India Data Quality Tools Market Size, Share, Trends and Forecast by Data Type, Functionality, Component, Deployment Type, Organization Size, Vertical, and Region, 2025-2033

India Data Quality Tools Market Overview:

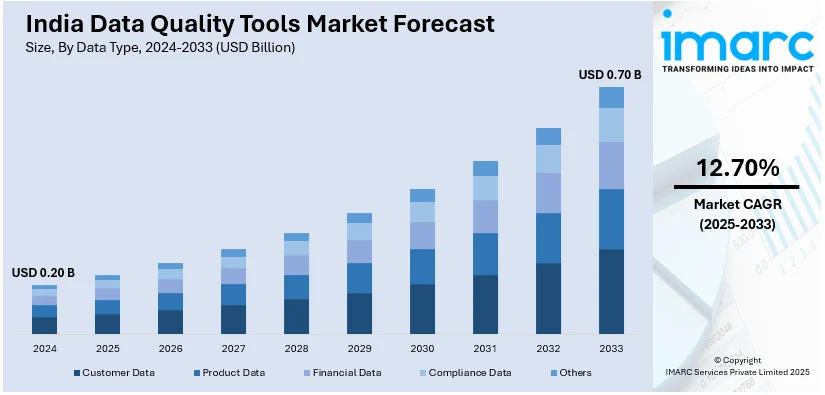

The India data quality tools market size reached USD 0.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.70 Billion by 2033, exhibiting a growth rate (CAGR) of 12.70% during 2025-2033. The drivers for the market include expanding data volumes, rising adoption of machine learning and AI, growing compliance requirements with regulations, surging demand for decision-making based on data, and accelerating requirement for consistent and accurate data to improve business operations and customer experiences across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.20 Billion |

| Market Forecast in 2033 | USD 0.70 Billion |

| Market Growth Rate 2025-2033 | 12.70% |

India Data Quality Tools Market Trends:

Increased Adoption of Cloud-Based Data Quality Solutions

The Indian market is seeing a shift towards cloud-based data quality software. The trend is supported by the scalability, adaptability, and affordability toffered by these cloud solutions. Companies are also increasingly using these platforms to deal with and cleanse their data as they eliminate the necessity of making big initial investments in hardware and infrastructure. In addition, cloud-based solutions enable effortless integration with other cloud services, allowing businesses to gain real-time insights and maximize operational efficiency. This uptake is also supported by the increasing recognition of cloud computing in diverse industries, along with enhanced data security features offered by cloud service providers. For instance, in June 2024, IDinsight, in partnership with the Gates Foundation, developed a data quality improvement strategy for India's administrative data, crucial for public sector decisions. They've created a digital toolkit for district administrations, enabling tech-driven random sampling and verification. This toolkit, embedded in existing supervisory structures, checks aggregation and accuracy, and facilitates third-party audits. It aims to improve data credibility by addressing reporting incentives and accountability, with pilot testing underway.

To get more information on this market, Request Sample

Emphasis on AI-Powered Data Quality Automation

There is a noticeable surge in the integration of artificial intelligence (AI) and machine learning (ML) into data quality tools within the Indian market. This trend is driven by the need for automated data cleansing, profiling, and validation processes, particularly as data volumes continue to escalate. AI-driven solutions can identify anomalies, predict data quality issues, and implement corrective actions with minimal human intervention. This automation enhances accuracy, reduces manual effort, and accelerates data processing, enabling organizations to make faster and more informed decisions. Furthermore, the ability of AI to learn and adapt to evolving data patterns ensures continuous improvement in data quality over time. For instance, in November 2024, Qlik launched a new cloud region in Mumbai, India, to enhance data sovereignty and AI capabilities. This investment meets growing demand for local data storage and compliance. The region enables Indian customers to use Qlik's AI-powered solutions while adhering to data residency requirements. It aims to improve decision-making across sectors and create local jobs, supporting Qlik's goal to double its Indian market share by 2026.

Growing Focus on Data Governance and Compliance

The Indian regulatory landscape is becoming increasingly stringent, with a heightened emphasis on data privacy and security. This has led to a greater focus on data governance and compliance, driving the demand for robust data quality tools. Organizations are now prioritizing solutions that can ensure data accuracy, consistency, and compliance with regulations such as the Personal Data Protection Bill. Data quality tools are essential for implementing data governance frameworks, establishing data lineage, and ensuring that data is managed and used responsibly. This focus on compliance is particularly prevalent in sectors such as BFSI, healthcare, and government, where data integrity is critical. For instance, in March 2024, the Indian Cabinet approved the IndiaAI Mission with a ₹10,371.92 crore budget to boost the nation's AI ecosystem. Key components include establishing a 10,000+ GPU compute infrastructure, developing indigenous AI models, creating a datasets platform, promoting AI applications in critical sectors, enhancing AI skills, providing startup financing, and ensuring safe and ethical AI development.

India Data Quality Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on data type, functionality, component, deployment type, organization size, and vertical.

Data Type Insights:

- Customer Data

- Product Data

- Financial Data

- Compliance Data

- Others

The report has provided a detailed breakup and analysis of the market based on the data type. This includes customer data, product data, financial data, compliance data, and others.

Functionality Insights:

- Data Validation

- Data Standardization

- Data Enrichment and Cleansing

- Data Monitoring

- Others

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes data validation, data standardization, data enrichment and cleansing, data monitoring, and others.

Component Insights:

- Software

- Services

- Professional Services

- Managed Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes software and services (professional and managed services).

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises and large enterprises.

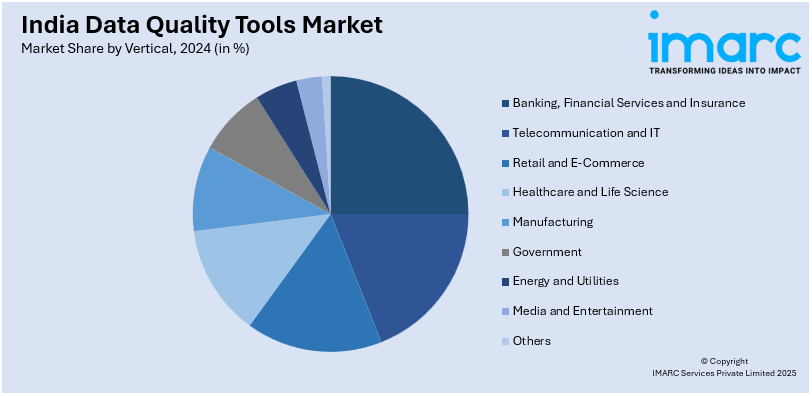

Vertical Insights:

- Banking, Financial Services and Insurance

- Telecommunication and IT

- Retail and E-Commerce

- Healthcare and Life Science

- Manufacturing

- Government

- Energy and Utilities

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes banking, financial services and insurance, telecommunication and IT, retail and e-commerce, healthcare and life sciences, manufacturing, government, energy and utilities, media and entertainment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Data Quality Tools Market News:

- In May 2024, Persistent Systems, having a strong presence in India, launched iAURA, an AI-powered data solutions suite designed to enhance enterprise data management. It streamlines AI adoption by ensuring data quality, automation, and seamless integration across platforms. The portfolio includes iAURA Insights for AI-driven analytics, iAURA Migrate for data modernization, iAURA Data Ops for quality assurance, and iAURA Platforms for governance and security. With rapid deployment and GenAI integration, iAURA accelerates decision-making and digital transformation.

- In September 2024, ST Telemedia Global Data Centres (India) signed a Memorandum of Understanding with the Telangana Government for a new data centre campus in Hyderabad. The INR 3,500 crore investment will feature cutting-edge technologies, with up to 100 MW capacity and AI-ready capabilities. The collaboration aims to boost Telangana's status as a technology hub, create employment, and support India’s digital transformation. As India continues its digital transformation, the expansion of data centres will drive the need for robust data quality tools to manage increasing data volumes, ensure compliance, and support AI integration.

India Data Quality Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Customer Data, Product Data, Financial Data, Compliance Data, Others |

| Functionalities Covered | Data Validation, Data Standardization, Data Enrichment and Cleansing, Data Monitoring, Others |

| Components Covered |

|

| Deployment Types Covered | Cloud-Based, On-Premises |

| Organization Sizes Covered | Small And Medium Enterprises, Large Enterprises |

| Verticals Covered | Banking, Financial Services and Insurance, Telecommunication and IT, Retail and E-Commerce, Healthcare and Life Sciences, Manufacturing, Government, Energy and Utilities, Media and Entertainment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India data quality tools market performed so far and how will it perform in the coming years?

- What is the breakup of the India data quality tools market on the basis of data type?

- What is the breakup of the India data quality tools market on the basis of functionality?

- What is the breakup of the India data quality tools market on the basis of component?

- What is the breakup of the India data quality tools market on the basis of deployment type?

- What is the breakup of the India data quality tools market on the basis of organization size?

- What is the breakup of the India data quality tools market on the basis of vertical?

- What are the various stages in the value chain of the India data quality tools market?

- What are the key driving factors and challenges in the India data quality tools market?

- What is the structure of the India data quality tools market and who are the key players?

- What is the degree of competition in the India data quality tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India data quality tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India data quality tools market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India data quality tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)