India Dairy Testing Market Size, Share, Trends and Forecast by Type, Technology, Product, and Region, 2025-2033

India Dairy Testing Market Overview:

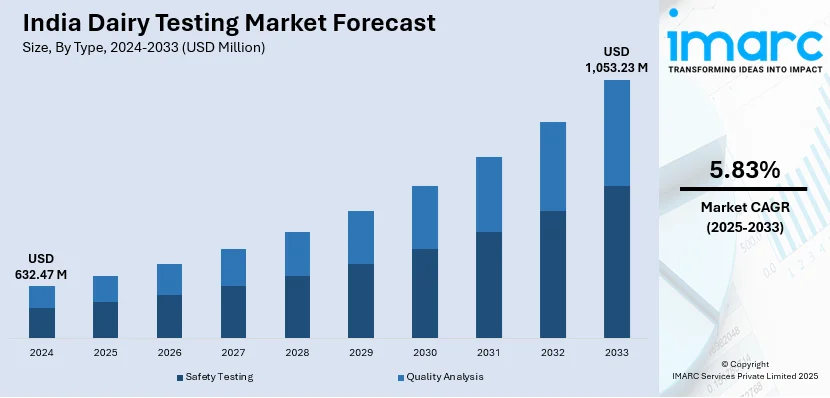

The India dairy testing market size reached USD 632.47 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,053.23 Million by 2033, exhibiting a growth rate (CAGR) of 5.83% during 2025-2033. The market is driven by stringent regulations from bodies like the Food Safety and Standards Authority of India (FSSAI) enforcing safety standards, rising consumer demand for premium dairy products, technological advancements in testing methods, and India's aspirations to boost dairy exports requiring adherence to global quality standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 632.47 Million |

| Market Forecast in 2033 | USD 1,053.23 Million |

| Market Growth Rate 2025-2033 | 5.83% |

India Dairy Testing Market Trends:

Integration of Blockchain Technology for Traceability and Transparency

The use of blockchain technology in India's dairy business is revolutionizing quality control and testing by improving traceability and transparency. The blockchain's decentralized and immutable ledger system records every transaction, from milk production to the finished product, assuring data accuracy and authenticity. This real-time monitoring feature enables stakeholders to monitor every stage of the supply chain, lowering the risk of adulteration and fraud. According to a 2022 FSSAI study, 68.7% of milk and milk products in India failed to meet the required criteria, underscoring the critical need for greater traceability. In response, the FSSAI initiated pilot programs in 2023 to integrate blockchain technology into dairy quality monitoring, with the goal of improving food safety compliance and customer confidence. Beyond regulatory benefits, blockchain implementation can result in considerable cost savings by eliminating intermediaries and decreasing spoilage or recalls. A 2023 research by the National Dairy Development Board (NDDB) found that by increasing supply chain efficiency and lowering fraud, blockchain adoption may save the Indian dairy sector some ₹15,000 crores a year. The dairy business in India is expected to become more transparent, safe, and efficient due to the growing use of blockchain by industry participants and regulatory organizations.

To get more information on this market, Request Sample

Adoption of Digital and Automated Testing Solutions

The dairy business is increasingly implementing digital and automated testing technologies to improve productivity, accuracy, and safety. Advanced systems that drastically cut down on testing time, such Polymerase Chain Reaction (PCR) and Enzyme-Linked Immunosorbent Assay (ELISA), are replacing manual approaches. In contrast to the three to five days needed by traditional approaches, PCR-based techniques may identify pathogens like Salmonella and E. coli in as little as 24 hours. This shorter turnaround allows for quicker decision-making and reduces the possibility of tainted items reaching customers. Additionally, digital testing platforms integrated with artificial intelligence (AI) and machine learning (ML) improve precision. AI-driven image recognition systems, for example, assess milk samples for somatic cell counts with over 95% accuracy, helping detect mastitis in dairy cows. A 2024 study found that automation reduced human errors in testing by 30%, leading to more reliable results. Regulatory bodies like the FSSAI are driving the adoption of automated testing to ensure compliance with stringent safety standards. In 2023, the FSSAI mandated automated testing for large-scale dairy producers, leading to a 20% increase in compliance rates within a year. These advancements are making dairy testing more efficient, accurate, and compliant with evolving industry regulations.

India Dairy Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, technology, and product.

Type Insights:

- Safety Testing

- Quality Analysis

The report has provided a detailed breakup and analysis of the market based on the type. This includes safety testing and quality analysis.

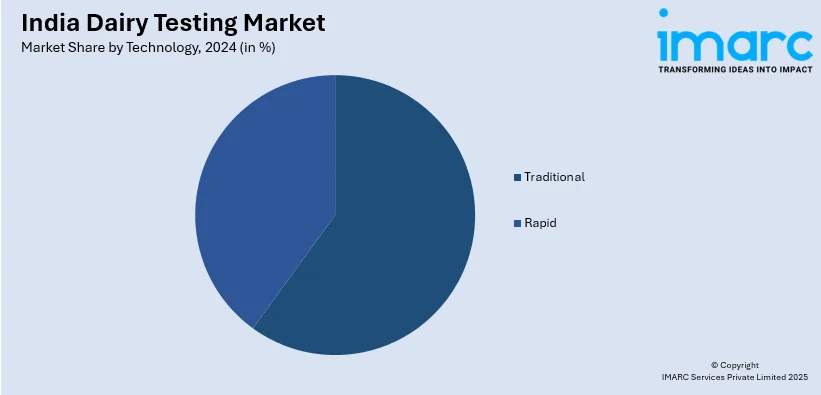

Technology Insights:

- Traditional

- Rapid

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes traditional and rapid.

Product Insights:

- Milk and Milk Powder

- Cheese

- Butter and Spreads

- Infant Food

- Ice Cream and Desserts

- Yogurt

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes milk and milk powder, cheese, butter and spreads, infant food, ice cream and desserts, yogurt, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dairy Testing Market News:

- July 2024: Researchers at Banaras Hindu University (BHU) developed a home-based milk testing technique using evaporation to detect adulterants. By analyzing unique ring patterns left after evaporation and integrating machine learning, the method achieved over 95% accuracy in identifying adulterated milk.

- May 2024: The FSSAI launched a comprehensive quality check on food products, including dairy, spices, fortified rice, fruits, vegetables, and fish. This initiative follows an investigation into branded spices and aims to strengthen food safety standards across the domestic market.

India Dairy Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Safety Testing, Quality Analysis |

| Technologies Covered | Traditional, Rapid |

| Products Covered | Milk and Milk Powder, Cheese, Butter and Spreads, Infant Food, Ice Cream and Desserts, Yogurt, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India dairy testing market performed so far and how will it perform in the coming years?

- What is the breakup of the India dairy testing market on the basis of type?

- What is the breakup of the India dairy testing market on the basis of technology?

- What is the breakup of the India dairy testing market on the basis of product?

- What are the various stages in the value chain of the India dairy testing market?

- What are the key driving factors and challenges in the India dairy testing?

- What is the structure of the India dairy testing market and who are the key players?

- What is the degree of competition in the India dairy testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dairy testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dairy testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dairy testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)