India Data Center Generator Market Size, Share, Trends and Forecast by Product, Capacity, Tier, and Region, 2025-2033

India Data Center Generator Market Overview:

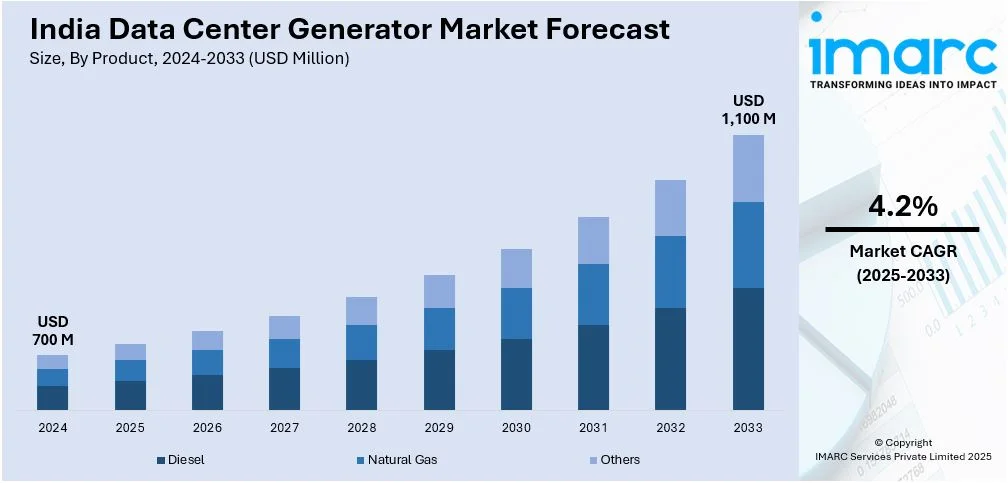

The India data center generator market size reached USD 700 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,100 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. The market is driven by rapid digital transformation, increasing data traffic, and the growth of cloud computing and IoT. Rising demand for uninterrupted power supply, government initiatives promoting infrastructure development, and the need for energy-efficient, scalable solutions further propel the India data center generator market share, ensuring reliable operations in a competitive landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 700 Million |

| Market Forecast in 2033 | USD 1,100 Million |

| Market Growth Rate 2025-2033 | 4.2% |

India Data Center Generator Market Trends:

Increasing Demand for Energy-Efficient Generators

The significant shift towards energy-efficient and environmentally sustainable power solutions augments the India data center generator market growth. With the rapid expansion of data centers across the country, driven by the rise in digital transformation, cloud computing, and IoT adoption, there is a growing emphasis on reducing carbon footprints and operational costs. On January 28, 2025, Godrej Enterprises Group announced plans to invest INR 1,200 Crore (approximately USD 146.34 Million) over the next three years in digital transformation and artificial intelligence (AI) initiatives for enhancing customer experience across its log of business sectors. This includes investments in AI-powered personalization, advanced data analytics, and an organization-wide reskilling initiative that will deliver 600,000 hours of training to employees. This strategy formation comes as a reaction to the growing demand for digital solutions in India, most notably impacting markets such as data center sectors that are driven by AI-embedded customer interaction and automation. Data center operators are increasingly opting for generators that utilize advanced technologies such as hybrid power systems, biodiesel compatibility, and low-emission engines. Additionally, government regulations and incentives promoting green energy solutions are further accelerating this trend. Companies are investing in generators that not only ensure uninterrupted power supply but also align with global sustainability goals. This focus on energy efficiency is expected to drive innovation in the market, with manufacturers developing smarter, more eco-friendly generator systems to meet the changing demands of the industry.

To get more information on this market, Request Sample

Rising Adoption of Modular and Scalable Generator Systems

The growing preference for modular and scalable power solutions is creating a positive India data center generator market outlook. As data centers expand to accommodate increasing data traffic and storage needs, operators are seeking flexible generator systems that can be easily scaled up or down based on demand. India has become an internet powerhouse, with average monthly usage per user reaching 20.27GB as of March 2024. It is a compound annual growth rate (CAGR) of 54% compared with 2014-15, as per Telecom Regulatory Authority of India (TRAI). It currently has over 954.4 Million internet subscribers, and data constitutes 85% of telecom revenue. Thus, this rise in digital demand is driving the expansion of network infrastructure and data centers. The growing 5G network, which currently makes up 16.9% of the market, contributes to this need, requiring reliable powering solutions such as data center generators to facilitate the transition into this digital age. Modular generators offer the advantage of incremental capacity additions, allowing data centers to optimize their power infrastructure without over-investing in excess capacity. This trend is particularly relevant in India, where the data center industry is experiencing rapid growth but faces challenges related to space constraints and capital expenditure. Modular systems also enhance operational efficiency by enabling faster deployment and easier maintenance. As a result, manufacturers are focusing on designing compact, scalable generator solutions that cater to the dynamic requirements of modern data centers, ensuring reliability and cost-effectiveness in the long run.

India Data Center Generator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, capacity, and tier.

Product Insights:

- Diesel

- Natural Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes diesel, natural gas, and others.

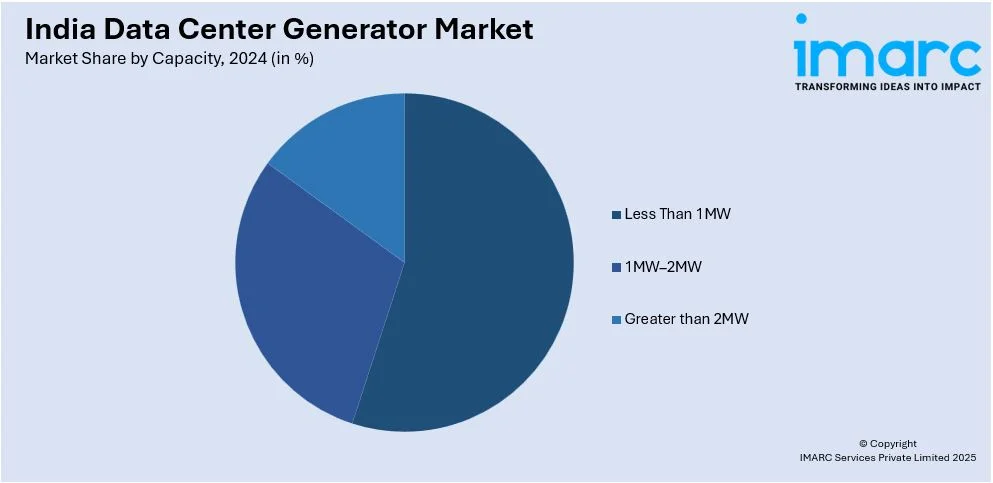

Capacity Insights:

- Less Than 1MW

- 1MW–2MW

- Greater than 2MW

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes less than 1MW, 1MW–2MW, and greater than 2MW.

Tier Insights:

- Tier I and II

- Tier III

- Tier IV

The report has provided a detailed breakup and analysis of the market based on the tier. This includes tier I and II, tier III, and tier IV.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Data Center Generator Market News:

- January 24, 2025: Reliance Industries announced its plan to build the world's biggest data center in Jamnagar, Gujarat, with AI semiconductors and Blackwell AI processors from NVIDIA.

- January 24, 2025: Hyderabad is becoming a major data center destination, with Telangana having received investments worth INR 24,500 Crores (approximately USD 2.8 Billion) to set up AI-optimized data centers with a total capacity of 550MW. As India builds its digital infrastructure, demand for reliable data center generators is expected to rise significantly.

- September 14, 2024: Microsoft acquired a 16-acre land parcel from K Raheja Corp in the Hinjewadi area of Pune for INR 519.72 Crore (approximately USD 62 Million) to enhance its data center presence in the country. Currently, the company has cloud regions running in Pune, Chennai, and Mumbai and is building a new facility in Hyderabad. With the transformation of the data center ecosystem in India, there is anticipated to be a substantial increase in the demand for high-capacity data center generators.

India Data Center Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Diesel, Natural Gas, Others |

| Capacities Covered | Less Than 1MW, 1MW–2MW, Greater than 2MW |

| Tiers Covered | Tier I and II, Tier III, Tier IV |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India data center generator market performed so far and how will it perform in the coming years?

- What is the breakup of the India data center generator market on the basis of product?

- What is the breakup of the India data center generator market on the basis of capacity?

- What is the breakup of the India data center generator market on the basis of tier?

- What is the breakup of the India data center generator market on the basis of region?

- What are the various stages in the value chain of the India data center generator market?

- What are the key driving factors and challenges in the India data center generator market?

- What is the structure of the India data center generator market and who are the key players?

- What is the degree of competition in the India data center generator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India data center generator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India data center generator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India data center generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)