India Corrosion Resistant Metal Coatings Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Corrosion Resistant Metal Coatings Market Overview:

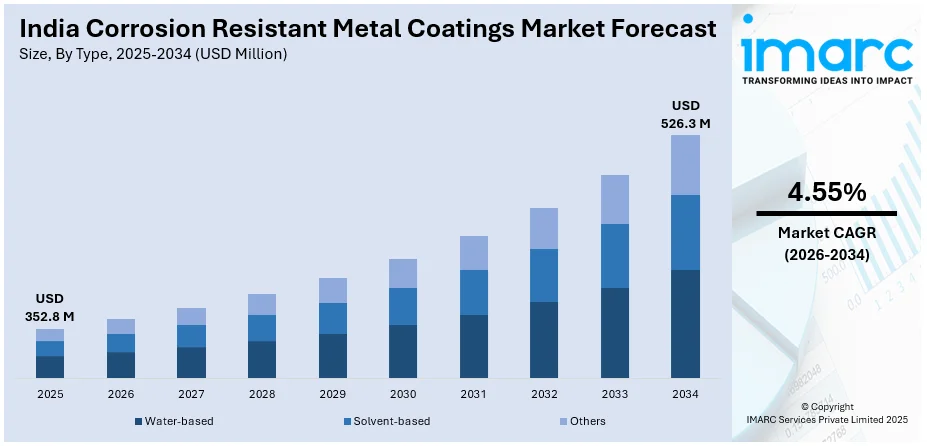

The India corrosion resistant metal coatings market size reached USD 352.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 526.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.55% during 2026-2034. The market is expanding due to rapid industrialization, infrastructure development, and rising need for durable protective solutions. Sectors, such as oil & gas, marine, automotive, and construction, are also driving demand for advanced coatings that enhance metal longevity and reduce maintenance costs. The shift toward eco-friendly, high-performance coatings is further influencing the India corrosion resistant metal coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 352.8 Million |

| Market Forecast in 2034 | USD 526.3 Million |

| Market Growth Rate 2026-2034 | 4.55% |

India Corrosion Resistant Metal Coatings Market Trends:

Infrastructure and Industrial Growth

India’s rapid infrastructure development, spanning highways, railways, bridges, ports, and industrial facilities, is a major driver of corrosion-resistant coatings. Steel and other metals used in these projects require protection against rust and environmental wear to ensure structural longevity. Government initiatives such as the National Infrastructure Pipeline (NIP) and Smart Cities Mission are fueling the need for durable coatings to reduce long-term maintenance costs. Additionally, industrial expansion in sectors like cement, mining, and power generation increases the application of corrosion-resistant solutions to protect machinery and facilities. As the country prioritizes long-lasting, cost-effective infrastructure, the demand for high-performance coatings to prevent corrosion is expected to rise steadily. For instance, in April 2023, PETRONAS introduced an innovative product to tackle the long-standing corrosion-related issues that jeopardize asset integrity. ProShield+, a paint additive for steel structures, is formulated with graphene material, which boasts ultra-high barrier properties.

To get more information on this market Request Sample

Expansion of Oil & Gas and Marine Sectors

The oil & gas and marine industries are highly susceptible to corrosion because of constant exposure to saltwater, chemicals, and harsh weather conditions. With India aiming to boost domestic oil exploration and expand its port infrastructure under initiatives like Sagarmala, the need for robust metal protection has grown sharply. Corrosion-resistant coatings are essential for pipelines, offshore rigs, storage tanks, and vessels to ensure operational safety and extend service life. Failure in these sectors due to corrosion can lead to significant economic and environmental losses. As a result, both public and private entities are investing in advanced coating technologies tailored to these challenging environments.

Rising Awareness and Regulatory Push for Environmental Compliance

The India corrosion resistant metal coatings market growth is also driven by the growing awareness among industries about the economic impact of corrosion and the benefits of preventive coatings. Simultaneously, environmental regulations are pushing companies to adopt low-VOC (volatile organic compounds), water-based, and eco-friendly coatings. India’s alignment with global environmental standards and sustainability goals has driven innovation in corrosion-resistant technologies. Manufacturers are now developing high-performance coatings that are both effective and environmentally responsible. Sectors such as consumer goods, construction, and electronics are also seeking solutions that minimize environmental harm while extending product life. This dual demand for performance and compliance is propelling growth in green, corrosion-resistant coating formulations across industries.

India Corrosion Resistant Metal Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Water-based

- Solvent-based

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes water-based, solvent-based, and others.

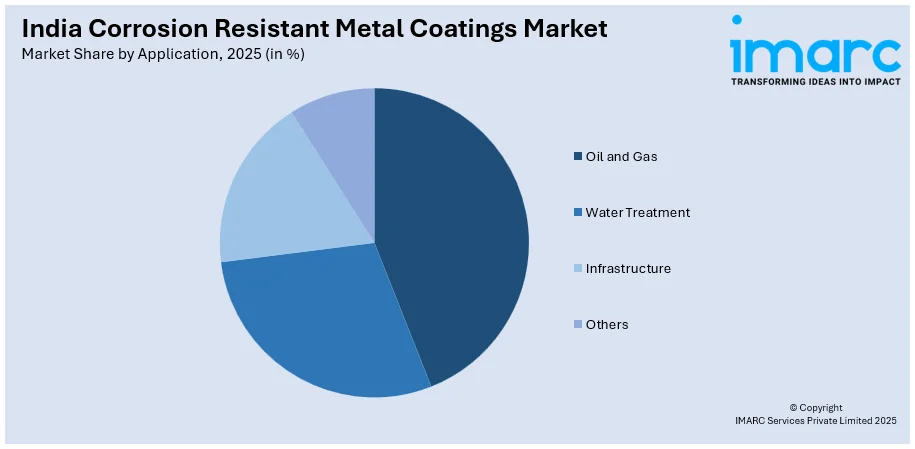

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Oil and Gas

- Water Treatment

- Infrastructure

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, water treatment, infrastructure, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Corrosion Resistant Metal Coatings Market News:

- In August 2024, ArcelorMittal Nippon Steel India (AM/NS India), a collaboration between Nippon Steel and ArcelorMittal, two prominent figures in the global steel industry, unveiled Optigal® - a premium color coated steel brand featuring a groundbreaking Zinc-Aluminium-Magnesium (ZAM) metallic coating.

- In April 2025, Jindal (India) Ltd, a downstream steel products manufacturer within the B.C. Jindal Group ventured into the renewable energy sector by launching its Jindalume line of aluminum-zinc (Al-Zn) coated coils designed for solar module mounting structures. Due to their aluminum-zinc coating, which offers excellent structural strength and corrosion resistance as well as a long service life, Al-Zn coils are ideal for use in solar modules and harsh outdoor environments.

India Corrosion Resistant Metal Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Water-based, Solvent-based, Others |

| Applications Covered | Oil and Gas, Water Treatment, Infrastructure, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India corrosion resistant metal coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the India corrosion resistant metal coatings market on the basis of type?

- What is the breakup of the India corrosion resistant metal coatings market on the basis of application?

- What is the breakup of the India corrosion resistant metal coatings market on the basis of region?

- What are the various stages in the value chain of the India corrosion resistant metal coatings market?

- What are the key driving factors and challenges in the India corrosion resistant metal coatings?

- What is the structure of the India corrosion resistant metal coatings market and who are the key players?

- What is the degree of competition in the India corrosion resistant metal coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India corrosion resistant metal coatings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India corrosion resistant metal coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India corrosion resistant metal coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)