India Data Storage Market Size, Share, Trends and Forecast by Storage System, Storage Architecture, End User, and Region, 2025-2033

India Data Storage Market Overview:

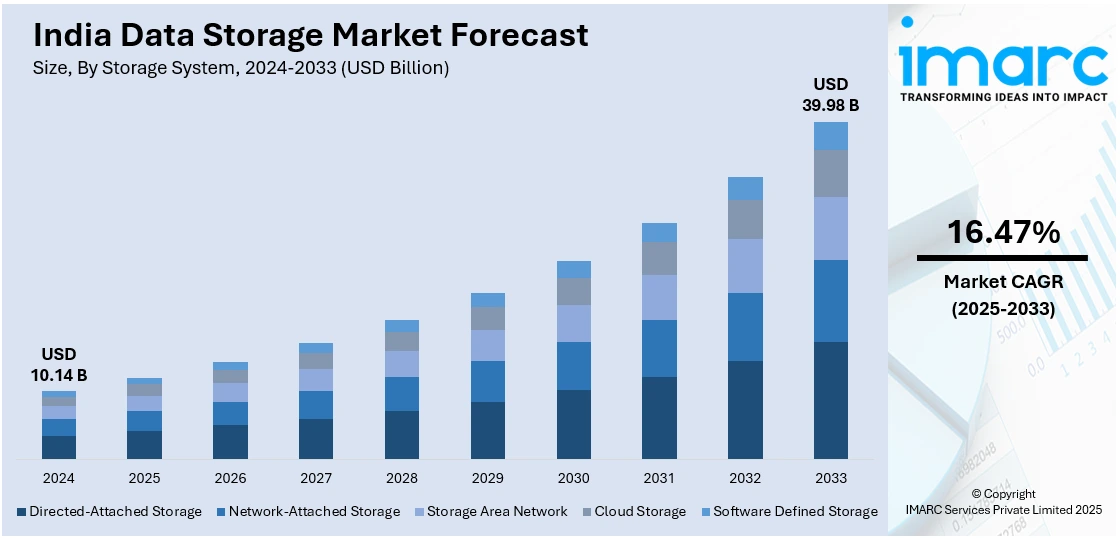

The India data storage market size reached USD 10.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 39.98 Billion by 2033, exhibiting a growth rate (CAGR) of 16.47% during 2025-2033. The market is driven by rapid digital adoption across industries, government-mandated data localization policies, increasing cloud computing demand, expanding e-commerce and fintech sectors, substantial investments in data centers, 5G rollout, AI-driven analytics, and the need for secure, scalable storage solutions to support the country's expanding digital economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.14 Billion |

| Market Forecast in 2033 | USD 39.98 Billion |

| Market Growth Rate 2025-2033 | 16.47% |

India Data Storage Market Trends:

Digital Transformation and Data Explosion

The speedy rise of digitalization across sectors in India has brought about an unprecedented explosion of data creation. Corporates across industries, like retail, banking, healthcare, and entertainment, are extensively moving their operations to digital platforms, leveraging cutting-edge technologies to drive efficiency, customer interactions, and decision-making. The surge in e-commerce websites, social networking sites, online payment gateways, and video streaming sites has led to an exponential growth in data traffic. Additionally, the increasing use of IoT devices, artificial intelligence (AI), and big data analytics has further accelerated the data explosion, as these technologies constantly collect, process, and store large amounts of structured and unstructured data. To cope with this volume of data, organizations are spending a lot of money on high-performance storage infrastructures, such as cloud-based, hybrid, and on-premises offerings. Cloud computing is now a favored solution among businesses because it is scalable, flexible, and affordable, offering transparent data access and storage without the need for major initial infrastructure expenses.

To get more information on this market, Request Sample

Rising Adoption of Cloud Computing and Hybrid Storage Solutions

Another key driver of India's data storage industry is the growing adoption of cloud computing and hybrid storage among enterprises of all sizes. With digital transformation sweeping across industries, the need for scalable, flexible, and affordable storage solutions has grown dramatically. Cloud storage provides organizations with the means to store large quantities of data without having to invest in large physical infrastructure, cutting capital costs while enhancing operational efficiency. The pay-as-you-go model of cloud storage also allows businesses to scale their storage capacities as needed, making it a likely choice for startups, SMEs, and big companies. Cloud vendors like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have grown their footprint in India by establishing data centers to support the propelling demand for cloud solutions. Also, the emergence of Software-as-a-Service (SaaS) platforms has spurred the uptake of cloud storage as businesses utilize cloud applications for collaboration, customer relationship management (CRM), enterprise resource planning (ERP), and cybersecurity solutions.

India Data Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on storage system, storage architecture, and end user.

Storage System Insights:

- Directed-Attached Storage

- Network-Attached Storage

- Storage Area Network

- Cloud Storage

- Software Defined Storage

The report has provided a detailed breakup and analysis of the market based on the storage system. This includes directed-attached storage, network-attached storage, storage area network, cloud storage, and software defined storage.

Storage Architecture Insights:

- File and Object Based Storage

- Block Storage

A detailed breakup and analysis of the market based on the storage architecture have also been provided in the report. This includes file and object based storage and block storage.

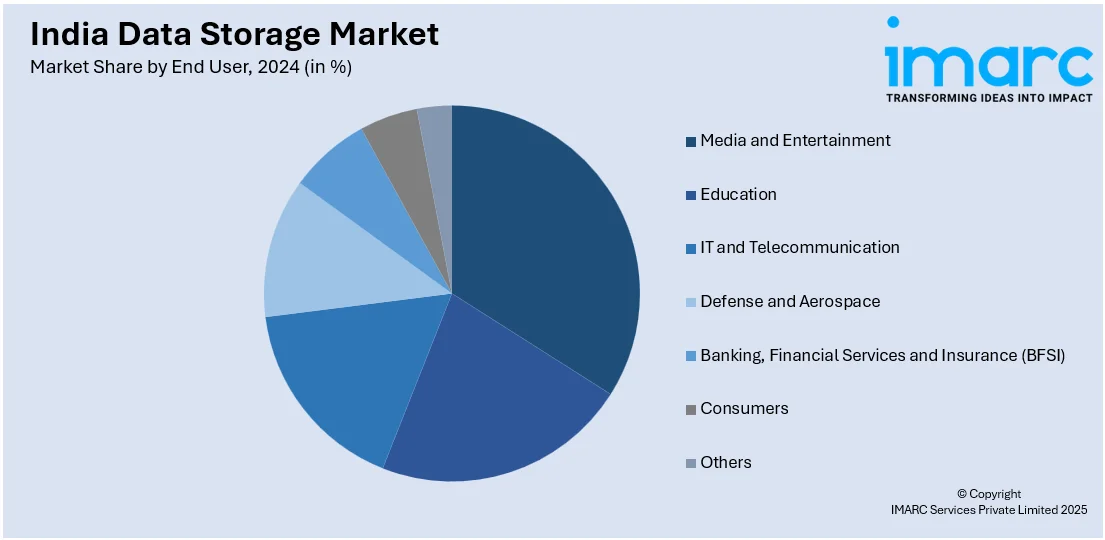

End User Insights:

- Media and Entertainment

- Education

- IT and Telecommunication

- Defense and Aerospace

- Banking, Financial Services and Insurance (BFSI)

- Consumers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes media and entertainment, education, IT and telecommunication, defense and aerospace, banking, financial services and insurance (BFSI), consumers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Data Storage Market News:

- November 2024: The Reserve Bank of India (RBI) plans to launch cloud storage services in 2025 to support financial institutions with secure and affordable data storage. This initiative aligns with India's data localization policies and encourages domestic investment in cloud infrastructure. By expanding regulated storage solutions, the RBI is driving demand for local data centers and strengthening India's data storage market.

- September 2024: The Uttar Pradesh government made plans to lure ₹30,000 crores of private investment for setting up eight data centers around Noida. This will help to improve India's data storage ecosystem, which was a concern in the wake of offshore data storage and improving data security.

India Data Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Storage Systems Covered | Directed-Attached Storage, Network-Attached Storage, Storage Area Network, Cloud Storage, Software Defined Storage |

| Storage Architecture Covered | File and Object Based Storage, Block Storage |

| End Users Covered | Media and Entertainment, Education, IT and Telecommunication, Defense and Aerospace, Banking, Financial Services and Insurance (BFSI), Consumers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India data storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India data storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India data storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data storage market in India was valued at USD 10.14 Billion in 2024.

The India data storage market is projected to exhibit a CAGR of 16.47% during 2025-2033, reaching a value of USD 39.98 Billion by 2033.

The India data storage market is propelled by surging data volumes from digital transformation, cloud adoption, and IoT deployment. Enterprise demand for scalable, secure storage solutions, coupled with heightened focus on data backup and disaster recovery, also supports growth. Rising regulatory compliance requirements further drive investment in robust storage infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)