India Dental Equipment Market Size, Share, Trends and Forecast by Procedure Type, Product Type, End User, and Region, 2025-2033

India Dental Equipment Market Overview:

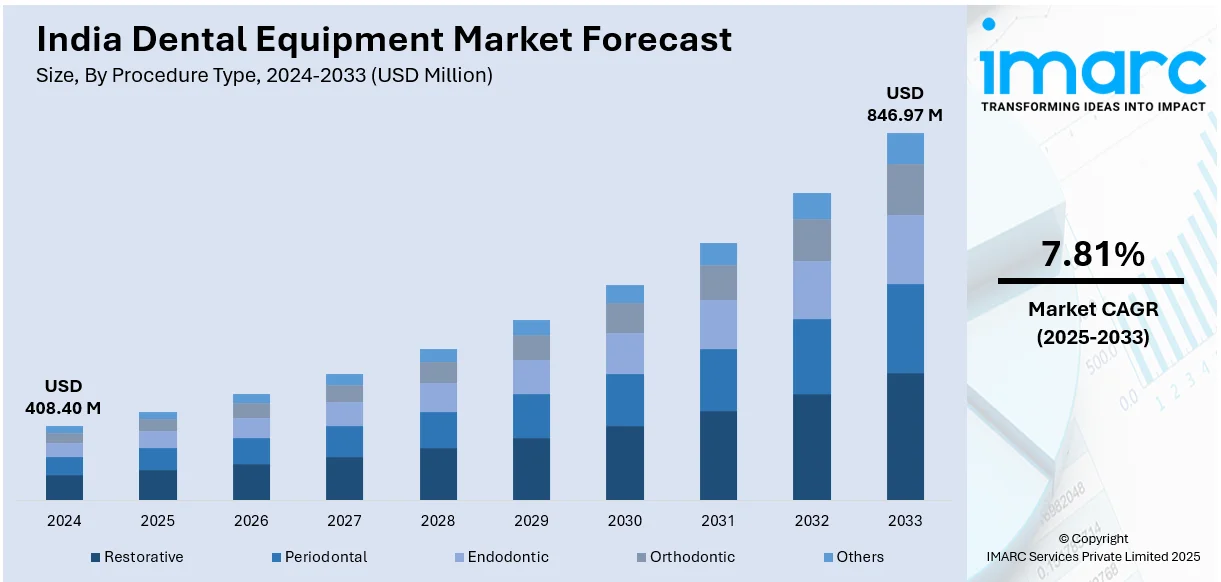

The India dental equipment market size reached USD 408.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 846.97 Million by 2033, exhibiting a growth rate (CAGR) of 7.81% during 2025-2033. The India dental equipment market share is expanding, driven by the growing awareness about oral hygiene, promoting regular dental checkups, along with the increasing medical tourism activities, motivating clinics to employ modern equipment and attract international patients seeking modern dental procedures.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 408.40 Million |

| Market Forecast in 2033 | USD 846.97 Million |

| Market Growth Rate 2025-2033 | 7.81% |

India Dental Equipment Market Trends:

Growing prevalence of dental diseases

The rising prevalence of oral ailments is offering a favorable India dental equipment market outlook. According to industry reports, in 2024, 64% of Indians dealt with stains, 48% encountered tooth decay, and 46% faced attrition. Increasing cases of periodontal diseases and dental caries are driving the demand for diagnostic and therapeutic dental equipment. As lifestyle changes and high sugar consumption contribute to poor oral health, dental clinics and hospitals are adopting modern equipment, such as digital imaging systems, dental lasers, and ultrasonic scalers, to provide effective treatments. Additionally, the growing awareness about oral hygiene is encouraging regular dental checkups, creating the need for preventive care tools like dental chairs, handpieces, and cleaning devices. Pediatric dental cases are also on the rise, further catalyzing the demand for effective equipment. Moreover, specialized tools for elderly patients with complex dental conditions is gaining traction. This surge in dental ailments is motivating healthcare facilities to invest in modern technologies to improve diagnosis, treatment accuracy, and patient comfort.

To get more information on this market, Request Sample

Expansion of dental clinics and hospitals

The increasing establishment of dental clinics and hospitals is impelling the India dental equipment market growth. As new dental clinics are opening in both urban and rural areas, there is a rising need for essential equipment, such as dental chairs and diagnostic devices to support routine checkups, treatments, and surgeries. In October 2024, JCBL unveiled the introduction of a mobile dental clinic under Project Smile Himalaya, an initiative spearheaded by Rotary International, Swami Vivekananda Sewa Trust in Karnataka, and Vision Himalaya based in Ladakh, which sought to deliver advanced dental services to the isolated villages of Ladakh. It guaranteed that all dental equipment were effectively incorporated into both the examination area and the storage space. Facilities are inculcating new technologies like computer-aided design (CAD) and computer-aided manufacturing (CAM) systems and intraoral scanners to enhance diagnostic accuracy and treatment efficiency. The increasing number of multi-specialty hospitals with dedicated dental departments is further driving the demand for comprehensive dental tools to cater to a wide range of oral health conditions. Moreover, the growing medical tourism activities are motivating clinics to employ modern equipment to attract international patients seeking modern dental procedures. Additionally, government initiatives to improve healthcare access in underserved areas are encouraging the establishment of dental care units, further catalyzing the demand for equipment. Clinics are also wagering on sterilization systems and patient management software to improve workflow and ensure better patient experiences.

India Dental Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on procedure type, product type, and end user.

Procedure Type Insights:

- Restorative

- Periodontal

- Endodontic

- Orthodontic

- Others

The report has provided a detailed breakup and analysis of the market based on the procedure type. This includes restorative, periodontal, endodontic, orthodontic, and others.

Product Type Insights:

- Dental Laser Equipment

- Dental Radiology Equipment

- Dental Software and Imaging

- Mechanical Systems

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes dental laser equipment, dental radiology equipment, dental software and imaging, mechanical systems, and others.

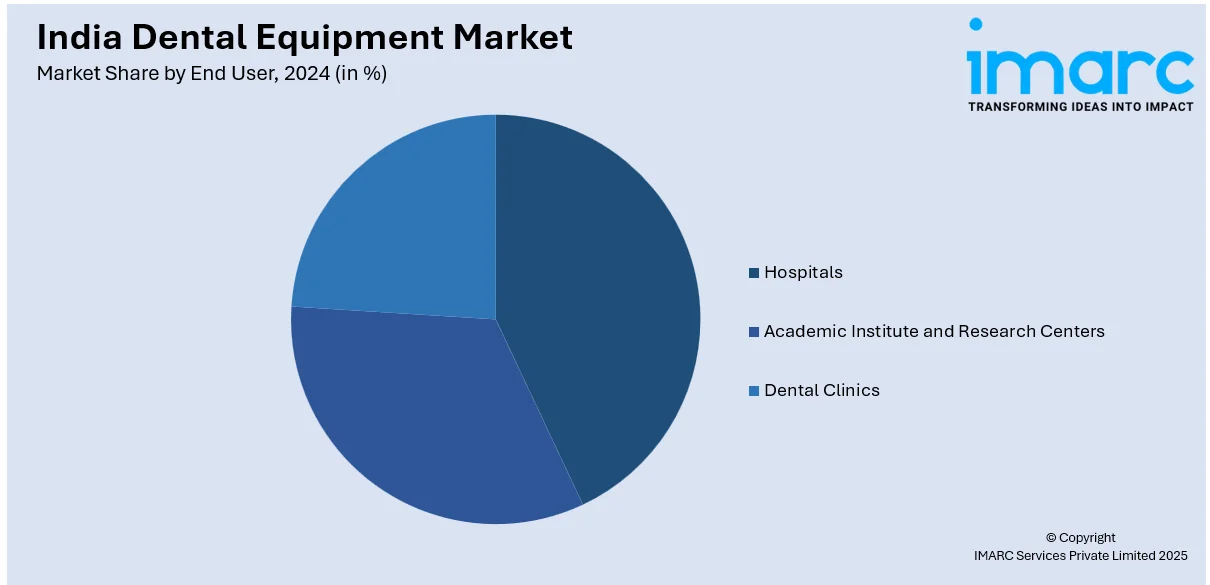

End User Insights:

- Hospitals

- Academic Institute and Research Centers

- Dental Clinics

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, academic institute and research centers, and dental clinics.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dental Equipment Market News:

- In September 2024, the Government Dental College and Research Institute (GDC&RI), one of the oldest and most esteemed dental institutions in India, unveiled state-of-the-art equipment and amenities, including the opening of its new digital dentistry section. The center was the first of its type in a government hospital. The facility was outfitted with cutting-edge technology like CAD/CAM systems that transformed restorative dentistry through the precise and efficient creation of dental prosthetics.

- In September 2024, DENTIS, a Korean company specializing in implant-based dental and medical solutions, commenced its operations in India after setting up its local subsidiary and obtaining the required import approvals. The firm was set to secure approval for crucial dental equipment, such as high-precision measurement instruments and dental chairs. The company highlighted its commitment to broadening its distribution network and boosting its market presence in India by providing extensive dental solutions.

India Dental Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Procedure Types Covered | Restorative, Periodontal, Endodontic, Orthodontic, Others |

| Product Types Covered | Dental Laser Equipment, Dental Radiology Equipment, Dental Software and Imaging, Mechanical Systems, Others |

| End Users Covered | Hospitals, Academic Institute and Research Centers, Dental Clinics |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dental equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dental equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dental equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dental equipment market in India was valued at USD 408.40 Million in 2024.

The India dental equipment market is projected to exhibit a CAGR of 7.81% during 2025-2033, reaching a value of USD 846.97 Million by 2033.

The India dental equipment market is expanding due to growing awareness of oral health, increasing visits to dental clinics, and higher healthcare spending. Advancements in dental technologies, rising demand for cosmetic dentistry, medical tourism, and improved access to dental insurance further contribute to market development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)