India Copper Sulphate Market Size, Share, Trends and Forecast by End-Use and Region, 2025-2033

India Copper Sulphate Market Overview:

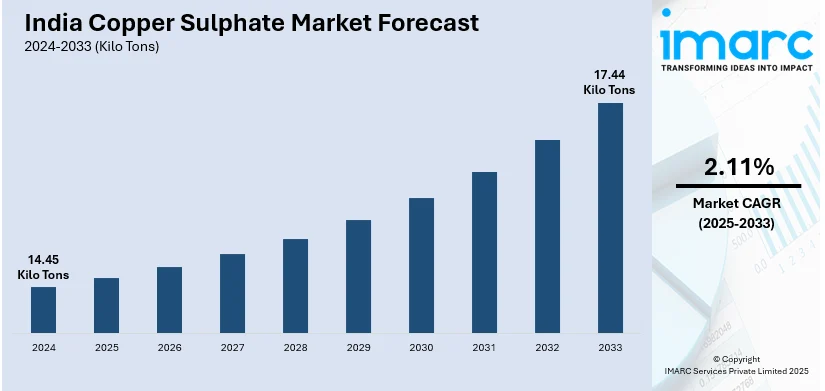

The India copper sulphate market size reached 14.45 Kilo Tons in 2024. Looking forward, IMARC Group expects the market to reach 17.44 Kilo Tons by 2033, exhibiting a growth rate (CAGR) of 2.11% during 2025-2033. India copper sulfate market is driven by rising agricultural demand for fungicides, expanding electroplating applications in manufacturing, and government support for domestic production, particularly in electric vehicle (EV) and electronics sectors, ensuring its continued importance in both industrial and agricultural applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 14.45 Kilo Tons |

| Market Forecast in 2033 | 17.44 Kilo Tons |

| Market Growth Rate 2025-2033 | 2.11% |

India Copper Sulphate Market Trends:

Rising Demand from Agriculture Sector

India's agriculture sector is a significant user of copper sulfate, mainly utilizing it in fungicides, pesticides, and soil treatments. The rising acceptance of contemporary agricultural methods and the necessity for efficient crop protection measures are fueling the demand. Copper sulfate is commonly utilized in creating Bordeaux mixture, an important fungicide for crops such as grapes, potatoes, and citrus fruits. Furthermore, the growing efforts of the governing body to enhance agricultural production via subsidies and educational initiatives on pest management are positively influencing the market. The expansion of horticulture and floriculture also plays a key role in boosting demand as these plants need significant protection from fungal diseases. As per the National Horticulture Database released by the National Horticulture Board, the land for floriculture production in India for the 2023-24 period covered 285 thousand hectares, yielding a total of 2,284 thousand tons of loose flowers and 947 thousand tons of cut flowers. Besides this, farmers are moving towards more efficient and economical plant protection options, rendering copper sulfate a crucial input. The rising occurrence of plant diseases caused by climate change is boosting the demand for effective fungicides, aiding the consistent expansion of the copper sulfate market in India.

To get more information on this market, Request Sample

Growing Role in Electroplating and Metal Processing

India's rapidly growing manufacturing sector, especially in the automotive, electronics, and electrical fields, is driving the need for copper sulfate in electroplating processes. The substance is extensively utilized as an electrolyte in processes of copper refining and plating, improving the corrosion resistance and conductivity of metal parts. The governing body’s support for local manufacturing through the ‘Make in India’ initiative is leading to increased production of electrical equipment, automotive components, and consumer electronics, which is directly influencing the use of copper sulfate. Furthermore, the shift to electric vehicles (EVs) is increasing the demand for superior copper plating in battery terminals and connectors. For example, according to the information supplied by the India Brand Equity Foundation (IBEF) in 2024, India aimed to boost the sales of EV to 30% in private cars, 70% in commercial vehicles, 40% in buses, and 80% in two-wheelers and three-wheelers by 2030. This corresponds to a bold goal of 80 million electric vehicles on Indian highways by 2030. Moreover, India aims for total local EV manufacturing via the 'Make in India' program. With industries requiring greater efficiency in metal finishing and surface treatment, copper sulfate will remain a vital chemical in India's expanding manufacturing sector.

India Copper Sulphate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on end-use.

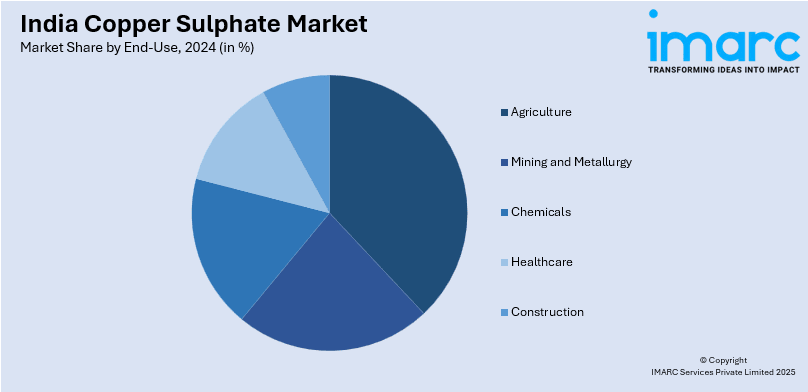

End-Use Insights:

- Agriculture

- Mining and Metallurgy

- Chemicals

- Healthcare

- Construction

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes agriculture, mining and metallurgy, chemicals, healthcare, and construction.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Copper Sulphate Market News:

- In January 2025, JSW Group announced an investment of 26 billion rupees ($301 million) to establish operations at two copper mines in Jharkhand, India, marking its foray into non-ferrous metals. The mines are expected to reach a copper ore capacity of 3 million tons per annum and begin partial operations by the second half of fiscal year 2027.

India Copper Sulphate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Agriculture, Mining and Metallurgy, Chemicals, Healthcare, Construction |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India copper sulphate market performed so far and how will it perform in the coming years?

- What is the breakup of the India copper sulphate market on the basis of end-use?

- What is the breakup of the India copper sulphate market on the basis of region?

- What are the various stages in the value chain of the India copper sulphate market?

- What are the key driving factors and challenges in the India copper sulphate market?

- What is the structure of the India copper sulphate market and who are the key players?

- What is the degree of competition in the India copper sulphate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India copper sulphate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India copper sulphate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India copper sulphate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)