India Cryptocurrency Exchange Market Size, Share, Trends and Forecast by Exchange Type, Cryptocurrency Type, User Type, Revenue Model, Trading Services, and Region, 2025-2033

India Cryptocurrency Exchange Market Size and Share:

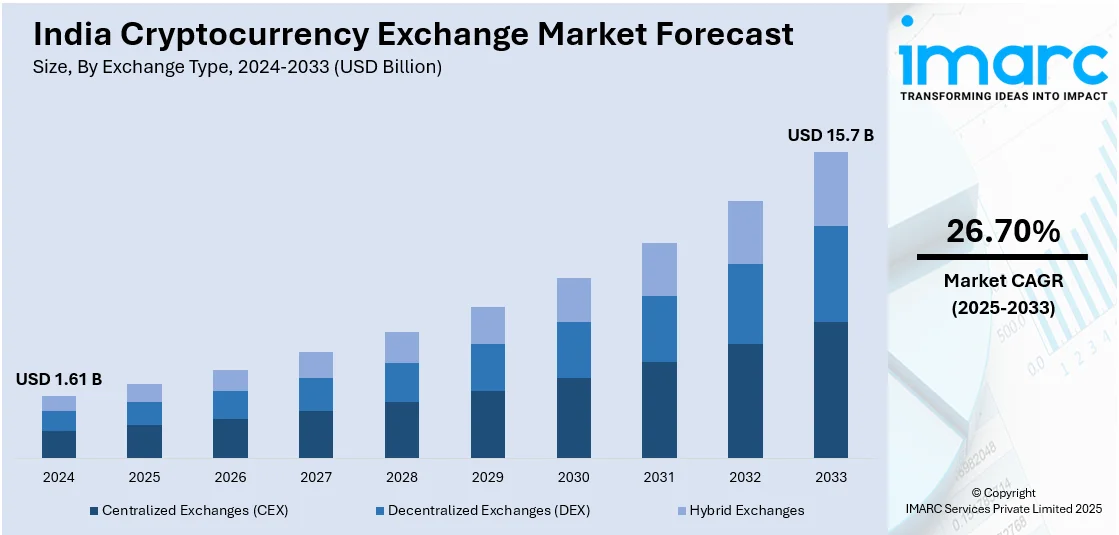

The India cryptocurrency exchange market size was valued at USD 1.61 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.7 Billion by 2033, exhibiting a CAGR of 26.70% from 2025-2033. The market is evolving rapidly, driven by increased retail participation, rising interest in digital assets, and advancements in mobile trading technologies. As regulatory clarity improves and financial literacy expands, more investors are exploring cryptocurrencies as part of diversified portfolios. Exchanges are also enhancing user experience with secure, real-time trading solutions. This dynamic environment continues to shape the India cryptocurrency exchange market share in the digital economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.61 Billion |

| Market Forecast in 2033 | USD 15.7 Billion |

| Market Growth Rate 2025-2033 | 26.70% |

The cryptocurrency exchange market in India is experiencing significant growth, driven by increasing digital adoption, the widespread use of smartphones, and rising interest from tech-savvy youth. As more people look for alternative investment opportunities beyond traditional assets like gold and real estate, cryptocurrencies are becoming increasingly popular. The rise of user-friendly platforms and mobile applications, along with smooth onboarding processes and low transaction fees, is facilitating participation for first-time investors. For instance, in July 2025, CoinSwitch launched Web3 Coins, enabling access to over 100,000 crypto tokens for everyday investors in India, using INR. This initiative simplifies decentralized trading by eliminating barriers like wallet setups and fees. CoinSwitch aims to democratize crypto access while ensuring user safety through a proprietary verification mechanism. Moreover, the surge of peer-to-peer trading and heightened financial literacy in urban and semi-urban regions are contributing to the growth of this digital asset market.

To get more information on this market, Request Sample

Additionally, the involvement of institutional players and advancements in regulatory frameworks are reinforcing the backbone of India's crypto exchange landscape. Venture capital investments in blockchain startups and increased media attention have improved market visibility. Government measures, including the taxation of crypto assets and discussions around a central digital currency, are helping to create a more structured environment that could enhance investor trust. For instance, in June 2025, the Government of India announced its plans to release a discussion paper on cryptocurrency regulation, marking a shift from previous ambiguity. This comprehensive framework aims to align with global standards, focusing on investor protection and taxation, while inviting public feedback. The move has generated optimism within the Indian crypto industry. Exchanges are also prioritizing compliance, cybersecurity, and transparent practices to attract long-term users. As global trends in cryptocurrency shape the behavior of Indian consumers, the introduction of sophisticated trading features, staking options, and educational initiatives is setting the stage for continued growth in the sector.

India Cryptocurrency Exchange Market Trends:

Increasing Adoption of Digital Currencies

The increasing adoption of digital currencies is one of the major drivers of the growth of the India cryptocurrency exchange market. Retail and institutional investors are increasingly adopting cryptocurrencies as an alternative asset class because of their high return potential and diversification. Over a two-year span, the digital rupee’s retail usage jumped sharply, rising from INR 5.7 Crore in March 2023 to INR 1,016.5 Crore by March 2025, an increase of nearly 180 times, according to RBI data. Individual retail investors are lured by the convenience of entry into crypto markets via exchanges and the increasing popularity of cryptocurrencies such as Bitcoin, Ethereum, and newer tokens. For instance, in April 2025, CoinSwitch, India's largest crypto trading platform, announced the launch of INR-based crypto Futures, enhancing the trading experience for retail users. This allows seamless trading without USDT conversion, featuring real-time price mapping and position visibility. The move aims to address the unique needs of India's fast-growing crypto market. Institutional investors like asset managers and hedge funds are, on the contrary, integrating cryptocurrencies into their portfolios as a long-term approach, recognizing the utility of these assets as an inflation and volatility hedge. With rising awareness and maturation of the crypto market, more investors are coming into the space, fueling growth faster. This growth is further catalyzed by the growing popularity of cryptocurrencies within mainstream financial systems and a trend towards decentralized finance (DeFi).

Government Regulation

Government regulation is becoming a crucial factor in the growth of the India cryptocurrency exchange market. As the adoption of digital currencies grows, the need for a structured regulatory framework is becoming more evident to ensure consumer protection, security, and financial system integrity. For instance, in August 2024, India announced its plans to regulate cryptocurrency, with a consultation paper expected by October 2024. Finance Minister of India highlighted a unified G20 approach to crypto regulations. The government seeks stakeholder input to shape its policies, addressing the risks associated with digital currencies. The government is considering frameworks to regulate exchanges, enforce KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, and provide clear tax guidelines for cryptocurrency transactions. These regulations aim to curb fraud, prevent illegal activities, and build trust in the cryptocurrency ecosystem. With proper regulations in place, exchanges are more likely to foster a secure environment for investors and attract institutional participation. Additionally, clearer rules will help cryptocurrency exchanges comply with global standards, further driving market acceptance. As regulations solidify, they will play a key role in supporting India cryptocurrency exchange market growth.

India Cryptocurrency Exchange Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India cryptocurrency exchange market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on exchange type, cryptocurrency type, user type, revenue model, and trading services.

Analysis by Exchange Type:

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Hybrid Exchanges

Centralized exchanges dominate the cryptocurrency landscape in India, primarily due to their user-friendly interfaces, liquidity, and customer support. Serving as intermediaries, these platforms provide custodial services and facilitate fiat-to-crypto conversions. They also feature advanced trading tools, mobile applications, and compliance with regulations, attracting both novice and seasoned investors. Notable CEX platforms in India typically implement Know Your Customer (KYC) processes, which bolster trust and security, leading to widespread acceptance in urban and semi-urban areas.

Decentralized exchanges are gaining popularity in India as privacy-minded users prefer non-custodial platforms that grant them more control over their digital assets. These blockchain-based systems operate without intermediaries, enabling peer-to-peer trading through smart contracts. While liquidity and user experience may not match that of centralized exchanges, the advantages of enhanced security, anonymity, and resistance to censorship are enticing more tech-savvy traders. In times of regulatory uncertainty, DEX platforms in India are especially favored for their resilient, decentralized architecture.

Hybrid exchanges merge the benefits of both centralized and decentralized platforms, striving to provide a streamlined user experience with added security and transparency. In India, these exchanges are emerging as a practical option for users who desire the convenience and liquidity of CEXs along with the privacy and asset management features of DEXs. Typically, hybrid models facilitate fast transactions, lower latency, and improved compliance options. As awareness increases, hybrid exchanges may serve as a crucial link for Indian users seeking a blend of functionality and decentralization.

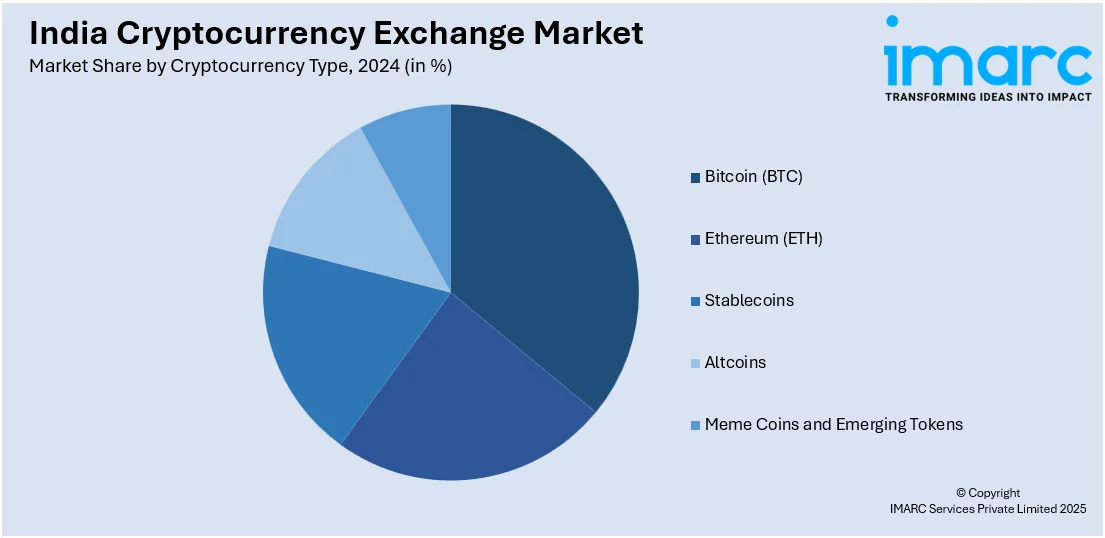

Analysis by Cryptocurrency Type:

- Bitcoin (BTC)

- Ethereum (ETH)

- Stablecoins

- Altcoins

- Meme Coins and Emerging Tokens

Bitcoin continues to be the most traded and recognized cryptocurrency in India, often regarded as digital gold and a reliable store of value. Its prominence is due to its first-mover advantage, high liquidity, and extensive media coverage. Indian investors see BTC as a long-term investment opportunity, especially during times of inflation or currency instability. Despite uncertainties in regulation, Bitcoin’s dominant market position and increasing institutional interest support its consistent trading volume on major Indian exchanges, making it a benchmark asset in the cryptocurrency ecosystem.

Ethereum plays a pivotal role in escalating the India cryptocurrency market demand, due to its versatile blockchain that supports smart contracts and decentralized applications (dApps). ETH is traded not only as an asset but also serves as a utility token for transactions in DeFi, NFTs, and tokenized assets. The growth of the Ethereum ecosystem is propelled by Indian developers and startups. With the increased popularity of staking following its upgrade and a widening range of applications, Ethereum’s importance continues to grow among Indian users seeking both investment opportunities and functional uses.

Stablecoins such as USDT and USDC are becoming increasingly popular in India as dependable options for mitigating crypto volatility. Being pegged to fiat currencies, they are commonly used for trading pairs, cross-border remittances, and accessing decentralized finance protocols. For Indian users, stablecoins provide quicker settlement, lower transaction costs, and a means of preserving capital without the fluctuations associated with BTC or ETH. As regulatory clarity improves, stablecoins are anticipated to play a more significant role in India’s trading and digital payment systems.

Altcoins are capturing a larger segment of India’s cryptocurrency market, providing investors with the chance to explore various blockchain innovations beyond Bitcoin and Ethereum. This category includes tokens focused on various features such as scalability, interoperability, privacy, and specialized use cases. Indian users are increasingly delving into altcoins for speculative investments and to engage with emerging blockchain initiatives. Many altcoins also have lower entry points, making them attractive to retail investors. With growing interest in layer-2 protocols, DeFi applications, and practical utilities, altcoins are broadening their presence on Indian exchanges.

Meme coins and emerging tokens have garnered attention among younger Indian investors drawn to their viral potential, community engagement, and possibility of high returns. Although these tokens carry inherent risks and are often speculative, they gain traction through social media, celebrity endorsements, and influencer marketing. Tokens like Shiba Inu and Dogecoin occasionally experience trading spikes during market surges. Indian exchanges frequently list these tokens promptly to capitalize on trading activities. Their allure lies in their accessibility, entertainment value, and the aspirational aspect of investing in early-stage projects.

Analysis by User Type:

- Retail Traders

- Institutional Investors

- High-Frequency Traders

Retail traders are integral to the cryptocurrency exchange landscape in India, fueled by increased financial awareness, the use of mobile trading applications, and influence from peers. Many of these traders are millennials and Gen Z individuals who view digital assets as a viable alternative to traditional investment avenues. Their trading patterns are influenced by market trends, sentiments on social media, and the accessibility of various tokens. With a straightforward onboarding process and low entry barriers, retail engagement remains robust, significantly impacting daily trading volumes, particularly for altcoins, meme coins, and new token introductions.

Institutional investors are slowly making their way into India’s cryptocurrency exchange scene, drawn by the prospect of diversifying their portfolios and gaining exposure to blockchain technologies. This group includes family offices, hedge funds, and venture capitalists focused on crypto investments. While regulatory ambiguities have hindered widespread adoption, the increasing acceptance of cryptocurrencies globally and the development of custodial frameworks are promoting a cautious approach to investment. Institutions usually target larger-cap tokens such as Bitcoin and Ethereum, often executing trades through over-the-counter (OTC) desks or structured products. Their participation is anticipated to grow with more defined regulations, the integration of stablecoins, and the rise of secure and compliant trading platforms.

High-frequency traders (HFTs) employ algorithmic techniques to exploit minor price fluctuations on Indian crypto exchanges. These traders depend on speed, volume, and advanced analytics, executing numerous trades within a single second. Their activity improves market liquidity and narrows bid-ask spreads. HFT firms typically operate on centralized exchanges that offer high throughput and API capabilities. With the development of institutional-grade infrastructure among more exchanges in India, HFT activity is expected to increase, providing greater efficiency and price discovery in a highly volatile trading landscape.

Analysis by Revenue Model:

- Transaction Fees

- Subscription-Based Models

- Listing Fees

- Staking and Yield Farming Services

In India, transaction fees represent the primary source of revenue for cryptocurrency exchanges. Each buy or sell order incurs a minor fee, typically a percentage of the total trade amount. These fees fluctuate based on trading volume and user classification, with discounts often available for high-volume traders or those holding specific tokens. As trading activity surges, particularly among retail traders, transaction fees generate significant recurring revenue. Additionally, exchanges frequently charge for deposits, withdrawals, and margin trading, making the transaction-based model a sustainable and scalable income source.

Some cryptocurrency platforms in India are embracing subscription-based revenue models to provide enhanced features such as reduced fees, advanced analytics, access to APIs, and prioritized customer support. These monthly or annual subscription plans are tailored for active traders, institutional clients, and algorithmic users seeking superior tools for performance. Such models allow exchanges to broaden their income streams beyond the volatile nature of trading and foster a committed user community. As competition intensifies, subscription models are gaining traction as exchanges look to stand out with value-added services and exclusive offerings.

Exchanges impose listing fees on token issuers to facilitate the addition of new cryptocurrencies, particularly those that are lesser-known or emerging. In India, this has become a vital revenue source for platforms looking to attract project developers and Web3 startups. The cost of listing varies significantly based on the exchange’s reputation, user base, and promotional packages. Beyond providing visibility, exchanges often offer bundled services for token promotion and liquidity assistance. With the increasing number of projects seeking retail access, listing fees continue to present lucrative one-time revenue opportunities for Indian crypto exchanges.

With the growing popularity of decentralized finance (DeFi), Indian exchanges are capitalizing on staking and yield farming services. These models enable users to lock in their crypto assets to earn interest or rewards, while exchanges profit through commissions or spreads. Staking appeals to long-term holders aiming for passive income, thereby increasing user engagement and loyalty to the platform. As a greater number of Indians venture into DeFi within secure exchange environments, staking and yield services are becoming competitive revenue avenues that provide financial advantages for users and consistent gains for exchanges.

Analysis by Trading Services:

- Spot Trading

- Futures and Derivatives Trading

- Margin Trading

- Peer-to-Peer (P2P) Trading

Spot trading serves as the core of cryptocurrency exchanges in India, enabling users to buy and sell crypto assets at real-time prices for immediate settlement. This trading method is popular among retail investors due to its straightforward nature and transparency. Indian exchanges typically provide a variety of trading pairs, usually valued against INR, USDT, or BTC. With increased adoption and a wider range of available tokens, spot trading remains the primary activity and revenue source for most first-time crypto investors.

Futures and derivatives trading is gaining popularity in India as more experienced traders look for exposure to leveraged positions and tools for risk management. These financial instruments allow users to speculate on price fluctuations without having to own the underlying assets. Although still less favored compared to spot trading, derivatives present higher profit potential for exchanges through funding fees and spreads. As investor awareness and regulatory clarity improve, Indian platforms are likely to broaden their derivative offerings to attract seasoned traders and institutional investors seeking portfolio diversification.

Margin trading allows users in India to borrow funds to enhance their trading positions, thereby increasing both potential profits and risks. Exchanges provide various leverage ratios based on the asset and the user's risk tolerance. This service is appealing to professional traders and those engaged in high-frequency trading who want to maximize returns. Exchanges benefit financially through interest on borrowed funds and increased transaction volumes. Despite the need for regulatory caution and effective risk management, demand for leveraged trading is on the rise in India, especially during bullish market conditions.

P2P trading facilitates direct buying and selling of cryptocurrencies between users, typically using local payment methods. It has gained significant popularity in India for converting crypto to fiat currencies and vice versa, avoiding banking restrictions and centralized intermediary processes. Exchanges assist in matching transactions, providing escrow services, and charging fees. P2P platforms are increasingly relevant in areas with stricter regulations or limited crypto-fiat options. In India, this method enhances accessibility and liquidity, particularly for users in tier-2 and tier-3 cities.

Regional Analysis:

- North India

- South India

- East India

- West India

North India, which includes Delhi, Punjab, Haryana, and Uttar Pradesh, is crucial to India’s cryptocurrency exchange landscape due to robust internet access and a tech-savvy youth population. Urban and semi-urban investors, especially in tier-1 and tier-2 cities, are showing rising interest. Educational initiatives and a familiarity with digital payments further foster this adoption. Crypto influencers and content creators based in the Delhi-NCR area are also raising awareness. With advancements in infrastructure and financial literacy, North India is likely to continue driving market activity.

South India stands out as a hub for technology and education, with Karnataka, Tamil Nadu, and Telangana hosting significant IT and fintech centers. Bengaluru, often dubbed India’s Silicon Valley, is a center for cryptocurrency innovation, attracting interest from software professionals, developers, and entrepreneurs. High levels of digital literacy, mobile usage, and disposable incomes contribute to stable trading volumes. The region's culture of early technology adoption and support for blockchain initiatives positions South India as a leader in shaping India cryptocurrency exchange market trends.

East India, which encompasses West Bengal, Odisha, and Bihar, is slowly making its mark in the cryptocurrency sector. While it currently trails behind other regions in terms of infrastructure, the rise in smartphone usage and affordable internet are encouraging more youth to engage in crypto trading. Regional influencers and content in local languages are promoting awareness. Exchanges are focusing on tier-2 and tier-3 cities through educational initiatives and user-friendly apps. Although still developing, East India has significant long-term potential as awareness and digital access continue to grow.

West India, comprising Maharashtra, Gujarat, and Rajasthan, plays a substantial role in the Indian cryptocurrency market. Mumbai, known as India’s financial capital, generates strong interest in digital assets from both institutional and retail investors. The presence of financial institutions, fintech startups, and a wealthy investor base enhances regional crypto activity. Gujarat and Rajasthan are also experiencing increased involvement driven by rising entrepreneurial initiatives and remittance demands. With a blend of financial sophistication and growing curiosity about cryptocurrencies in smaller cities, West India significantly contributes to the overall growth of the market.

Competitive Landscape:

The India cryptocurrency exchange market is becoming increasingly competitive as platforms work to differentiate themselves through innovative offerings and robust infrastructure. According to India cryptocurrency exchange market analysis, key players are enhancing their services with features such as advanced trading tools, improved security protocols, and user-friendly interfaces tailored to both beginners and experienced traders. Many exchanges are also investing in educational resources, multilingual support, and efficient customer service to strengthen user engagement. As regulatory frameworks gradually take shape, companies are proactively aligning with compliance norms to ensure long-term viability. The rising popularity of decentralized finance (DeFi), staking services, and peer-to-peer trading options is further intensifying market rivalry. Strong growth potential and evolving investor behavior are expected to shape the India cryptocurrency exchange market forecast.

The report provides a comprehensive analysis of the competitive landscape in the India cryptocurrency exchange market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: SunCrypto launched Crypto Futures Trading in India, offering 500+ pairs in INR and USDT. The platform supports up to 100x leverage, direct INR trading, auto USDT conversion, and risk tools like Stop Loss and Isolated Margin, aiming to simplify futures trading for Indian users.

- June 2025: Mudrex launched an upgraded six-tier Alpha Program with India’s lowest crypto trading fees, 0.03% for Futures and 0.12% for Spot. Based on 30-day trading volume, the program offers zero-fee INR withdrawals, priority support, and exclusive content to enhance user experience and reward active traders.

- March 2025: Coinbase registered with India’s Financial Intelligence Unit to launch crypto trading services later in the year. This is its second entry attempt after a halted 2022 launch. Despite India’s strict tax rules, Coinbase joins Binance, Bybit, and KuCoin in seeking regulatory compliance for local operations.

- November 2024: WazirX proposed launching a decentralised exchange and a recovery token to compensate users affected by the July cyber-attack that froze over USD 230 Million in crypto assets. The exchange aims to become India’s largest DEX within a year, offering users control over their asset custody.

- July 2024: India-based CoinDCX acquired Dubai’s BitOasis to augment its global expansion, ten months after an initial investment. CoinDCX, FIU-IND registered and backed by USD 240 Million in funding, aims to strengthen crypto services across MENA. BitOasis, active in 15 countries, has processed USD 6 Billion in trading volumes.

- June 2024: Delta Exchange officially launched its India platform, offering INR-based crypto futures and options trading. Backed by top investors and FIU-IND registered, it claims 1 lakh users and USD 300 Million peak daily volume. The platform ensures compliance by disallowing crypto custody, targeting secure, regulated trading for Indian users.

India Cryptocurrency Exchange Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Exchange Types Covered | Centralized Exchanges (CEX), Decentralized Exchanges (DEX), Hybrid Exchanges |

| Cryptocurrency Types Covered | Bitcoin (BTC), Ethereum (ETH), Stablecoins, Altcoins, Meme Coins and Emerging Tokens |

| User Types Covered | Retail Traders, Institutional Investors, High-Frequency Traders |

| Revenue Models Covered | Transaction Fees, Subscription-Based Models, Listing Fees, Staking and Yield Farming Services |

| Trading Services Covered | Spot Trading, Futures and Derivatives Trading, Margin Trading, Peer-to-Peer (P2P) Trading |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cryptocurrency exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cryptocurrency exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cryptocurrency exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cryptocurrency exchange market in India was valued at USD 1.61 Billion in 2024.

The India cryptocurrency exchange market is projected to exhibit a CAGR of 26.70% during 2025-2033, reaching a value of USD 15.7 Billion by 2033.

The key factors driving India’s cryptocurrency exchange market include India’s large, young, tech-savvy population embracing alt-investments, thriving fintech and blockchain startups, inclusion through digital finance for unbanked users, high retail trading interest amid job stagnation, and evolving regulatory clarity encouraging global exchanges.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)