India Data Governance Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Business Function, Application, End Use Industry, and Region, 2025-2033

India Data Governance Market Overview:

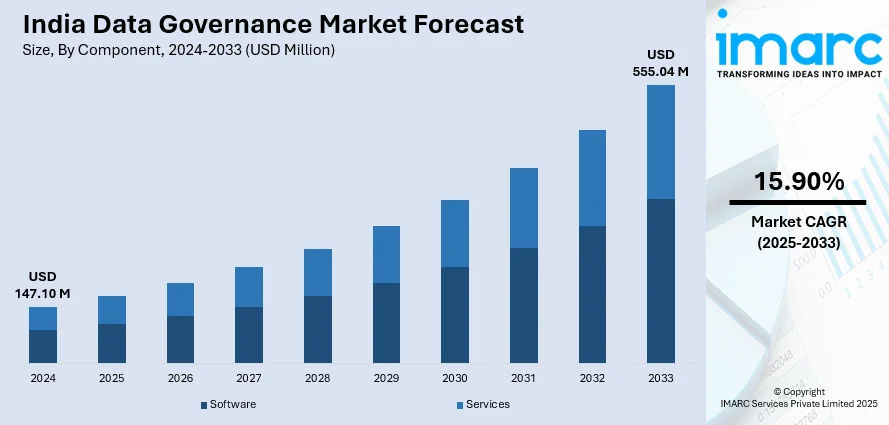

The India data governance market size reached USD 147.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 555.04 Million by 2033, exhibiting a growth rate (CAGR) of 15.90% during 2025-2033. The market is driven by stringent data privacy regulations, increasing consumer awareness about data rights, and the need for compliance. Additionally, the adoption of AI-driven tools for efficient data management and the rise of cloud-based solutions are key factors propelling the India data governance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 147.10 Million |

| Market Forecast in 2033 | USD 555.04 Million |

| Market Growth Rate 2025-2033 | 15.90% |

India Data Governance Market Trends:

Increasing Adoption of Data Privacy Regulations

The growing emphasis on data privacy and protection is significantly supporting the India data governance market growth. According to a Consumer Survey 2024, 82% of Indian consumers consider personal data protection to be the most important element of trust, while 76% are concerned about privacy on social media. However, 58% of consumers are making purchases using social media, but trust remains sub-par, depicting the need for proper management of data governance. The introduction of the Digital Personal Data Protection (DPDP) Act, 2023, has compelled organizations to reassess their data-handling practices. Businesses are now investing heavily in compliance frameworks, data encryption, and secure storage solutions to align with regulatory requirements. This trend is further fueled by rising consumer awareness about data rights, pushing companies to adopt transparent data governance policies. Additionally, the demand for data privacy officers and compliance experts has accelerated, creating new opportunities in the job market. As organizations strive to build trust with customers, the focus on ethical data usage and robust governance frameworks is expected to drive market growth in the coming years.

To get more information on this market, Request Sample

Rise of AI-Driven Data Governance Solutions

Artificial Intelligence (AI) is revolutionizing the market by enabling smarter and more efficient data management. Therefore, this is further creating a positive India data governance market outlook. According to a report by the IMARC Group, the size of the digital transformation market in India reached a value of USD 26.7 Billion in 2024. The market is expected to grow to USD 126.8 Billion by 2033 with a compound annual growth rate (CAGR) of 17.50% from 2025 to 2033. AI-driven tools are being increasingly adopted to automate data classification, monitoring, and risk assessment processes. These solutions help organizations identify sensitive data, detect anomalies, and ensure compliance with regulatory standards in real-time. The integration of AI with data governance platforms is also enhancing decision-making capabilities by providing actionable insights from vast datasets. Furthermore, the growing adoption of cloud-based data governance solutions is amplifying this trend as businesses seek scalable and cost-effective ways to manage their data. With AI becoming more accessible, small and medium enterprises (SMEs) are also leveraging these technologies to strengthen their data governance practices, contributing to the overall expansion of the market.

India Data Governance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, business function, application, and end use industry.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

Organization Size Insights:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises (SMEs), and large enterprises.

Business Function Insights:

- Operation and IT

- Legal

- Finance

- Sales and Marketing

- Others

A detailed breakup and analysis of the market based on the business function have also been provided in the report. This includes operation and IT, legal, finance, sales and marketing, and others.

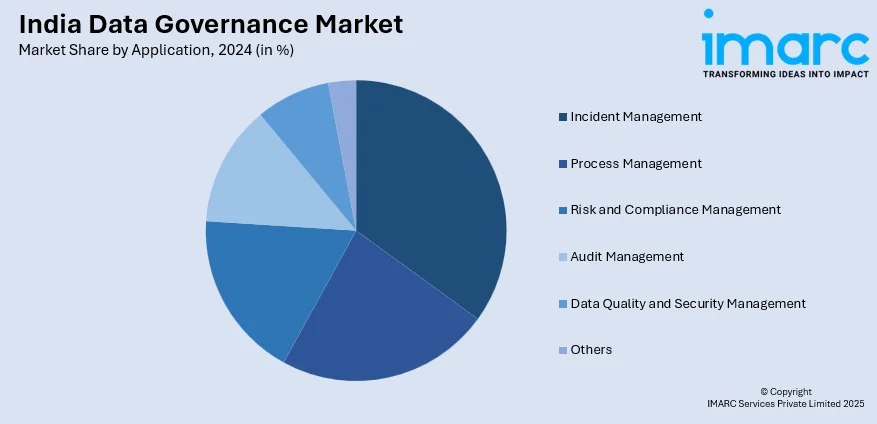

Application Insights:

- Incident Management

- Process Management

- Risk and Compliance Management

- Audit Management

- Data Quality and Security Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes incident management, process management, risk and compliance management, audit management, data quality and security management, and others.

End Use Industry Insights:

- IT and Telecom

- Healthcare

- Retail

- Defense

- BFSI

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes IT and telecom, healthcare, retail, defense, BFSI, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Data Governance Market News:

- March 08, 2025: The Indian government launched AI Kosha, a repository of 316 datasets designed to assist in the creation of AI models using local, non-personal data, thereby bolstering India’s data governance system. This is part of the INR 10,370 Crore (approximately USD 1,264.63 Million) India AI Mission to enhance AI research, especially in translation for Indian languages. Additionally, as part of the Compute Capacity pillar, pooled GPU access has been introduced for startups and academic institutes.

- October 01, 2024: The Government of India launched the BharatGen initiative, which will be the first Government-led Multimodal Large Language Model project under implementation to develop AI models for text, speech, and computer vision, with a special focus on linguistic diversity and data sovereignty. The institute has embarked upon this initiative under the aegis of INR 3,660 Crores (approximately USD 445.12 Million) National Mission on Interdisciplinary Cyber-Physical Systems (NM-ICPS) and in collaboration with IITs, IT Hyderabad, and IIM Indore. This project aims to extend access to Artificial Intelligence for governance, industry, and research. By targeting completion by July 2026, BharatGen is likely to bolster the AI ecosystem in India, reduce dependence on foreign technologies, and promote the Atmanirbhar Bharat vision.

India Data Governance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | Cloud-Based, On-Premises |

| Organization Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Business Functions Covered | Operation and IT, Legal, Finance, Sales and Marketing, Others |

| Applications Covered | Incident Management, Process Management, Risk and Compliance Management, Audit Management, Data Quality and Security Management, Others |

| End Use Industries Covered | IT and Telecom, Healthcare, Retail, Defense, BFSI, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India data governance market performed so far and how will it perform in the coming years?

- What is the breakup of the India data governance market on the basis of component?

- What is the breakup of the India data governance market on the basis of deployment mode?

- What is the breakup of the India data governance market on the basis of organization size?

- What is the breakup of the India data governance market on the basis of business function?

- What is the breakup of the India data governance market on the basis of application?

- What is the breakup of the India data governance market on the basis of end use industry?

- What is the breakup of the India data governance market on the basis of region?

- What are the various stages in the value chain of the India data governance market?

- What are the key driving factors and challenges in the India data governance?

- What is the structure of the India data governance market and who are the key players?

- What is the degree of competition in the India data governance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India data governance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India data governance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India data governance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)