India Dental Consumables Market Size, Share, Trends and Forecast by Product, Treatment, Material, End User, and Region, 2026-2034

India Dental Consumables Market Summary:

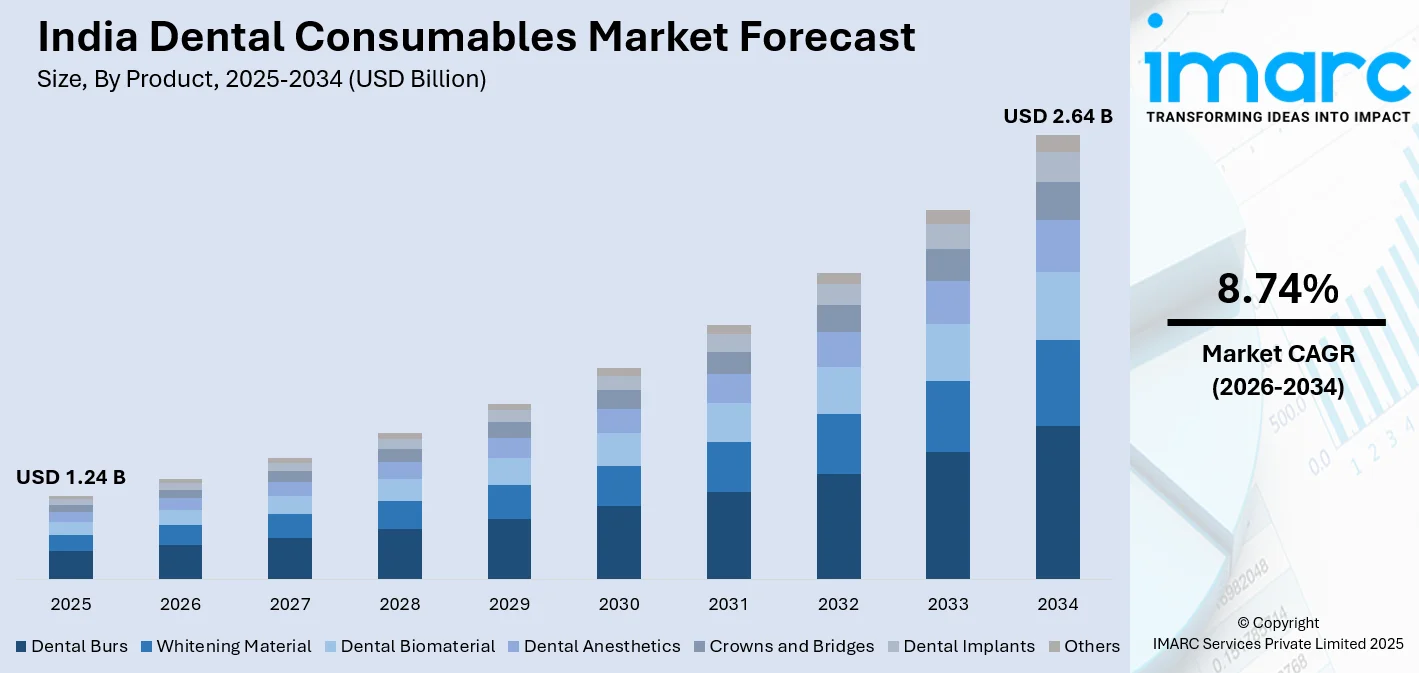

The India dental consumables market size was valued at USD 1.24 Billion in 2025 and is projected to reach USD 2.64 Billion by 2034, growing at a compound annual growth rate of 8.74% from 2026-2034.

The market for dental consumables in India is growing significantly because of increased oral health awareness, the rise in dental abnormalities, and the requirement for cosmetic dentistry. Development in the country’s healthcare infrastructure, dental tourism, and the increasing number of people in the growing middle class, who have greater purchasing capacity, contribute to the primary factors. The product range encompasses burs, teeth whiteners, biomaterial, anesthetics, crowns, bridges, and implants. Advancements in CAD/CAM, 3D printing, and biocompatibility, along with the growing number of dental practices, add to the development.

Key Takeaways and Insights:

- By Product: Dental burs dominate the market with a share of 18% in 2025, due to their indispensable use in nearly all dental procedures, such as cavity preparation and crown adjustments, and restoration work, combined with their consumable nature requiring regular replacement and the wide variety of bur types serving diverse clinical applications.

- By Treatment: Orthodontic leads the market with a share of 30% in 2025, attributed to increasing aesthetic consciousness among young adults and teenagers, growing adoption of clear aligners and invisible braces, rising social media influence on appearance standards, and expanding availability of orthodontic treatments across dental clinics.

- By Material: Metals dominate the market with a share of 39% in 2025, backed by their proven durability and strength, essential for dental restorations, along with an established clinical track record and cost-effectiveness compared to advanced ceramics, and widespread use in crowns, bridges, orthodontic appliances, and implant components.

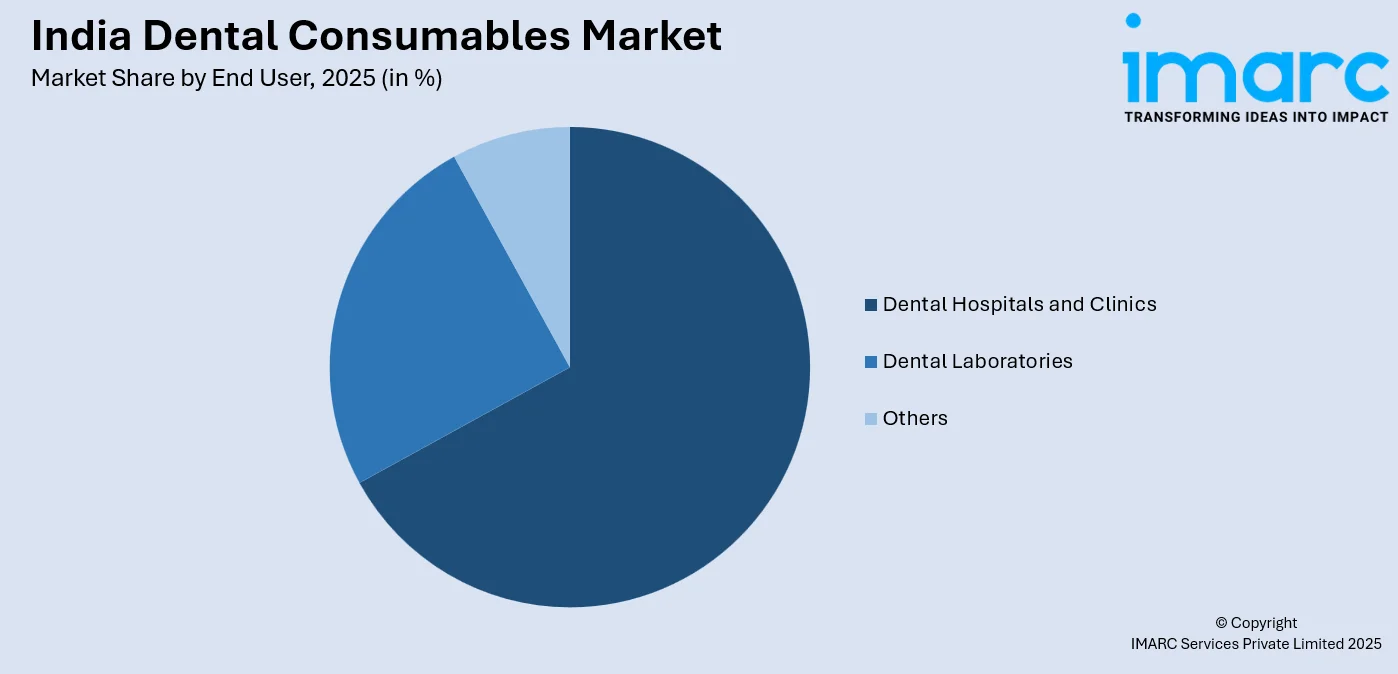

- By End User: Dental hospitals and clinics lead the market with a share of 67% in 2025, reflecting the concentration of dental treatment services in clinical settings, the proliferation of dental clinic chains across metropolitan and tier-two cities, and patient preference for professional dental care environments with comprehensive treatment capabilities.

- By Region: North India dominates the market with a share of 33% in 2025, supported by higher urbanization in the National Capital Region, concentration of corporate dental chains, greater healthcare spending capacity, established medical tourism infrastructure, and significant presence of dental hospitals and specialty clinics.

- Key Players: The competitive landscape in India’s dental consumables market is shaped by strong global and domestic players offering diverse product portfolios, innovative solutions, and extensive distribution networks. Competition is driven by product quality, technological advancements, pricing strategies, and regional reach, with domestic manufacturers focusing on cost-effectiveness and local market penetration, while international players emphasize innovation, brand reputation, and advanced treatment solutions.

To get more information on this market Request Sample

The India dental consumables industry is a vital part of healthcare, providing materials for diagnostic, therapeutic, preventive, and restorative procedures across orthodontic, endodontic, periodontic, and prosthodontic treatments. In November 2025, Osstem Implant expanded its India presence by advancing digital dentistry through K-Digital solutions, integrating CBCT, scanners, guides, and implants to improve precision and minimally invasive dental care. Products include burs, whitening materials, biomaterials, anesthetics, crowns, bridges, and implants. Distributed via hospitals, clinics, and laboratories, the market serves domestic patients and dental tourists. Technological adoption, digital dentistry, minimally invasive techniques, and biocompatible materials are driving innovation, while India’s cost advantage attracts international patients seeking quality, affordable dental care.

India Dental Consumables Market Trends:

Rising Adoption of Digital Dentistry and Advanced Technologies

The India dental consumables market is witnessing accelerated adoption of digital dentistry technologies including CAD/CAM systems, intraoral scanners, and 3D printing capabilities that are transforming treatment workflows and consumable demand patterns. In June 2025, Unicorn Denmart unveiled AI-powered intraoral and portable X-ray solutions at FAMDENT Mumbai, enhancing imaging quality, diagnostic accuracy, and clinical workflow efficiency for Indian dentists. Digital impression systems are reducing reliance on traditional impression materials while increasing demand for compatible milling blocks and restoration materials.

Growing Demand for Aesthetic and Cosmetic Dental Procedures

Consumer demand for aesthetic dental treatments is expanding rapidly, driven by rising disposable incomes, social media influence, and increasing awareness of cosmetic dentistry options. A 2025 IDA report highlights rapid growth in aesthetic dentistry across urban India, with millennials and professionals prioritizing whitening, aligners, veneers, and smile makeovers over pain-driven dental treatments. Teeth whitening procedures, clear aligners, ceramic veneers, and tooth-colored restorations are gaining popularity among urban consumers seeking enhanced dental aesthetics. The proliferation of orthodontic treatments among adults, particularly clear aligner therapy, is creating significant demand growth for associated consumables.

Expansion of Dental Tourism and Corporate Dental Chains

India's emergence as a major dental tourism destination is driving demand for high-quality consumables as clinics upgrade their offerings to serve international patients. Dental procedures in India are significantly more affordable than in Western countries while maintaining quality standards, attracting patients for complex treatments including full-mouth rehabilitation, implant procedures, and cosmetic dentistry. According to reports, Dent Ally was ranked among the top global dental tourism companies by The Business Research Company, showcasing India’s role in providing world-class, cost-effective dental care for international patients. Simultaneously, the expansion of corporate dental chains with standardized protocols and procurement practices is professionalizing the market and driving volume-based consumable demand.

Market Outlook 2026-2034:

The India dental consumables market is set for sustained growth, driven by rising oral disease prevalence, expanding healthcare infrastructure, and treatment awareness. Government initiatives and domestic manufacturing support improve access and supply resilience. Demand spans prosthodontic, restorative, orthodontic, and cosmetic treatments, fueled by aging and youth populations. Technological advances in biomaterials and digital dentistry further enable innovative product adoption, strengthening market opportunities across diagnostic, preventive, and therapeutic consumable segments. The market generated a revenue of USD 1.24 Billion in 2025 and is projected to reach a revenue of USD 2.64 Billion by 2034, growing at a compound annual growth rate of 8.74% from 2026-2034.

India Dental Consumables Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Dental Burs | 18% |

| Treatment | Orthodontic | 30% |

| Material | Metals | 39% |

| End User | Dental Hospitals and Clinics | 67% |

| Region | North India | 33% |

Product Insights:

- Dental Burs

- Whitening Material

- Dental Biomaterial

- Dental Anesthetics

- Crowns and Bridges

- Dental Implants

- Others

The dental burs dominate with a market share of 18% of the total India dental consumables market in 2025.

Dental burs represent the most frequently consumed product category due to their essential role in nearly all dental procedures requiring tooth structure modification. These rotary cutting instruments are indispensable for cavity preparation, crown and bridge work, tooth shaping, and restoration adjustments. In October 2024, HuFriedyGroup acquired SS White Dental, expanding its global reach and product portfolio in carbide and diamond burs for high-quality rotary instruments in routine clinical dentistry. The consumable nature of dental burs, which require regular replacement due to wear and sterilization limitations, ensures consistent recurring demand across dental practices.

This is made possible through the high volumes of dental procedures in Indian dental practices, which involve common dental procedures like filling of cavities, preparations for prosthetics, and simple cosmetic recontouring procedures that necessitate bur usage. This is being driven by the concern for quality shown by dental practitioners, which is pushing the demand for high-quality dental bur products for their high cutting ability, strength, and comfort during utilization. Improvements in local production capacity have been witnessed for these dental bur products.

Treatment Insights:

- Orthodontic

- Endodontic

- Periodontic

- Prosthodontic

The orthodontic leads with a share of 30% of the total India dental consumables market in 2025.

Orthodontic treatment has emerged as the leading treatment category driven by surging demand for teeth alignment and aesthetic correction procedures among Indian consumers. The segment encompasses consumables including brackets, archwires, bands, elastics, clear aligners, and associated accessories required for malocclusion treatment. In 2025, Laxmi Dental, one of India’s major dental products companies, partnered with actress Kareena Kapoor Khan to promote its Illusion Aligners through a nationwide campaign that highlighted greater accessibility of clear aligner therapy via easy EMI options, boosting awareness and adoption of invisible orthodontic treatments among urban patients. Rising aesthetic consciousness, particularly among teenagers and young adults influenced by social media and celebrity culture, is propelling orthodontic treatment adoption.

The increasing acceptance of adult orthodontic treatments has emerged as an area of profound market growth, where the need for teeth corrections has been typical for the young generation only, but thanks to the altering needs of professionals in an evolving work environment, they are also turning to these treatments. Financing assistance provided by dental clinics has improved accessibility to these dental solutions. An increase in the number of dental programs for the training of orthodontists has spread the treatment to rural areas.

Material Insights:

- Metals

- Polymers

- Ceramics

- Biomaterials

The metals dominate with a market share of 39% of the total India dental consumables market in 2025.

Metal-based dental materials remain dominant due to their performance, versatility, and cost-effectiveness. Precious and base metal alloys, titanium, and stainless steel are widely used in crowns, bridges, dentures, implants, and orthodontics. Their strength, durability, and biocompatibility make them ideal for load-bearing and structural applications. Titanium’s superior biocompatibility makes it the standard for implants, while diverse alloy compositions fulfill prosthodontic restoration requirements, supporting reliable and long-lasting dental treatments.

Metals remain vital in dentistry for posterior restorations, implants, and orthodontic appliances, where strength is critical, despite rising demand for ceramics and polymers in visible areas. Their cost-effectiveness appeals to price-sensitive patients, while ongoing improvements in alloy properties and metal-ceramic bonding techniques enhance durability and performance. These advancements ensure metals retain clinical relevance, supporting reliable, long-lasting restorations and dental hardware, even as tooth-colored materials increasingly capture aesthetic-focused segments of the market.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Dental Hospitals and Clinics

- Dental Laboratories

- Others

The dental hospitals and clinics lead with a share of 67% of the total India dental consumables market in 2025.

Dental hospitals and clinics are the main end-users in India, accounting for the majority of dental consumable demand. This segment includes multi-specialty hospitals, corporate dental chains, standalone clinics, and dental departments within general hospitals. The concentration of treatment services in these settings drives consumption across all product categories. Market growth is further accelerated by the rapid expansion of clinics in metropolitan and tier-two cities and the rise of corporate dental chains offering standardized, high-quality services.

Corporate dental chains are reshaping the market through centralized procurement, bulk pricing, and standardized protocols that guide consumable use. By investing in modern equipment and premium materials, they attract quality-conscious patients. The dental tourism trend drives clinics to enhance material quality and treatment offerings for international clients. Government and institutional dental facilities, catering to high patient volumes, further contribute significant demand, making organized and institutional players key drivers of consumable consumption and market growth.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The North India exhibits a clear dominance with a 33% share of the total India dental consumables market in 2025.

North India is the major driving force of the dental consumables industry, due to the densely populated nature of not only Delhi/NCR but also neighboring states. Additionally, there is increased expenditure on health care, along with large chain dental centers as well as a significant flow of dental tourism patients. There is an established infrastructure of premier dental colleges, specialty dental hospitals, as well as modern dental clinics that steadily provide a demand for dental consumables of any sort.

The young, beauty-conscious, and increasing middle-class population in North India fuels demand for cosmetic as well as orthodontic treatments. The distribution channel efficiently supports the availability of all consumables. Punjab, Haryana, & Uttar Pradesh are witnessing an increase in the set up of clinics since prosperity reaches beyond the metros. The distribution centers of important dental equipment & consumables are based in the same region, hence supporting the demand for treatments based on large geographical locations, establishing North India as an important market for the dental sector.

Market Dynamics:

Growth Drivers:

Why is the India Dental Consumables Market Growing?

Rising Prevalence of Dental Disorders and Oral Health Issues

The high prevalence of dental diseases in India is a fundamental driver of consumable demand, with dental caries affecting a significant portion of the population and periodontal disease widespread among adults. Poor oral hygiene practices, dietary habits including high sugar consumption, and tobacco usage contribute to the substantial disease burden requiring treatment. According to a 2025 report by the Indian Council of Medical Research (ICMR), Indian adults suffer from some form of periodontal disease, while over 50% of children have untreated dental caries, underscoring the urgent need for preventive and therapeutic dental consumables. The growing awareness of oral health connections to systemic conditions is encouraging preventive care and early treatment intervention.

Increasing Healthcare Infrastructure and Dental Clinic Expansion

The rapid expansion of dental healthcare infrastructure across India is directly driving consumable market growth. Corporate dental chains are aggressively scaling their clinic networks, with leading players targeting significant expansion in metropolitan and tier-two cities. In 2025, Clove Dental expanded across West India, opening multiple clinics and targeting 100 in Mumbai, enhancing standardized, quality dental care access. The establishment of new dental colleges, training programs, and residency positions is increasing the supply of dental professionals. Government initiatives including the National Oral Health Programme and integration of oral health services within primary healthcare are expanding access in underserved areas. This infrastructure development creates new demand sources and improves treatment accessibility for previously unserved populations.

Growing Demand for Cosmetic and Aesthetic Dental Treatments

Rising aesthetic consciousness among Indian consumers is fueling demand for cosmetic dental procedures and associated premium consumables. Teeth whitening, veneers, clear aligners, and tooth-colored restorations are experiencing rapid adoption driven by social media influence and increasing importance of appearance in professional and social contexts. According to The New Indian Express, the Indian Dental Association (IDA) estimates that India’s cosmetic dentistry market is growing at around 20% annually, with tier‑2 cities quickly catching up and millennials increasingly seeking perfect smiles through aesthetic treatments such as whitening, veneers, and invisible aligners. Nearly 62% of young Indians now consider aesthetic appearance a primary reason for visiting a dentist, surpassing pain‑related visits, underscoring the shift toward elective cosmetic care. The growing affluence of the middle class enables discretionary spending on elective dental treatments previously considered luxury services.

Market Restraints:

What Challenges the India Dental Consumables Market is Facing?

Limited Dental Insurance Penetration and Affordability Concerns

The limited penetration of dental insurance coverage in India constrains market growth by placing treatment costs directly on patients, deterring many from seeking needed care. Out-of-pocket payment requirements make advanced treatments utilizing premium consumables inaccessible for significant population segments. Price sensitivity, particularly in rural and semi-urban markets, drives preference for lower-cost materials that may compromise treatment longevity and outcomes. The absence of comprehensive dental coverage in most health insurance policies limits affordability and delays treatment decisions, affecting consumable demand across the value chain.

Shortage of Trained Dental Professionals and Technicians

The shortage of qualified dental professionals and laboratory technicians constrains market development, particularly for advanced treatments requiring specialized skills. India produces significantly fewer dental laboratory technicians than required to meet demand, creating bottlenecks in prosthetics fabrication and limiting adoption of advanced digital workflows. Uneven geographic distribution of dental professionals concentrates capacity in urban areas while leaving rural populations underserved. The skill gaps in emerging technologies including CAD/CAM fabrication and digital dentistry restrict the diffusion of advanced consumables beyond metropolitan centers with concentrated talent pools.

Presence of Counterfeit and Substandard Products

The presence of counterfeit and substandard dental consumables in the market poses quality and safety concerns while undermining legitimate product demand. Unregulated distribution channels and price-driven purchasing decisions in some market segments create opportunities for inferior products that may compromise treatment outcomes. The fragmented nature of dental consumable distribution, with numerous small distributors and limited regulatory enforcement, enables substandard product circulation. This challenge affects premium segment manufacturers and creates uncertainty around product authenticity and performance expectations.

Competitive Landscape:

The India dental consumables market comprises global multinationals, established domestic firms, and emerging local players competing across price tiers and product categories. International dental majors dominate premium segments through strong brands, clinical validation, and technological leadership. Domestic manufacturers are expanding rapidly in value segments, supported by cost advantages, local insights, and improving quality. Competition centers on product innovation and distribution. Strategic international–local partnerships aid market entry and technology transfer. Intense price competition persists in commoditized products, while advanced materials rely on brand loyalty and clinical positioning across evolving regulatory conditions.

Recent Developments:

- In September 2025, India inaugurated its first Dental Technology Innovation Hub (DTIH) at Maulana Azad Institute of Dental Sciences (MAIDS), New Delhi, a collaborative initiative by the Department of Science & Technology and ICMR to advance indigenous dental tech, cut import reliance and lower treatment costs. The hub currently nurtures ~16 early-stage dental innovations toward clinical and commercial use.

India Dental Consumables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Dental Burs, Whitening Material, Dental Biomaterial, Dental Anesthetics, Crowns and Bridges, Dental Implants, Others |

| Treatments Covered | Orthodontic, Endodontic, Periodontic, Prosthodontic |

| Materials Covered | Metals, Polymers, Ceramics, Biomaterials |

| End Users Covered | Dental Hospitals and Clinics, Dental Laboratories, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India dental consumables market size was valued at USD 1.24 Billion in 2025.

The India dental consumables market is expected to grow at a compound annual growth rate of 8.74% from 2026-2034 to reach USD 2.64 Billion by 2034.

Dental burs dominate the market with 18% share as they are essential in almost all dental procedures, including cavity preparation, crown adjustments, and restorative work, and are consumable items that require regular replacement, while a wide variety of bur types cater to diverse clinical applications.

Key factors driving the India dental consumables market include rising prevalence of dental disorders, increasing healthcare infrastructure and dental clinic expansion, growing demand for cosmetic dental treatments, dental tourism growth, rising disposable incomes, technological advancements in dental materials, and government initiatives promoting oral health awareness.

Major challenges include limited dental insurance penetration affecting treatment affordability, shortage of trained dental professionals and laboratory technicians, presence of counterfeit and substandard products, price sensitivity in rural and semi-urban markets, and uneven geographic distribution of dental care infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)