India Consumer IoT Market Size, Share, Trends and Forecast by Component, Connectivity Technology, Application, and Region, 2026-2034

India Consumer IoT Market Summary:

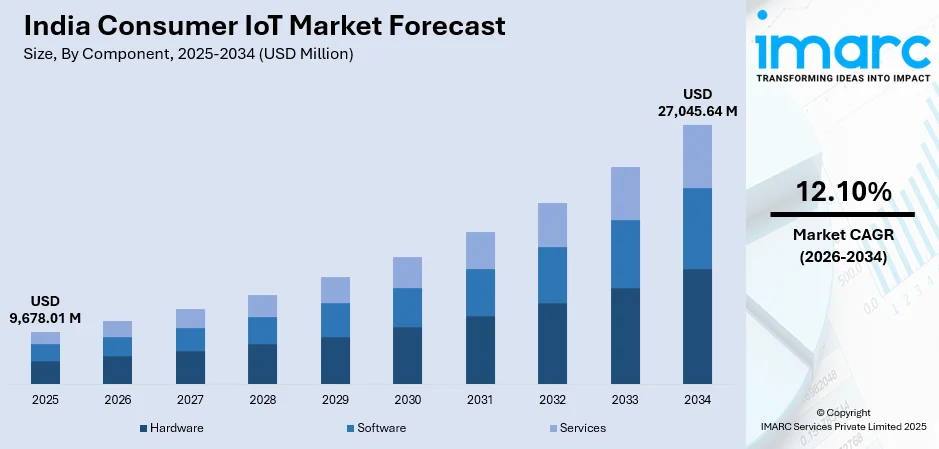

The India consumer IoT market size was valued at USD 9,678.01 Million in 2025 and is projected to reach USD 27,045.64 Million by 2034, growing at a compound annual growth rate of 12.10% from 2026-2034.

The India consumer IoT market is experiencing robust expansion driven by rapid digital transformation initiatives, rising smartphone penetration, and supportive government policies promoting smart infrastructure development. Increasing consumer awareness of intelligent home automation, health monitoring wearables, and connected vehicle technologies is fueling adoption across demographic segments. Additionally, advancements in artificial intelligence integration, declining hardware costs through domestic manufacturing, and expanding e-commerce accessibility are positioning India as an emerging hub for next-generation connected consumer devices, strengthening the India consumer IoT market share.

Key Takeaways and Insights:

-

By Component: Hardware dominates the market with a share of 44% in 2025, driven by the growing demand for processors, sensors, and memory devices essential for powering intelligent connected devices across consumer applications.

-

By Connectivity Technology: Wireless leads the market with a share of 80% in 2025, supported by expanding Bluetooth, Wi-Fi, and emerging wireless protocols enabling seamless device connectivity and user experience.

-

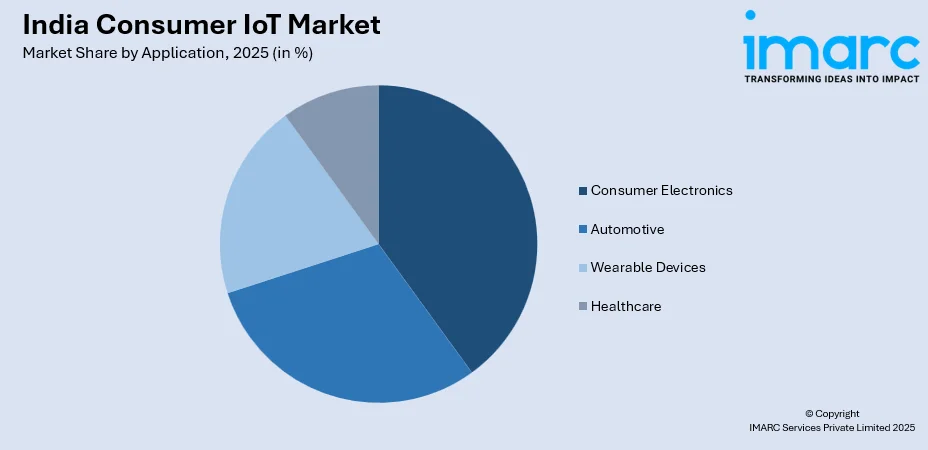

By Application: Consumer Electronics represents the largest segment with a market share of 36% in 2025, reflecting strong consumer preference for smart televisions, connected appliances, and intelligent lighting systems.

-

By Region: South India dominates the market with a share of 37% in 2025, attributed to strong technology infrastructure, higher urbanization rates, and concentration of IT hubs in cities like Bengaluru and Chennai.

-

Key Players: The India consumer IoT market exhibits moderate competitive intensity, with global technology leaders, established Indian electronics manufacturers, and emerging startups competing across product innovation, ecosystem integration, price positioning, and distribution networks.

To get more information on this market Request Sample

The India consumer IoT market is advancing as governments, industries, and consumers embrace connected solutions for enhanced convenience, security, and efficiency. Growing urbanization and expanding middle-class purchasing power are accelerating the adoption of smart home automation systems, wearable health devices, and intelligent entertainment systems. Government initiatives including the Smart Cities Mission have catalyzed extensive IoT-enabled infrastructure deployment, with all 100 designated cities now operating Integrated Command and Control Centres utilizing AI, IoT, and data analytics technologies. In September 2024, ABB India launched ABB-free@home, a comprehensive smart home automation system with enhanced interoperability features, integrating with major platforms including Apple HomeKit, Google Home, and Amazon Alexa, enabling seamless cross-functionality with various connected devices while optimizing energy consumption for residential applications.

India Consumer IoT Market Trends:

Government-Led Smart Infrastructure Investment Accelerating IoT Adoption

India’s consumer IoT market is being strongly driven by government-led digital transformation and smart city initiatives. The Smart Cities Mission, spanning over 100 cities, has accelerated the adoption of IoT-enabled infrastructure, including connected streetlights, intelligent surveillance systems, and environmental sensors, creating a foundation for wider smart device integration and boosting overall market growth. In the Union Budget 2024-25, the government allocated INR 2,400 crore to the Smart Cities Mission, demonstrating continued financial commitment to technology-driven urban development.

Domestic Semiconductor Innovation Drives Cost Efficiency and Independence

The creation of locally designed and produced IoT-specific semiconductors is a transformative trend, tackling cost challenges and mitigating supply chain vulnerabilities while supporting the growth of India’s connected device ecosystem. Government backing through Production-Linked Incentive and Design-Linked Incentive schemes is fostering innovation in chip design and manufacturing capabilities. In May 2024, Mindgrove Technologies, an IIT Madras-incubated startup, introduced India's first commercial high-performance IoT chip named Secure IoT, priced approximately 30 percent lower than comparable imported chips while maintaining advanced security features.

Expanding 5G Connectivity Infrastructure Enabling Advanced Applications

The rapid rollout of 5G infrastructure across India is creating enhanced connectivity conditions for sophisticated consumer IoT applications requiring low latency and high bandwidth. By October 2025, 5.08 lakh 5G base transceiver stations have been installed across India, with coverage extending to over 99 percent of districts. This expanding network infrastructure is enabling advanced use cases including augmented reality applications, remote healthcare monitoring, and sophisticated smart home ecosystems that were previously constrained by network limitations.

Market Outlook 2026-2034:

The India consumer IoT market is set for steady growth over the forecast period, fueled by rapid digital transformation, supportive government policies, and increasing consumer demand for intelligent, connected devices. The rising incorporation of artificial intelligence, coupled with expanding e-commerce channels that improve device accessibility, is driving adoption across urban and semi-urban households. Additionally, the growing popularity of smart home automation solutions, including connected appliances, lighting, and security systems, is creating significant opportunities for market expansion and innovation in India’s consumer IoT ecosystem. The market generated a revenue of USD 9,678.01 Million in 2025 and is projected to reach a revenue of USD 27,045.64 Million by 2034, growing at a compound annual growth rate of 12.10% from 2026-2034.

India Consumer IoT Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Hardware |

44% |

|

Connectivity Technology |

Wireless |

80% |

|

Application |

Consumer Electronics |

36% |

|

Region |

South India |

37% |

Component Insights:

- Hardware

- Processor

- Memory Devices

- Logic Devices

- Sensors

- Pressure

- ECG

- Temperature

- Inertial Measurement Unit

- Humidity

- Light

- Accelerometers

- Camera Modules

- Others

- Software

- Real-time Streaming Management

- Network Management

- Security

- Data Management

- Remote Monitoring

- Others

- Services

- Managed Services

- Professional Services

- Implementation Services

- Consulting Services

- Support and Maintenance

The hardware dominates with a market share of 44% of the total India consumer IoT market in 2025.

The hardware component segment maintains market leadership driven by the fundamental requirement for processors, sensors, and memory devices that power intelligent connected consumer products. Rising demand for sophisticated IoT devices incorporating multiple sensor types, advanced processing capabilities, and enhanced memory specifications is propelling hardware investments. The segment benefits from increasing deployment of smart home automation systems, wearable health monitors, and connected entertainment devices that require diverse hardware components for functionality.

Indigenous semiconductor manufacturing initiatives are reshaping the hardware landscape, reducing reliance on imported components and enhancing cost efficiency. Government-supported incentive programs are promoting domestic chip design and fabrication, allowing manufacturers to develop hardware tailored to local environmental and operational conditions. These efforts are strengthening the country’s capability to design advanced semiconductor solutions, supporting the growth of sophisticated IoT devices. As a result, consumer IoT applications are benefiting from more reliable, locally optimized hardware, fostering innovation and accelerating market adoption.

Connectivity Technology Insights:

- Wired

- Wireless

- Bluetooth

- Wi-Fi

- NFC

- ANT+

- Zigbee

- Others

The wireless leads with a share of 80% of the total India consumer IoT market in 2025.

Wireless connectivity technologies dominate the market, driven by consumer preference for convenient, cable-free device operation and seamless mobile integration. Bluetooth and Wi-Fi protocols remain the primary connectivity choices for smart home devices, wearables, and consumer electronics, enabling easy pairing with smartphones and voice assistants. The proliferation of affordable data plans and expanding broadband infrastructure has created favorable conditions for wireless IoT device adoption across urban and semi-urban households.

The widespread rollout of 5G networks in India is set to significantly enhance connectivity for low-latency, high-bandwidth IoT applications. This advanced infrastructure enables innovative use cases such as augmented reality experiences, real-time health monitoring, and sophisticated smart home systems. Additionally, the adoption of open-source connectivity standards is helping to overcome interoperability challenges, allowing devices from different manufacturers to communicate seamlessly within integrated consumer ecosystems, thereby improving usability, convenience, and the overall adoption of connected technologies across households. For instance, in June 2025, Bharat Sanchar Nigam Limited (BSNL), India’s state-owned telecom operator, introduced high-speed connectivity solutions in the Telangana region, featuring Quantum 5G Fixed Wireless Access (FWA), a Micro Data Centre, and an International Gateway in Hyderabad.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Connected Cars

- In-car Infotainment

- Traffic Management

- Wearable Devices

- Smart Watch

- Body-worn Cameras

- Fitness Tracker

- Smart Glasses

- Others

- Consumer Electronics

- TV

- Lighting

- Washing Machine

- Dishwasher

- Others

- Healthcare

- Fitness and Heartrate Monitor

- Blood Pressure Monitor

- Pulse Oximeter

- Blood Glucose Meter

- Others

The consumer electronics exhibits clear dominance with a 36% share of the total India consumer IoT market in 2025.

The consumer electronics segment dominates India’s consumer IoT market due to widespread adoption of smart devices such as televisions, refrigerators, and lighting systems. The India consumer electronics market size reached USD 89.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 158.4 Billion by 2034, exhibiting a growth rate (CAGR) of 6.56% during 2026-2034. Rising disposable incomes, rapid urbanization, and increased digital literacy have fueled demand for connected home solutions. Consumers are increasingly seeking convenience, remote control, and energy efficiency in daily life, driving manufacturers to integrate IoT features directly into products. Smart TVs with built-in Wi-Fi and voice assistants exemplify this trend, highlighting the sector’s appeal among tech-savvy middle-class households.

Another key factor contributing to the dominance of consumer electronics is the growing ecosystem of interconnected devices that simplify home automation. Companies are offering products that work seamlessly together, from smart lighting and HVAC systems to kitchen appliances and security solutions. This integration enhances usability and encourages adoption, as consumers can manage multiple devices through single apps or voice commands. The continuous expansion of IoT-enabled consumer electronics, coupled with attractive features and affordability, ensures sustained market leadership within India’s broader consumer IoT landscape.

Regional Insights:

- North India

- South India

- East India

- West India

South India represents the largest share at 37% of the total India consumer IoT market in 2025.

South India continues to lead in the consumer IoT market, supported by robust technology infrastructure, high urbanization, and the presence of major IT hubs such as Bengaluru, Chennai, and Hyderabad. The region’s tech-savvy population enjoys higher disposable incomes and exhibits greater awareness of smart home technologies compared to other parts of the country. Strategic investments in smart city projects and the concentration of key electronics manufacturers have created a favorable ecosystem, driving widespread adoption of connected home solutions and IoT-enabled consumer devices.

The region benefits from high digital literacy and a propensity for early adoption among urban professionals seeking connected lifestyle solutions. Government initiatives promoting sustainability and energy efficiency are further encouraging smart home device usage. Additionally, South India’s dense network of research institutions and technology startups is fostering innovation in IoT applications, enabling the development of localized products that cater to specific regional preferences and requirements, strengthening the overall consumer IoT adoption and market growth in the region.

Market Dynamics:

Growth Drivers:

Why is the India Consumer IoT Market Growing?

Rapid Expansion of Smart City Infrastructure and Government Investment

Large-scale government initiatives focused on digital transformation and smart urban development are driving widespread adoption of consumer IoT in India. For instance, under the NICDP initiative, new industrial cities will be developed as greenfield smart cities adhering to global standards. These cities are planned “ahead of demand” and will integrate concepts such as ‘plug-and-play’ infrastructure and ‘walk-to-work’ layouts, providing advanced facilities that promote sustainable practices and efficient industrial operations. These programs have enabled extensive deployment of connected infrastructure such as smart streetlights, intelligent surveillance systems, and environmental sensors. Authorities are collaborating with technology providers to implement scalable IoT frameworks that enhance urban living. Comprehensive policy guidelines supporting machine-to-machine communication and integrated command systems leveraging data analytics, artificial intelligence, and IoT are improving city operations, including transportation management, water distribution, and waste management efficiency.

Rising Smartphone Penetration and Digital Connectivity Expansion

Rapid growth in smartphone adoption, broadband connectivity expansion, and increasingly affordable data plans are establishing a robust foundation for widespread consumer IoT implementation throughout India's urban and rural landscapes. The India smartphone market size reached 153.3 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 277.1 Million Units by 2033, exhibiting a growth rate (CAGR) of 6.6% during 2025-2033. The proliferation of internet access is creating an environment conducive to connected device adoption, driven by the increasing availability of online content in regional languages, making digital services accessible to non-English speaking populations. The growing user base, coupled with an expanding middle class with rising disposable incomes, is fueling acceptance of connected consumer devices, including smart televisions, wearable fitness trackers, and home automation systems.

Indigenous Semiconductor Development Reducing Costs and Dependency

The creation of locally designed and produced IoT-focused semiconductors is becoming a significant driver of growth, helping to overcome cost constraints and mitigate supply chain risks. Government support through policy incentives is fostering innovation in chip design and production capabilities. Numerous companies and research institutions are focusing on creating programmable, secure, and energy-efficient chips tailored for IoT applications. These locally optimized semiconductors enable the deployment of connected smart devices, including wearables, smart city infrastructure, and connected home solutions, providing cost-effective and reliable hardware for the expanding IoT ecosystem.

Market Restraints:

What Challenges the India Consumer IoT Market is Facing?

Cybersecurity Vulnerabilities and Data Privacy Concerns

As the volume and complexity of consumer IoT deployments increase throughout India, cybersecurity has emerged as a critical concern for enterprises, government bodies, and individual consumers. IoT devices frequently operate on minimal computing resources and have not adhered to consistent security standards, leaving them vulnerable to various attack vectors. Consumer awareness of IoT security risks remains limited, with many users failing to change default passwords or understand data collection practices of their devices.

Interoperability Challenges and Fragmented Standards

The absence of universally adopted interoperability standards represents a significant impediment to seamless consumer IoT ecosystem development in India. The proliferation of proprietary technologies and competing communication protocols creates a fragmented landscape where devices from different manufacturers struggle to communicate effectively. Multiple wireless standards including Wi-Fi, Bluetooth, Zigbee, and Z-Wave coexist alongside various application-layer protocols, resulting in compatibility challenges for consumers attempting to integrate devices from different brands.

High Implementation Costs and Rural Infrastructure Limitations

Despite declining hardware prices through local manufacturing initiatives, the cumulative cost of implementing comprehensive consumer IoT solutions remains a significant barrier for large segments of the Indian population. A complete smart home system encompassing intelligent lighting, climate control, and security automation requires substantial upfront investment exceeding budget constraints of middle and lower-income households. In rural areas, infrastructure limitations compound affordability challenges, as inconsistent electricity supply and unreliable internet connectivity undermine the value proposition of connected devices.

Competitive Landscape:

The India consumer IoT market exhibits a moderately competitive structure characterized by a diverse mix of global technology leaders, established Indian electronics manufacturers, and emerging startups specializing in connected devices. Competition centers around product innovation, ecosystem integration capabilities, price positioning, and brand reputation. Global players leverage their extensive research and development resources, established distribution networks, and comprehensive product portfolios spanning smart home devices, wearables, and consumer electronics. Indian companies are gaining market share through localized product design addressing specific domestic needs, competitive pricing strategies, and growing manufacturing capabilities supported by government incentives. Strategic partnerships between hardware manufacturers, software platforms, cloud service providers, and telecommunications operators are increasingly common as companies seek to offer integrated solutions.

Recent Developments:

-

April 2025: Panasonic Life Solutions India launched its Smart Home Experience Centre in New Delhi, a tech-enabled showcase demonstrating modern homes with seamlessly integrated health, safety, and convenience through intelligent automation. The experience centre combined Panasonic's extensive smart home portfolio, including HVAC systems, smart lighting, kitchen fixtures, and advanced security tools like video door phones and surveillance cameras.

-

January 2025: Amazon launched the Echo Spot in India, a smart alarm clock with Alexa integration, offering customizable clock faces, new alarm sounds, and vibrant sound. The device features an interactive 2.83-inch touch-screen and can control Alexa-compatible smart devices, available across Amazon.in, Blinkit, and Croma retail channels.

India Consumer IoT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Connectivity Technologies Covered |

|

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India consumer IoT market size was valued at USD 9,678.01 Million in 2025.

The India consumer IoT market is expected to grow at a compound annual growth rate of 12.10% from 2026-2034 to reach USD 27,045.64 Million by 2034.

Consumer electronics, representing the largest revenue share of 36% in 2025, remains pivotal for India's consumer IoT adoption, driven by strong demand for smart televisions, connected home appliances, and intelligent lighting systems across urban and semi-urban households.

Key factors driving the India consumer IoT market include supportive government policies through the Smart Cities Mission, expanding 5G infrastructure and digital connectivity, growing smartphone penetration, rising consumer awareness of smart home benefits, indigenous semiconductor development, and declining hardware costs through domestic manufacturing.

Major challenges include cybersecurity vulnerabilities and data privacy concerns, interoperability issues due to fragmented connectivity standards, high implementation costs for comprehensive smart home solutions, rural infrastructure limitations including inconsistent electricity and internet access, and limited consumer awareness regarding device security practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)