India Copper Wire Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

India Copper Wire Market Overview:

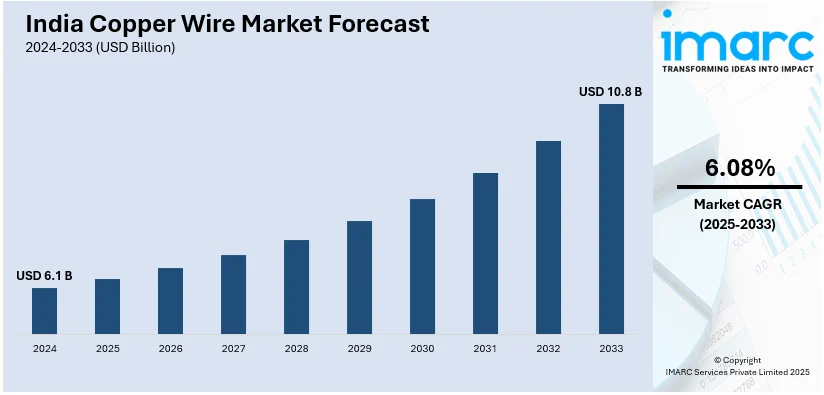

The India copper wire market size reached USD 6.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. The rising infrastructure development, increasing power transmission needs, rapid urbanization, growing automotive and electronics sectors, government initiatives, expanding renewable energy projects, and technological advancements enhancing conductivity, efficiency, and corrosion resistance in electrical applications are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.1 Billion |

| Market Forecast in 2033 | USD 10.8 Billion |

| Market Growth Rate 2025-2033 | 6.08% |

India Copper Wire Market Trends:

Expanding Domestic Copper Wire Production

The expansion of copper wire manufacturing is accelerating due to increasing demand from power transmission, electric vehicles, and renewable energy sectors. Growing infrastructure projects and advancements in electronics are further driving production capacity. Companies are investing in modern facilities to manufacture high-quality copper rods, flats, and wires for industries like transformers, railways, and solar energy. This shift toward domestic manufacturing is enhancing supply chain resilience and reducing import reliance. Additionally, localized production is improving cost efficiency, ensuring a stable supply for key applications. As the electrical and industrial sectors expand, the need for efficient and high-conductivity copper components is increasing, making investments in manufacturing facilities crucial for meeting future energy and technology requirements in India. For example, in June 2024, Gopalan Enterprises inaugurated a copper manufacturing unit in Hoskote, Bengaluru, under its subsidiary, Gopalan Metals (India) Private Ltd. The facility would produce copper rods, flats, and wires for sectors like cable, transformer, automobile, electronics, solar energy, and railways. The company aims to achieve INR 270 Crore in revenue by the fiscal year 2024-25.

To get more information on this market, Request Sample

Increasing Copper Demand in Rail Electrification

The expansion of high-speed rail networks is driving greater use of copper in electrification projects. With a focus on improving efficiency and reliability, domestically sourced copper is becoming a key material in railway infrastructure. Its high conductivity and durability support the growing shift toward electrified transport, reducing reliance on fossil fuels. Governments and industries are prioritizing local production to ensure stable supply chains and cost-effective solutions. As rail networks expand, the demand for copper in power transmission and signaling systems continues to rise. This shift not only enhances energy efficiency but also strengthens domestic industries by minimizing import dependency. The increasing adoption of electrified transportation further solidifies copper’s role in advancing sustainable mobility and infrastructure development. For instance, in September 2024, India's first Namo Bharat Rapid Rail was inaugurated in Gujarat, marking a milestone in high-speed rail infrastructure. The project extensively utilizes domestically produced copper for electrification, emphasizing India's push for self-reliance in critical materials. With growing demand for efficient transport networks, copper's role in rail electrification is expanding, reducing import dependency while ensuring high conductivity and durability for modern railway systems.

India Copper Wire Market Segmentation:

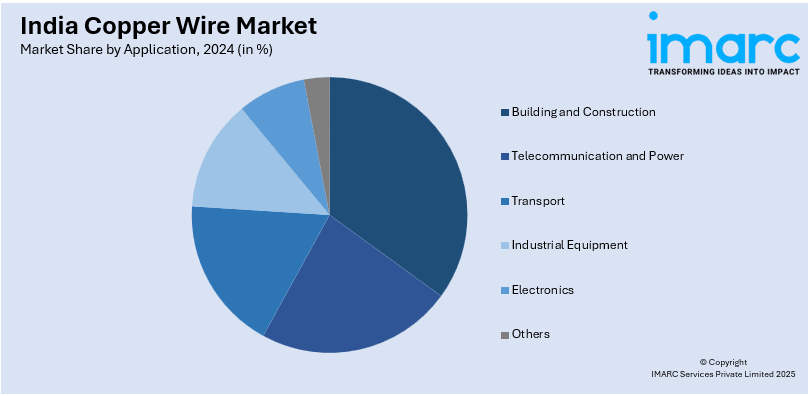

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application.

Application Insights:

- Building and Construction

- Telecommunication and Power

- Transport

- Industrial Equipment

- Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, telecommunication and power, transport, industrial equipment, electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Copper Wire Market News:

- In February 2025, APAR Industries Limited showcased its latest advancements in copper wire technology at ELECRAMA 2025, emphasizing its commitment to electrifying India's energy future. The company's innovative solutions aim to enhance efficiency and reliability in power transmission, supporting the nation's growing infrastructure and energy demands.

- In January 2025, Parmeshwar Metal Limited launched its IPO, aiming to raise INR 24.74 Crore by issuing 4,056,000 equity shares at INR 10 each. The funds would establish a new manufacturing facility in Dehgam, Gujarat, producing bunched copper wire and 1.6 mm copper wire, renovate furnaces, and meet working capital needs.

India Copper Wire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Building and Construction, Telecommunication and Power, Transport, Industrial Equipment, Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India copper wire market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India copper wire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India copper wire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The copper wire market in India was valued at USD 6.1 Billion in 2024.

The India copper wire market is projected to exhibit a CAGR of 6.08% during 2025-2033, reaching a value of USD 10.8 Billion by 2033.

India copper wire market is primarily driven by rapid infrastructure development, including power transmission, urban electrification, and renewable energy projects. Growing demand from the automotive, electronics, and telecom sectors, especially with EV and 5G expansion, is boosting consumption. Additionally, government initiatives like “Make in India” further support domestic production and long-term growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)