India Curtain and Blinds Market Size, Share, Trends and Forecast by Material Type, Product Type, Application, Distribution Channel, and Region, 2025-2033

India Curtain and Blinds Market Overview:

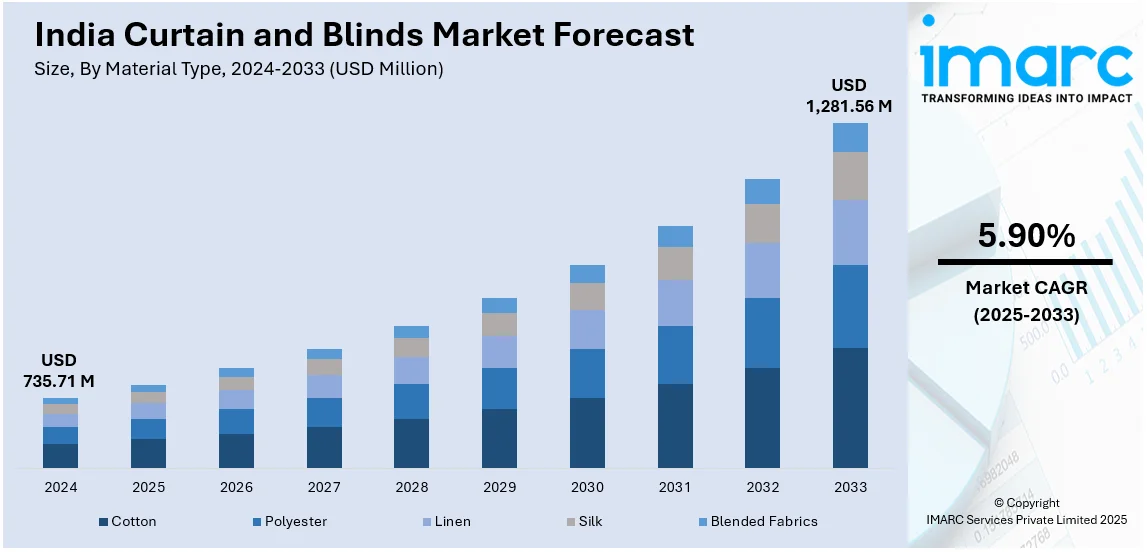

The India curtain and blinds market size reached USD 735.71 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,281.56 Million by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. Rising urbanization, increasing disposable income, home décor trends, real estate expansion, smart homes, hospitality sector growth, e-commerce penetration, customization demand, premium fabrics, energy efficiency, UV protection, automated blinds, renovation projects, commercial spaces, and interior design preferences are driving India’s curtain and blinds market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 735.71 Million |

| Market Forecast in 2033 | USD 1,281.56 Million |

| Market Growth Rate (2025-2033) | 5.90% |

India Curtain and Blinds Market Trends:

Integration of Smart and Automated Window Treatments

The market is experiencing a huge trend toward smart and automated window treatments, fueled by the increasing uptake of smart home technologies and a quest for greater convenience. Customers are looking more and more for window coverings that can be operated remotely or programmed to open automatically at the time of day or ambient light levels. This is in line with the international trend towards home automation, where different devices are networked together for enhanced efficiency and convenience. Recent trends have indicated rising interest, with overall smart home penetration in India rising by about 30% over the last two years, showing an expanding potential market share for automated window treatments. Manufacturers are meeting this trend by providing motorized blinds and curtains that are compatible with leading smart home platforms, enabling users to control them through smartphones, voice commands, or automated timers. Additionally, the increasing consciousness of energy conservation and sustainability has emerged as a major force in the window blinds market. For instance, India imported products worth $30 million in 2023, a 44% hike from 2022, with the leading supplier, China, providing 61% of the overall imports, which is fueling the market growth further.

To get more information on this market, Request Sample

Growing Preference for Customized and Aesthetic Home Décor

Another strong trend that is fueling the expansion of the curtain and blinds market in India is the growing consumer demand for personalized and tasteful home furnishings. Homeowners are spending more on interior design to express their own tastes, which is making more people buy customized window coverings that appeal to individual tastes and home decor. The size of the India home decor market was USD 25.5 billion in 2024 and is anticipated to reach USD 40.8 billion by 2033, with a growth rate (CAGR) of 5.4% from 2025-2033, which in turn is driving the market growth. This is complemented by the growth of e-commerce websites, that provide extensive choices in terms of designs, materials, and personalization, hence making it simple for customers to obtain products that match their particular tastes. Online shopping convenience, as well as the provision of virtual visualization capabilities, enables clients to test different designs before making a purchase, thus increasing demand for custom window treatments. Also, the social media influence and home improvement television shows have increased awareness regarding interior looks, and this is prompting consumers to spend on quality, trendy curtains and blinds.

India Curtain and Blinds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material type, product type, application, and distribution channel.

Material Type Insights:

- Cotton

- Polyester

- Linen

- Silk

- Blended Fabrics

The report has provided a detailed breakup and analysis of the market based on the material type. This includes cotton, polyester, linen, silk, and blended fabrics.

Product Type Insights:

- Curtains

- Blinds

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes curtains and blinds.

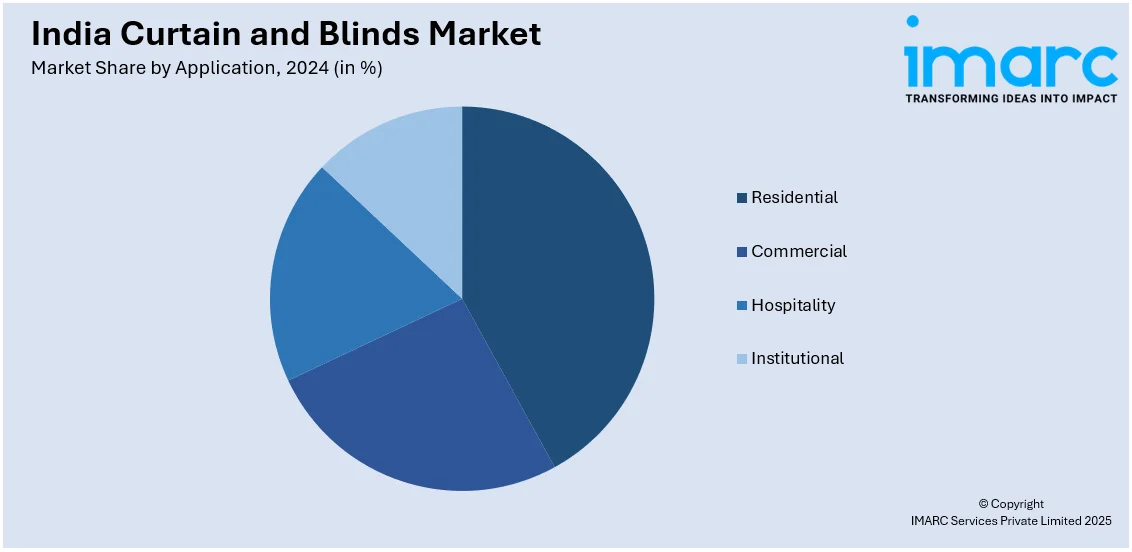

Application Insights:

- Residential

- Commercial

- Hospitality

- Institutional

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, hospitality, and institutional.

Distribution Channel Insights:

- Offline

- Retail

- Specialty

- Online

- E-commerce

- Websites

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline (retail and specialty) and online (e-commerce and websites).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Curtain and Blinds Market News:

- February 2025: Infra.Market, a $2.7 billion construction goods firm backed by Tiger Global, raised more than $120 million in a pre-IPO investment round. The firm intends to broaden its lifestyle vertical and develop into other markets such as beds, curtains, and home décor.

- March 2024: D'Decor, India's top curtain and upholstery producer, announced a 50% expansion in manufacturing capacity over the next four years. The firm, which is debt-free, intends to increase its daily output from 140,000 to over 200,000 meters of cloth.

India Curtain and Blinds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Cotton, Polyester, Linen, Silk, Blended Fabrics |

| Product Types Covered | Curtains, Blinds |

| Applications Covered | Residential, Commercial, Hospitality, Institutional |

| Distribution Channels Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India curtain and blinds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India curtain and blinds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India curtain and blinds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The curtain and blinds market in India was valued at USD 735.71 Million in 2024.

The India curtain and blinds market is projected to exhibit a CAGR of 5.90% during 2025-2033, reaching a value of USD 1,281.56 Million by 2033.

The India curtain and blinds market is driven by rising urban developments, growing demand for home décor, and expanding real estate development. Additionally, the preference for smart and energy-efficient window solutions and the influence of interior design trends contribute significantly to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)