India Data Center Market Size, Share, Trends and Forecast by Application, Type, Component, Size, and Region, 2026-2034

India Data Center Market Summary:

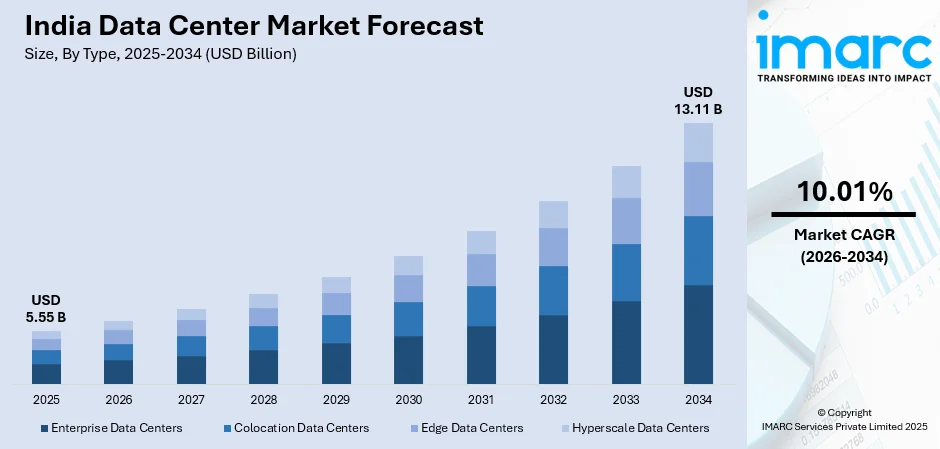

The India data center market size was valued at USD 5.55 Billion in 2025 and is projected to reach USD 13.11 Billion by 2034, growing at a compound annual growth rate of 10.01% from 2026-2034.

The market is driven by rapid digital transformation, increasing cloud adoption, and rising demand for data storage solutions across enterprises. Growing internet penetration and smartphone usage are fueling data generation, while government initiatives supporting digital infrastructure development are accelerating investments. The expansion of e-commerce, fintech, and streaming services further propels demand for robust data center facilities. Enhanced focus on data localization requirements and emerging technologies continues strengthening the India data center market share.

Key Takeaways and Insights:

-

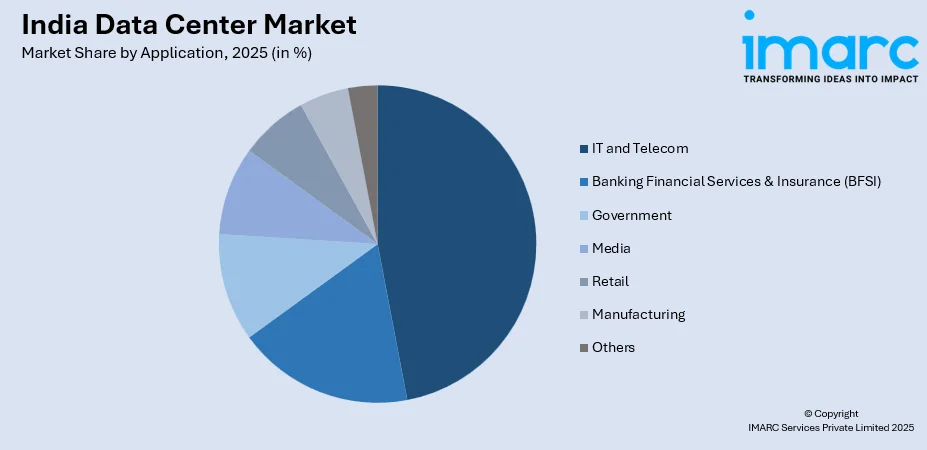

By Application: IT and telecom dominate the market with a share of 47% in 2025, driven by telecommunications infrastructure expansion, cloud computing deployments, and growing enterprise demand for reliable data processing capabilities.

-

By Type: Colocation data centers lead the market with a share of 61% in 2025, owing to cost-effective shared infrastructure models, reduced capital expenditure requirements, and enterprise preference for outsourced facility management.

-

By Component: Hardware represents the largest segment with a market share of 50% in 2025, driven by substantial investments in servers, storage systems, networking equipment, and cooling infrastructure essential for data center operations.

-

By Size: Mid-size data center dominates the market with a share of 46% in 2025, owing to balanced infrastructure requirements of growing enterprises, optimal cost-efficiency ratios, and manageable operational complexity.

-

By Region: Maharashtra leads the market with a share of 26% in 2025, driven by Mumbai's position as India's financial capital, superior connectivity infrastructure, skilled workforce availability, and corporate headquarters concentration.

- Key Players: The India data center market exhibits a moderately fragmented competitive landscape, with domestic operators competing alongside international service providers. Market participants differentiate through geographical coverage, service reliability, and energy efficiency. Some of the key players operating in the market include Adani Group, Arshiya Limited, CTRLS Datacenters Ltd., Equinix Inc., ESDS Software Solution Ltd., NetDataVault (NGBPS Limited), Nikom InfraSolutions Pvt. Ltd., Nippon Telegraph and Telephone Corporation, Nxtra Data Limited (Bharti Airtel Limited), Sify Technologies Limited, Sterling and Wilson Pvt. Ltd., and Web Werks India Pvt. Ltd.

To get more information on this market Request Sample

The India data center market is experiencing robust expansion driven by the country's accelerating digital transformation journey and growing enterprise technology adoption. Increasing internet penetration across urban and rural regions, combined with rising smartphone usage, is generating unprecedented volumes of data requiring efficient storage and processing infrastructure. The proliferation of cloud computing services, artificial intelligence (AI) applications, and big data analytics is compelling organizations to invest in advanced data center capabilities. As per sources, in January 2025, Sify Technologies announced a $5 Billion investment to expand its Indian AI data centers, planning 20 smaller AI inference facilities across secondary cities to meet growing enterprise demand. Moreover, government initiatives promoting digital governance and smart city development are further stimulating infrastructure investments. The expanding e-commerce sector, growing fintech ecosystem, and streaming media consumption patterns are creating sustained demand for reliable data center services.

India Data Center Market Trends:

Adoption of Green and Sustainable Data Center Practices

Data center operators are increasingly prioritizing environmental sustainability through the implementation of energy-efficient technologies and renewable power sources. The industry is witnessing growing adoption of advanced cooling systems, including liquid cooling and free-air cooling methodologies, to reduce energy consumption significantly. Operators are pursuing green building certifications and implementing comprehensive carbon neutrality strategies to address environmental concerns. The integration of solar and wind energy sources is becoming commonplace as facilities strive to minimize their ecological footprint while meeting rising demand for computing resources. According to sources, in November 2024, Equinix partnered with CleanMax to build a 33 MW captive solar and wind power project in Maharashtra, providing renewable energy to decarbonize its Mumbai data centers.

Edge Computing Integration and Distributed Infrastructure

The proliferation of Internet of Things (IoT) devices and real-time application requirements is driving significant investment in edge computing infrastructure across India. As per sources, in July 2025, ICRA reported India’s edge data centre capacity may triple from 60–70 MW in 2024 to nearly 200–210 MW by 2027, driven by 5G and IoT demand. Moreover, organizations are deploying smaller, geographically distributed data centers closer to end-users to reduce latency and enhance service delivery performance. This trend supports emerging applications including autonomous vehicles, smart manufacturing, telemedicine, and immersive entertainment experiences. The hybrid approach combining centralized hyperscale facilities with distributed edge locations is becoming the preferred architecture for enterprises seeking optimal performance and cost efficiency.

Artificial Intelligence and Automation in Data Center Operations

Data center operators are increasingly leveraging AI and machine learning (ML) technologies to optimize facility management and operational efficiency. Predictive maintenance systems are being deployed to anticipate equipment failures and minimize downtime through proactive interventions. According to sources, in 2025, Astrikos.ai launched its AI-powered S!aP Cognus platform in India, enabling predictive maintenance, real-time analytics, and automated optimization to improve data center uptime and operational efficiency. Automated workload management and intelligent resource allocation are enhancing energy efficiency while improving service reliability. The adoption of robotic process automation for routine tasks is reducing operational costs while enabling personnel to focus on strategic initiatives and complex problem-solving activities.

Market Outlook 2026-2034:

The India data center market revenue is poised for substantial expansion during the forecast period, driven by continued digital transformation initiatives and increasing enterprise technology investments. Growing cloud adoption, AI deployment, and data localization requirements will sustain demand momentum. Infrastructure modernization projects and capacity expansion by established operators will contribute to revenue growth. The emergence of tier-two cities as viable data center locations and government incentive programs supporting the sector will create additional growth opportunities throughout the forecast period. The market generated a revenue of USD 5.55 Billion in 2025 and is projected to reach a revenue of USD 13.11 Billion by 2034, growing at a compound annual growth rate of 10.01% from 2026-2034.

India Data Center Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Application |

IT and Telecom |

47% |

|

Type |

Colocation Data Centers |

61% |

|

Component |

Hardware |

50% |

|

Size |

Mid-Size Data Center |

46% |

|

Region |

Maharashtra |

26% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Banking Financial Services & Insurance (BFSI)

- Government

- IT and Telecom

- Media

- Retail

- Manufacturing

- Others

IT and telecom dominate with a market share of 47% of the total India data center market in 2025.

IT and telecom maintain its dominant position within the India data center market, commanding the largest revenue share among all application categories. This segment encompasses the extensive infrastructure requirements of telecommunications service providers, information technology companies, software development enterprises, and digital platform operators. The continuous expansion of mobile networks, broadband services, and enterprise connectivity solutions generates substantial demand for reliable data processing and storage capabilities. According to sources, in 2025, Indian telecom majors, including Bharti Airtel and Jio, announced plans to invest over ₹1 Lakh Crore in AI-ready data centers, edge infrastructure, and cloud platforms to scale enterprise digital services. Furthermore, cloud service providers serving the IT sector require massive computing infrastructure to support their expanding customer bases and service portfolios.

The segment's prominence is further reinforced by the ongoing digital transformation initiatives across Indian businesses, driving increased outsourcing of computing resources to specialized data center facilities. Software-as-a-service providers, managed service operators, and system integrators contribute significantly to capacity utilization within this segment. The proliferation of application programming interfaces, microservices architectures, and containerized deployments necessitates scalable and flexible data center infrastructure. Telecommunications providers continue expanding their infrastructure to support enhanced mobile experiences and emerging connectivity technologies.

Type Insights:

- Enterprise Data Centers

- Colocation Data Centers

- Edge Data Centers

- Hyperscale Data Centers

Colocation data centers lead with a share of 61% of the total India data center market in 2025.

Colocation data centers represent the predominant facility type within the India market, offering enterprises shared infrastructure environments where they maintain ownership of their computing equipment. This model provides organizations with reduced capital expenditure requirements while delivering enterprise-grade facility amenities including redundant power systems, advanced cooling infrastructure, and comprehensive physical security measures. In January 2025, CtrlS announced a 40-acre data center campus near Hyderabad, India, with 600MW potential capacity, featuring solar facades, free air-cooling, liquid cooling, and immersion cooling technologies. Moreover, the colocation approach enables businesses to benefit from carrier-neutral connectivity options and proximity to major network exchange points without bearing the full burden of facility construction and operation.

The segment's substantial market share reflects the growing preference among Indian enterprises for flexible infrastructure solutions that accommodate evolving business requirements. Organizations benefit from the ability to scale their computing footprint incrementally while accessing professional facility management expertise. The colocation model particularly appeals to businesses seeking geographic diversification for disaster recovery purposes and regulatory compliance requirements. Service providers continue enhancing their offerings through value-added services including remote hands support, interconnection services, and comprehensive monitoring solutions.

Component Insights:

- Hardware

- Software

- Service

Hardware exhibits a clear dominance with a 50% share of the total India data center market in 2025.

The hardware encompasses all physical infrastructure elements essential for data center operations, including servers, storage arrays, networking equipment, and supporting systems. This segment maintains the largest share owing to the substantial capital investments required for establishing and expanding data center facilities. Organizations must continuously invest in computing hardware to accommodate growing workload demands and technology refresh cycles. Storage infrastructure requirements continue expanding as data volumes increase exponentially across enterprise environments.

Networking equipment investments support the high-bandwidth, low-latency connectivity requirements of modern applications and cloud-native architectures. According to sources, in September 2024, India’s National Stock Exchange announced plans to triple colocation rack capacity at its Mumbai data center, growing from 1,400 to over 4,000 racks to support high-frequency trading operations. Furthermore, power distribution systems, uninterruptible power supplies, and backup generation equipment represent critical hardware investments ensuring operational continuity. Cooling infrastructure including precision air conditioning, chillers, and heat rejection systems constitute significant capital allocation within this segment. Physical security systems, monitoring equipment, and fire suppression installations complete the comprehensive hardware portfolio required for professional data center operations.

Size Insights:

- Small Data Center

- Mid-Size Data Center

- Large Data Center

Mid-size data center leads with a market share of 46% of the total India data center market in 2025.

Mid-size data centers have emerged as the preferred infrastructure scale for a substantial portion of the India market, serving organizations with moderate computing requirements and growth trajectories. These facilities offer an optimal balance between capacity availability and operational manageability, enabling efficient resource utilization without the complexity associated with hyperscale operations. Mid-size facilities typically provide sufficient redundancy and reliability levels to meet enterprise requirements while maintaining cost-effective operational profiles attractive to budget-conscious organizations.

The segment's leading position reflects the composition of Indian enterprise computing demand, where numerous medium and large businesses require dedicated infrastructure without hyperscale capacity levels. These facilities serve as regional hubs providing localized services to businesses within specific geographic areas or vertical markets. As per sources, in May 2025, RackBank inaugurated an 80 MW AI datacenter park in Raipur, Chhattisgarh, housing 1,00,000 GPUs, supporting regional AI workloads, innovation, and India’s AI Mission. Furthermore, the mid-size segment accommodates organizations transitioning from smaller infrastructure deployments while providing room for measured expansion aligned with business growth. Operators of mid-size facilities often differentiate through specialized vertical expertise and personalized customer service approaches.

Regional Insights:

- Maharashtra

- Tamil Nadu

- Uttar Pradesh

- Gujarat

- Karnataka

- West Bengal

- Rajasthan

- Andhra Pradesh

- Telangana

- Madhya Pradesh

- Delhi NCR

- Punjab

- Haryana

- Others

Maharashtra dominates with a market share of 26% of the total India data center market in 2025.

Maharashtra maintains its position as the leading regional market for data center infrastructure within India, with Mumbai serving as the primary concentration point for facility development. The state benefits from its status as India's financial capital, hosting numerous banking institutions, insurance companies, and financial services organizations with substantial computing requirements. Mumbai's superior connectivity infrastructure, including submarine cable landing stations and extensive fiber networks, provides exceptional domestic and international bandwidth availability essential for data center operations.

The region's established commercial real estate ecosystem facilitates data center development projects with available land parcels and supportive regulatory frameworks. Maharashtra attracts significant foreign investment in data center infrastructure given Mumbai's recognition as a global business hub. The concentration of corporate headquarters across diverse industries including media, entertainment, pharmaceuticals, and manufacturing creates concentrated demand for proximity data services. State government initiatives promoting technology sector development and infrastructure investment further enhance Maharashtra's attractiveness for data center operators. According to sources, in October 2025, ST Telemedia Global Data Centres (India) signed an MoU with the Maharashtra government to invest up to ₹5,000 crore, expanding AIready data center campuses in Mumbai and Pune.

Market Dynamics:

Growth Drivers:

Why is the India Data Center Market Growing?

Accelerating Digital Transformation Across Enterprise Sectors

Indian enterprises across all industry verticals are embracing comprehensive digital transformation strategies, fundamentally reshaping their operational models and technology infrastructure requirements. Organizations are migrating legacy systems to modern architectures, implementing cloud-native applications, and deploying data analytics capabilities to derive competitive advantages. In August 2025, Tata Projects adopted SAP’s cloud-first ERP suite, unifying operations across finance, procurement, and analytics to drive enterprise-wide digital transformation and real-time decision-making. Further, this transformation necessitates robust data center infrastructure capable of supporting diverse workloads ranging from transaction processing to AI model training. The convergence of operational technology with information technology in manufacturing and industrial sectors is generating additional computing demands requiring reliable facility infrastructure.

Rising Cloud Computing Adoption and Hyperscaler Expansion

The accelerating adoption of cloud computing services across Indian organizations is driving substantial demand for data center infrastructure supporting both public and private cloud deployments. Global hyperscale cloud providers are expanding their India presence, establishing availability zones and regions that require local data center partnerships and facility investments. As per sources, in January 2025, AWS announced an $8.3 Billion investment to expand cloud infrastructure in Maharashtra’s Mumbai Region, formalized via an MoU signed during the World Economic Forum 2025. Moreover, Indian enterprises are increasingly adopting hybrid and multi-cloud strategies, maintaining some workloads within colocation facilities while leveraging public cloud services for others. The growing sophistication of cloud-native applications and the increasing comfort level of organizations with cloud security and compliance frameworks are removing previous adoption barriers.

Government Digital Initiatives and Data Localization Requirements

Government programs promoting digital governance, financial inclusion, and citizen services are generating significant demand for data center infrastructure across India. In December 2024, India’s National Data Centres (NDCs) expanded across Delhi, Pune, Bhubaneswar, and Hyderabad, deploying 5,000 servers and 100PB storage to enhance cloud services for government ministries and PSUs. Further, the implementation of national identification systems, digital payment platforms, and e-governance portals requires substantial computing capacity distributed across multiple geographic locations. Data localization regulations mandating that certain categories of information be stored within Indian borders are compelling both domestic enterprises and international corporations to establish local data center presence. Public sector digitization projects spanning healthcare, education, agriculture, and transportation create diverse infrastructure requirements.

Market Restraints:

What Challenges the India Data Center Market is Facing?

High Power Costs and Energy Infrastructure Limitations

Data centers require substantial and reliable electrical power supplies, with energy costs representing a significant portion of operational expenditures. In numerous Indian regions, electricity tariffs remain elevated compared to other global data center markets, impacting facility economics and service pricing competitiveness. Power infrastructure reliability varies considerably across states, necessitating substantial investments in backup generation and redundancy systems.

Skilled Workforce Availability and Training Requirements

The rapid expansion of data center infrastructure across India has created substantial demand for qualified technical personnel capable of operating and maintaining sophisticated facility systems. Competition for experienced data center professionals intensifies as new facilities enter operation, creating workforce retention challenges for operators. The specialized skills required for modern data center operations, including expertise in cooling systems, power distribution, and automation platforms, necessitate comprehensive training programs.

Land Acquisition and Infrastructure Development Challenges

Securing appropriate land parcels for data center development presents significant challenges in prime metropolitan locations where demand concentration is highest. Real estate costs in established data center markets have increased substantially, impacting project economics and limiting expansion options. Infrastructure development timelines for power connectivity, fiber network access, and municipal services can extend project schedules considerably.

Competitive Landscape:

The India data center market competitive landscape is characterized by a diverse mix of established domestic operators, international facility providers, and emerging regional players competing across various service segments and geographic markets. Competition intensifies as hyperscale cloud providers expand their India presence, partnering with local operators while also developing proprietary facilities. Market participants differentiate through geographic coverage, reliability certifications, sustainability credentials, and specialized vertical solutions. Established operators leverage their experience and customer relationships while newer entrants compete through modern facility designs and competitive pricing strategies. Strategic partnerships, capacity expansion investments, and service portfolio diversification represent key competitive approaches as the market continues its expansion trajectory.

Some of the key players include:

- Adani Group

- Arshiya Limited

- CTRLS Datacenters Ltd.

- Equinix Inc.

- ESDS Software Solution Ltd.

- NetDataVault (NGBPS Limited)

- Nikom InfraSolutions Pvt. Ltd.

- Nippon Telegraph and Telephone Corporation

- Nxtra Data Limited (Bharti Airtel Limited)

- Sify Technologies Limited

- Sterling and Wilson Pvt. Ltd.

- Web Werks India Pvt. Ltd.

Recent Developments:

-

In October 2025, AdaniConneX and Google announced a landmark partnership to develop India’s largest AI data centre campus in Visakhapatnam. The project includes next-generation data centre infrastructure, gigawatt-scale operations, subsea cable networks, and green energy solutions, aimed at enhancing India’s AI capabilities and digital infrastructure.

-

In January 2025, Reliance Industries, in collaboration with Nvidia, revealed plans to construct the world’s largest AI data centre in Jamnagar, Gujarat. The project will feature one-gigawatt capacity powered by Nvidia’s advanced AI semiconductors, reinforcing India’s AI ambitions and strengthening the nation’s digital infrastructure for AI and high-performance computing

India Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Middle East Tire Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Banking Financial Services & Insurance (BFSI), Government, IT and Telecom, Media, Retail, Manufacturing, Others |

| Types Covered | Enterprise Data Centers, Colocation Data Centers, Edge Data Centers, Hyperscale Data Centers |

| Components Covered | Hardware, Software, Service |

| Sizes Covered | Small Data Center, Mid-Size Data Center, Large Data Center |

| Regions Covered | Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, Karnataka, West Bengal, Rajasthan, Andhra Pradesh, Telangana, Madhya Pradesh, Delhi NCR, Punjab, Haryana, Others |

| Companies Covered | Adani Group, Arshiya Limited, CTRLS Datacenters Ltd., Equinix Inc., ESDS Software Solution Ltd., NetDataVault (NGBPS Limited), Nikom InfraSolutions Pvt. Ltd., Nippon Telegraph and Telephone Corporation, Nxtra Data Limited (Bharti Airtel Limited), Sify Technologies Limited, Sterling and Wilson Pvt. Ltd., Web Werks India Pvt. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India data center market size was valued at USD 5.55 Billion in 2025.

The India data center market is expected to grow at a compound annual growth rate of 10.01% from 2026-2034 to reach USD 13.11 Billion by 2034.

IT and telecom dominated the market, driven by the expansion of telecommunications infrastructure, widespread cloud computing deployments, advanced software development ecosystems, and increasing enterprise demand for reliable, scalable, and efficient data processing and storage capabilities.

Key factors driving the India data center market include accelerating digital transformation initiatives, rising cloud computing adoption, government digitization programs, data localization requirements, expanding e-commerce and fintech ecosystems, and increasing enterprise demand for reliable data processing infrastructure.

Major challenges include high power costs and energy infrastructure limitations, skilled workforce availability constraints, land acquisition difficulties in prime locations, substantial capital investment requirements, regulatory compliance complexities, and competition for quality real estate suitable for facility development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)