India Decorative Laminates Market Size, Share, Trends and Forecast by Product Type, Application, End Use, Texture, Pricing, Sector, and Region, 2026-2034

India Decorative Laminates Market Summary:

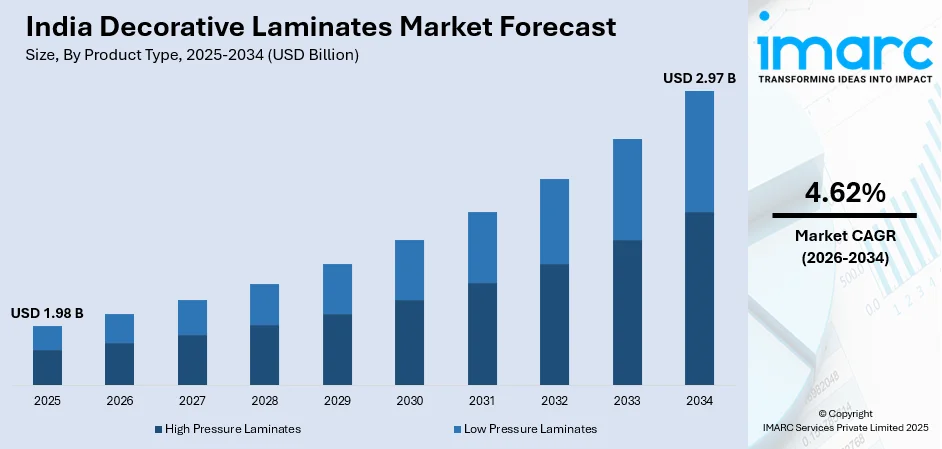

The India decorative laminates market size was valued at USD 1.98 Billion in 2025 and is projected to reach USD 2.97 Billion by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

The market is driven by rapid urbanization, expanding real estate and construction activities, growing middle-class population with rising disposable incomes, and increasing consumer preference for stylish and affordable interior solutions. The surge in modular furniture adoption, technological advancements in digital printing enabling diverse design options, and government initiatives promoting affordable housing further bolster demand. Additionally, the shift toward organized retail and factory-finished products enhances India decorative laminates market share.

Key Takeaways and Insights:

- By Product Type: Low pressure laminates dominate the market with a share of 63% in 2025, driven by cost-effectiveness, versatility, and ease of production ideal for price-sensitive consumers.

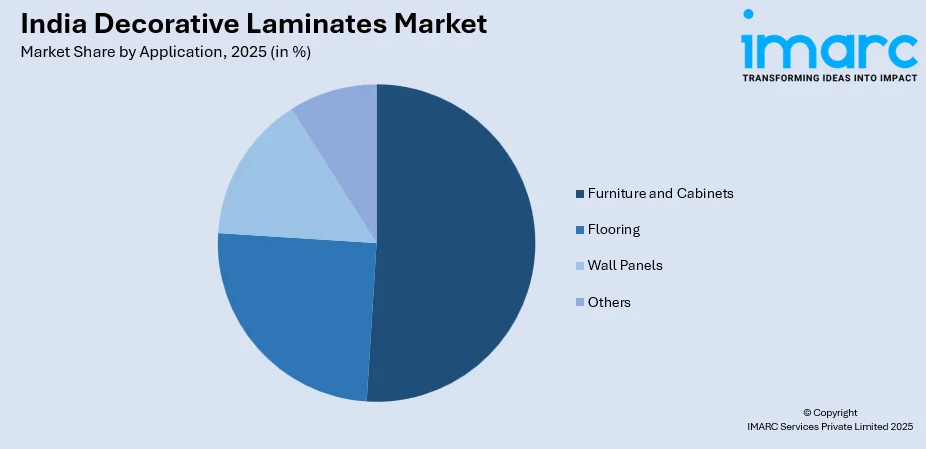

- By Application: Furniture and cabinets lead the market with a share of 51% in 2025, owing to the flourishing furniture industry, growing preference for ready-to-assemble furniture, and modular kitchen adoption.

- By End Use: Non‑residential represents the largest segment with a market share of 56% in 2025, driven by expanding commercial infrastructure and increasing investments in retail spaces, hospitality establishments, and institutional projects.

- By Texture: Matte/suede dominates the market with a share of 59% in 2025, owing to increasing consumer preference for sophisticated and modern finishes that give a warm and elegant ambiance to modern space.

- By Pricing: Premium leads the market with a share of 55% in 2025, driven by increasing consumer willingness to invest in high-quality, innovative designs with superior durability and customized aesthetic solutions.

- By Sector: Organised represents the largest segment with a market share of 67% in 2025, owing to established brand recognition, standardized quality, extensive distribution networks, and compliance with environmental and safety regulations.

- By Region: North India leads the market with a share of 32% in 2025, driven by by rapid urbanization in major cities like Delhi, Chandigarh, and Lucknow, coupled with substantial real estate development.

- Key Players: The India decorative laminates market exhibits moderate fragmentation, with established organized players competing alongside regional manufacturers. Leading domestic manufacturers dominate through design innovation and extensive distribution networks, while unorganized players cater to regional markets.

To get more information on this market Request Sample

The India decorative laminates market is experiencing robust growth propelled by the convergence of economic development, evolving consumer preferences, and industry modernization. Rapid urbanization across major metropolitan cities and tier-two towns has catalyzed unprecedented demand for contemporary interior solutions. In July 2025, Greenlam Industries announced a Rs 1,147 Crore investment to establish South India’s largest high‑pressure laminate and particle board manufacturing facility in Naidupeta, Andhra Pradesh, supported by Rs 329 Crore in government incentives. Moreover, the expanding middle-class population with rising disposable incomes increasingly prioritizes stylish, durable, and affordable surfacing materials for residential and commercial spaces. Government initiatives supporting affordable housing and smart city development further accelerate construction activities, creating sustained demand for decorative laminates in diverse applications. The flourishing furniture manufacturing industry and growing adoption of modular kitchen concepts significantly contribute to market expansion. Additionally, technological advancements in digital printing and surface treatments enable manufacturers to offer diverse design options, attracting consumers seeking customized aesthetic solutions.

India Decorative Laminates Market Trends:

Rise of Digitally Printed and Customizable Laminates

The adoption of digital printing technology is revolutionizing the decorative laminates industry by enabling manufacturers to offer highly customized designs at competitive price points. In February 2024, Greenlam Industries launched its Compact Laminate 2023–2025 range, introducing nine new decors and three additional sizes, enhancing design flexibility and efficiency for residential and commercial projects. This technological advancement allows mid-tier producers to provide premium aesthetics previously accessible only through expensive imported materials. Interior designers and consumers increasingly demand personalized design options reflecting individual tastes and unique spatial requirements.

Growing Preference for Sustainable and Eco-Friendly Products

Environmental consciousness is reshaping consumer purchasing decisions and manufacturing practices within the decorative laminates industry. Manufacturers are increasingly adopting low-emission resins, recycled content materials, and environmentally responsible adhesives to meet stringent regulatory requirements. In November 2024, Merino Laminates teamed up with GreenLine Mobility to become India’s first building materials brand to integrate LNG‑powered logistics, reducing transportation emissions and advancing sustainable supply chain practices. Furthermore, the demand for Green Label-approved and FSC-certified laminates continues expanding as sustainability becomes a critical purchasing criterion.

Integration into Wall Panels and Decorative Applications

Decorative laminates are transcending traditional furniture applications to become prominent elements in wall paneling, ceiling designs, and architectural installations. This expansion creates demand for larger-size sheets, specialized textures, and innovative finishes delivering high-end visual appeal. As per sources, in October 2025, Rushil Décor Limited commenced trial run production under Phase 2 of its state‑of‑the‑art jumbo size laminate manufacturing facility in Gandhinagar, adding significant capacity to meet rising demand for large‑format decorative laminate sheets used in architectural applications. Moreover, the trend toward contemporary minimalist interiors and statement walls drives adoption of textured, embossed, and synchronized finishes.

Market Outlook 2026-2034:

The India decorative laminates market demonstrates promising revenue growth trajectory through the forecast period, driven by sustained construction activities, expanding modular furniture adoption, and evolving consumer preferences for aesthetically appealing interior solutions. The market revenue is expected to witness significant expansion as organized players increase production capacities and distribution networks. Technological innovations including antimicrobial surfaces, moisture-resistant coatings, and digitally printed customization will drive premium segment revenue growth. Export potential for Indian-origin laminates is anticipated to increase due to price competitiveness and improving quality standards in the global marketplace. The market generated a revenue of USD 1.98 Billion in 2025 and is projected to reach a revenue of USD 2.97 Billion by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

India Decorative Laminates Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Low Pressure Laminates |

63% |

|

Application |

Furniture and Cabinets |

51% |

|

End Use |

Non‑Residential |

56% |

|

Texture |

Matte/Suede |

59% |

|

Pricing |

Premium |

55% |

|

Sector |

Organised |

67% |

|

Region |

North India |

32% |

Product Type Insights:

- High Pressure Laminates

- Low Pressure Laminates

Low pressure laminates dominate with a market share of 63% of the total India decorative laminates market in 2025.

Low pressure laminates command the dominant position within the product type segmentation owing to their superior cost-effectiveness and manufacturing efficiency compared to high pressure alternatives. These laminates provide an optimal balance between affordability and visual appeal, making them particularly attractive for price-sensitive market segments across residential and commercial applications. The widespread adoption in modular furniture, kitchen cabinets, and wardrobes reflects their versatility and ease of installation. Their compatibility with diverse substrates further enhances market penetration.

The segment benefits from an extensive availability in diverse colors, textures, and finishes that satisfy varying consumer preferences and interior design requirements. Compatibility with ready-to-assemble furniture concepts and quick installation processes further accelerates demand, particularly in rapidly growing urban markets seeking efficient interior solutions. Manufacturers continue expanding product portfolios with innovative designs to maintain competitive positioning. The cost advantage over high pressure laminates ensures sustained dominance across price-conscious consumer segments.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Furniture and Cabinets

- Flooring

- Wall Panels

- Others

Furniture and cabinets lead with a share of 51% of the total India decorative laminates market in 2025.

The furniture and cabinets maintain market leadership driven by India's flourishing furniture manufacturing industry and evolving consumer preferences for factory-finished products. Rising disposable incomes and changing lifestyle aspirations fuel demand for stylish, functional furniture solutions that enhance living and working environments. The segment encompasses wardrobes, kitchen cabinets, office furniture, and storage systems requiring durable, aesthetically appealing surfaces. In December 2025, Greenlam Industries rebranded NewMika as Mikasa Laminates, launching a 1.0 mm collection featuring 97 decors, four textures, and two design categories, combining innovation, aesthetics, and durability.

Growing adoption of modular kitchen concepts significantly contributes to segment growth as consumers prioritize contemporary designs with customizable configurations. The shift from traditional carpenter-based furniture toward organized retail offerings featuring standardized laminate surfaces accelerates consumption patterns. Pre-laminated particleboards and medium-density fibreboards increasingly serve as preferred substrates for mass-produced furniture meeting diverse aesthetic and functional requirements. This transformation supports sustained demand growth across residential and commercial sectors. The increasing preference for ready-to-assemble furniture solutions further strengthens segment positioning throughout urban markets.

End Use Insights:

- Non-Residential

- Residential

- Transportation

Non‑residential exhibits a clear dominance with a 56% share of the total India decorative laminates market in 2025.

Non-residential dominates the end-use classification reflecting substantial commercial infrastructure expansion across retail, hospitality, healthcare, and institutional sectors. Modern commercial establishments prioritize interior aesthetics to create distinctive brand experiences and professional environments that attract customers and employees. Decorative laminates offer cost-effective solutions for achieving sophisticated appearances while ensuring durability under high-traffic conditions. As per sources, in July 2024, India’s Union Budget allocated ₹11,11,111 Crore for infrastructure development, strengthening commercial, institutional, and urban construction projects that directly increase demand for interior surfacing solutions.

Expanding organized retail chains, shopping complexes, corporate offices, and hospitality establishments drive sustained demand for premium laminate applications. Healthcare facilities increasingly specify antibacterial and easy-to-maintain laminate surfaces for hygiene compliance. Educational institutions and government buildings contribute additional demand as infrastructure modernization programs progress across urban and semi-urban regions throughout the country. Rising commercial construction activities ensure continued segment expansion during the forecast period. Government initiatives supporting infrastructure development further strengthen non-residential segment growth prospects.

Texture Insights:

- Matte/Suede

- Glossy

Matte/suede leads with a market share of 59% of the total India decorative laminates market in 2025.

Matte/suede dominate the texture segmentation reflecting contemporary design preferences for sophisticated, understated finishes that complement modern interior aesthetics. These textures create warm, elegant ambiances without the reflective glare associated with glossy alternatives, making them suitable for diverse lighting conditions and spatial configurations. The tactile quality of matte finishes enhances user experience in furniture and surface applications. Growing preference for minimalist interiors drives sustained adoption across residential and commercial projects seeking refined visual identities.

Interior designers increasingly specify matte and textured finishes for premium residential projects, corporate interiors, and hospitality spaces seeking refined visual identities. According to sources, in 2024, Formica India showcased FENIX ultra-matte, anti-fingerprint laminate surfaces at Matecia 2024, highlighting advanced texture technologies for premium residential and commercial interiors. Furthermore, the segment benefits from synchronized texture technologies that replicate natural wood and stone patterns with authentic tactile characteristics. Growing consumer awareness of design trends and aesthetic possibilities drives adoption across market segments.

Pricing Insights:

- Mass

- Premium

Premium dominates with a market share of 55% of the total India decorative laminates market in 2025.

The premium demonstrates market leadership reflecting increasing consumer willingness to invest in superior quality, innovative designs, and enhanced durability characteristics. Rising disposable incomes and evolving lifestyle aspirations drive demand for high-end laminate products featuring advanced functionalities including scratch resistance, antimicrobial properties, and specialized finishes. In May 2025, NewMika laminates by Greenlam Industries were showcased at the IIID Delhi Design Conclave, highlighting premium 1.25 mm and 1mm collections with elegant textures and designer finishes for luxury interiors. Moreover, premium products command higher margins while delivering differentiated value propositions.

Organized manufacturers focus extensively on premium development through research and development investments, design collaborations, and brand building initiatives. Architects and interior designers increasingly recommend premium laminates for projects requiring distinctive aesthetics and long-term performance reliability. The segment benefits from expanding distribution through exclusive showrooms and specialized retail channels. Increasing consumer appreciation for quality and design innovation sustains premium segment growth trajectory. Strategic marketing initiatives and product differentiation efforts further strengthen premium segment positioning across urban markets.

Sector Insights:

- Organised

- Unorganised

Organised leads with a share of 67% of the total India decorative laminates market in 2025.

Organised maintains commanding market position through established brand recognition, consistent product quality, extensive distribution networks, and compliance with regulatory standards. Leading manufacturers invest substantially in research and development, marketing initiatives, and customer engagement programs to strengthen competitive positioning. These companies offer comprehensive product portfolios featuring diverse designs, textures, and finishes catering to evolving consumer preferences. Strong brand equity enables premium pricing strategies. The shift toward market formalization continues accelerating organized sector dominance across diverse regional markets.

Organised benefits from economies of scale enabling competitive pricing while maintaining quality standards and delivery reliability. Strong relationships with architects, interior designers, and institutional buyers facilitate specification and procurement processes. Environmental and safety compliance, including formaldehyde emission standards, positions organized manufacturers favorably as regulatory requirements intensify. Expanding showroom networks and digital engagement platforms enhance consumer accessibility and brand visibility. Continuous product innovation and strategic partnerships further consolidate organized sector leadership throughout the Indian decorative laminates market.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 32% of the total India decorative laminates market in 2025.

North India leads regional market distribution driven by concentrated economic activities, substantial population density, and accelerated urbanization across major cities including Delhi, Chandigarh, Lucknow, and Jaipur. The region benefits from robust real estate development encompassing residential complexes, commercial centers, and institutional projects requiring decorative laminate applications. Established distribution infrastructure facilitates efficient product availability across urban and semi-urban markets throughout the region. Strong consumer purchasing power and brand awareness further strengthen regional market positioning.

Manufacturing concentration in northern states provides supply chain advantages including reduced logistics costs and faster delivery capabilities. Government infrastructure initiatives and affordable housing programs particularly impact regional demand patterns. Rising consumer awareness and brand preferences among urban populations drive organized sector growth and premium segment penetration throughout the region. Continued urbanization and construction activities ensure sustained regional market leadership during the forecast period. Expanding retail networks and showroom presence enhance product accessibility across diverse consumer segments.

Market Dynamics:

Growth Drivers:

Why is the India Decorative Laminates Market Growing?

Rapid Urbanization and Real Estate Expansion

India's accelerating urbanization represents a fundamental driver propelling decorative laminates demand as millions migrate to cities seeking improved economic opportunities and lifestyle enhancements. Urban population growth necessitates substantial residential construction including apartments, housing societies, and individual homes requiring interior finishing materials. According to reports, in June 2025, 2.35 Lakh houses were approved under PMAY‑Urban 2.0 across nine states, supporting affordable urban housing and promoting inclusivity for women, SC, ST, and OBC beneficiaries. Furthermore, metropolitan expansion creates parallel demand for commercial real estate encompassing retail establishments, office complexes, and hospitality venues extensively utilizing decorative laminates.

Rising Middle-Class Consumer Base and Disposable Incomes

Economic development has expanded India's middle-class population significantly, creating consumer segments prioritizing lifestyle improvements and home aesthetics within available budgets. Rising disposable incomes enable increased expenditure on interior decoration and furniture upgrades previously considered discretionary purchases. Decorative laminates offer accessible pathways to achieving aspirational interior appearances by replicating expensive natural materials at substantially lower price points. The value proposition combining aesthetic appeal, durability, and affordability resonates strongly with cost-conscious consumers seeking quality interior solutions.

Growth of Modular Furniture and Organized Retail

The transformation from traditional carpenter-based furniture toward factory-finished modular solutions fundamentally reshapes decorative laminates consumption patterns across residential and commercial sectors. Modular furniture concepts emphasizing standardized components, efficient installation, and contemporary aesthetics rely extensively on pre-laminated substrates including particleboards and medium-density fiberboards. Organized furniture retailers and e-commerce platforms expand consumer access to diverse laminate-surfaced products. As per sources, in November 2025, IKEA India launched online deliveries across Delhi‑NCR and nine satellite cities, providing access to 7000+ modular furniture and pre-laminated products, supporting urban consumers’ furniture needs. The modular approach particularly appeals to nuclear families in urban apartments seeking space-efficient storage solutions with customizable configurations and consistent quality.

Market Restraints:

What Challenges the India Decorative Laminates Market is Facing?

Volatile Raw Material Costs

The decorative laminates industry faces significant challenges from fluctuating prices of essential raw materials including kraft paper, decorative paper, phenolic resins, and melamine. These price variations, influenced by global supply chain dynamics and petroleum price volatility, directly impact manufacturing costs and profit margins. Manufacturers struggle to maintain stable pricing structures while absorbing raw material cost increases.

Competition from Alternative Surfacing Materials

Decorative laminates encounter intensifying competition from alternative surfacing solutions including polyvinyl chloride panels, acrylic sheets, engineered veneers, ceramic tiles, and engineered stone products. These alternatives offer distinct advantages in specific applications such as superior moisture resistance and enhanced durability. Innovation within competing material categories continuously expands their application scope while improving cost competitiveness.

Unorganized Sector Competition and Price Pressure

The substantial presence of unorganized manufacturers creates intense price competition that constrains profit margins across the industry. Regional players offering lower-priced alternatives capture price-sensitive market segments, particularly in semi-urban and rural areas where brand recognition carries limited influence. The commoditized nature of standard laminate products enables easy replication and price-based competition.

Competitive Landscape:

The India decorative laminates market exhibits moderate fragmentation characterized by dynamic competition between established organized players and numerous regional manufacturers. Leading domestic manufacturers command significant market presence through extensive product portfolios, strong distribution networks, and continuous design innovation. Market competition intensifies as organized players expand production capacities and strengthen brand positioning through strategic marketing initiatives. Regional manufacturers maintain relevance through cost leadership strategies and localized distribution networks. The trajectory toward market formalization benefits organized manufacturers while intensifying competitive pressures on smaller regional operators.

Recent Developments:

- In April 2025, Infra.Market expanded its wood panel business with strategic acquisitions of manufacturing plants in Rudrapur and Yamunanagar, enhancing production of laminates, MDF, and plywood. The move strengthens its digital-first approach, boosts dealer network engagement, and positions the company to capitalize on India’s growing real estate and interior design demand.

- In December 2024, SkyDecor Laminates Pvt Ltd launched two new decorative laminate collections during a dealership meet in Indore. Design Master 1 MM + features over 300 unique designs, while Acrylish Volume 2 high gloss laminates use 100 % virgin PMMA, offering enhanced surface stability, scratch resistance, and improved interior aesthetics and functionality.

India Decorative Laminates Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High Pressure Laminates, Low Pressure Laminates |

| Applications Covered | Furniture and Cabinets, Flooring, Wall Panels, Others |

| End Uses Covered | Non-Residential, Residential, Transportation |

| Textures Covered | Matte/Suede, Glossy |

| Pricings Covered | Mass, Premium |

| Sectors Covered | Organized, Unorganized |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India decorative laminates market size was valued at USD 1.98 Billion in 2025.

The India decorative laminates market is expected to grow at a compound annual growth rate of 4.62% from 2026-2034 to reach USD 2.97 Billion by 2034.

Low pressure laminates held the largest India decorative laminates market share due to their cost-effectiveness, versatility, and widespread adoption in furniture and cabinet applications balancing affordability with aesthetic appeal across residential and commercial sectors.

Key factors driving the India decorative laminates market include rapid urbanization and real estate expansion, rising middle-class consumer base with increasing disposable incomes, growth of modular furniture and organized retail, and technological advancements enabling diverse design customization.

Major challenges include volatile raw material costs affecting manufacturing margins, intensifying competition from alternative surfacing materials, price pressure from unorganized sector players, fluctuating supply chain dynamics, and the need for continuous design innovation to maintain competitive differentiation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)