India Data Loss Prevention Market Size, Share, Trends and Forecast by Type, Services, Size, Deployment Type, Application, Industry, and Region, 2025-2033

India Data Loss Prevention Market Overview:

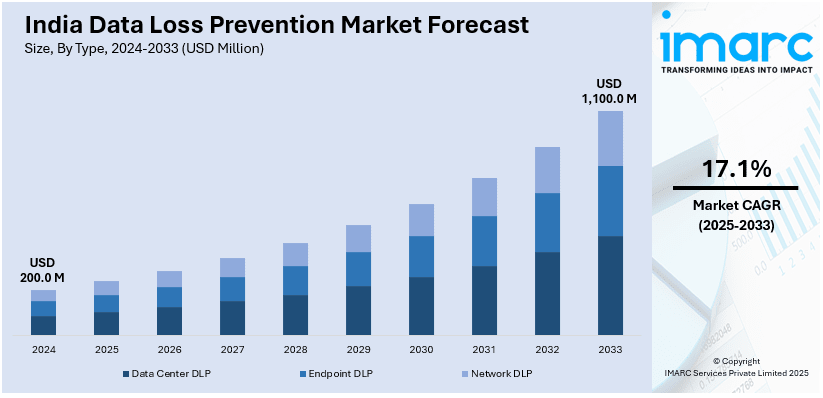

The India data loss prevention market size reached USD 200.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,100.0 Million by 2033, exhibiting a growth rate (CAGR) of 17.1% during 2025-2033. The market is witnessing significant growth, driven by rising adoption of cloud based data loss prevention solutions and increasing regulatory compliance and data protection mandates.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 200.0 Million |

| Market Forecast in 2033 | USD 1,100.0 Million |

| Market Growth Rate 2025-2033 | 17.1% |

India Data Loss Prevention Market Trends:

Rising Adoption of Cloud-Based Data Loss Prevention (DLP) Solutions

The increasing shift toward cloud computing across industries in India is driving demand for cloud-based Data Loss Prevention (DLP) solutions. Organizations are integrating cloud-based DLP to safeguard sensitive data transmitted, processed, and stored on cloud platforms. The adoption is particularly strong among enterprises in banking, financial services, healthcare, and IT sectors, where regulatory compliance and data security are top priorities. For instance, in March 2025, Indian CISOs is set to adopt collaborative risk management for AI security as India’s information security spending rises 16.4% to $3.3 billion in 2025, driven by GenAI data sprawl, ransomware, regulations, and cloud adoption. Cloud-based DLP solutions offer scalable protection across multiple endpoints, networks, and cloud environments, enabling real-time monitoring and automated response mechanisms to prevent unauthorized access and data breaches. The growth of remote work and hybrid workforce models has further necessitated secure cloud collaboration tools integrated with DLP functionalities. Regulatory frameworks such as the Digital Personal Data Protection Act (DPDPA) 2023 are influencing the adoption of DLP solutions by requiring businesses to implement stringent data protection measures. Moreover, the expansion of India’s digital economy and the rise of Software-as-a-Service (SaaS) applications have accelerated cloud adoption, making cloud-based DLP solutions an essential component of enterprise cybersecurity strategies. As a result, vendors are enhancing their offerings with AI-driven analytics, encryption technologies, and Zero Trust security models to address evolving cyber threats and compliance requirements.

To get more information on this market, Request Sample

Increasing Regulatory Compliance and Data Protection Mandates

India’s evolving regulatory landscape is shaping the adoption of advanced DLP solutions, as enterprises seek to comply with data protection mandates and industry-specific cybersecurity guidelines. The implementation of the Digital Personal Data Protection Act (DPDPA) 2023 has reinforced the need for stringent data security measures, compelling organizations to prevent unauthorized data access, leakage, and misuse. Regulated sectors such as banking, financial services, healthcare, and government agencies are investing in DLP solutions to meet compliance obligations and mitigate data breach risks. For instance, in January 2025, MeitY published the Draft Digital Personal Data Protection Rules, outlining data fiduciary compliance, consent manager obligations, state data processing, breach handling, and retention policies, balancing regulation and innovation for India's digital economy. The Reserve Bank of India (RBI) and the Insurance Regulatory and Development Authority of India (IRDAI) have also introduced guidelines for financial institutions to strengthen data governance frameworks, prompting increased DLP adoption. Furthermore, the growth of cross-border data flows and India’s push for data localization under regulatory policies require businesses to implement robust security architectures. DLP solutions equipped with real-time data monitoring, encryption, and automated threat detection are gaining traction as enterprises navigate compliance complexities. To address regulatory challenges, DLP providers are enhancing their solutions with AI-driven risk assessment, policy automation, and machine learning-based anomaly detection. This shift is expected to drive innovation in the Indian DLP market, as businesses prioritize data governance and regulatory adherence.

India Data Loss Prevention Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, services, size, deployment type, application, and industry.

Type Insights:

- Data Center DLP

- Endpoint DLP

- Network DLP

The report has provided a detailed breakup and analysis of the market based on the type. This includes data center DLP, endpoint DLP, and network DLP.

Services Insights:

- Managed Security Services

- Training and Education

- Consulting

- System Integration and Installation

- Threat and Risk Assessment

A detailed breakup and analysis of the market based on the services have also been provided in the report. This includes managed security services, training and education, consulting, system integration and installation, and threat and risk assessment.

Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes large enterprises and small and medium enterprises.

Deployment Type Insights:

- On-Premises

- Cloud Data Loss Protection

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud data loss prevention.

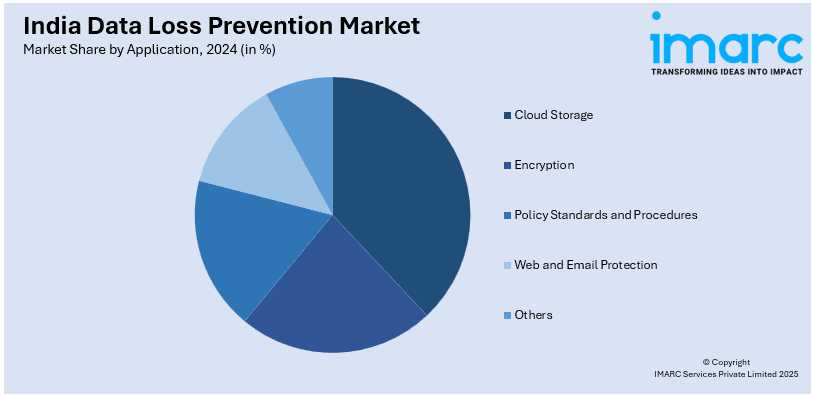

Application Insights:

- Cloud Storage

- Encryption

- Policy Standards and Procedures

- Web and Email Protection

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cloud storage, encryption, policy standards and procedures, web and email protection, and others.

Industry Insights:

- Healthcare

- Retail and Logistics

- Defense and Intelligence

- Public Utilities and Government Bodies

- BFSI

- IT and Telecom

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes healthcare, retail and logistics, defense and intelligence, public utilities and government bodies, BFSI, IT and telecom, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Data Loss Prevention Market News:

- In September 2024, Star Health, a major Indian insurer, filed a lawsuit against Telegram and a hacker over leaked policyholder data and medical records. A Tamil Nadu court issued a temporary injunction, directing Telegram to block chatbots and websites involved in the data breach within India.

India Data loss prevention Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Data Center DLP, Endpoint DLP, Network DLP |

| Services Covered | Managed Security Services, Training and Education, Consulting, System Integration and Installation, Threat and Risk Assessment |

| Sizes Covered | large Enterprises, Small and Medium Enterprises |

| Deployment types Covered | On-premises, cloud data loss prevention |

| Applications Covered | Cloud Storage, Encryption, Policy Standards and Procedures, Web and Email Protection, Others |

| Industries Covered | Healthcare, Retail and Logistics, Defense and Intelligence, Public Utilities and Government Bodies, BFSI, IT and Telecom, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India data loss prevention market performed so far and how will it perform in the coming years?

- What is the breakup of the India data loss prevention market on the basis of type?

- What is the breakup of the India data loss prevention market on the basis of services?

- What is the breakup of the India data loss prevention market on the basis of size?

- What is the breakup of the India data loss prevention market on the basis of deployment type?

- What is the breakup of the India data loss prevention market on the basis of application?

- What is the breakup of the India data loss prevention market on the basis of industry?

- What is the breakup of the India data loss prevention market on the basis of region?

- What are the various stages in the value chain of the India data loss prevention market?

- What are the key driving factors and challenges in the India data loss prevention?

- What is the structure of the India data loss prevention market and who are the key players?

- What is the degree of competition in the India data loss prevention market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India data loss prevention market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India data loss prevention market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India data loss prevention industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)