India Corporate Training Market Size, Share, Trends and Forecast by Technical Training, End Use Industry, and Region, 2026-2034

India Corporate Training Market Size and Share:

The India corporate training market size reached USD 12.2 Billion in 2025. The market is expected to reach USD 39.9 Billion by 2034, exhibiting a growth rate (CAGR) of 12.86% during 2026-2034. The market growth is attributed to the rising demand for upskilling and reskilling, digital transformation across industries, growth in e-learning platforms, increased focus on employee productivity, government initiatives, adoption of hybrid work models, technological advancements in training delivery, and growing emphasis on leadership development, compliance, and soft skills training.

Market Insights:

- Based on region, the market is divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of technical training, the market is categorized as soft skills, quality training, compliance, and others.

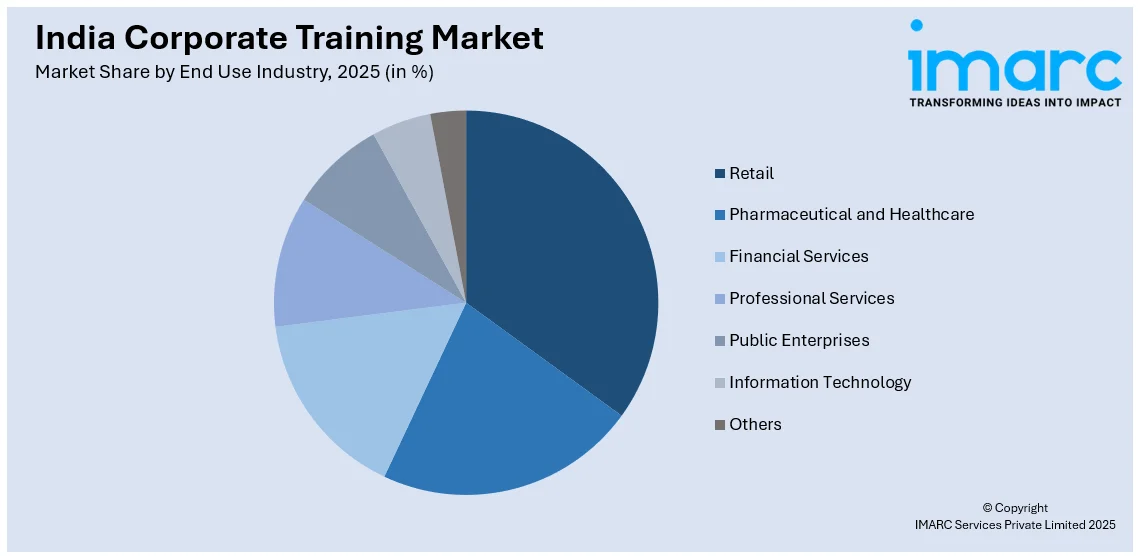

- Based on the end use industry, the market is segmented into retail, pharmaceutical and healthcare, financial services, professional services, public enterprises, information technology, and others.

Market Size and Forecast:

- 2025 Market Size: USD 12.2 Billion

- 2034 Projected Market Size: USD 39.9 Billion

- CAGR (2026-2034): 12.86%

Corporate training is a strategic approach to workforce development that places a premium on the creation and dissemination of original and authentic learning materials within an organizational context. In this paradigm, the emphasis goes beyond merely adhering to legal and ethical standards; it extends to ensuring that training content is innovative, specific to the organization's needs, and devoid of unauthorized use of external intellectual property. This approach involves the conscientious crafting of training programs, resources, and materials, employing various strategies such as utilizing open educational resources responsibly, obtaining proper licenses for third-party content, and implementing robust plagiarism checks. By prioritizing originality, organizations not only mitigate legal risks but also create a dynamic learning environment that fosters creativity, meets the unique needs of their workforce, and enhances the overall effectiveness of corporate training initiatives.

To get more information on this market Request Sample

The India corporate training market has undergone significant transformations, driven by a confluence of factors that underscore the dynamism of the business landscape. Firstly, the rise of digital technology has been a pivotal force, reshaping the training paradigm. Organizations are increasingly adopting e-learning platforms, leveraging their scalability and flexibility to meet the diverse learning needs of a modern workforce. This, in turn, is significantly expanding the Indian corporate training market size. Coupled with the digital shift, there is a growing recognition of the importance of personalized learning experiences. Furthermore, the imperative to adapt to a remote work environment has led to a surge in demand for online training modules, webinars, and virtual classrooms. This shift is not only a response to immediate challenges but also indicative of a broader transformation in the way organizations perceive and implement corporate training strategies. Simulations, gamified content, and immersive experiences are gaining traction, offering a more engaging and effective learning environment. Additionally, this trend aligns with the understanding that practical, applicable skills are crucial in a competitive business landscape. Besides this, organizations are navigating a landscape where adaptability and innovation in training strategies are paramount for success, which in turn, is expected to fuel the market growth over the forecasted period.

India Corporate Training Market Trends:

Increasing Government Support

Government support plays a vital role in shaping the market development. Initiatives such as Skill India, Pradhan Mantri Kaushal Vikas Yojana (PMKVY), and National Skill Development Mission aim to improve workforce skills and promote industry-relevant training. These programs encourage collaboration between public institutions and private training providers, helping organizations adopt structured training models. In addition to this, the government has also promoted digital skilling through e-learning platforms like Swayam and FutureSkills Prime, which provide access to upskilling and reskilling programs in areas like AI, cybersecurity, data science, and business analytics. Moreover, incentives for companies investing in employee skill development and sector-specific skill councils further augment the India corporate training market share. The implementation of labor codes and compliance standards has increased awareness of regulatory training across industries. Additionally, partnerships with state governments to address regional workforce needs are helping bridge skill gaps. These policies have created a favorable environment for enterprises to invest in structured, scalable, and future-ready training initiatives.

Growing Adoption of Learning Technologies and Platforms

The corporate training landscape in India is reshaped by the adoption of advanced learning technologies and digital platforms. Learning Management Systems (LMS) have become essential tools for delivering, tracking, and evaluating training outcomes, enabling centralized control over employee development across large, distributed organizations. These platforms support multimedia content, real-time assessments, and learner analytics, facilitating data-driven decisions. Moreover, logistics platforms also assist in scheduling, resource allocation, and cost management of both virtual and in-person sessions. Besides, micro-learning apps are gaining traction by offering short, focused modules accessible on mobile devices, enhancing learning retention and engagement. This is a significant factor supporting the India corporate training market growth. The use of immersive technologies such as Virtual Reality (VR) and Augmented Reality (AR) has expanded in sectors like manufacturing, healthcare, and aviation, where simulation-based training improves skill proficiency and reduces operational risks. These tools support scalability and customization across industries.

Tech-Driven Soft Skills and Personalized Learning Models

The market is witnessing a strong shift toward technology-enabled soft skills development and personalized learning experiences. Organizations are prioritizing communication, emotional intelligence, adaptability, and collaboration, embedding these into digital formats for wider reach and consistent delivery. Platforms now offer video-based coaching, interactive case studies, and AI-powered simulations to create immersive, experiential learning. Leadership programs are being integrated with role-based assessments and real-time feedback, while EQ assessments within LMS dashboards help tailor individual learning paths. Simultaneously, gamification is gaining traction in the corporate training industry in India, with companies using points, badges, leaderboards, and scenario-driven modules to drive engagement and knowledge retention. Microlearning supports this with short, modular content suitable for on-demand use. AI further enhances the experience by analyzing learner behavior to offer content personalization, allowing employees to progress at an optimized pace. With the expansion of hybrid and remote work models, training is increasingly being delivered through webinars, mobile apps, and asynchronous platforms, enabling workforce-wide access across locations and schedules without compromising consistency or learning outcomes.

Challenges and Opportunities of India Corporate Training Market:

The market faces challenges related to workforce diversity, inconsistent digital infrastructure, and limited training budgets, particularly among small and mid-sized enterprises. Many organizations struggle to align training programs with measurable outcomes, and resistance to change among employees often affects the adoption of new learning models. There's also a skills mismatch between training content and real-world job requirements in several industries. Despite these challenges, as per the India corporate training market analysis, the market presents strong opportunities. The rising demand for digital learning platforms and customized training solutions tailored to sector-specific needs is creating new business models. The shift toward remote and hybrid work has fueled the growth of e-learning, microlearning, and mobile-based training tools. Increasing awareness of the need for continuous learning, especially in fields like technology, healthcare, and finance, further drives market expansion. Moreover, partnerships between training providers and enterprises to deliver outcome-focused learning, improve productivity, and enhance retention in a highly competitive labor market.

India Corporate Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on technical training and end use industry.

Technical Training Insights:

- Soft Skills

- Quality Training

- Compliance

- Others

The report has provided a detailed breakup and analysis of the market based on the technical training. This includes soft skills, quality training, compliance, and others.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Pharmaceutical and Healthcare

- Financial Services

- Professional Services

- Public Enterprises

- Information Technology

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes retail, pharmaceutical and healthcare, financial services, professional services, public enterprises, information technology, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- November 2024: Bengaluru‑based XR startup AutoVRse launched VRseBuilder, an AI‑powered, modular SaaS platform designed to enable enterprises to efficiently create, deploy, and scale immersive VR training programs across sectors including manufacturing, engineering, and heavy industry. The platform features a Creation Studio that automates module development, a VR‑native LMS, a deployment dashboard, and no‑code Unity SDK to convert SOPs and other documents into VR training modules.

- November 2024: At the Bengaluru Tech Summit, the Government of Karnataka signed five strategic MoUs with leading global technology companies to deliver advanced skills training in emerging IT domains like AI, deep tech, cybersecurity, and data science. The objective is to upskill 100,000 individuals over the coming year, targeting a 70 percent placement rate for trained participants.

- May 2024: Kairos unveiled what it describes as India’s first comprehensive game‑based training platform designed specifically to enhance corporate soft skills. The platform combines a suite of digital and physical games and tools, along with robust supporting resources, allowing Learning & Development professionals to conduct engaging, impactful training in areas such as collaboration, emotional intelligence, agility, and creative thinking.

India Corporate Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technical Trainings Covered | Soft Skills, Quality Training, Compliance, Others |

| End Use Industries Covered | Retail, Pharmaceutical and Healthcare, Financial Services, Professional Services, Public Enterprises, Information Technology, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India corporate training market performed so far and how will it perform in the coming years?

- What is the breakup of the India corporate training market on the basis of technical training?

- What is the breakup of the India corporate training market on the basis of end use industry?

- What are the various stages in the value chain of the India corporate training market?

- What are the key driving factors and challenges in the India corporate training?

- What is the structure of the India corporate training market and who are the key players?

- What is the degree of competition in the India corporate training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India corporate training market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India corporate training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India corporate training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)