India Corundum Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

India Corundum Market Overview:

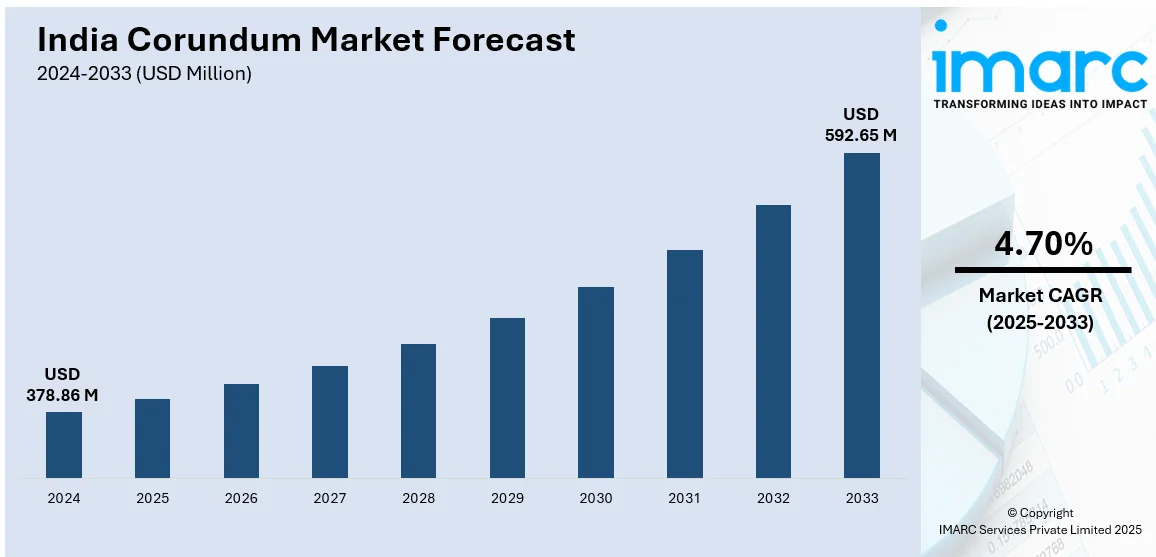

The India corundum market size reached USD 378.86 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 592.65 Million by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The rising demand from the abrasive and refractory industries, expanding infrastructure and manufacturing sectors, and increasing applications in electronics and optics. Government initiatives promoting industrial growth and self-reliant electronics manufacturing further propel market expansion, along with growing preference for high-performance materials in end-use industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 378.86 Million |

| Market Forecast in 2033 | USD 592.65 Million |

| Market Growth Rate 2025-2033 | 4.70% |

India Corundum Market Trends:

Rising Demand from Abrasive Applications

India's corundum industry is experiencing a strong trend upwards on account of its increasing use in abrasive equipment and machinery. The exceptional hardness and heat resistance of corundum make it particularly suitable for grinding wheels, sanding paper, cutting tools, and polishants. As the manufacturing, automobile, and metalworking sectors are expanding, demand for accurate finishing tools has gone up, thus fueling the use of corundum-based abrasives. Moreover, Make-in-India campaign has encouraged indigenous production of industrial parts and equipment, further intensifying the demand for high-quality abrasive materials. The transition towards mechanized surface treatment processes across primary industries has also increased dependence on effective abrasive media, placing corundum in a prime position as a raw material of significance in this changing industrial scene.

To get more information on this market, Request Sample

Expansion of Electronics and Optics Applications

Corundum’s role in India’s electronics and optical sectors is growing rapidly, driven by its use in LEDs, optical windows, and sapphire-based screens for wearables and high-end devices. Synthetic sapphire, a corundum variant, is valued for its clarity and strength, making it ideal for advanced optoelectronic applications. India’s push for self-reliance through semiconductor initiatives is accelerating demand for high-purity corundum. Government-backed programs like the “PLI for Semiconductor Manufacturing” and infrastructure projects are supporting this shift. For example, an Electronics Manufacturing Cluster (EMC) spanning 474.30 acres in Tamil Nadu, with a project cost of ₹587.47 crore, is expected to attract ₹4,175 crore in investments and create 16,900 jobs. As India strengthens its high-tech manufacturing base, corundum is becoming integral to its evolving electronics ecosystem.

Growing Utilization in Refractory and Ceramics Industry

Corundum's excellent thermal stability and chemical inertness are driving its usage in refractory linings and advanced ceramics across India. As steel and cement production intensifies, so does the need for high-performance refractory materials capable of withstanding extreme heat and corrosion. Corundum is a crucial component in refractory bricks, furnace linings, and ceramic kilns. Moreover, the increasing adoption of energy-efficient and high-temperature resistant materials in industrial furnaces is propelling demand for synthetic corundum. The development of smart cities and infrastructural projects has also pushed demand for specialty ceramics, tiles, and sanitary ware, indirectly contributing to market growth. As the Indian ceramics sector modernizes, corundum is becoming more integral to its manufacturing processes.

India Corundum Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application.

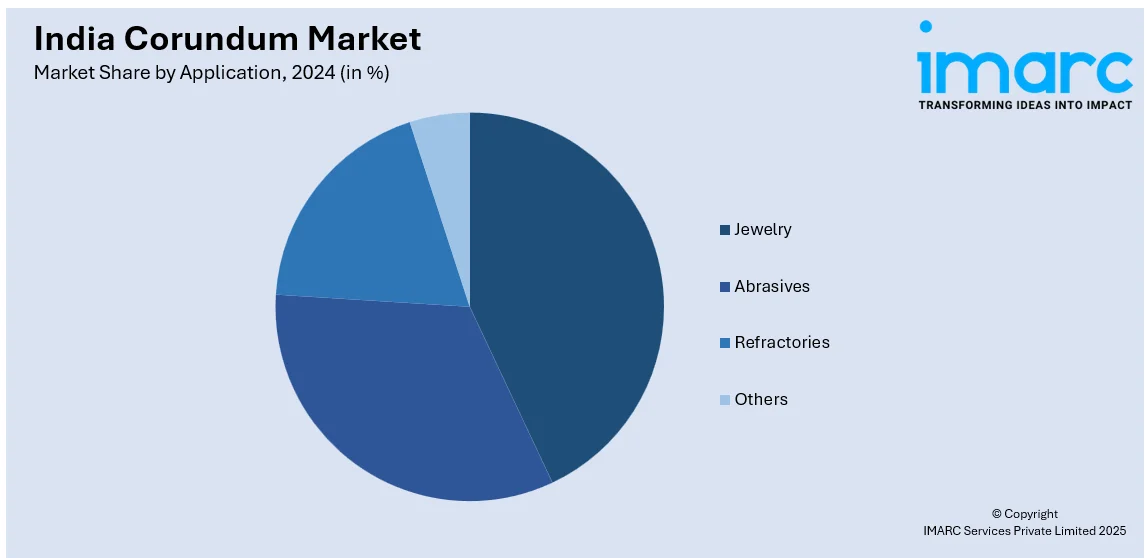

Application Insights:

- Jewelry

- Abrasives

- Refractories

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes jewelry, abrasives, refractories, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Corundum Market News:

- In September 2024, Carborundum Universal Ltd. (CUMI) signed an agreement to fully acquire U.S.-based Silicon Carbide Products, Inc. (SCP) for an enterprise value of ₹56 crore. According to CUMI Managing Director Sridharan Rangarajan, the acquisition aligns with the company’s strategic expansion plans and aims to strengthen its global footprint. This move enhances CUMI’s capabilities in the advanced ceramics and materials segment, supporting its long-term growth objectives in international markets.

- In July 2024, Sukhadia Stones Co Ltd, a leading corundum specialist, meets global market demand with its vast inventory of rubies and sapphires in various sizes, qualities, and origins. Renowned for supplying high-quality calibrated gemstones and fulfilling customized orders, the company exports midrange to high-end stones to over 30 countries. With strong inventory management and a customer-focused approach, Sukhadia Stones continues to support jewellery brands with consistent, premium coloured gemstone supplies.

India Corundum Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Jewelry, Abrasives, Refractories, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India corundum market performed so far and how will it perform in the coming years?

- What is the breakup of the India corundum market on the basis of application?

- What is the breakup of the India corundum market on the basis of region?

- What are the various stages in the value chain of the India corundum market?

- What are the key driving factors and challenges in the India corundum market?

- What is the structure of the India corundum market and who are the key players?

- What is the degree of competition in the India corundum market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India corundum market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India corundum market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India corundum industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)