India Crane Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

India Crane Market Summary:

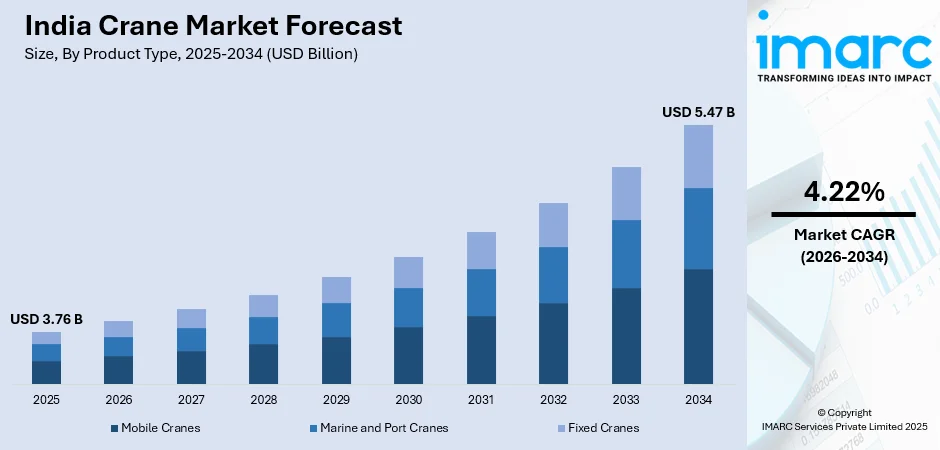

The India crane market size was valued at USD 3.76 Billion in 2025 and is projected to reach USD 5.47 Billion by 2034, growing at a compound annual growth rate of 4.22% from 2026-2034.

The market is driven by rapid infrastructure development, increasing construction activities, and government initiatives supporting urbanization and industrialization across the country. Rising demand for efficient material handling solutions in construction sites, ports, and manufacturing facilities is fueling market expansion. Additionally, technological advancements in crane design and the integration of smart features are enhancing operational efficiency. The growing adoption of cranes across diverse industrial sectors is strengthening the India crane market share.

Key Takeaways and Insights:

- By Product Type: Mobile cranes dominate the market with a share of 78.59% in 2025, driven by exceptional versatility across diverse construction sites, infrastructure projects, and industrial applications requiring flexible lifting capabilities.

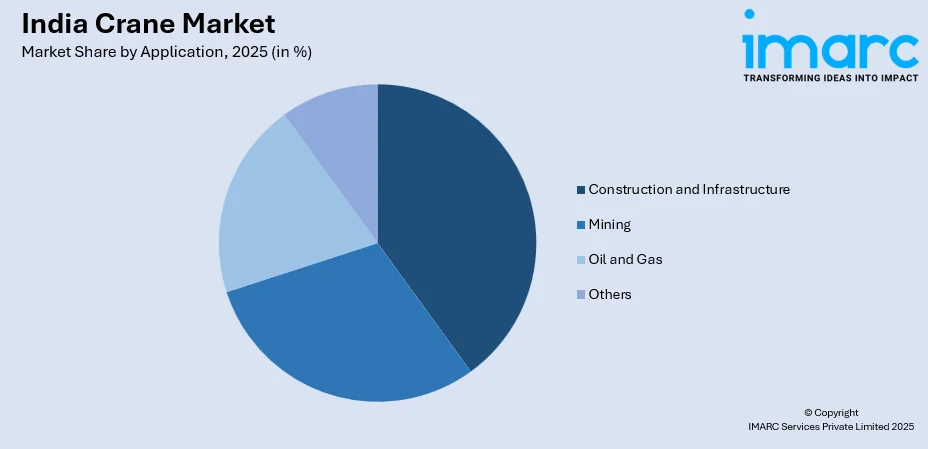

- By Application: Construction and infrastructure lead the market with a share of 35.01% in 2025, owing to extensive government investments in highways, bridges, airports, metro systems, and urban development projects.

- By Region: North India represents the market with a share of 32% in 2025, driven by concentration of major infrastructure corridors, industrial development zones, and rapid urbanization in metropolitan areas including Delhi-NCR.

- Key Players: The India crane market exhibits a moderately fragmented competitive landscape, with multinational equipment manufacturers competing alongside established domestic producers across various capacity segments, product categories, regional service networks, and aftermarket support capabilities.

To get more information on this market Request Sample

The India crane market is experiencing substantial growth driven by multiple converging factors reshaping the industrial landscape. Government initiatives focused on infrastructure modernization, including highway development, port expansion, and urban renewal projects, are generating unprecedented demand for lifting equipment. As per sources, in December 2025, ACE and Sanghvi Movers signed an MOU to deploy Indian-made truck and crawler cranes across infrastructure projects, supporting Make in India and reducing reliance on imports. Moreover, the construction sector's rapid expansion, fueled by rising urbanization and increasing investments in residential and commercial real estate development, is creating sustained requirements for diverse crane solutions. Additionally, the growing industrial manufacturing base and expanding logistics sector are driving adoption of specialized lifting equipment. The integration of advanced technologies, including telematics and automation capabilities, is enhancing crane functionality while improving operational safety and efficiency across construction sites, manufacturing facilities, and port operations throughout the country. These factors collectively position the market for continued expansion during the forecast period.

India Crane Market Trends:

Integration of Smart Technologies and IoT Connectivity

The India crane market is witnessing accelerated adoption of intelligent systems incorporating Internet of Things connectivity and telematics solutions. These advanced features enable real-time monitoring of crane operations, remote diagnostics capabilities, and predictive maintenance functionalities that minimize unexpected downtime. In December 2025, TIL showcased cranes at EXCON 2025 equipped with IoT integration and telematics‑based predictive maintenance to enhance remote performance monitoring and analytics during infrastructure projects. Furthermore, operators can access comprehensive performance data through connected platforms, facilitating informed decision-making regarding equipment utilization and maintenance scheduling.

Growing Emphasis on Energy-Efficient and Eco-Friendly Equipment

Environmental sustainability considerations are increasingly influencing crane procurement decisions across the Indian market. Equipment manufacturers are responding by developing hybrid and electrically powered crane variants that significantly reduce carbon emissions and fuel consumption compared to conventional diesel-powered alternatives. As per sources, in 2025, Konecranes secured 30 battery-powered RTG cranes for a new Indian container terminal, using fully electric E-Hybrid technology with zero emissions, supporting sustainable port operations and efficient container handling. Moreover, this trend aligns with corporate sustainability objectives and regulatory requirements emphasizing reduced environmental impact.

Expansion of Rental and Leasing Business Models

The India crane market is experiencing significant growth in equipment rental and leasing services as an alternative to outright equipment purchases. This trend is particularly pronounced among small and medium-sized construction contractors who prefer flexible access to specialized lifting equipment without substantial capital investments. In May 2025, Radha Cranes reinforced its position as Chennai’s largest crane rental provider, expanding its diverse fleet to serve major infrastructure and industrial projects across South India. Rental providers are expanding their fleet portfolios to include diverse crane types and capacity ranges, catering to varying project requirements across construction, industrial, and infrastructure sectors.

Market Outlook 2026-2034:

The India crane market is projected to demonstrate sustained revenue growth throughout the forecast period, driven by continuing infrastructure investments and industrial expansion across the country. Government initiatives supporting smart city development, transportation network enhancement, and manufacturing sector modernization are expected to generate substantial demand for diverse crane solutions. The market revenue trajectory reflects increasing adoption of technologically advanced equipment variants and expanding applications across construction, mining, port operations, and industrial manufacturing sectors, positioning India as a significant growth market within the global crane industry landscape. The market generated a revenue of USD 3.76 Billion in 2025 and is projected to reach a revenue of USD 5.47 Billion by 2034, growing at a compound annual growth rate of 4.22% from 2026-2034

India Crane Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Mobile Cranes |

78.59% |

|

Application |

Construction and Infrastructure |

35.01% |

|

Region |

North India |

32% |

Product Type Insights:

- Mobile Cranes

- Marine and Port Cranes

- Fixed Cranes

Mobile cranes dominate with a market share of 78.59% of the total India crane market in 2025.

Mobile cranes represent the leading product category within the India crane market, reflecting exceptional versatility and operational flexibility across diverse applications and working environments. Their ability to be rapidly deployed across multiple construction sites without requiring permanent installation makes them particularly suitable for India's dynamic infrastructure development landscape. As per sources, Franna, a Terex brand, announced expansion into India, establishing local production of pick-and-carry mobile cranes at Hosur to support domestic and international infrastructure projects. Additionally, mobile cranes accommodate varying lifting requirements through diverse configurations including truck-mounted, rough terrain, and all-terrain variants.

The leadership position is further reinforced by growing demand from construction contractors undertaking multiple concurrent projects requiring flexible lifting solutions. Mobile cranes provide cost-effective alternatives to fixed crane installations for projects with limited duration or evolving site requirements. Their adaptability to challenging terrain conditions prevalent across Indian construction sites, combined with advancing technological features including telescopic boom extensions and enhanced load management systems, continues driving sustained demand. The ongoing infrastructure expansion across urban and rural areas further supports adoption.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction and Infrastructure

- Mining

- Oil and Gas

- Others

Construction and infrastructure lead with a share of 35.01% of the total India crane market in 2025.

Construction and infrastructure dominate the application landscape, reflecting substantial equipment requirements generated by India's ambitious development agenda. Major infrastructure initiatives encompassing highway networks, railway modernization, airport expansion, port development, and urban transit systems are driving unprecedented demand for lifting equipment. In September 2025, ACE announced a ₹400 Crore investment to establish a new crane manufacturing facility in Palwal, Haryana, enhancing domestic production capacity to support India’s growing construction and infrastructure projects. Moreover, high-rise construction projects in metropolitan areas require specialized crane solutions for vertical material handling at significant elevations.

This prominence is sustained by continuing government investments in infrastructure development under various national programs and initiatives. The construction sector's expansion into tier-two and tier-three cities is broadening geographical demand patterns while creating new market opportunities. Infrastructure projects typically require diverse crane types and configurations to address varying lifting requirements throughout different construction phases, from foundation work through structural completion. Smart city development and industrial corridor projects are further amplifying equipment demand across this application area.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 32% of the total India crane market in 2025.

North India commands the leading regional position within the India crane market, driven by concentrated industrial activity and extensive infrastructure development across this strategically located geographical zone. Major metropolitan areas including Delhi-NCR and surrounding industrial hubs serve as significant economic centers generating substantial construction and industrial equipment demand. The region's positioning along critical transportation corridors and proximity to national capital infrastructure projects reinforces its market leadership. Ongoing development of industrial parks and logistics facilities continues driving sustained requirements.

The regional market dynamics are shaped by diverse industrial sectors including manufacturing, logistics, and construction that collectively drive equipment requirements. Government initiatives focusing on industrial corridor development, highway expansion, and urban infrastructure enhancement within this region are generating sustained demand for crane solutions. The presence of established equipment distribution networks and service infrastructure facilitates market accessibility while supporting aftermarket service requirements across the region's diverse customer base spanning contractors and manufacturers.

Market Dynamics:

Growth Drivers:

Why is the India Crane Market Growing?

Accelerating Infrastructure Development and Government Initiatives

The India crane market is experiencing robust growth driven by extensive government investments in infrastructure development under various national programs. Large-scale initiatives focusing on highway network expansion, railway modernization, airport construction, and urban transit system development are generating substantial demand for lifting equipment across the country. In December 2025, BEML partnered with HD KSOE and Hyundai Samho to develop next-generation maritime and port cranes in India, supporting Make in India and reducing import dependence. Moreover, the emphasis on enhancing transportation connectivity and developing industrial corridors is creating sustained requirements for diverse crane solutions. Urban development programs targeting smart city creation and metropolitan infrastructure enhancement are further amplifying equipment demand.

Expanding Construction Sector and Urbanization Trends

Rapid urbanization and the consequent expansion of construction activities represent significant growth catalysts for the India crane market. The residential construction sector is experiencing substantial growth driven by increasing urban population and rising housing demand across metropolitan and emerging urban centers. As per sources, in June 2025, the Mumbai Metro Line 4 project achieved a major construction milestone by installing U‑girders using 550‑tonne and three 500‑tonne cranes, underscoring demand for heavy lifting in urban transit development. Commercial real estate development, including office complexes, retail facilities, and hospitality infrastructure, is generating additional equipment requirements. High-rise construction projects necessitate specialized lifting solutions capable of operating at significant elevations while maintaining operational safety standards.

Industrial Manufacturing Growth and Port Modernization

The expanding industrial manufacturing sector and ongoing port modernization initiatives are driving substantial crane market growth across India. Manufacturing facilities require overhead cranes, gantry cranes, and specialized lifting equipment for material handling, assembly operations, and finished goods logistics. In September 2025, DP World added a new quay crane and three electric RTGCs at Mundra Terminal, boosting capacity, efficiency, and sustainability while reducing emissions and noise levels. Moreover, the government's emphasis on domestic manufacturing capacity enhancement is generating sustained industrial equipment demand. Simultaneously, port infrastructure modernization programs are driving adoption of specialized marine and port cranes for cargo handling operations. Container terminal expansions and bulk cargo facility upgrades require advanced lifting solutions with enhanced capacity and operational efficiency. These industrial and port development trends collectively support market expansion across specialized crane categories.

Market Restraints:

What Challenges the India Crane Market is Facing?

High Initial Capital Investment Requirements

The substantial capital investment required for crane procurement represents a significant market constraint, particularly affecting small and medium-sized construction contractors. Advanced crane equipment incorporating latest technologies commands premium pricing that may exceed available capital budgets for many potential purchasers. This investment barrier influences equipment selection decisions and encourages preference for rental alternatives.

Skilled Operator Availability and Training Requirements

The specialized technical expertise required for safe crane operation presents ongoing market challenges related to workforce availability. Qualified crane operators possessing appropriate certifications and experience are essential for maintaining operational safety and equipment productivity. Training requirements for advanced crane systems demand substantial time investments, constraining equipment utilization in regions with limited trained operators.

Infrastructure Limitations and Transportation Constraints

Logistical challenges associated with crane transportation and deployment present operational constraints affecting market development. Road infrastructure limitations in certain regions can restrict movement of large crane equipment between project sites. Weight restrictions on bridges and roads may require alternative routing that increases transportation costs and deployment timelines, influencing equipment selection decisions.

Competitive Landscape:

The India crane market features a diversified competitive structure encompassing multinational equipment manufacturers, established domestic producers, and regional equipment suppliers serving various market segments. Competition is characterized by product differentiation across capacity ranges, technological features, and application-specific configurations. Market participants compete through product quality, aftermarket service capabilities, pricing strategies, and distribution network coverage. The rental and leasing segment has emerged as a significant competitive arena with multiple service providers expanding fleet portfolios. Technological innovation, particularly regarding smart features and energy efficiency, represents a key competitive differentiator. Market participants are investing in service infrastructure expansion and customer support capabilities to strengthen competitive positioning across different regional markets and customer segments.

Recent Developments:

- In July 2025, Loadmate Industries launched its upgraded Smart EOT Crane Series in India, featuring IoT-based health monitoring, anti-sway technology, regenerative braking, and remote diagnostics. The initiative supports efficient, intelligent lifting across manufacturing, steel, logistics, construction, and automotive sectors, advancing India’s adoption of Industry 4.0.

India Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Segment Coverage |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type | Mobile Cranes, Marine and Port Cranes, Fixed Cranes |

| Applicatiom | Construction and Infrastructure, Mining, Oil and Gas, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India crane market size was valued at USD 3.76 Billion in 2025.

The India crane market is expected to grow at a compound annual growth rate of 4.22% from 2026-2034 to reach USD 5.47 Billion by 2034.

Mobile cranes held the largest market share, driven by exceptional versatility, operational flexibility across diverse construction environments, adaptability to varying lifting requirements, ease of transportation between multiple project locations, and cost-effective deployment capabilities.

Key factors driving the India crane market include accelerating infrastructure development through government initiatives, expanding construction activities driven by urbanization, industrial manufacturing growth, port modernization programs, and technological advancements enhancing equipment efficiency.

Major challenges include high initial capital investment requirements, skilled operator availability constraints, infrastructure limitations affecting equipment transportation, fluctuating raw material prices impacting manufacturing costs, import dependencies for specialized components, and regulatory compliance requirements across different operational environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)