India Consumer Electronics Recycling Market Size, Share, Trends and Forecast by Source Type, Material Recovered, Recycler Type, Application, and Region, 2025-2033

India Consumer Electronics Recycling Market Overview:

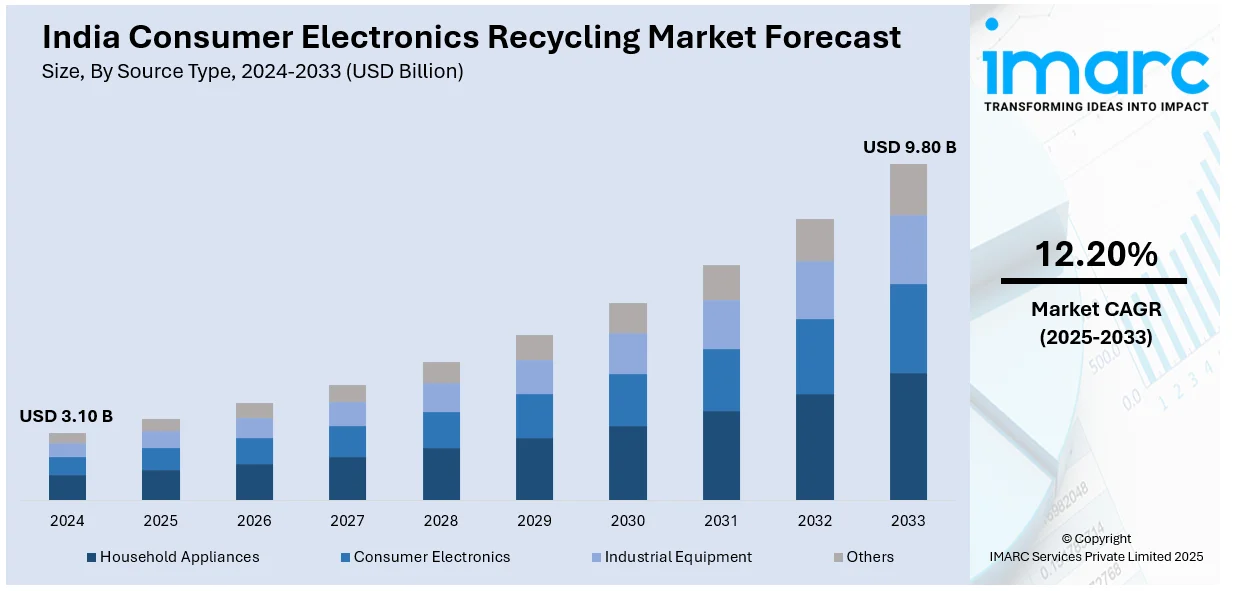

The India consumer electronics recycling market size reached USD 3.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.80 Billion by 2033, exhibiting a growth rate (CAGR) of 12.20% during 2025-2033. The market is witnessing significant growth due to rising awareness about environmental concerns and government regulations on e-waste disposal. Increasing electronics consumption and the need for sustainable disposal solutions are driving market demand. Companies are focusing on developing efficient recycling technologies are expected to expand as they prioritize eco-friendly recycling practices, thus influencing India consumer electronics recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.10 Billion |

| Market Forecast in 2033 | USD 9.80 Billion |

| Market Growth Rate 2025-2033 | 12.20% |

India Consumer Electronics Recycling Market Trends:

Government Policies

The Indian government has implemented tighter e-waste management policies and regulations to curb the increasing environmental issues surrounding electronic waste. The E-Waste (Management) Rules 2016 mandate manufacturers to be responsible for the collection, recycling, and disposal of electronic products. These policies require extended producer responsibility (EPR) which requires producers to ensure that their products are disposed of in an appropriate manner at the end of their life cycle. To further strengthen the regulatory framework the Indian government is implementing new initiatives aimed at improving e-waste management practices. For instance, in March 2024, the Indian government announced its plans to launch an online platform for trading Extended Producer Responsibility (EPR) certificates to tackle e-waste. This initiative promoted by the Central Pollution Control Board aims to enhance compliance and transparency while allowing companies to meet recycling targets and design more sustainable products to reduce electronic waste. The government has also imposed targets for collection and recycling of e-waste encouraging recycling efforts. These policies promote both consumers and businesses to practice sustainable behavior such as bringing back old electronics for disposal. Also, more attention to improper disposal and penalties for non-compliance are further encouraging responsible recycling. As these regulations become stricter they are driving the use of formal e-waste recycling fueling the expansion of the consumer electronics recycling market.

To get more information on this market, Request Sample

Technological Advancements

Technological developments are playing an important part in the development of the India consumer electronics recycling industry. Developments in recycling technologies, including automated sorting systems, hydrometallurgical processes, and advanced shredding technologies, are greatly enhancing the efficiency of recovering valuable materials like gold, silver, copper, and rare earth metals from electronic waste. For instance, in March 2024, Recyclekaro announced its plans to launch India's first plasma furnace technology for e-waste recycling, significantly increasing capacity from 7,500 to 75,000 metric tonnes annually. This innovation aims to extract valuable metals from e-waste, enhancing India's resource recovery and self-sufficiency in rare earth elements while promoting environmental sustainability. These technologies facilitate higher purity material recovery, lower energy consumption, and lower environmental footprints for recycling processes. Furthermore, advances in artificial intelligence (AI) and machine learning are being leveraged to improve e-waste processing, with more accurate and faster sorting. Such innovations not only increase recycling rates but also present new opportunities for companies to gain more value from retired electronics. As the technologies continue to improve, they are driving the India consumer electronics recycling market growth, facilitating more environmentally friendly procedures and the circular economy.

India Consumer Electronics Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source type, material recovered, recycler type, and application.

Source Type Insights:

- Household Appliances

- Washing Machines

- Refrigerators

- Air Conditioners

- Others

- Consumer Electronics

- Televisions

- Computers and IT Devices

- Mobile Phones

- Others

- Industrial Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the source type. This includes household appliances (washing machines, refrigerators, air conditioners, and others), consumer electronics (televisions, computers and IT devices, mobile phones, and others), industrial equipment, and others.

Material Recovered Insights:

- Metals

- Plastics

- Glass

- Others

A detailed breakup and analysis of the market based on the material recovered have also been provided in the report. This includes metals, plastics, glass, and others.

Recycler Type Insights:

- Metal Recyclers

- Plastic Recyclers

- Glass Recyclers

- PCB (Printed Circuit Board) Recyclers

A detailed breakup and analysis of the market based on the recycler type have also been provided in the report. This includes metal recyclers, plastic recyclers, glass recyclers, and PCB (printed circuit board) recyclers.

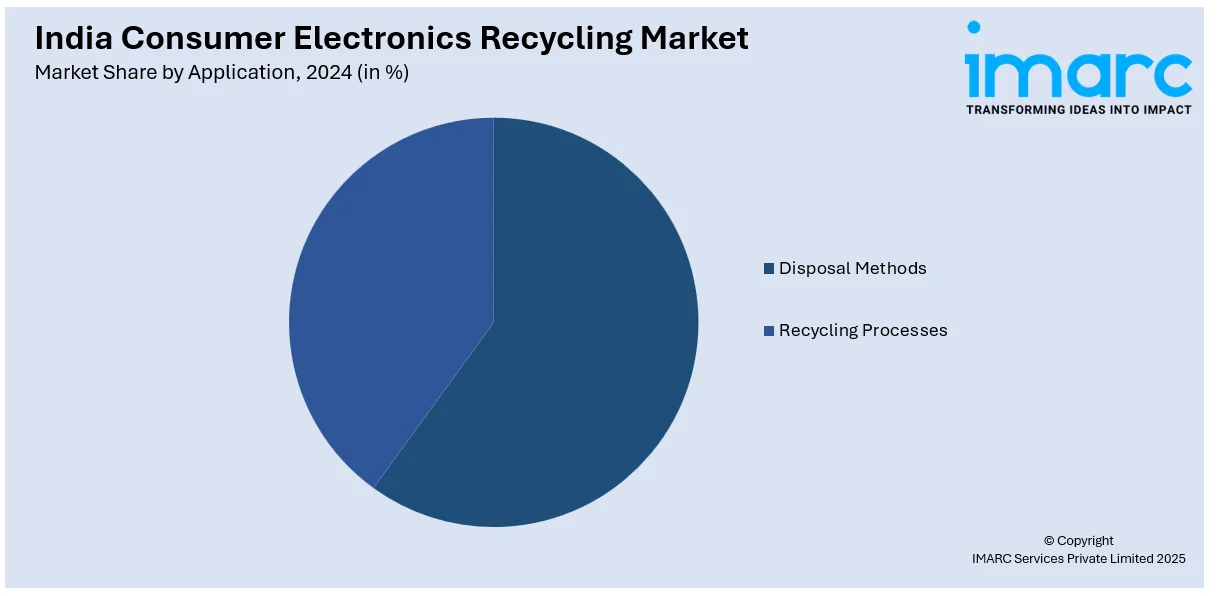

Application Insights:

- Disposal Methods

- Reuse

- Landfill

- Incineration

- Recycling Processes

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes disposal methods (reuse, landfill, and incineration) and recycling processes.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Consumer Electronics Recycling Market News:

- In March 2025, Casio India announced the launch of its "Recycle Responsibly" CSR campaign in Delhi NCR to address e-waste issues. The campaign features mobile collection vans for easy recycling. In partnership with NGO SHEOWS and Allied Waste Solutions, the initiative promotes awareness and encourages responsible e-waste disposal across communities.

- In July 2024, Attero announced the launch of Selsmart, an integrated e-waste consumer take-back platform aimed at addressing India’s e-waste crisis. The goal of the initiative is to reach an annual recurring revenue of INR 1,000 crore by the third year. It aims to promote sustainable recycling practices and expand its reach from ten metropolitan areas to a nationwide presence within the next three years.

India Consumer Electronics Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Source Types Covered |

|

| Materials Recovered Covered | Metals, Plastics, Glass, Others |

| Recycler Types Covered | Metal Recyclers, Plastic Recyclers, Glass Recyclers, PCB (Printed Circuit Board) Recyclers |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India consumer electronics recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India consumer electronics recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India consumer electronics recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The consumer electronics recycling market in India was valued at USD 3.10 Billion in 2024.

The India consumer electronics recycling market is projected to exhibit a CAGR of 12.20% during 2025-2033, reaching a value of USD 9.80 Billion by 2033.

Growth is driven by rising e-waste generation, stricter government regulations, and consumer awareness of environmental impact. The expanding electronics market, shorter product lifecycles, and formalized recycling infrastructure are encouraging responsible disposal. Incentive programs are also promoting collection and reuse across major cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)