India Craft Spirits Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

India Craft Spirits Market Overview:

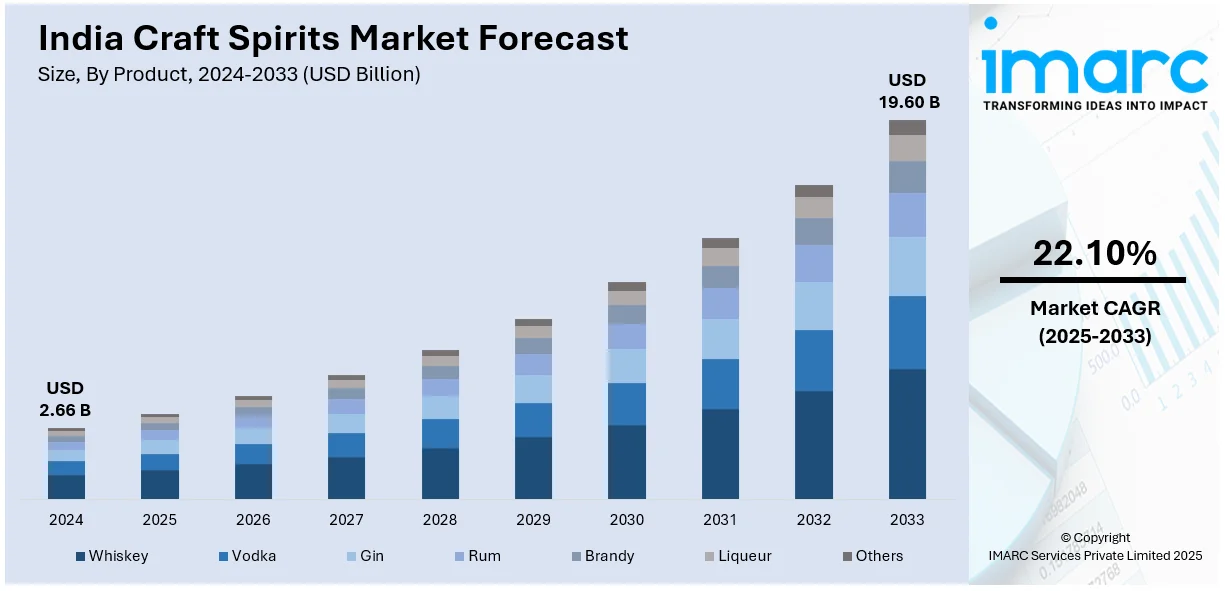

The India craft spirits market size reached USD 2.66 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.60 Billion by 2033, exhibiting a growth rate (CAGR) of 22.10% during 2025-2033. Rising disposable incomes, growing consumer preference for premium and artisanal spirits, expanding urban nightlife, and increasing awareness of homegrown brands are driving the market. Regulatory support, evolving drinking preferences, innovative flavor profiles, and the expansion of direct-to-consumer sales channels further contribute to market growth and differentiation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.66 Billion |

| Market Forecast in 2033 | USD 19.60 Billion |

| Market Growth Rate 2025-2033 | 22.10% |

India Craft Spirits Market Trends:

Rising Popularity of Indigenous Ingredients in Craft Spirits

The craft spirits market in India is witnessing an increasing use of indigenous ingredients, reflecting a shift toward locally sourced botanicals and flavors. Distillers are incorporating unique Indian botanicals such as Himalayan juniper, gondhoraj lime, saffron, and exotic spices to create distinct flavor profiles that resonate with Indian consumers. This trend is driven by the demand for authentic, high-quality spirits that celebrate regional heritage and craftsmanship. Additionally, locally sourced ingredients reduce dependence on imports, making production more cost-effective while supporting local farming communities. For instance, in September 2023, Himmaleh Spirits launched Kumaon & I, India’s first provincial dry gin, crafted using 11 botanicals from Uttarakhand. Distilled for nine hours, it features Timur (Szechuan pepper), Black Turmeric, and local citrus fruits (Galgal and Kinu), offering a distinct flavor. The brand emphasizes a farm-to-bottle approach, sustainability, and regional traceability. The gin’s design reflects Kumaon’s cultural heritage. The focus on indigenous botanicals aligns with the broader consumer preference for organic and sustainable products. Premiumization efforts are being reinforced through limited-edition releases and region-specific craft spirits, further solidifying India's identity in the global craft spirits industry.

To get more information on this market, Request Sample

Expansion of Homegrown Craft Distilleries and Premiumization

India's craft spirits market is experiencing a surge in homegrown distilleries focusing on small-batch production, emphasizing quality over quantity. Independent brands are emerging across states, leveraging India’s diverse climate to produce unique expressions of gin, whisky, rum, and vodka. Premiumization is becoming a key driver, with consumers willing to pay more for meticulously crafted spirits with distinctive aging processes and intricate flavor profiles. The shift toward premium craft spirits is also fueled by an increasing appreciation for artisanal and locally produced beverages. Additionally, these brands are employing innovative barrel-aging techniques using indigenous woods and experimenting with hybrid distillation methods. The emphasis on storytelling, provenance, and craftsmanship positions Indian craft spirits brands competitively against global players in the premium segment. For instance, in December 2024, Diageo India launched India Rare Spirits, an exclusive personalized cask program offering bespoke aged malts crafted to individual preferences. Based at the Ponda Distillery in Goa, the initiative blends India’s whisky-making heritage with innovation. Customers select from 30–40 aged malts, including Indian Peated Single Malts, Ex-Bourbon and Oloroso Cask finishes. Each cask is bottled with customized labels and artwork for special occasions. This program reinforces India’s growing prominence in global luxury whisky markets and premium craftsmanship.

Growth of Direct-to-Consumer (DTC) and Experiential Marketing Strategies

Craft spirits brands in India are increasingly adopting direct-to-consumer (DTC) sales and experiential marketing to engage customers. With changing regulations allowing for greater digital engagement, brands are leveraging online sales platforms, subscription-based models, and interactive tasting experiences to enhance consumer loyalty. Experiential marketing strategies, including distillery tours, pop-up events, and mixology workshops, are gaining popularity, offering consumers an immersive brand experience. For instance, in November 2024, Diageo India launched the Flavour Lab in Bengaluru under The Good Craft Co. initiative to showcase Indian craft spirits globally. This experiential space offers guided tours across four zones, where visitors can explore brewing, distillation, fermentation, and mixology of spirits like whisky, gin, mahua, and toddy created using local ingredients like dukshiri and sarsaparilla. The lab fosters education, innovation, and sustainability, allowing enthusiasts to engage with raw materials and spirit-making processes. This initiative strengthens India’s craft spirits industry through experiential learning and consumer engagement. Social media and influencer collaborations play a crucial role in brand positioning, helping smaller craft labels build a strong community. The rise of premium bars and speakeasies dedicated to craft cocktails further complements this trend. By creating unique consumer experiences, Indian craft spirit brands are fostering deeper connections with their target audience, reinforcing brand loyalty and market penetration.

India Craft Spirits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Whiskey

- Vodka

- Gin

- Rum

- Brandy

- Liqueur

- Others

A detailed breakup and analysis of the market based on the product have been provided in the report. This includes whiskey, vodka, gin, rum, brandy, liqueur, and others.

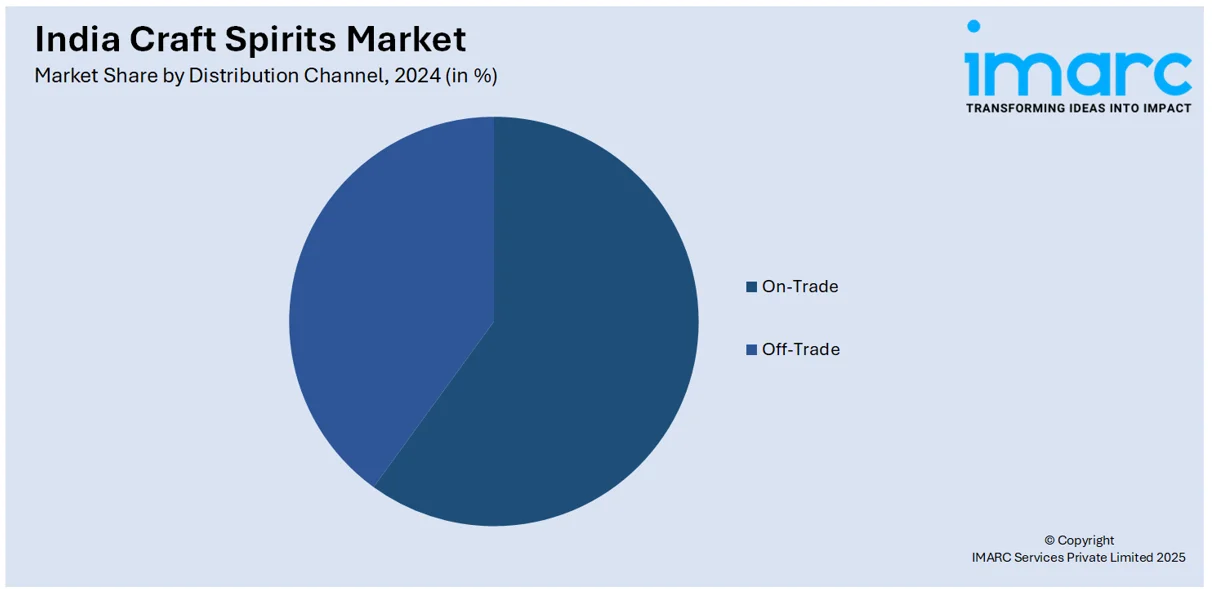

Distribution Channel Insights:

- On-Trade

- Off-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Craft Spirits Market News:

- In September 2024, Diageo India launched The Good Craft Co., its first sensorial Experience Home dedicated to Indian craft spirits. Located at the Ponda Distillery in Goa, it serves as a hub for innovation, sustainability, and community-building in the craft spirits industry. The initiative integrates education, advocacy, and experiential engagement, offering immersive distillery tours, curated tastings, and craft-focused R&D. Through collaborations and investments in alco-bev startups, The Good Craft Co. aims to elevate Indian craft spirits to a global stage, reinforcing premiumization and innovation.

- In December 2024, Globus Spirits launched TERAI India Craft Gin – Litchi & Mulberries, crafted at The India Craft Spirits Co. distillery in Rajasthan. The gin follows a Grain-to-Glass philosophy, blending tradition and innovation. Initially available in Uttar Pradesh, Rajasthan, and Goa, the brand plans further expansion. The gin celebrates India’s rich flavors, reinforcing TERAI’s reputation for premium craft spirits with a modern approach.

India Craft Spirits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, Others |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India craft spirits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India craft spirits market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India craft spirits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The craft spirits market in India was valued at USD 2.66 Billion in 2024.

The India craft spirits market is projected to exhibit a CAGR of 22.10% during 2025-2033, reaching a value of USD 19.60 Billion by 2033.

India’s craft spirits market is expanding due to changing consumer preferences, especially among young adults seeking distinctive, high-quality beverages. Growth is further supported by rising incomes, interest in locally crafted products, evolving social trends, innovative branding strategies, and increased availability through premium retail and online platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)