India Data Center Chip Market Size, Share, Trends and Forecast by Chip Type, Data Center Size, Industry Vertical, and Region, 2025-2033

India Data Center Chip Market Overview:

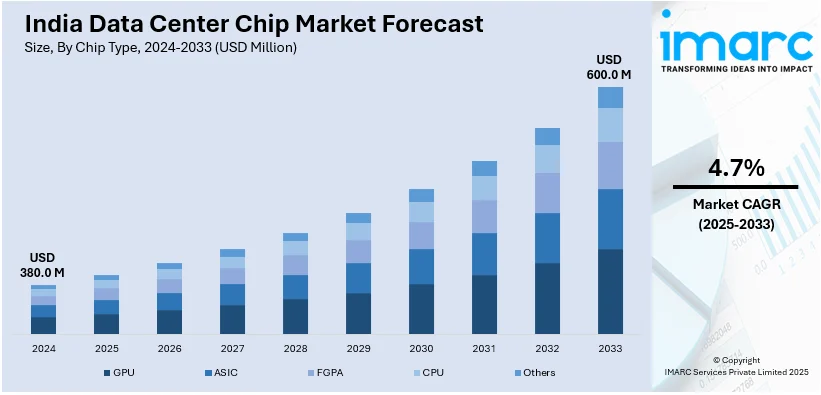

The India data center chip market size reached USD 380.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 600.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.7% during 2025-2033. India’s market is growing steadily due to rising AI adoption, cloud service expansion, and demand for energy-efficient processing. Investments in GPU infrastructure and regional data centers are driving chip requirements for scalable, high-performance computing across enterprise and digital platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 380.0 Million |

| Market Forecast in 2033 | USD 600.0 Million |

| Market Growth Rate 2025-2033 | 4.7% |

India Data Center Chip Market Trends:

AI Workload Expansion Accelerating Demand

India's rising focus on artificial intelligence is reshaping demand patterns in the data center chip market. As enterprises and cloud service providers increasingly adopt AI tools, the need for high-performance GPU-based infrastructure continues growing. Companies are actively pursuing large-scale deployments of AI chips to manage training and inference workloads efficiently. These chips are crucial for handling parallel processing tasks required in large language models and generative AI tools. The push for faster computing and optimized energy use is prompting a shift from general-purpose processors to AI-specific chips, particularly those offering scalability and lower latency. In April 2024, Yotta Data Services confirmed its plan to scale up its GPU infrastructure to 32,000 Nvidia chips by March 2025. This move followed an earlier investment of USD 1 Billion for procuring 16,000 H100 GPUs and supporting infrastructure. Yotta's initiative reflects the rising requirement for dedicated AI computing power across India and shows how AI data centers are becoming central to national digital strategies. This transition is creating consistent demand for high-density, power-efficient chips capable of supporting multiple AI models. As deployment continues, domestic data centers are likely to play a larger role in regional and global AI processing, pushing chip requirements steadily upward.

To get more information on this market, Request Sample

Cloud Hosting Expansion Driving Growth

The wider adoption of digital services across South Asia is creating a strong demand for scalable and efficient data infrastructure. As enterprises migrate to cloud-based platforms, performance and latency become key priorities. This shift is accelerating the deployment of optimized data center chips that balance cost, energy efficiency, and processing capabilities. India's growing internet penetration and the expanding startup ecosystem are reinforcing the need for reliable local cloud support. This demand is pushing service providers to establish or expand infrastructure closer to end-users, supporting real-time services and smooth digital access. In July 2024, Contabo launched a data center in India as part of its global expansion strategy. Positioned to serve both local and offshore clients, the facility enhances digital access across South Asia. The launch is aligned with Contabo's goal of providing affordable, low-latency hosting and increasing reliance on energy-efficient chips designed for fast data transfers and high uptime. This development is contributing to the uptake of specialized processors that support constant workloads in regional centers without high energy draw. As India becomes a regional cloud hosting hub, demand for reliable and cost-effective data center chips is strengthening, especially among global companies looking to localize digital infrastructure.

India Data Center Chip Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on chip type, data center size, and industry vertical.

Chip Type Insights:

- GPU

- ASIC

- FGPA

- CPU

- Others

The report has provided a detailed breakup and analysis of the market based on the chip type. This includes GPU, ASIC, FGPA, CPU, and others.

Data Center Size Insights:

- Small and Medium Size

- Large Size

The report has provided a detailed breakup and analysis of the market based on the data center size. This includes small and medium size and large size.

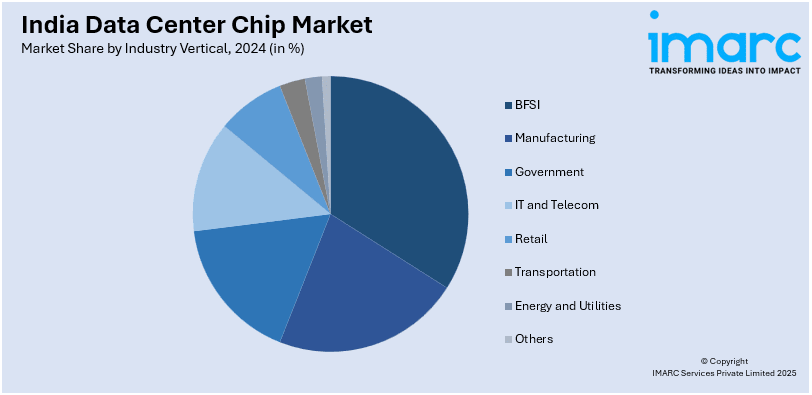

Industry Vertical Insights:

- BFSI

- Manufacturing

- Government

- IT and Telecom

- Retail

- Transportation

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, manufacturing, government, it and telecom, retail, transportation, energy and utilities, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Data Center Chip Market News:

- January 2025: Reliance announced a USD 30 Billion investment to build a 3-gigawatt AI-powered data center in Jamnagar. This scaled demand for high-performance data center chips, boosting segment growth through increased AI workloads and energy-efficient chip deployment across global cloud infrastructure.

- October 2024: RackBank launched India’s first AI-focused data center near Indore with 60,000 GPU capacity and 80MW power. This accelerated demand for high-density, energy-efficient data center chips, driving innovation in AI workloads and reinforcing India’s role in global chip deployment strategies.

India Data Center Chip Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chip Types Covered | GPU, ASIC, FGPA, CPU, Others |

| Data Center Sizes Covered | Small and Medium Size, Large Size |

| Industry Verticals Covered | BFSI, Manufacturing, Government, IT and Telecom, Retail, Transportation, Energy and Utilities, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India data center chip market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India data center chip market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India data center chip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data center chip market in India was valued at USD 380.0 Million in 2024.

The India data center chip market is projected to exhibit a CAGR of 4.7% during 2025-2033, reaching a value of USD 600.0 Million by 2033.

India’s data center chip market is growing due to the growing demand for energy-efficient processing as well as rising AI adoption, and cloud service expansion. Heavy investments in regional data centers and GPU infrastructure are supporting scalable, high-performance computing for enterprise and digital platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)