2026-2034 to reach USD 29.50 Billion by 2034.

Products dominate India’s construction equipment market with a 69% market share, driven by infrastructure, real estate, and mining demand. Government manufacturing initiatives, technology upgrades, and investments in highways, smart cities, and industrial projects sustain strong demand nationwide.

Key factors driving the India construction equipment market include government infrastructure investment under the National Infrastructure Pipeline, rapid urbanization generating housing and commercial construction demand, mining sector expansion, and supportive policy frameworks promoting domestic manufacturing.

Major challenges include high initial capital investment requirements, skilled operator shortages affecting equipment productivity, project execution delays due to regulatory complexities, financing constraints for small contractors, and infrastructure gaps in remote regions limiting equipment accessibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)