India Copper Cathode Market Size, Share, Trends and Forecast by Refining Process Type, Application, and Region, 2025-2033

India Copper Cathode Market Overview:

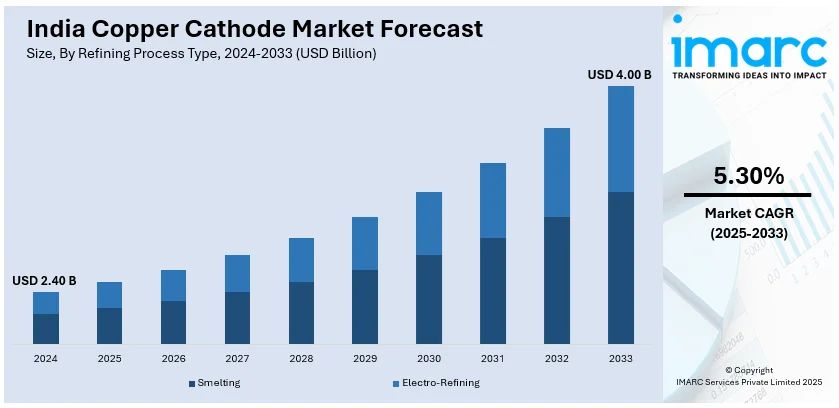

The India copper cathode market size reached USD 2.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.00 Billion by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. Increasing demand from the electrical and electronics sector, rapid industrialization, infrastructure development, growing renewable energy projects, rising electric vehicle adoption, and government initiatives promoting domestic production are driving the India copper cathode market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.40 Billion |

| Market Forecast in 2033 | USD 4.00 Billion |

| Market Growth Rate (2025-2033) | 5.30% |

India Copper Cathode Market Trends:

Growing Demand from Electrical and Electronics Industry

The increasing adoption of copper cathodes in the electrical and electronics sector is a significant trend driving the India copper cathode market. Copper cathodes are widely used in power transmission, wiring, and circuit boards due to their superior conductivity and corrosion resistance. With India's rapid urbanization and industrialization, the demand for high-quality copper is rising, especially in renewable energy projects and electric vehicle (EV) infrastructure. Government initiatives such as ‘Make in India’ and investments in smart grids are further fueling the India copper cathode market growth. For instance, the 'Make in India' campaign celebrated its tenth anniversary on September 25, 2024, commemorating ten years of noteworthy progress in turning India into a major global manufacturing base. With USD 165.1 Billion going to the manufacturing sector, the program has brought in a total of USD 667.4 Billion in Foreign Direct Investment (FDI) since its launch in 2014—a 119% increase over the previous ten years. Furthermore, since its introduction in 2020, the Production Linked Incentive (PLI) Scheme has produced investments totaling INR 1.32 Lakh Crore (USD 16 Billion), increasing manufacturing output by INR 10.90 Lakh Crore (USD 130 Billion), and, as of June 2024, creating over 8.5 lakh employment. As a result, the electrical and electronics industry remains a major contributor to the expanding India copper cathode market share.

To get more information on this market, Request Sample

Sustainability and Recycling Initiatives Fostering Market Growth

The push for sustainable and eco-friendly practices is positively influencing the India copper cathode market outlook. Recycling copper has gained prominence as industries seek to reduce carbon footprints and dependency on mined copper. Companies are investing in secondary copper production, leveraging advanced refining technologies to produce high-purity cathodes from scrap. Additionally, government policies promoting circular economy practices are encouraging large-scale adoption of recycled copper in construction, automotive, and power industries. For instance, at the 12th Regional 3R and Circular Economy Forum in Asia and the Pacific, which was inaugurated on March 3, 2025, Union Minister of Housing and Urban Affairs Manohar Lal suggested creating the Cities Coalition for Circularity (C3), a global platform that would promote city-to-city cooperation, knowledge exchange, and private sector partnerships to hasten the adoption of circular economy practices. In keeping with the forum's theme, "Realising Circular Societies Towards Achieving SDGs and Carbon Neutrality in Asia-Pacific," this project aims to combine cutting-edge technology with conventional sustainable practices. As a result of the meeting, the Jaipur Declaration 2025-2034, which reflects a shared commitment to sustainable urban development, is anticipated to be adopted. With sustainability becoming a priority, the market is witnessing increased investments in green technologies, ensuring long-term availability of copper cathodes while minimizing environmental impact.

India Copper Cathode Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on refining process type and application.

Refining Process Type Insights:

- Smelting

- Electro-Refining

The report has provided a detailed breakup and analysis of the market based on the refining process type. This includes smelting and electro-refining.

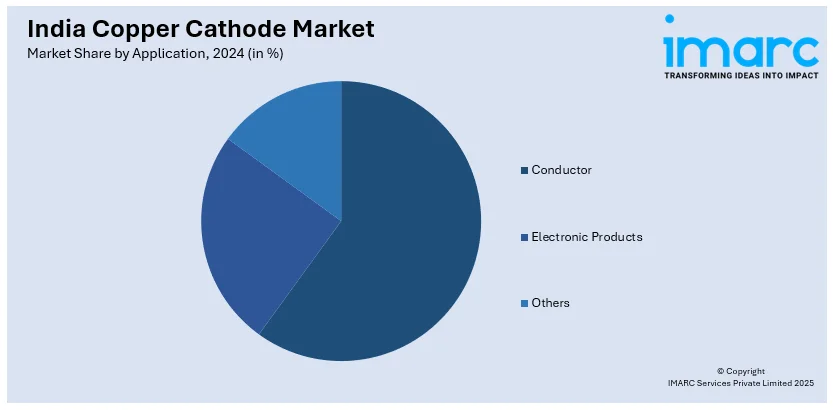

Application Insights:

- Conductor

- Electronic Products

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes conductor, electronic products, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Copper Cathode Market News:

- On March 3, 2025, the Ministry of Mines promised that India will not experience any copper shortages after the Copper Quality Control Order (QCO) went into effect on December 1, 2024. The Bureau of Indian Standards (BIS) has certified eight local and foreign suppliers as of right now, and two more are anticipated to be certified by the middle of December 2024. In order to guarantee a steady supply of copper free from interruptions or price manipulation, this strategy seeks to improve the quality control ecosystem in the non-ferrous metals industry.

- On December 6, 2024, the Ministry of Mines declared that Adani's Kutch Copper Refinery had started up and would be operating at full capacity by February or March 2025. This plant is anticipated to generate 500,000 metric tons of refined copper per year when it is fully operational, thereby lowering India's dependency on imports. About 69% of the 363,000 tons of refined copper cathode that India bought in the previous fiscal year, valued at ₹24,552 Crore, came from Japan.

India Copper Cathode Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Refining Process Types Covered | Smelting, Electro-Refining |

| Applications Covered | Conductor, Electronic Products, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India copper cathode market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India copper cathode market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India copper cathode industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The copper cathode market in India was valued at USD 2.40 Billion in 2024.

The India copper cathode market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 4.00 Billion by 2033.

The market is driven by rapid industrialization and urban infrastructure development, which significantly boosts demand for copper in power, construction, and manufacturing sectors. Expanding renewable energy projects and increasing adoption of electric vehicles further accelerate consumption. Additionally, rising government investments in electrical grid modernization and strong demand from the electronics industry are key factors supporting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)