India Corn Starch Market Size, Share, Trends and Forecast by Category, Application, and Region, 2025-2033

India Corn Starch Market Size and Share:

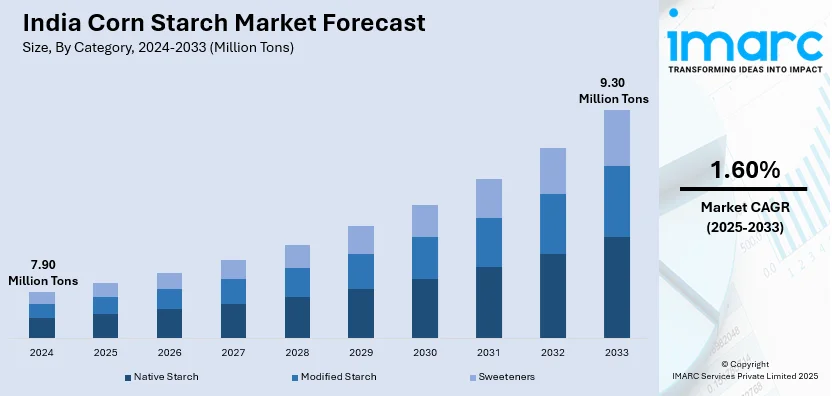

The India corn starch market size reached 7.90 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 9.30 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.60% during 2025-2033. The rising demand for convenience foods, expanding industrial applications, increasing usage in bio-based products, government support for maize production, and advancements in starch processing technologies are strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 7.90 Million Tons |

| Market Forecast in 2033 | 9.30 Million Tons |

| Market Growth Rate 2025-2033 | 1.60% |

India Corn Starch Market Trends:

Surge in Corn-Based Ethanol Production

India's strategic focus on sustainable energy has driven a surge in corn-based ethanol production, significantly impacting the corn starch market. In January 2024, the government revised its ethanol procurement policy to prioritize corn over traditional sugarcane sources, aiming to diversify production and mitigate the environmental impact of sugarcane cultivation. This shift has led to a sharp rise in domestic corn demand, with imports projected to reach 1 million tons in 2024—marking a transition from India’s past status as a net exporter. Additionally, to meet its ethanol blending target of 20% in gasoline by 2025-26, up from the current 13%, India will require over 10 billion liters of ethanol, doubling production from the previous year. Corn-based ethanol is expected to be a key contributor to this expansion. However, this growing demand for ethanol is redirecting corn supply away from the corn starch industry, potentially leading to supply constraints, price increases, and the need for efficiency improvements or alternative sourcing strategies in the starch sector.

To get more information on this market, Request Sample

Growing Demand from the Pharmaceutical Sector

India's expanding pharmaceutical industry is driving significant growth in the corn starch market. Corn starch is essential in tablet formulations, serving as a disintegrant, binder, and filler to enhance medication dissolution and bioavailability. The demand for pharmaceutical-grade corn starch is growing due to increasing healthcare awareness, expanded manufacturing capacities, and greater investments in research and development (R&D). India's pharmaceutical industry has drawn significant foreign direct investment (FDI), with equity inflows reaching $21.22 billion between April 2000 and December 2022, representing approximately 3% of the country's total FDI across every sector. This influx of investment underscores the industry's growth potential and its escalating demand for essential raw materials like corn starch. As pharmaceutical production continues to rise, the demand for high-quality excipients is expected to surge, further propelling the growth of the corn starch market.

India Corn Starch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on category and application.

Category Insights:

- Native Starch

- Modified Starch

- Sweeteners

The report has provided a detailed breakup and analysis of the market based on the category. This includes native starch, modified starch, and sweeteners.

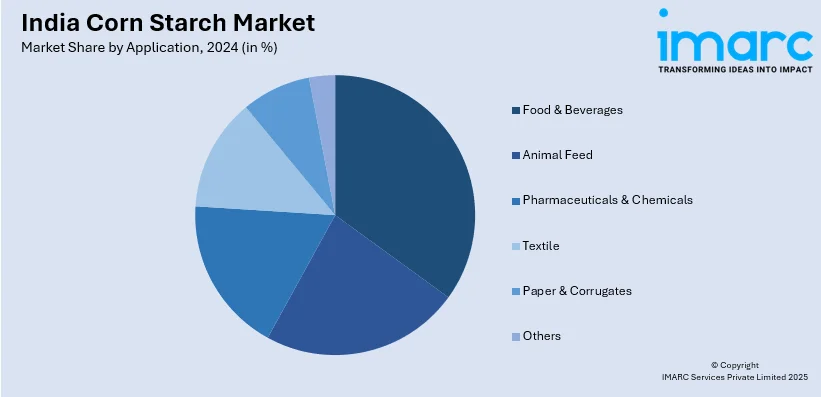

Application Insights:

- Food & Beverages

- Animal Feed

- Pharmaceuticals & Chemicals

- Textile

- Paper & Corrugates

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food & beverages, animal feed, pharmaceuticals & chemicals, textile, paper & corrugates, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Corn Starch Market News:

- March 2025: Cargill opened its newest Indian corn milling factory in Gwalior, Madhya Pradesh, to fulfill the rising demand for confectionery and other food products. The factory, established by local producer Saatvik Agro Processors, has the potential to service a $15 billion market for sweets, snacks, dairy, and baby formula.

- December 2024: Auro Sundram International invested around Rs 250 crore to develop a starch manufacturing factory in Bihar's Araria district. The company, which operates a maize processing facility in Forbesganj, supplies maize grits to FMCG companies and produces floating fish feed for fish farmers. The factory will have an annual capacity of 500 tons per day and will be operating in March 2027.

India Corn Starch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Native Starch, Modified Starch, Sweeteners |

| Applications Covered | Food & Beverages, Animal Feed, Pharmaceuticals & Chemicals, Textile, Paper & Corrugates, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India corn starch market performed so far and how will it perform in the coming years?

- What is the breakup of the India corn starch market on the basis of category?

- What is the breakup of the India corn starch market on the basis of application?

- What are the various stages in the value chain of the India corn starch market?

- What are the key driving factors and challenges in the India corn starch market?

- What is the structure of the India corn starch market and who are the key players?

- What is the degree of competition in the India corn starch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India corn starch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India corn starch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India corn starch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)