India Corn Oil Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

India Corn Oil Market Overview:

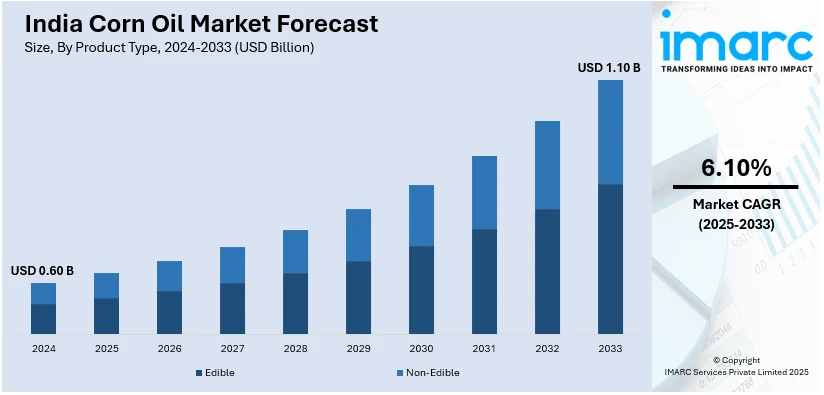

The India corn oil market size reached USD 0.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.10 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The India corn oil market share is expanding, driven by the rising awareness about the risks associated with high cholesterol, obesity, and cardiovascular diseases, along with the increasing usage of corn oil as an effective ingredient in pharmaceutical formulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.60 Billion |

| Market Forecast in 2033 | USD 1.10 Billion |

| Market Growth Rate 2025-2033 | 6.10% |

India Corn Oil Market Trends:

Growing health awareness

The increasing health awareness among individuals is impelling the India corn oil market growth. With a rise in the number of people with cardiovascular conditions in the country, the demand for beneficial cooking oil options like corn oil is high. According to industry reports, heart-related claims rose from 9-12% in 2019-2020 to 18-20% in 2023-2024, indicating a growing occurrence of cardiac problems. Corn oil is packed with polyunsaturated fats like omega-6 fatty acids, which aid in reducing bad cholesterol levels and promoting heart health. As more individuals are becoming conscious about the risks associated with high cholesterol, obesity, and cardiovascular diseases, they are shifting towards oils with lower saturated fat content, driving the demand for corn oil. Additionally, corn oil contains plant sterols, which further assist in lowering cholesterol, making it a preferred choice for health-conscious people. Fitness trends, diet awareness programs, and social media campaigns are also educating individuals about the advantages of corn oil in improving metabolism and supporting overall well-being. Moreover, restaurants and food chains are incorporating corn oil in their cooking processes to meet user preferences for healthier meal options. The growing trend of using oil blends, where corn oil is combined with other healthy oils to enhance nutritional value, is offering a favorable India corn oil market outlook.

To get more information on this market, Request Sample

Rising pharmaceutical applications

Corn oil serves as an effective carrier oil in pharmaceutical formulations, particularly for fat-soluble vitamins, essential nutrients, and medicinal syrups. Its mild flavor, stability, and ease of absorption make it suitable for delivering active ingredients without altering the product’s properties. Corn oil’s antioxidant content also enhances the shelf life of pharmaceutical items, ensuring their effectiveness over time. Additionally, its presence in skincare ointments and topical creams benefits wound healing and skin protection, contributing to its growing demand. The pharmaceutical sector also uses corn oil in formulations targeting cholesterol reduction, given its natural plant sterols that help to manage lipid levels. With rising investments in India’s healthcare sector and increasing production of dietary supplements, nutritional syrups, and wellness products, corn oil is gaining traction as a versatile and reliable pharmaceutical ingredient. As the demand for effective drug delivery systems and health supplements rises, corn oil’s role in supporting formulation stability and improving absorption further strengthens its presence in the burgeoning pharmaceutical industry. As per the information provided on the official website of the IBEF, the total market size of the Indian pharmaceutical industry is set to attain USD 130 Billion by 2030.

India Corn Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Edible

- Non-Edible

The report has provided a detailed breakup and analysis of the market based on the product types. This includes edible and non-edible.

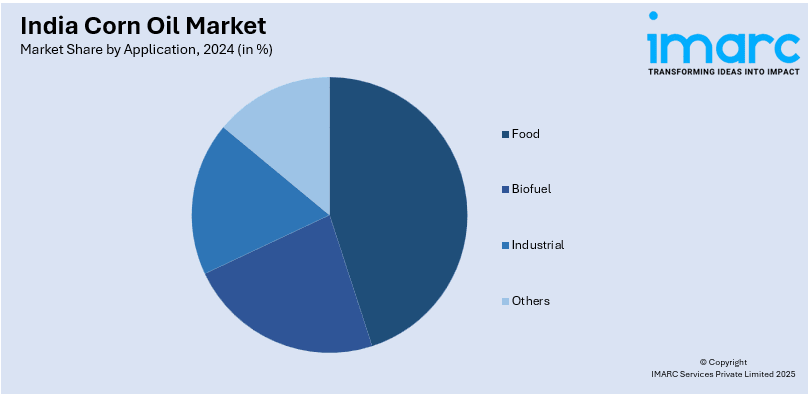

Application Insights:

- Food

- Biofuel

- Industrial

- Others

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes food, biofuel, industrial, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channels. This includes supermarkets and hypermarkets, convenience stores, departmental stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Corn Oil Market News:

- In March 2025, Woodpecker Green Agri Nutrients Private Limited, a subsidiary of the Som Group, announced plans to establish its facility in Farrukhabad, India, covering an area of around 40 acres. The firm intended to invest more than INR 600 Crore to set up a distillery and brewery unit focused on potatoes, maize, and grains. Featuring a production capability of 700 Tons daily for maize and 200 Kiloliters daily for molasses, the starch processing facility, which included corn oil, ethanol, starch powders, gluten, and CO2, was anticipated to create jobs for more than 1,000 individuals.

- In October 2024, the Indian Union Cabinet sanctioned the ‘National Mission on Edible Oils-Oilseeds (NMEO-Oilseeds)’ to improve local oilseed output and attain self-sufficiency in edible oils. Assistance was to be offered to cooperatives, FPOs, and industry stakeholders to set up or improve post-harvest facilities, concentrating on boosting recovery from resources like corn oil, cottonseed, and rice bran.

India Corn Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Edible, Non-Edible |

| Applications Covered | Food, Biofuel, Industrial, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India corn oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India corn oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India corn oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The corn oil market in India was valued at USD 0.60 Billion in 2024.

The India corn oil market is projected to exhibit a (CAGR) of 6.10% during 2025-2033, reaching a value of USD 1.10 Billion by 2033.

Growing health consciousness and low-cholesterol, heart-friendly edible oils demand is driving the corn oil market. Growing disposable income, dietary patterns in urban areas, and suitability of corn oil for high-heat cooking are driving demand. Moreover, uses of corn oil in the cosmetic and pharmaceutical industries are broadening its market scope across various industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)