India Cutting Tools Market Size, Share, Trends and Forecast by Type, Material Type, Application, and Region, 2025-2033

India Cutting Tools Market Size and Share:

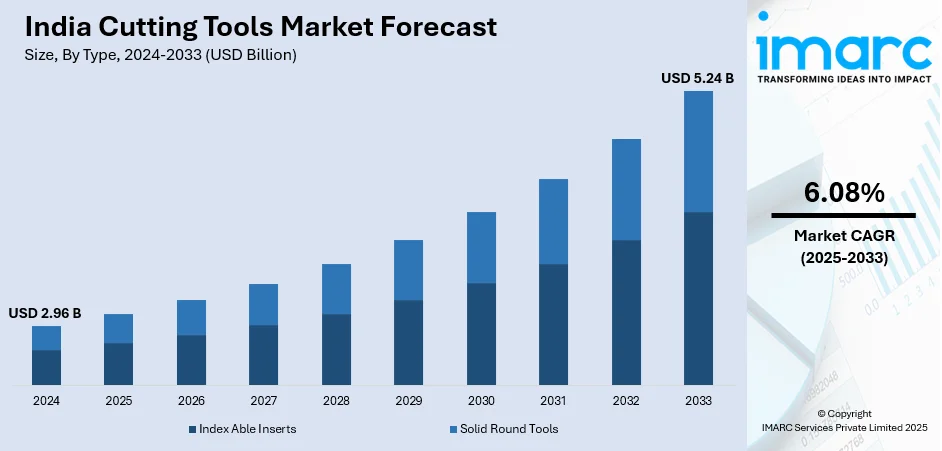

The India cutting tools market size reached USD 2.96 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.24 Billion by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. The escalating demand for tailored cutting tools in India is driven by the need for specialized solutions to enhance efficiency, precision, and tackle material challenges. Government initiatives and infrastructure development further stimulate the market growth by strengthening local manufacturing, attracting investments, and rising need for advanced, high-quality tools.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.96 Billion |

| Market Forecast in 2033 | USD 5.24 Billion |

| Market Growth Rate (2025-2033) | 6.08% |

India Cutting Tools Market Trends:

Government Initiatives and Infrastructure Development

The efforts of the governing body to support the manufacturing sector, including projects to reinforce local production abilities, are an essential element driving the market expansion. These efforts aim to enhance local production, lessen reliance on imports, and draw in investments. By backing local industries, Government of India is fostering a stronger industrial ecosystem, which is driving the need for high-quality cutting tools. In addition, the Government aims to establish around 12 industrial parks in 2024 to draw in ₹1.50 lakh crore in investments, concentrating on industries such as food processing, textiles, and electric vehicles. These parks were designed to enhance production and generate employment. This emphasis on infrastructure development, such as transportation systems and industrial centers, has further supported the expansion of manufacturing, contributing to the demand for sophisticated machinery and equipment. As industrial operations are growing more advanced and specialized, producers are seeking cutting tools that can satisfy these emerging needs. The need for cutting tools is rising not just because of higher production levels but also because of the demand for more effective, accurate, and long-lasting tools that can meet current manufacturing benchmarks. With an increased emphasis on improving production capability and efficiency, the cutting tools market is likely to gain from the growing industrial foundation, as producers need more sophisticated tools to satisfy both domestic and global market requirements.

To get more information on this market, Request Sample

Growing Demand for Tailored Solutions

As industries progress, the demand for specialized tools tailored to particular materials, machining methods, and production needs continues to rise. Indian manufacturers seek cutting tools that enhance efficiency while also tackling issues like excessive tool wear, material waste, and the demand for higher precision. This customization is crucial for sectors such as automotive, aerospace, and electronics, wherein the intricate nature of components requires specialized tooling solutions. High-performance cutting tools enable manufacturers to refine their processes, boost productivity, and lower production expenses by decreasing downtime and extending the lifespan of tools. Customized cutting tools also allow manufacturers to work with tougher materials, such as high-strength alloys and composites, which are being used more frequently in advanced manufacturing processes. As Indian producers aim to align with global standards and remain competitive in the global marketplace, they are increasingly seeking tailored solutions that address their unique requirements. The capability to provide cutting tools tailored for specific manufacturing challenges is not only driving the market but also enhancing operational efficiency in Indian industries. In December 2023, Dormer Pramet, part of the Sandvik Group, launched a new line of metal cutting tools for the Indian market. The product range included milling, turning, drilling, tapping tool holders, and high-speed steel drills and taps. The goal was to enhance productivity, reduce costs, and offer tailored solutions to Indian manufacturers.

India Cutting Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, material type, and application.

Type Insights:

- Index Able Inserts

- Solid Round Tools

The report has provided a detailed breakup and analysis of the market based on the type. This includes index able inserts and solid round tools.

Material Type Insights:

- Cemented Carbide

- High-Speed Steel

- Ceramics

- Stainless steel

- Polycrystalline Diamond

- Cubic Boron Nitride

- Exotic Materials

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes cemented carbide, high-speed steel, ceramics, stainless steel, polycrystalline diamond, cubic boron nitride, and exotic materials.

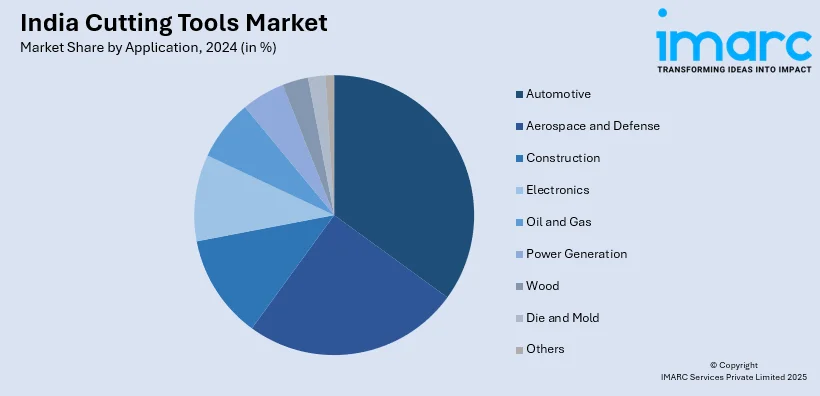

Application Insights:

- Automotive

- Aerospace and Defense

- Construction

- Electronics

- Oil and Gas

- Power Generation

- Wood

- Die and Mold

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, aerospace and defense, construction, electronics, oil and gas, power generation, wood, die and mold, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cutting Tools Market News:

- In April 2024, the ICTMA Annual Conference 2024 was scheduled at The Atria, Radisson Blu, Bangalore, to address challenges while encouraging development in India's cutting tool industry. Key discussion points included technology integration, market trends, and strategies to address issues like shortages in raw materials.

- In June 2023, Nidec Machine Tool Corporation revealed intentions to establish a new cutting tool manufacturing facility in Ranipet, Tamil Nadu, India, boosting its production capacity by 1.5 times. The factory was established to manufacture gear-cutting tools, catering to India's increasing automotive needs, particularly in the electric vehicle and transmission industries.

India Cutting Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Index Able Inserts, Solid Round Tools |

| Material Types Covered | Cemented Carbide, High-Speed Steel, Ceramics, Stainless steel, Polycrystalline Diamond, Cubic Boron Nitride, Exotic Materials |

| Applications Covered | Automotive, Aerospace and Defense, Construction, Electronics, Oil and Gas, Power Generation, Wood, Die and Mold, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cutting tools market performed so far and how will it perform in the coming years?

- What is the breakup of the India cutting tools market on the basis of type?

- What is the breakup of the India cutting tools market on the basis of material type?

- What is the breakup of the India cutting tools market on the basis of application?

- What is the breakup of the India cutting tools market on the basis of region?

- What are the various stages in the value chain of the India cutting tools market?

- What are the key driving factors and challenges in the India cutting tools market?

- What is the structure of the India cutting tools market and who are the key players?

- What is the degree of competition in the India cutting tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cutting tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cutting tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cutting tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)