India Dairy Protein Market Size, Share, Trends and Forecast by Type, Form, Application, and Region, 2025-2033

India Dairy Protein Market Overview:

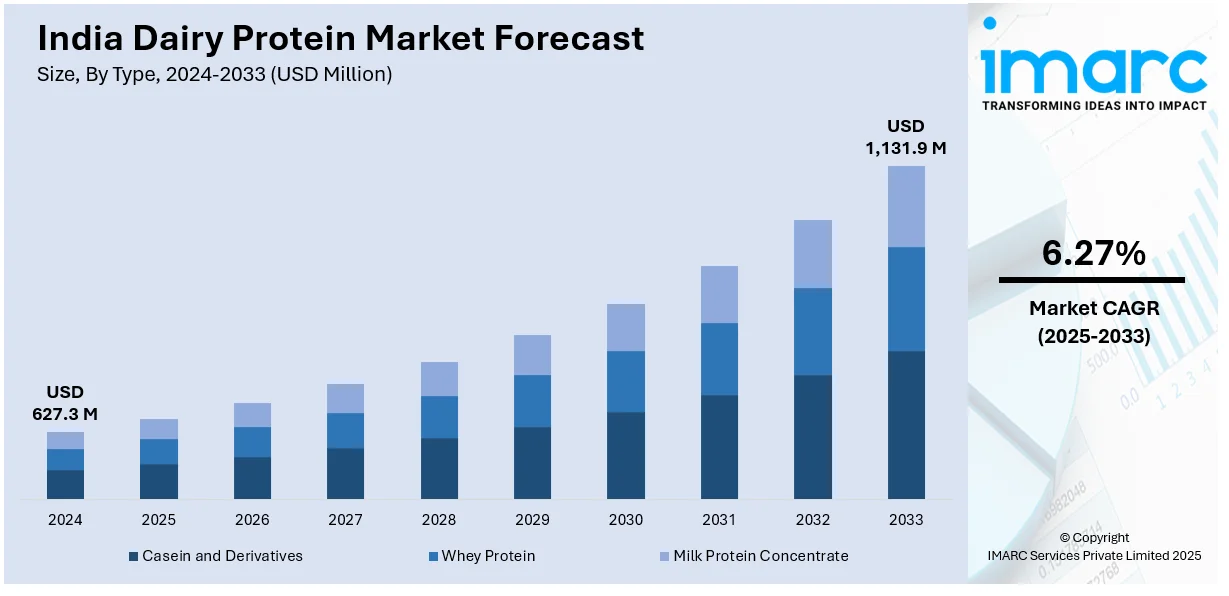

The India dairy protein market size reached USD 627.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,131.9 Million by 2033, exhibiting a growth rate (CAGR) of 6.27% during 2025-2033. Rising health consciousness, growing demand for protein-rich diets, government support for dairy development, and the expansion of value-added dairy products are driving the India dairy protein market, with initiatives like the National Programme for Dairy Development and new high-protein product launches boosting production, innovation, and consumer adoption across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 627.3 Million |

| Market Forecast in 2033 | USD 1,131.9 Million |

| Market Growth Rate 2025-2033 | 6.27% |

India Dairy Protein Market Trends:

Government Initiatives and Support

The Government of India has launched a series of programs to expand dairy production and promote the dairy industry, which have played an important role in the development of the dairy protein market. The Rashtriya Gokul Mission, for instance, is aimed at developing and conserving indigenous bovine breeds. Up to December 2023, this mission resulted in artificial insemination of more than 7.96 crore animals and benefited over four crore farmers in the country. Moreover, the National Programme for Dairy Development has also been a major factor in building the dairy industry's collection and processing infrastructure. As a part of the program, around 3,864 bulk milk coolers with 84.4 lakh liters of chilling capacity have been installed in village-level milk collection centers. The improvement in infrastructure provides for higher quality and shelf life of milk, and thereby enables production of high-quality dairy protein foods. Schemes of financial support have also played a role. For example, the "Supporting Dairy Cooperatives and Farmer Producer Organizations” scheme was sanctioned to allocate working capital loans to federations and state cooperatives. Until December 2021, a sum of INR 303 crore had been disbursed to the National Dairy Development Board for implementing the scheme, thus ensuring dairy cooperatives are equipped with financial means to operate optimally. These government policies have cumulatively fortified the dairy industry, resulting in higher milk production and stable supply of raw material for dairy protein foods. Such consistent support has provided a lucrative environment for the dairy protein market to thrive.

To get more information on this market, Request Sample

Rising Health Consciousness and Protein Consumption

There has also been a prominent change in demand from consumers in favor of healthy eating options, with more stress on protein intake. This demand has positively influenced the sales of dairy protein items, including whey protein, casein, and protein-enhanced dairy beverages. India has experienced a substantial rise in milk per capita availability, mirroring this substantial demand. In 2022-23, per capita availability crossed 459 grams per day from the world average of 322 grams per day in 2022. It shows an enhanced consumption of milk and milk products, as witnessed globally, and the integration of more protein content in diets every day. Further, the Indian dairy sector has witnessed impressive boost, and value-added products have led to a propelled market. The sector has expanded at around 12% over the last five years, with value-added dairy products, such as protein-rich foods, contributing sizably to expansion. The elevation in number of private dairy companies, which presently represent over 60% of the country's dairy processing capacity, has contributed further to the supply and choice of dairy protein products. With this expansion, protein-fortified dairy foods have become even more accessible to a wider populace, meeting growing health awareness among Indians.

India Dairy Protein Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, form, and application.

Type Insights:

- Casein and Derivatives

- Whey Protein

- Milk Protein Concentrate

The report has provided a detailed breakup and analysis of the market based on the type. This includes casein and derivatives, whey protein, and milk protein concentrate.

Form Insights:

- Solid

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes solid and liquid.

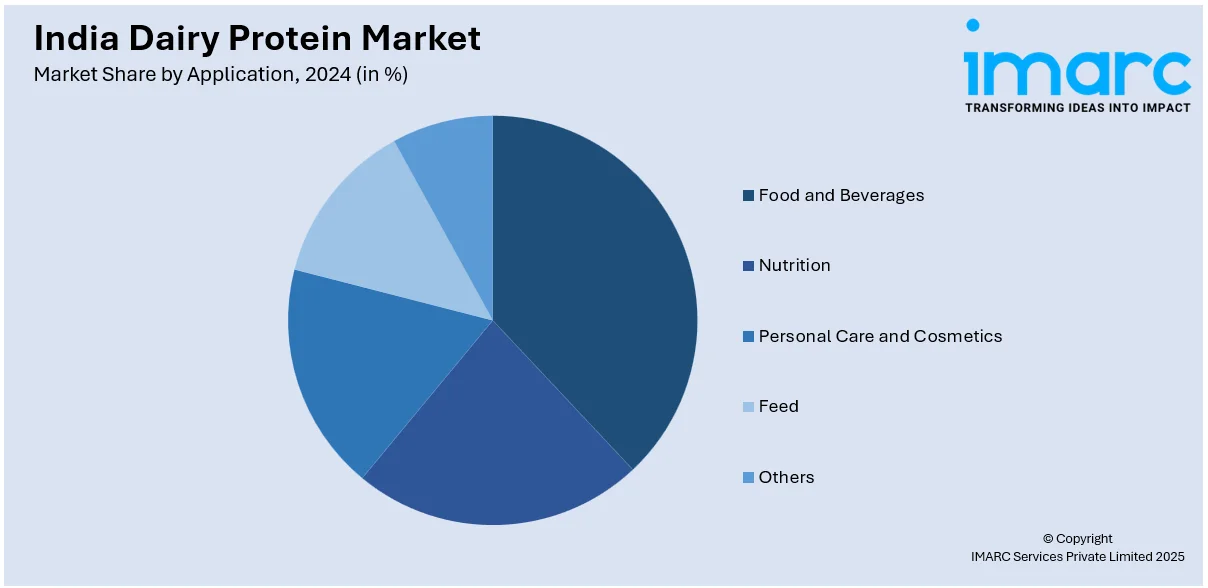

Application Insights:

- Food and Beverages

- Nutrition

- Personal Care and Cosmetics

- Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, nutrition, personal care and cosmetics, feed, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dairy Protein Market News:

- June 2024: Steadfast Nutrition introduced two quick-releasing protein supplements, Whey Protein and LIV Raw, and a vegetarian Multivitamin mega pack of 180 tablets to meet Indians' unmet protein and nutrient requirements, targeting health and fitness enthusiasts and serious athletes. This introduction enhances the availability of high-quality dairy protein products in India, complementing the escalating demand for protein supplementation. The growth of such products solidifies the India dairy protein market by encouraging fitness enthusiasts and sportspersons to consume dairy-based proteins.

- May 2024: Indian cooperative Amul launched its "super milk" with 35 grams of protein per glass. This introduction fortifies the dairy protein market by introducing a high-protein variant of milk for health-aware consumers and gym goers. This step leads to a rise in the demand for protein products based on dairy and prompts innovation in the category. Besides this, Amul introduced high-protein lassi, milkshakes, buttermilk, and whey protein, each containing 15-20 grams of protein per serving, on its online platform.

India Dairy Protein Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Casein and Derivatives, Whey Protein, Milk Protein Concentrate |

| Forms Covered | Solid, Liquid |

| Applications Covered | Food and Beverages, Nutrition, Personal Care and Cosmetics, Feed, Others |

| Regions Covered | North India, South India, East India, Wets India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dairy protein market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dairy protein market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dairy protein industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dairy protein market in India was valued at USD 627.3 Million in 2024.

The India dairy protein market is projected to exhibit a CAGR of 6.27% during 2025-2033, reaching a value of USD 1,131.9 Million by 2033.

India dairy protein market is gaining strong traction as consumers increasingly embrace high-protein diets, wellness trends, and functional nutrition. Protein-rich dairy items like fortified milk, yogurt, whey, and paneer are also driving demand across age groups. Brands are innovating with clean-label, fortified, and convenient formats to further capture the expanding Indian market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)