India Cookware Market Size, Share, Trends and Forecast by Type, Product, Material, Application, Distribution Channel, and Region, 2026-2034

India Cookware Market Summary:

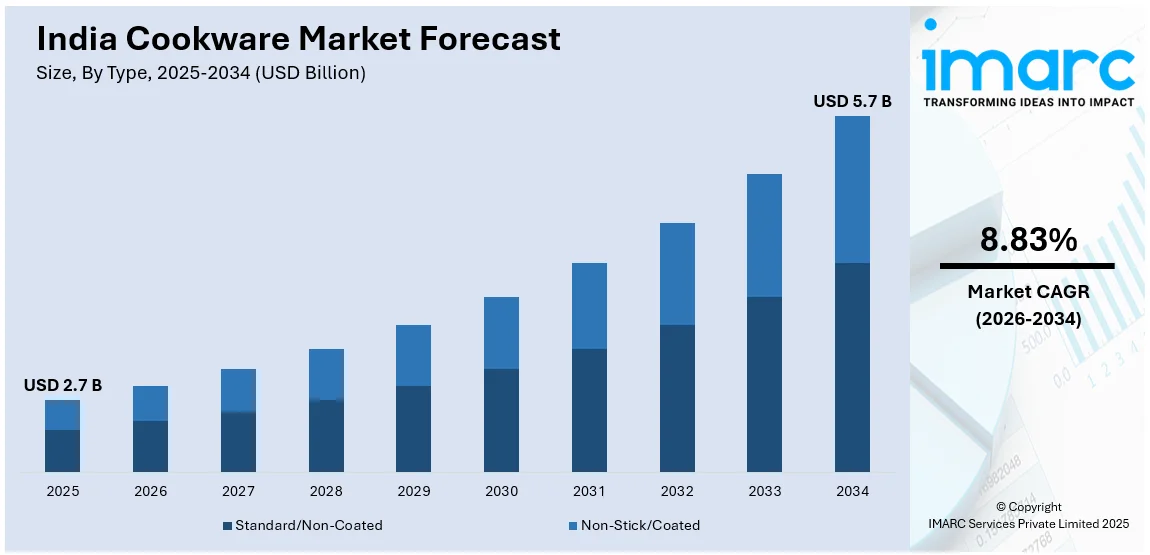

The India cookware market size was valued at USD 2.7 Billion in 2025 and is projected to reach USD 5.7 Billion by 2034, growing at a compound annual growth rate of 8.83% from 2026-2034.The growth of the Indian cookware market is continuous, underpinning an increase in urbanization and rising per capita incomes combined with shifting trends to high-quality products that are non-stick and friendly to the environment. Demand for stainless steel, cast iron, and innovative materials is rising due to health awareness and changed cooking habits. Growing interest in home cooking-aided by social media, cookery shows, organized retail, and online sales-promotes strong growth across both urban and semi-urban markets.

Key Takeaways and Insights:

- By Type: Non-stick/coated dominates the market with a share of 59% in 2025, driven by consumer preference for convenient cooking solutions that require less oil, offer easy cleaning, and provide healthier meal preparation options with diverse coating technologies including ceramic, Teflon, and enamel variants.

- By Product: Pots and pans lead the market with a share of 30% in 2025, attributed to their highly versatile nature suitable for diverse daily cooking practices in Indian households, multi-functional applications, and essential positioning in traditional and modern kitchen setups.

- By Material: Stainless steel dominates the market with a share of 27% in 2025, owing to its proven durability, corrosion resistance, food safety credentials, ease of maintenance, and alignment with government-mandated quality standards ensuring consumer confidence.

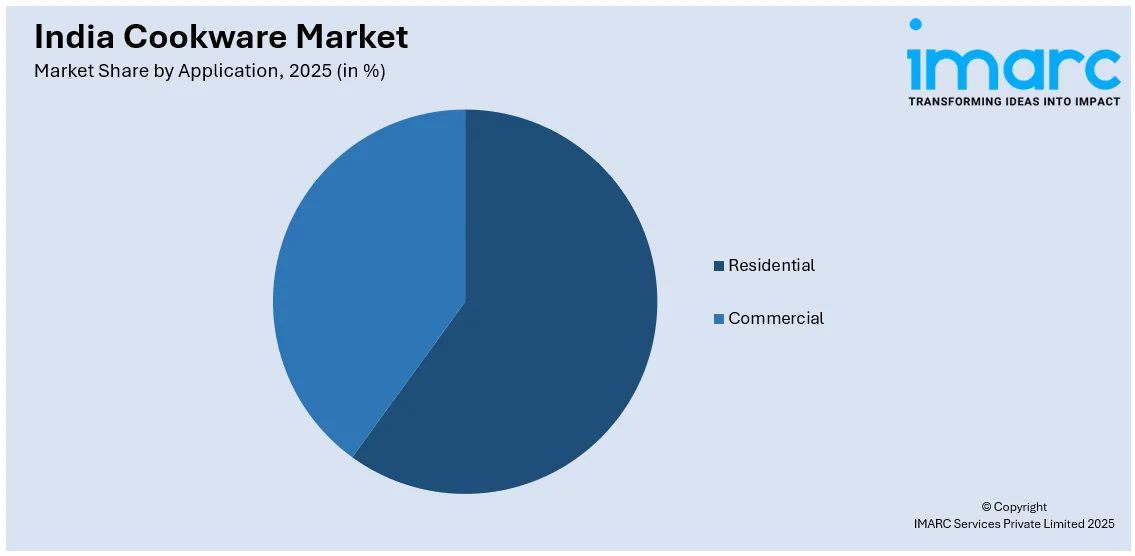

- By Application: Residential leads the market with a share of 71% in 2025, supported by rising home cooking trends, growing nuclear family formations, increased time spent at home, and consumer interest in upgrading kitchen equipment for enhanced culinary experiences.

- By Distribution Channel: Supermarket/hypermarket dominates the market with a share of 41% in 2025, driven by wide product assortments, competitive pricing, promotional offers, in-store demonstrations, and convenient one-stop shopping experiences for household products.

- By Region: North India leads the market with a share of 29% in 2025, supported by high population density, significant urbanization rates, the presence of major metropolitan centers, and well-developed retail infrastructure facilitating premium cookware adoption.

- Key Players: The Indian cookware market is highly competitive, dominated by established brands like Hawkins, Prestige, and Pigeon, alongside regional manufacturers. Companies focus on product innovation, durability, and affordable pricing to capture urban and tier-2 consumer segments.

To get more information on this market Request Sample

The Indian cookware industry is transforming as consumers increasingly prioritize quality, health safety, and convenience. Rising middle-class aspirations, exposure to global lifestyle trends through digital media, and awareness of cooking material health impacts are changing purchasing behaviors. In February 2025, Brazilian cookware brand Tramontina has partnered with Indian manufacturer Aequs to establish its first cookware facility in India, boosting local production and expanding premium cookware availability. Manufacturers are offering non-stick, tri-ply stainless steel, induction-compatible, and cast iron options to cater to varied preferences. Growing demand for toxin-free coatings, eco-friendly materials, and sustainable production reflects health and environmental awareness. Additionally, the expansion of modern retail and e-commerce channels is making premium cookware more accessible in tier-two and tier-three cities, beyond metropolitan areas, supporting widespread market growth.

India Cookware Market Trends:

Growing Demand for Health-Conscious and Eco-Friendly Cookware

Indian consumers are shifting toward healthy, eco-friendly cookware as health awareness and environmental concerns grow. Traditional PTFE-coated cookware is increasingly replaced by ceramic and toxin-free options due to chemical leaching concerns. In 2025, Cumin Co. launched India’s first 100% toxin-free enamel cast iron cookware, offering non-reactive, safe alternatives for modern cooking. Manufacturers are now using natural, hypoallergenic materials and safer formulations. The revival of cast iron, clay, and bronze cookware highlights rising interest in indigenous, chemical-free cooking practices.

Premiumization and Multi-Functional Product Innovation

The Indian cookware market is shifting toward premium, multi-functional products as consumers seek versatile, durable, and high-performance solutions. Rising disposable incomes among middle and upper-middle-class households are encouraging upgrades from basic aluminum to tri-ply stainless steel, hard-anodized, and induction-compatible cookware. In June 2025, TTK Prestige launched its Tri-Ply Hexamagic range with a honeycomb-patterned non-stick surface and premium construction to cater to modern kitchens. Consumers increasingly value even heat distribution, multi-layered designs, and ergonomic features, while social media culinary content fuels experimentation and investment in specialized cookware.

E-commerce Growth and Direct-to-Consumer Channel Expansion

The rapid rise of e‑commerce and direct-to-consumer channels is reshaping the Indian cookware market, making premium kitchenware accessible to urban and rural consumers. Online platforms offer wider choices, competitive pricing, and doorstep delivery, appealing to busy households. In January 2025, healthy cookware brand The Indus Valley generates around 60% of revenue via its D2C site and drives sales through Amazon and quick-commerce platforms like Swiggy Instamart, Blinkit, and Zepto. Digital channels outpace traditional retail with reviews, comparisons, and influencer campaigns, while D2C brands stand out through design, toxin-free warranties, and eco-friendly messaging that resonates with millennials and health-conscious buyers.

Market Outlook 2026-2034:

The Indian cookware industry is set to witness steady growth during the forecasting period, driven by positive demographical changes, increasing disposable income, and changes in consumer lifestyle. Continued urbanization and the development of nuclear families in urban areas are also projected to contribute to higher demand for modern and space-saving cookware. The development of the organized retail and e-commerce industry will help products reach remote regions. The ongoing development in materials and eco-friendly manufacturing processes will play a significant role in helping market players to create a niche. Health-conscious and informed consumers are set to continue driving demand for healthy and toxic-free materials and coatings. The market generated a revenue of USD 2.68 Billion in 2025 and is projected to reach a revenue of USD 5.73 Billion by 2034, growing at a compound annual growth rate of 8.83% from 2026-2034.

India Cookware Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Non-Stick/Coated | 59% |

| Product | Pots and Pans | 30% |

| Material | Stainless Steel | 27% |

| Application | Residential | 71% |

| Distribution Channel | Supermarket/Hypermarket | 41% |

| Region | North India | 29% |

Type Insights:

- Standard/Non-Coated

- Non-Stick/Coated

- Teflon (PTFE) Coated

- Ceramic Coated

- Enamel Coated

- Others

The non-stick/coated dominates with a market share of 59% of the total India cookware market in 2025.

Non-stick and coated cookware continue to lead the Indian market as health-conscious consumers favor convenient, low-oil cooking and easy-to-clean solutions. Growing focus on healthier meal preparation has boosted adoption of non-stick options that prevent food from sticking. Consumers increasingly seek ceramic, enamel, and toxin-free coatings that combine non-stick performance with food safety, reflecting heightened awareness of potential health risks from conventional cookware surfaces.

This part includes a number of coating technologies depending on the requirements of the target clientele. Upmarket ceramic-coated cookware is in high demand among Health-conscious customers seeking a healthier cooking surface, while standard Teflon-coated variants are for those who prioritize costs. The industry is also shifting to more modern coating technologies with greater endurance, heat resistance, and resistance to scratching. They are also acting on the harmful effects of chemicals in relation to a healthy environment and are turning to eco-friendly technology.

Product Insights:

- Pots and Pans

- Pressure Cooker

- Cooking Racks

- Cooking Tools

- Bakeware

- Microware Cookware

The pots and pans lead with a share of 30% of the total India cookware market in 2025.

Pots and pans maintain their position as the largest product category in the Indian cookware market due to their highly versatile nature that makes them ideal for diverse daily cooking practices across household kitchens. These essential cookware items serve multiple functions including frying, sautéing, boiling, and simmering, making them indispensable components of traditional and modern Indian cooking styles. The widespread applicability of pots and pans across various cuisines and cooking methods ensures consistent demand from residential consumers seeking reliable everyday cooking solutions.

Consumer demand for premium pots and pans featuring advanced materials such as tri-ply stainless steel, hard-anodized aluminum, and multi-layered construction continues to grow as households upgrade their kitchen equipment. The segment benefits from social media influence where culinary content creators showcase professional-quality cookware that inspires home cooks to invest in better equipment. Manufacturers offer diverse size options, handle designs, and compatibility features including induction-ready bases that enable consumers to select products matching their specific cooking requirements and kitchen appliance configurations.

Material Insights:

- Stainless Steel

- Carbon Steel

- Cast Iron

- Aluminium

- Glass

- Stoneware

- Others

The stainless steel dominates with a market share of 27% of the total India cookware market in 2025.

Stainless steel cookware remains a market leader in India due to its durability, corrosion resistance, food safety, and easy maintenance, appealing to health-conscious consumers. In July 2024, the Government of India mandated ISI certification for stainless steel and aluminium utensils, reinforcing trust in certified, safe cookware. Its non-reactive surfaces preserve food flavor and nutrition, while compliance with quality standards and safe steel grades further strengthen stainless steel’s dominance in the cookware market.

The market benefits from a broad array of products from basic single-layer cookware to tri-ply or multi-clad cookware for effective heat distribution. Modern consumers in urban areas are increasingly shifting towards stainless steel cookware due to its aesthetically pleasing modern look that complements modern homes. Moreover, the durable nature of stainless steel cookware and its compatibility with intense heat of modern forms of cooking match perfectly with the traditional ways of Indian cooking.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

The residential leads with a share of 71% of the total India cookware market in 2025.

The residential segment holds the largest share of the Indian cookware market as households upgrade kitchen equipment to improve cooking experiences. Social media, food influencers, and cooking shows drive experimentation and investment in diverse cookware. In 2025, Vinod Intelligent Cookware’s Instagram campaign featuring chefs and creators garnered over 161 million views, boosting engagement with its premium range. Rising nuclear families and working professionals further increase demand for convenient, time-saving cooking solutions.

Urban nuclear families increasingly opt for space-saving stackable cookware sets that accommodate shrinking kitchen footprints in high-rise apartments while meeting diverse cooking needs. The cultural importance of home-cooked meals in Indian households sustains consistent demand for quality cookware across income segments and geographic regions. Additionally, cookware products serve popular gifting purposes during weddings, festivals, and housewarming celebrations, creating sustained demand beyond routine replacement purchases and driving consumer engagement with premium branded products.

Distribution Channel Insights:

- Supermarket/Hypermarket

- Specialty Stores

- Online

- Others

The supermarket/hypermarket dominates with a market share of 41% of the total India cookware market in 2025.

The principal retailing channels for cookware available to Indian consumers are supermarkets as well as hypermarkets, which offer consumers an extensive assortment of available products at favorable pricing with convenience shopping. They also enable viewers to assess various options with expert assistance offered at shopping destinations. The organized retailing format also facilitates visual merchandising that has an efficiency effect on buyers.

The availability of supermarkets/hypermarkets in major Indian cities is increasing the reach of cookware. These stores provide cookware products of all types – economy to high-end – suiting the taste and pockets of the buyers. Discounts, combo offers, and rewards schemes will tempt buyers to acquire these products while doing their grocery shopping. It will increase the penetration of the category and trigger the impulse to buy even the most priced ones.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 29% share of the total India cookware market in 2025.

North India maintains its position as a leading regional market for cookware, supported by high population density, significant urbanization rates, and the presence of major metropolitan centers including the National Capital Region. The region benefits from relatively higher disposable incomes in urban areas, well-developed retail infrastructure including modern trade formats, and strong consumer awareness regarding branded household products. North Indian consumer preferences favor premium cookware upgrades, particularly induction-ready and stackable products suitable for modern urban kitchen spaces.

The region demonstrates strong adoption of modern retail formats and e-commerce platforms that enhance consumer access to diverse cookware products across multiple price segments and brand offerings. Cultural factors including the importance of elaborate meal preparation and home cooking traditions further support robust cookware demand in North Indian households. Additionally, the concentration of manufacturers and distribution centers in northern states ensures consistent product availability and supports efficient supply chain operations serving regional retail networks.

Market Dynamics:

Growth Drivers:

Why is the India Cookware Market Growing?

Rising Urbanization and Changing Lifestyle Patterns

India is experiencing rapid urbanization, with millions migrating to cities for better employment and living standards. This concentration in urban centers increases demand for modern, efficient kitchen equipment suitable for compact homes. Reflecting this trend, TTK Prestige announced plans in 2025 to expand its retail presence by 30% over four years to meet rising demand in both large and smaller towns. The rise of nuclear families, exposure to global culinary trends, and more women in the workforce are driving preference for small, multi-functional, and convenient cookware that meets international quality and performance standards.

Increasing Disposable Incomes and Premiumization Trends

Economic growth and rising employment opportunities have increased household incomes in India, enabling consumers to spend more on premium kitchen products. Shoppers are increasingly investing in cookware that offers safety, durability, and superior cooking performance rather than opting for basic low-cost alternatives. For instance, Jindal Lifestyle’s Arttd’inox aims to achieve ₹1,000 crore in revenue from its premium cookware range by 2029, reflecting strong demand for high-end products. The shift from aluminum to stainless steel, non-stick, and induction-compatible cookware highlights growing consumer sophistication. Social media further drives aspirational purchases among millennials and Gen Z, who view quality kitchen equipment as part of their lifestyle and cooking identity.

Health Awareness and Safety Consciousness

Growing health awareness is shaping cookware choices across India, as rising chronic diseases like heart conditions, diabetes, and obesity make consumers more selective about cooking methods and materials. In November 2025, Stahl launched its Artisan Schild range in India featuring a highly durable, toxin-free non-stick surface that supports healthier cooking with less oil. This drives demand for ceramic-coated, stainless steel, and traditional cookware like cast iron, while manufacturers focus on safer coatings, natural ingredients, and transparent sourcing.

Market Restraints:

What Challenges the India Cookware Market is Facing?

Price Sensitivity and Competition from Unorganized Sector

The Indian consumer market remains highly price-sensitive, particularly in semi-urban and rural areas where branded cookware competes with lower-priced alternatives from unorganized manufacturers. The presence of numerous local producers offering economical products creates pricing pressure on established brands seeking to maintain market share while investing in quality and innovation. Balancing affordability with product quality, safety certifications, and brand positioning requires careful strategic consideration from market participants targeting diverse consumer segments.

Raw Material Cost Volatility and Supply Chain Pressures

Fluctuations in raw material costs, particularly for stainless steel, aluminum, and specialty coating materials, create margin pressures for cookware manufacturers operating in competitive market conditions. Supply chain disruptions and import dependencies for certain specialized components can impact production costs and product availability. Manufacturers face challenges in managing cost structures while maintaining product quality standards and meeting consumer price expectations in an increasingly competitive marketplace.

Consumer Awareness Gaps in Rural and Smaller Markets

Despite overall market growth, branded cookware adoption remains concentrated in urban and metropolitan areas, with limited penetration in rural and smaller town markets. Lower awareness about the benefits of quality cookware materials, safety certifications, and product features constrains market expansion beyond established urban centers. Additionally, traditional preferences for conventional cookware materials and limited distribution infrastructure in rural areas restrict access to modern branded products among potential consumers in these underserved markets.

Competitive Landscape:

The India cookware market exhibits a moderately fragmented competitive landscape with established players competing against emerging direct-to-consumer brands and unorganized sector participants, creating a multi-tier competitive structure based on brand recognition, distribution reach, and price positioning. Leading manufacturers leverage multi-plant capacity, celebrity endorsements, and extensive distribution networks to preserve brand recall and market presence across diverse consumer segments. Companies compete through product innovation, advanced coating technologies, design aesthetics, and strategic partnerships to differentiate their offerings and capture evolving consumer preferences. The competitive environment is characterized by investments in research and development for non-stick coatings, induction-compatible bases, ergonomic designs, and smart cookware features that address changing lifestyle needs. Emerging direct-to-consumer entrants differentiate on toxin-free warranties, environmental messaging, and design-forward approaches appealing to urban millennials and health-conscious consumers.

Recent Developments:

- In September 2025, Tupperware Corporation expanded its India offering with a new range of glassware, cookware and stainless‑steel bottles & flasks, marking a strategic push into kitchen essentials beyond storage products to cater to evolving consumer needs.

India Cookware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Products Covered | Pots And Pans, Pressure Cookers, Cooking Racks, Cooking Tools, Bakeware, Microwave Cookware |

| Materials Covered | Stainless Steel, Carbon Steel, Cast Iron, Aluminium, Glass, Stoneware, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarket/Hypermarket, Specialty Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India cookware market size was valued at USD 2.68 Billion in 2025.

The India cookware market is expected to grow at a compound annual growth rate of 8.83% from 2026-2034 to reach USD 5.73 Billion by 2034.

Non-stick/coated dominated the India cookware market with a share of 59%, driven by consumer preference for convenient cooking solutions requiring less oil, easy cleaning benefits, and healthier meal preparation options with diverse coating technologies including ceramic, Teflon, and enamel variants.

Key factors driving the India cookware market include rising urbanization and changing lifestyle patterns, increasing disposable incomes and premiumization trends, growing health awareness and safety consciousness regarding cooking materials, expansion of organized retail and e-commerce channels, and rising interest in home cooking influenced by social media and culinary content.

Major challenges include price sensitivity among consumers particularly in rural and semi-urban areas, competition from unorganized sector manufacturers offering lower-priced alternatives, raw material cost volatility and supply chain pressures, limited awareness and penetration beyond metropolitan markets, and the need to balance affordability with product quality and safety certifications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)