India Data Center Power Market Size, Share, Trends and Forecast by Solution Type, Service Type, Size, Vertical, and Region, 2026-2034

India Data Center Power Market Summary:

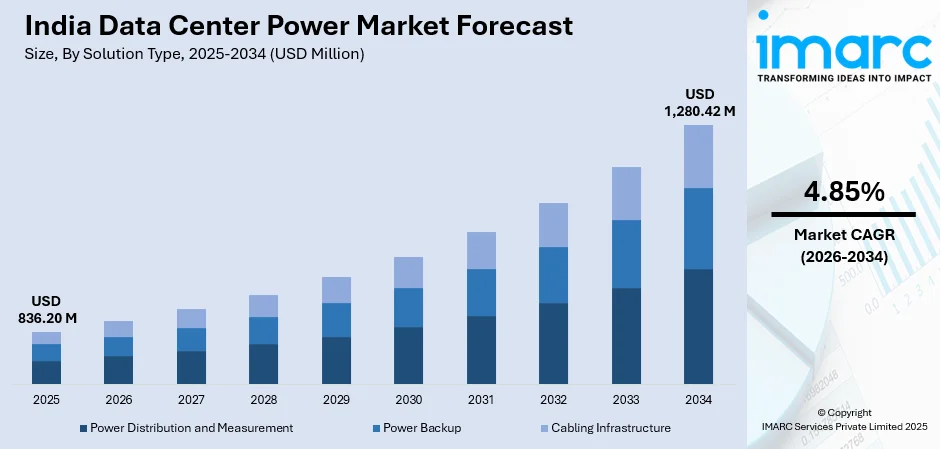

The India data center power market size was valued at USD 836.20 Million in 2025 and is projected to reach USD 1,280.42 Million by 2034 , growing at a compound annual growth rate of 4.85% from 2026-2034.

The market is driven by the rapid expansion of digital infrastructure, increasing cloud adoption across enterprises, and government initiatives promoting data localization. Rising demand for uninterrupted power supply solutions and energy-efficient technologies further accelerates growth. The proliferation of smart cities, artificial intelligence applications, and the expanding telecommunications sector continues to fuel investments in reliable power infrastructure, contributing to the expanding India data center power market share.

Key Takeaways and Insights:

- By Solution Type: Power distribution and measurement dominates the market with a share of 42% in 2025, driven by critical real-time monitoring needs and intelligent load balancing capabilities across data center facilities.

- By Service Type: System integration leads the market with a share of 46% in 2025, owing to complex infrastructure requirements necessitating seamless integration of diverse power systems and monitoring solutions.

- By Size: Enterprise data center represents the largest segment with a market share of 40% in 2025, driven by large-scale digital transformation initiatives requiring dedicated power infrastructure for mission-critical operations.

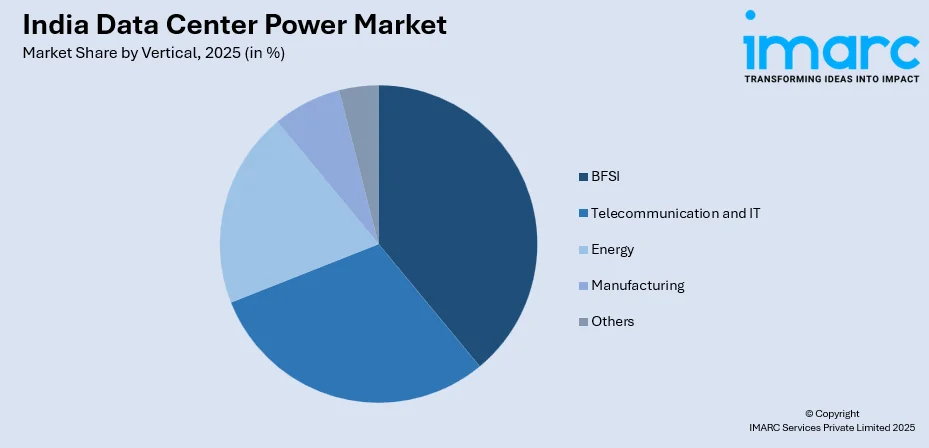

- By Vertical: BFSI dominates the market with a share of 38% in 2025, owing to stringent uptime requirements, regulatory compliance mandates, and increasing digitization of financial services demanding robust solutions.

- By Region: North India leads the market with a share of 30% in 2025, driven by the concentration of data center hubs, strong connectivity infrastructure, and favorable government policies attracting investments.

- Key Players: The India data center power market exhibits a competitive landscape with established global technology providers competing alongside domestic infrastructure specialists. Market participants focus on energy-efficient innovations, strategic partnerships with data center operators, and expanding service portfolios to address evolving customer requirements.

To get more information on this market Request Sample

The India data center power market is experiencing robust expansion driven by the accelerating digital transformation across industries and the growing emphasis on data sovereignty. The proliferation of cloud computing services, enterprise applications, and emerging technologies such as artificial intelligence and machine learning generates substantial demand for reliable power infrastructure. Government initiatives promoting digital India and smart city development further catalyse investments in data center facilities requiring sophisticated power solutions. The increasing adoption of colocation services by small and medium enterprises, coupled with the expansion of hyperscale data centers by global technology providers, creates sustained demand for power distribution, backup systems, and energy management solutions. According to reports, in May 2025, Techno Electric invested USD 1 Billion to launch Techno Digital, targeting 250 MW data center capacity across India over five years, marking its entry into the data center power and infrastructure segment. Moreover, rising awareness regarding operational efficiency and sustainability also propels the adoption of advanced power infrastructure across the data center ecosystem.

India Data Center Power Market Trends:

Transition Toward Renewable Energy Integration

Data center operators across India are increasingly prioritizing the integration of renewable energy sources into their power infrastructure to address sustainability objectives and reduce operational costs. The adoption of solar and wind power solutions, combined with advanced energy storage systems, enables facilities to decrease their carbon footprint while maintaining operational reliability. As per sources, in November 2024, Equinix signed its first India PPA with CleanMax to develop a 33 MW captive solar-wind project in Maharashtra, enabling 100% renewable power coverage for its Mumbai data centers. Further, this shift reflects broader corporate commitments to environmental responsibility and aligns with regulatory frameworks encouraging clean energy adoption across the technology sector.

Adoption of Modular Power Infrastructure Solutions

The data center industry is witnessing growing preference for modular and scalable power infrastructure that enables flexible capacity expansion based on evolving operational requirements. In December 2025, Pioneer Power Solutions launched PRYMUS, a modular hybrid mobile power system for data centers, offering pre-engineered 1 to 10 MW blocks deployable within six months to address rapid power scalability needs. Further, these solutions allow operators to deploy power systems incrementally, optimizing capital expenditure while ensuring infrastructure readiness for future growth. Modular architectures facilitate faster deployment timelines, simplified maintenance procedures, and enhanced redundancy configurations, making them particularly attractive for organizations seeking agility in their data center operations.

Implementation of Intelligent Power Management Systems

Advanced power management solutions incorporating real-time monitoring, predictive analytics, and automated load distribution are gaining significant traction across Indian data centers. As per sources, in July 2025, Astrikos.ai launched S!aP Cognus, an AI-powered data center intelligence platform enabling real-time monitoring, predictive maintenance, and energy efficiency optimisation across critical power and infrastructure systems. Moreover, these intelligent systems enable operators to optimize energy consumption, identify potential equipment failures before they occur, and maintain optimal power utilization across facility infrastructure. The integration of artificial intelligence capabilities within power management platforms further enhances operational efficiency by enabling dynamic adjustments based on workload patterns and environmental conditions.

Market Outlook 2026-2034:

The India data center power market is positioned for substantial revenue growth throughout the forecast period, driven by continued digital infrastructure expansion and increasing enterprise technology investments. The market revenue trajectory reflects the sustained demand for advanced power solutions across emerging data center facilities and the modernization of existing infrastructure. Ongoing developments in energy-efficient technologies, coupled with the expansion of hyperscale facilities and edge computing deployments, are expected to contribute significantly to revenue generation through enhanced power infrastructure requirements across the nation. The market generated a revenue of USD 836.20 Million in 2025 and is projected to reach a revenue of USD 1,280.42 Million by 2034, growing at a compound annual growth rate of 4.85% from 2026-2034.

India Data Center Power Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Solution Type |

Power Distribution and Measurement |

42% |

|

Service Type |

System Integration |

46% |

|

Size |

Enterprise Data Center |

40% |

|

Vertical |

BFSI |

38% |

|

Region |

North India |

30% |

Solution Type Insights:

- Power Distribution and Measurement

- Intelligent PDUs

- Non-intelligent PDUs

- Monitoring Software

- Power Backup

- UPS Devices

- Generators

- Cabling Infrastructure

- Transfer Switches

- Switchgear

Power distribution and measurement dominates with a market share of 42% of the total India data center power market in 2025.

Power distribution and measurement represent the largest category within the India data center power market, reflecting the fundamental importance of efficient power delivery and monitoring capabilities across facilities. These solutions encompass intelligent power distribution units, metering systems, and monitoring software that enable operators to maintain precise control over energy consumption while ensuring optimal load distribution across server infrastructure and supporting equipment. The growing complexity of data center environments necessitates sophisticated power management tools capable of addressing diverse operational requirements effectively.

The dominance of this category is attributable to the critical role these solutions play in maintaining operational efficiency and preventing costly downtime events. Organizations increasingly prioritize investments in advanced power distribution infrastructure featuring real-time monitoring capabilities, automated alerts, and comprehensive reporting functionalities that support informed decision-making regarding capacity planning and energy optimization. In June 2025, Netrack’s Power Distribution Units in India ensured uninterrupted, safe power delivery for servers, networking devices, and critical data center equipment, enhancing operational reliability and supporting energy-efficient operations. Moreover, the emphasis on sustainable operations further drives adoption of intelligent power distribution technologies that enable precise tracking and reduction of energy consumption.

Service Type Insights:

- System Integration

- Training and Consulting

- Support and Maintenance

System integration leads with a share of 46% of the total India data center power market in 2025.

System integration holds the leading position within the service category, driven by the complexity inherent in deploying and managing comprehensive data center power infrastructure. These services encompass the seamless integration of diverse power components including distribution systems, backup solutions, cooling equipment, and monitoring platforms into cohesive operational frameworks meeting specific organizational requirements and performance standards. The increasing sophistication of data center environments amplifies demand for specialized integration expertise capable of coordinating multiple technology platforms into unified systems. In September 2025, Invenia‑STL Networks secured a ₹360 crore contract from PowerGrid Teleservices to design, build, and maintain IT and cloud infrastructure for a Tier III data center.

The prominence of system integration reflects the specialized expertise required to configure and optimize power infrastructure for maximum efficiency and reliability across facilities. Data center operators increasingly rely on integration specialists to navigate technical complexities associated with implementing advanced power solutions, ensuring compatibility across equipment from multiple vendors while maintaining compliance with industry standards and regulatory requirements. Strategic partnerships between integration providers and facility operators continue strengthening to address evolving infrastructure demands.

Size Insights:

- Mid-size Data Center

- Enterprise Data Center

- Large Data Center

Enterprise data center exhibits a clear dominance with a 40% share of the total India data center power market in 2025.

Enterprise data center constitutes the dominant category by facility size, reflecting the substantial power infrastructure requirements of large-scale organizational computing environments across India. According to sources, in October 2025, AdaniConneX and Google partnered to develop India’s largest AI data centre campus in Visakhapatnam, featuring gigawatt-scale power infrastructure and green energy to support advanced enterprise computing. Further, these facilities house mission-critical applications and data assets requiring sophisticated power solutions featuring multiple redundancy layers, advanced backup systems, and comprehensive monitoring capabilities to ensure uninterrupted operations supporting core business functions. The expansion of digital services across enterprises continues driving investments in dedicated computing facilities requiring robust and reliable power infrastructure.

The leadership position of enterprise data centers stems from their significant power consumption requirements and stringent uptime mandates that necessitate substantial investments in robust power infrastructure solutions. Organizations operating enterprise facilities prioritize reliability and performance, driving demand for premium power distribution systems, high-capacity uninterruptible power supplies, and advanced management solutions capable of supporting demanding operational environments. The growing adoption of hybrid cloud architectures further amplifies power infrastructure requirements within enterprise computing facilities.

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Telecommunication and IT

- Energy

- Manufacturing

- Others

BFSI leads with a market share of 38% of the total India data center power market in 2025.

BFSI represents the largest vertical category, driven by stringent regulatory requirements and operational demands characterizing financial services technology infrastructure across India. Financial institutions require exceptional power reliability to support the transaction processing systems, customer-facing applications, and data storage solutions where even momentary disruptions can result in significant financial and reputational consequences. According to sources, in June 2025, CtrlS Datacenters partnered with the Bombay Stock Exchange (BSE) to power its critical data center infrastructure, supporting over 700 Crore daily transactions and ensuring uninterrupted financial operations. Moreover, the sector's continuous expansion of digital services amplifies requirements for sophisticated power infrastructure capable of maintaining uninterrupted operations.

BFSI organizations invest substantially in data center power infrastructure featuring comprehensive redundancy configurations, rapid failover capabilities, and sophisticated monitoring systems to maintain continuous availability essential for financial operations. The sector's digital transformation initiatives, including expansion of digital banking services and adoption of advanced analytics platforms, further amplify power infrastructure requirements across primary data center facilities and disaster recovery sites. Regulatory compliance mandates regarding data protection additionally drive investments in reliable power solutions.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates with a market share of 30% of the total India data center power market in 2025.

North India maintains the leading regional position within the data center power market, benefiting from the concentration of technology infrastructure investments in the National Capital Region and surrounding areas. The region hosts numerous enterprise data centers, colocation facilities, and emerging hyperscale developments that collectively generate substantial demand for advanced power solutions supporting diverse organizational computing requirements. Favorable climatic conditions in certain areas additionally reduce cooling-related power consumption, enhancing overall operational efficiency for data center facilities.

The regional leadership reflects favorable factors including robust connectivity infrastructure, proximity to major commercial centers, availability of skilled technical workforce, and supportive policy frameworks encouraging data center investments across the region. Government initiatives promoting digital infrastructure development continue attracting new facility deployments, while existing operators invest in power infrastructure upgrades to enhance operational efficiency and expand capacity. In July 2025, Anant Raj Limited commissioned a new 7 MW data centre in Panchkula, Haryana, enhancing North India’s digital infrastructure and regional power capacity for data operations. Furthermore, strategic location advantages position North India as the preferred destination for organizations establishing data center operations.

Market Dynamics:

Growth Drivers:

Why is the India Data Center Power Market Growing?

Accelerating Digital Transformation Across Industries

The comprehensive digital transformation occurring across Indian industries serves as a primary catalyst for data center power market expansion. Organizations spanning manufacturing, healthcare, retail, education, and government sectors are increasingly migrating critical operations to digital platforms, generating substantial computational workloads requiring reliable data center infrastructure. This transformation encompasses the adoption of cloud computing services, enterprise resource planning systems, customer relationship management platforms, and industry-specific applications that collectively demand robust power infrastructure capable of supporting continuous operations. According to reports, in December 2025, India’s cloud data centre capacity reached 1,280 MW, serving critical sectors, and is projected to grow 4–5 times by 2030, driven by digitalisation and AI adoption. Moreover, the digitization of government services and the expansion of e-commerce platforms further amplify power requirements as data processing and storage needs escalate across the economy.

Government Initiatives Supporting Data Infrastructure Development

Strategic government policies and incentive programs significantly contribute to data center power market growth by encouraging investments in digital infrastructure across the nation. Initiatives promoting data localization requirements, digital India programs, and smart city developments create favorable conditions for data center expansion and corresponding power infrastructure investments. State-level policies offering incentives including subsidized land allocation, reduced power tariffs, and streamlined approval processes attract both domestic and international operators to establish new facilities. As per sources, in April 2025, Rajasthan announced the Data Centre Policy‑2025, aiming to attract ₹20,000 Crore investment over five years, offering incentives like interest subsidies, fee waivers, and green solution support. Further, these supportive frameworks reduce investment barriers while addressing infrastructure requirements essential for facility development, thereby accelerating the deployment of advanced power solutions across emerging data center locations.

Proliferation of Emerging Technologies Requiring Computational Resources

The widespread adoption of emerging technologies including artificial intelligence, machine learning, internet of things, and edge computing generates escalating demand for computational resources and corresponding power infrastructure. According to sources, in July 2025, India’s edge data centre capacity was projected to triple from 60–70 MW in 2024 to 200–210 MW by 2027, driven by AI, IoT, and 5G adoption. Moreover, these technology applications require substantial processing capabilities supported by reliable power delivery systems capable of managing variable workloads while maintaining operational efficiency. The development of smart city infrastructure, autonomous vehicle systems, and advanced manufacturing solutions further amplifies power requirements as organizations deploy sophisticated computing environments to support these initiatives. Additionally, the expansion of fifth-generation wireless networks creates new edge computing requirements that necessitate distributed power infrastructure supporting decentralized data processing capabilities.

Market Restraints:

What Challenges the India Data Center Power Market is Facing?

High Initial Capital Investment Requirements

The substantial capital expenditure associated with deploying advanced data center power infrastructure presents significant challenges for market expansion. Organizations considering facility development or upgrades must allocate considerable financial resources for power distribution systems, backup solutions, and monitoring equipment, potentially constraining investment decisions particularly among smaller enterprises with limited capital availability. These cost considerations may delay infrastructure modernization initiatives and restrict market growth potential.

Power Grid Infrastructure Limitations

Constraints within India's electrical grid infrastructure create challenges for data center power market development, particularly in regions with limited access to reliable utility power supplies. Grid stability concerns and power quality issues necessitate substantial investments in backup systems and power conditioning equipment, increasing overall infrastructure costs. These limitations may influence site selection decisions and potentially concentrate development in established regions with superior grid infrastructure.

Skilled Workforce Availability Constraints

The specialized technical expertise required to design, deploy, and maintain sophisticated data center power infrastructure faces supply constraints within the Indian market. The shortage of qualified professionals with experience in advanced power systems, energy management, and facility operations may impact project timelines and operational efficiency. Organizations must invest in workforce development programs to address these capability gaps, adding to overall operational complexity and costs.

Competitive Landscape:

The India data center power market features a dynamic competitive environment characterized by diverse participant categories including global technology corporations, regional infrastructure specialists, and emerging solution providers. Market competition centers on technological innovation, service quality, energy efficiency capabilities, and comprehensive solution offerings that address evolving customer requirements. Established participants leverage extensive product portfolios and technical expertise to maintain market positions, while newer entrants differentiate through specialized solutions and agile service delivery models. Strategic collaborations between power infrastructure providers and data center operators increasingly shape competitive dynamics, enabling tailored solutions addressing specific facility requirements. The emphasis on sustainability and operational efficiency continues to influence competitive positioning across the market landscape.

Recent Developments:

- In May 2025, RackBank inaugurated inaugurated its Rs 1,000-crore, 80MW AI Datacentre Park in Raipur, Chhattisgarh. The facility, India’s first AI-focused data centre in the state, houses 1,00,000 GPUs and features advanced liquid cooling technology, supporting AI workloads and enhancing digital infrastructure across healthcare, education, agritech, and other sectors.

India Data Center Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered |

|

| Service Types Covered | System Integration, Training and Consulting, Support and Maintenance |

| Sizes Covered | Mid-size Data Center, Enterprise Data Center, Large Data Center |

| Verticals Covered | BFSI, Telecommunication and IT, Energy, Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India data center power market size was valued at USD 836.20 Million in 2025.

The India data center power market is expected to grow at a compound annual growth rate of 4.85% from 2026-2034 to reach USD 1,280.42 Million by 2034.

Power distribution and measurement held the largest India data center power market share, driven by the complexity of modern data center infrastructure requiring seamless integration of diverse power components, monitoring systems, and operational technologies.

Key factors driving the India data center power market include accelerating digital transformation across industries, government initiatives supporting data infrastructure development, and the proliferation of emerging technologies requiring substantial computational resources.

Major challenges include high initial capital investment requirements for advanced power infrastructure, power grid infrastructure limitations in certain regions, skilled workforce availability constraints, and the complexity of integrating sustainable energy solutions within existing facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)