India Construction Safety Equipment Market Size, Share, Trends and Forecast by Equipment Type, Construction Type, Application, and Region, 2026-2034

India Construction Safety Equipment Market Overview:

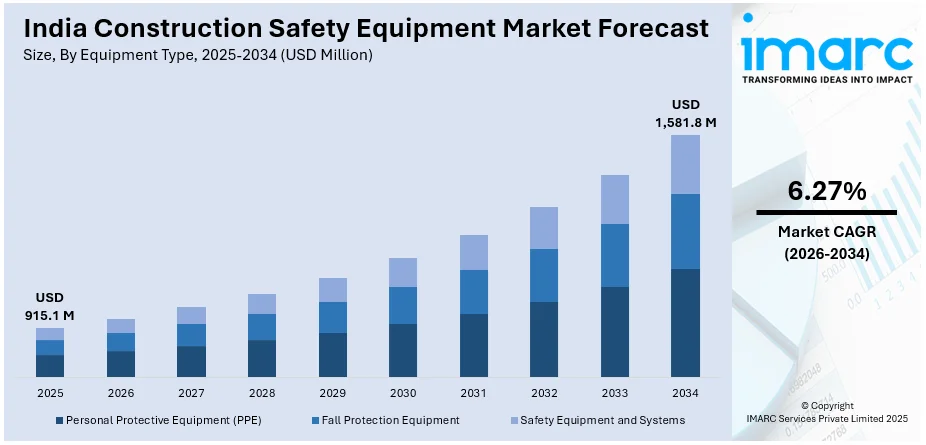

The India construction safety equipment market size reached USD 915.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,581.8 Million by 2034, exhibiting a growth rate (CAGR) of 6.27% during 2026-2034. The increasing construction activity, stricter safety laws, growing worker protection consciousness, rapid urbanization, accelerating infrastructure development, safety equipment technology improvements, expansion of industrial projects, and a spike in foreign investments are some of the factors expanding the India construction safety equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 915.1 Million |

| Market Forecast in 2034 | USD 1,581.8 Million |

| Market Growth Rate 2026-2034 | 6.27% |

India Construction Safety Equipment Market Trends:

Rising Demand for Advanced Protective Gear in the Construction Sector

Innovative safety equipment is being adopted on construction sites due to strict government regulations and the increased emphasis on worker safety. The requirement for fall prevention systems, fire safety equipment, and personal protective equipment (PPE) is rapidly increasing due to the growing number of infrastructure projects, including residential, commercial, and industrial developments. According to an industry report, around 600 Million people are anticipated to live in urban areas in India by 2036, which may contribute to 75% of the nation's GDP. This urban expansion is anticipated to drive infrastructure development, leading to a greater demand for safety equipment. Additionally, rising awareness among workers and employers regarding workplace hazards is contributing to the widespread usage of safety helmets, gloves, and high-visibility clothing, which is fostering India construction safety equipment market growth. Construction site safety is further improved using smart technology, such as artificial intelligence (AI)-driven monitoring systems and IoT-enabled safety devices. These developments are creating a safer workplace by lowering accident rates and increasing adherence to safety rules. Furthermore, it is anticipated that the growth of urbanization and major construction projects will increase the need for premium safety gear, making this sector an essential part of the construction industry.

To get more information on this market Request Sample

Increasing Adoption of Digital Solutions in Construction Safety

Digital solution integration is transforming safety procedures on building sites, increasing productivity, and lowering hazards. Businesses are using technology to develop preventative safety measures due to developments in artificial intelligence (AI), real-time monitoring, and Internet of Things-enabled safety systems. Utilizing smart wearables, including connected vests and helmets with sensors, enables real-time monitoring of employee activity and health, averting possible risks. Predictive analytics and automated safety inspections are also improving risk assessment techniques and guaranteeing adherence to legal requirements. Better coordination and incident reporting are made possible by the growing demand for cloud-based safety management systems. Furthermore, safety cameras, such as Hikvision's Turbo HD 3K Smart Hybrid Light Camera introduced on August 2024, enhance security, providing clear surveillance in varying lighting conditions. These developments contribute to safer, more efficient construction environments, fostering improved safety standards across the industry. As technology adoption accelerates, companies are expected to invest heavily in digital safety innovations to improve workplace conditions, which in turn is positively impacting India construction safety equipment market outlook. This shift toward technology-driven safety solutions will not only enhance worker protection but also contribute to the long-term sustainability of the construction sector.

India Construction Safety Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on equipment type, construction type, and application.

Equipment Type Insights:

- Personal Protective Equipment (PPE)

- Head Protection

- Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Foot Protection

- Hearing Protection

- Fall Protection Equipment

- Harnesses

- Lanyards

- Lifelines

- Anchors

- Safety Equipment and Systems

- Fire Safety Equipment

- Safe Access Equipment

- Gas Detection Systems

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes personal protective equipment (PPE) (head protection, eye and face protection, respiratory protection, hand and arm protection, protective clothing, foot protection, and hearing protection), fall protection equipment, (harnesses, lanyards, lifelines, and anchors), and safety equipment and systems (fire safety equipment, safe access equipment, and gas detection systems).

Construction Type Insights:

- Residential Construction

- Commercial Construction

- Industrial Construction

A detailed breakup and analysis of the market based on the construction type have also been provided in the report. This includes residential construction, commercial construction, and industrial construction.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Worker Body Safety

- Workplace Safety

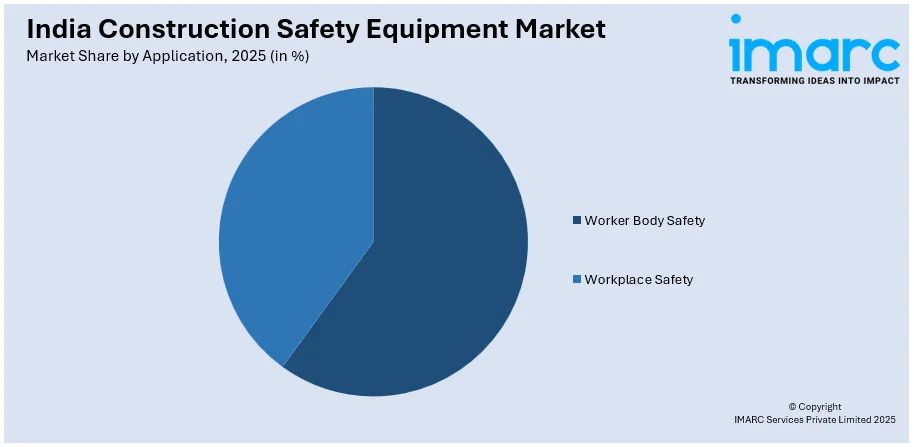

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes worker body safety and workplace safety.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Construction Safety Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Construction Types Covered | Residential Construction, Commercial Construction, And Industrial Construction |

| Applications Covered | Worker Body Safety, Workplace Safety |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India construction safety equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India construction safety equipment market on the basis of equipment type?

- What is the breakup of the India construction safety equipment market on the basis of construction type?

- What is the breakup of the India construction safety equipment market on the basis of application?

- What is the breakup of the India construction safety equipment market on the basis of region?

- What are the various stages in the value chain of the India construction safety equipment market?

- What are the key driving factors and challenges in the India construction safety equipment market?

- What is the structure of the India construction safety equipment market and who are the key players?

- What is the degree of competition in the India construction safety equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India construction safety equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India construction safety equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India construction safety equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)