India Cryogenic Tanker Market Size, Share, Trends and Forecast by Product Type, Application, Liquefied Gas, End User and Region, 2025-2033

India Cryogenic Tanker Market Overview:

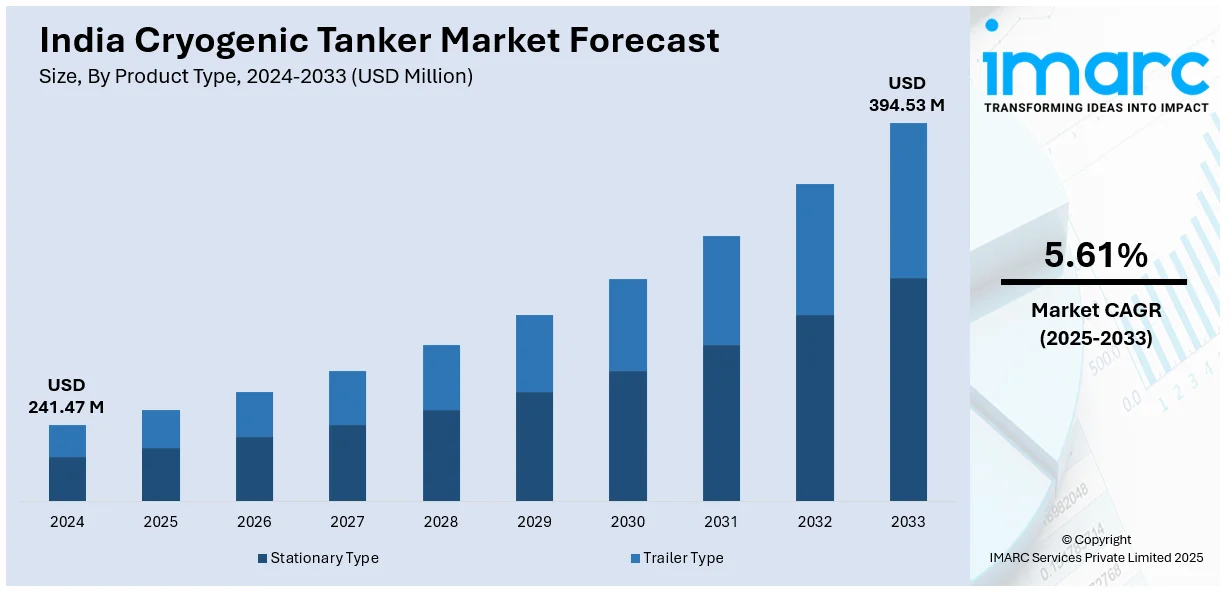

The India cryogenic tanker market size reached USD 241.47 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 394.53 Million by 2033, exhibiting a growth rate (CAGR) of 5.61% during 2025-2033. The increasing demand for liquefied gases like LNG, nitrogen, and oxygen across industries, including healthcare, food processing, and petrochemicals, growing adoption of LNG as a cleaner fuel and ongoing advancements in cryogenic storage technology are some of the major factors augmenting India cryogenic market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 241.47 Million |

| Market Forecast in 2033 | USD 394.53 Million |

| Market Growth Rate 2025-2033 | 5.61% |

India Cryogenic Tanker Market Trends:

Growing Demand for Cryogenic Tankers in Healthcare and Industrial Sectors

India's cryogenic tanker market development is influenced by the increasing demand for the healthcare and industrial markets. Medical centers and hospitals need an uninterrupted supply of liquid oxygen to be used in critical care and operations, leading to a greater need for effective cryogenic storage and transportation. Besides, sectors like steel, chemicals, and electronics are increasingly applying liquefied gases like nitrogen and argon, thus augmenting demand for cryogenic tankers. Healthcare infrastructure development by government efforts along with the boost to industrialization is also favoring India cryogenic market growth. According to an industry report, India's public spending on healthcare increased to 1.9% of GDP in FY24, up from 1.6% in FY23, with the Health Ministry targeting 2.5% by FY25. This growing investment in the healthcare sector is driving the demand for medical infrastructure, including advanced storage and transportation solutions such as cryogenic tanks. These tanks are essential for storing medical oxygen, liquid nitrogen, and other gases critical for hospitals, laboratories, and pharmaceutical facilities. The rise in COVID-19 cases in recent years further highlights the importance of reliable oxygen supply chains, leading to higher investments in cryogenic tankers. With technological advancements improving the efficiency and safety of these tankers, the market is expected to grow steadily in the coming years.

To get more information on this market, Request Sample

Advancements in Cryogenic Tanker Technology Driving Market Growth

Continuous technology improvements in the production of cryogenic tankers are greatly influencing the Indian market. Firms are creating lightweight, high-capacity tankers with better insulation to reduce the loss of gas during storage and transportation. These developments are improving tankers in terms of efficiency, cost savings, and ability for long haulage. Adding automation and remote monitoring systems enables live monitoring of temperature and pressure, which guarantees the safe transportation of liquefied gases. Also, the move towards green energy alternatives, like LNG-fueled vehicles and businesses, is boosting demand for cryogenic tankers to carry liquefied natural gas (LNG). Notably, according to an on September 9, 2024, India intends to minimize pollution and diesel usage by converting a third of its fleet of heavy-duty long-haul trucks to run on liquefied natural gas (LNG) in five to seven years. As part of its plan to reach net-zero emissions by 2070, the government plans to raise the proportion of natural gas in the energy mix from the current 6% to 15% by 2030. India is setting up 49 LNG distribution stations. It intends to set aside 0.5 Million Cubic Meters of gas per day to power about 50,000 vehicles over two to three years in order to facilitate this shift. These developments are expected to substantially boost the demand for cryogenic tanks, as the expansion of LNG infrastructure and transportation networks requires reliable storage and supply systems. Moreover, government policies supporting clean energy and industrial modernization are further driving technological investments in this sector, which in turn is positively impacting the India cryogenic tanker market outlook. As industries continue to demand more advanced and efficient cryogenic storage and transportation solutions, the market is set for steady growth in the coming years.

India Cryogenic Tanker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, application, liquified gas, and end user.

Product Type Insights:

- Stationary Type

- Trailer Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes stationary type and trailer type.

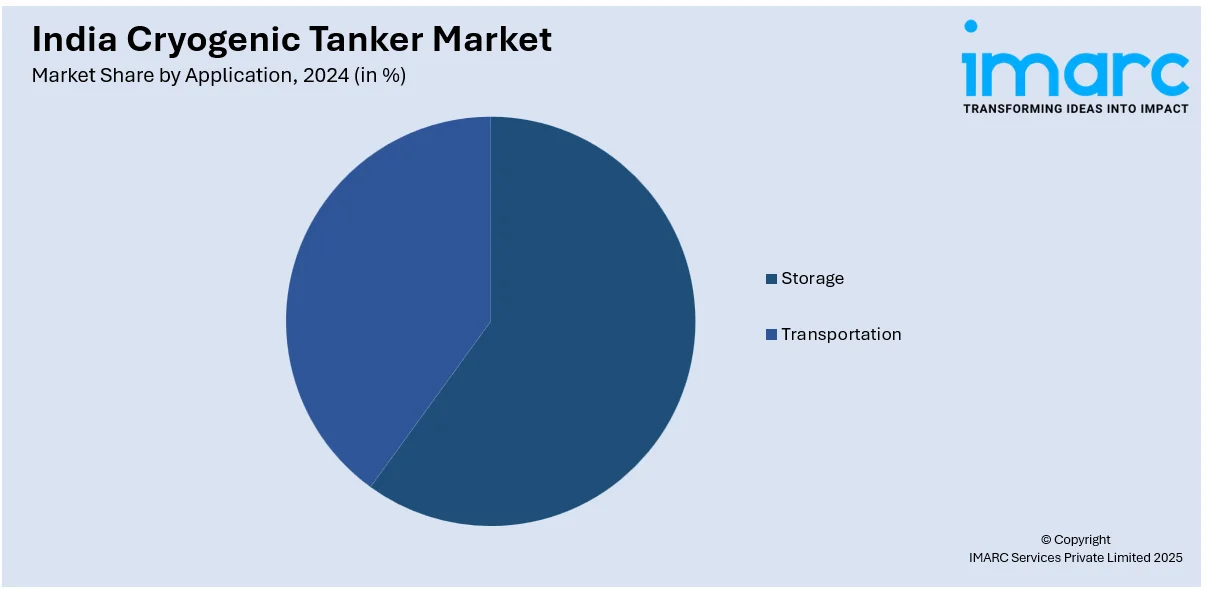

Application Insights:

- Storage

- Transportation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes storage and transportation.

Liquefied Gas Insights:

- Natural Gas

- Nitrogen

- Oxygen

- Others

The report has provided a detailed breakup and analysis of the market based on the liquefied gas. This includes natural gas, nitrogen, oxygen, and others.

End User Insights:

- Healthcare

- Food and Beverage

- Petrochemical

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes healthcare, food and beverage, petrochemical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cryogenic Tanker Market News:

- On November 7, 2024, Highview Power, UK, awarded INOX India Ltd (INOXCVA) a major contract to deliver five 690-kiloliter high-pressure, vacuum-insulated cryogenic tanks for the largest Liquid Air Energy Storage (LAES) project in the world, located in Manchester. These tanks mark the first industrial usage of cryogenic tanks for renewable energy storage and are the biggest vacuum-insulated industrial gas tanks ever manufactured by INOXCVA in a shop.

- On June 27, 2024, Hypro, a gas storage solutions company based in India, introduced a new range of cryogenic tanks intended for the transportation and storage of liquid nitrogen, carbon dioxide, and oxygen. These tanks are designed to accommodate sub-zero activities in a variety of settings, such as industrial manufacturing and breweries. In an effort to cater to the global market, Hypro claims that the tanks satisfy the strictest requirements for cryogenic solutions.

India Cryogenic Tanker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Stationary Type, Trailer Type |

| Applications Covered | Storage, Transportation |

| Liquefied Gases Covered | Nitrogen, Oxygen, Others |

| End Users Covered | Healthcare, Food and Beverage, Petrochemical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cryogenic tanker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cryogenic tanker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cryogenic tanker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cryogenic tanker market in India was valued at USD 241.47 Million in 2024.

The India cryogenic tanker market is projected to exhibit a CAGR of 5.61% during 2025-2033, reaching a value of USD 394.53 Million by 2033.

The market is driven by increased movement of industrial gases, growing applications in sectors such as healthcare, chemicals, and energy, and the need for secure, temperature-controlled transportation. Demand for high-quality insulated tankers continues to grow as industries require safe handling of liquefied gases. Expansion of specialized logistics and infrastructure further supports this trend.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)