India Dental Implants Market Size, Share, Trends and Forecast by Material, Product, End Use, and Region, 2025-2033

India Dental Implants Market Size and Share:

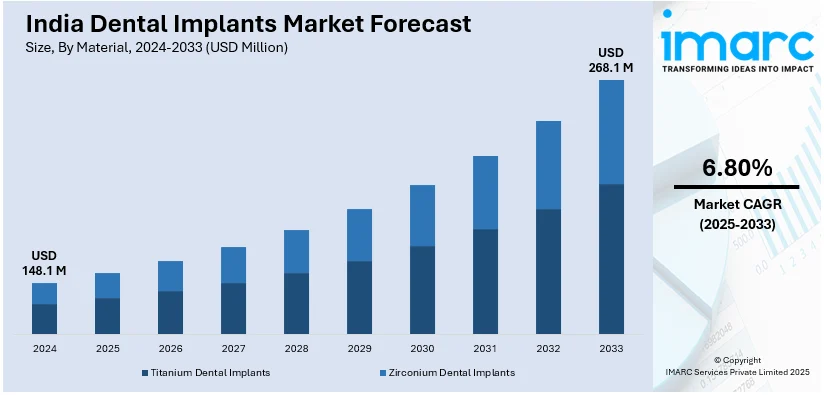

The India dental implants market size was valued at USD 148.1 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 268.1 Million by 2033, exhibiting a CAGR of 6.80% from 2025-2033. The rising awareness about oral hygiene and cosmetic dentistry, an aging population requiring dental solutions, and improved disposable income, are bolstering the market growth. Increased focus on dental tourism and affordability of treatments also play a crucial role in driving the demand. Additionally, advancements in implant technology, better dental healthcare infrastructure, and a growing preference for aesthetically pleasing dental solutions are further contributing to India dental implants market share expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 148.1 Million |

|

Market Forecast in 2033

|

USD 268.1 Million |

| Market Growth Rate 2025-2033 | 6.80% |

Continuous advancements in materials, including titanium, which bonds effectively with bone, and stronger ceramics, are making implants a more appealing choice. The application of 3D imaging and computer-assisted surgery is also enhancing the precision, safety, and minimized invasiveness of procedures. In addition, implants are now offered in a variety of shapes, sizes, and types, providing tailored solutions for diverse requirements. These advancements are improving the efficacy and availability of implants, resulting in greater demand. Besides this, as healthcare infrastructure improves and dental tourism grows in India, dental implants are becoming more cost-effective. Furthermore, numerous international and local dental clinics are providing competitive rates, thereby making implants available to a wider audience.

To get more information on this market, Request Sample

Apart from this, the growing awareness about oral health, driven by public health initiatives, social media, and educational efforts in schools and communities, is offering a favorable India dental implants market outlook. Individuals are becoming more aware about the lasting consequences of inadequate oral care and the significance of preserving a healthy smile. This rising awareness is making individuals more inclined to seek professional solutions for oral problems, such as dental implants, which are seen as a permanent solution for missing teeth. Moreover, the increasing geriatric population in India is one of the major factors catalyzing the demand for dental implants. Older adults often experience tooth loss due to age-related issues like decreased bone density, gum diseases, or inadequate dental hygiene over their lifetime, leading to a higher need for implant procedures.

India Dental Implants Market Trends:

Growing Awareness about Preventive Oral Healthcare

India is placing greater emphasis on preventive oral health, with dental implants emerging as a favored option in proactive dental treatment. Instead of letting dental problems escalate, an increasing number of people are choosing implants as a lasting, robust solution for absent teeth. Public health efforts, social media platforms, and educational programs are raising awareness about the significance of keeping up with proper oral hygiene. In 2024, Colgate-Palmolive India launched the #ColgateOralHealthMovement, an AI-powered dental screening initiative in partnership with the Indian Dental Association. The campaign aimed to boost oral health awareness by offering free screenings via WhatsApp and engaging 50,000 dentists across India. It also included mass media promotions and educational outreach to schools and communities. As such initiatives gain momentum, dental implants are being recognized as a reliable and permanent solution, further contributing to the demand in the Indian market.

Technological Advancements in Dental Implantology

Recent technological advancements in dental implantology are making procedures more efficient, affordable, and reliable. Innovations like computer-guided implant placement, 3D imaging, and enhanced implant materials are leading to improved success rates, lowered recovery times, and higher patient comfort. Furthermore, the introduction of mini implants and advanced surface treatments are decreasing costs, making dental implants more accessible to a broader demographic. These developments are not only improving the technical aspects of dental implants but are also contributing to the overall appeal of the procedure. A key example of this growing focus on innovation is the 6th Global AAID & 12th WCOI Conference held in New Delhi from November 8–10, 2024. The event, organized by the American Academy of Implant Dentistry (AAID) and WCOI Japan, highlighted global trends and advancements in dental implantology through scientific sessions, courses, and exhibitions, showcasing the latest innovations in the field and thus, fueling the India dental implants market growth.

Rising Focus on Oral Health in Rural Areas

Traditionally, dental care in rural India has been inadequate, but this is swiftly evolving as efforts from both government and private sectors aim to enhance access to high-quality oral health services in isolated regions. Mobile dental clinics, dental camps, and outreach programs are helping to raise awareness about the importance of oral hygiene and the available solutions for tooth loss, including dental implants. As dental professionals extend their reach to rural regions and educate local populations about the benefits of implants, the market for dental implants is expanding, making them more accessible to people who were previously unaware or unable to afford such treatments. In 2025, Sensodyne and TV9 Network initiated a nationwide oral health campaign on World Oral Health Day, titled “Take the First Step” and using the hashtag #BeSensitiveToOralHealth. The project featured Mobile Dental Vans providing complimentary check-ups and AI-driven diagnostics to encourage proactive dental care throughout India. The campaign sought to increase awareness, particularly in neglected areas, and enhance oral hygiene habits.

India Dental Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India dental implants market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on material, product, and end use.

Analysis by Material:

- Titanium Dental Implants

- Zirconium Dental Implants

Titanium dental implants represent the largest segment, holding 86.6% market share in 2024. The dominance of the segment is attributed to their excellent biocompatibility, strength, and longevity. Titanium’s capability to bond with the jawbone via osseointegration makes it a suitable material for dental implants, providing lasting stability and performance. The resistance to rust and minimal chance of allergic responses of titanium dental implants boost their attractiveness, as they are easily accepted by the human body. The durable yet light characteristics of titanium further enhance the appeal, as it guarantees that implants stay secure and comfortable for patients. Moreover, the capacity of titanium to be easily molded into different shapes facilitates customization to cater to individual patient requirements, enhancing overall treatment results. With patients progressively desiring dependable, enduring dental solutions, titanium dental implants remain at the forefront of the material sector, providing an ideal equilibrium of performance and safety in dental implant operations.

Analysis by Product:

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

- Intramucosal Implants

Endosteal implants stand as the largest component in 2024, holding 92.1% of the market because of their impressive success rates and their fitting for various patient types. These implants are surgically inserted directly into the jawbone, providing outstanding stability and support, thereby guaranteeing optimal osseointegration. Their design, incorporating screws, cylinders, or blades, enables a secure fit within the bone structure, making them suitable for patients with sufficient bone volume. The extended durability and low risk of complications linked to endosteal implants are greatly increasing their popularity. Moreover, improvements in implant materials like titanium are boosting the overall effectiveness of endosteal implants, resulting in improved patient outcomes. Their capacity to accommodate one or several crowns and bridges enhances their flexibility, addressing various patient requirements. As a result, endosteal implants remain the favored option among dental experts for substituting lost teeth, reinforcing their market leadership.

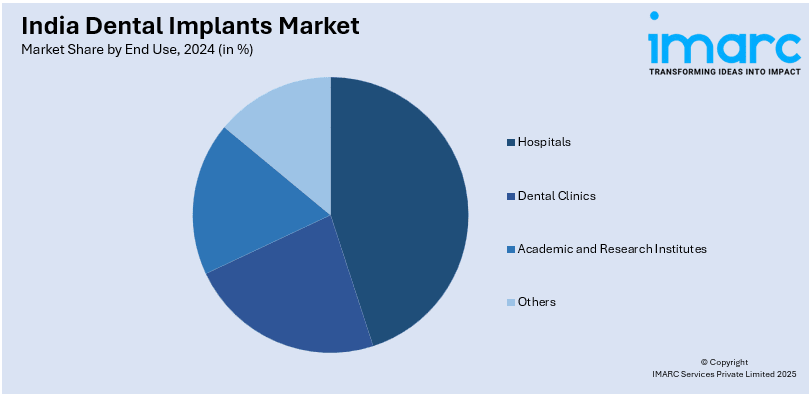

Analysis by End Use:

- Hospitals

- Dental Clinics

- Academic and Research Institutes

- Others

Dental clinics leads the market with 80.7% of market share in 2024, because of their key function in delivering specialized dental care and implant treatments. These clinics provide various treatments, such as consultations, implant placements, and post-operative care, serving as the main point of contact for patients in need of dental implants. The rising need for cosmetic dentistry and restorative dental procedures enhances the status of dental clinics in the marketplace. Moreover, dental clinics possess cutting-edge technologies and experienced specialists capable of executing intricate implant procedures, guaranteeing elevated success rates and patient contentment. As individuals look for dependable, safe, and efficient dental implant options, dental clinics continue to be the preferred choice for these procedures. Additionally, dental practices offer tailored care, catering to specific needs and preferences of each patient, which enhances the chances of returning visits.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

In 2024, South India held the biggest market share of 40.2%. The area is known for its robust healthcare system, featuring many reputable dental clinics and hospitals that provide comprehensive dental services. In 2025, the Chennai Dental Research Foundation (CDRF) announced a charity initiative offering 100 free zygoma implants to deserving patients, marking the milestone of completing 1,000 such specialized procedures. The initiative was launched in collaboration with Rajan Dental Institute. South India is experiencing a rising consciousness regarding oral health, motivated by educational programs and higher disposable incomes, encouraging individuals to pursue cosmetic and restorative dental care. Moreover, the area boasts a significant number of qualified dental experts specializing in implantology, guaranteeing excellent procedures and positive results. The increasing need for dental implants is driven by the growing population of seniors who need solutions for tooth replacement. This trend positions the India dental implants market forecast for steady growth, with South India remaining a key contributor to the market expansion.

Competitive Landscape:

Major participants in the market are concentrating on strategic efforts to strengthen their market standing. Businesses are allocating resources to research and development (R&D) to launch novel, affordable implant options that meet the increasing need for sophisticated dental treatments. They are broadening their product ranges with premium materials and enhanced designs to increase implant success rates and patient comfort. Furthermore, partnerships with international dental experts and healthcare practitioners are being sought to enhance client knowledge and encourage adoption. For instance, in 2024, Korean dental solutions provider DENTIS announced the launch of its Indian subsidiary in Gurgaon, along with securing regulatory approvals for key products like SQ implants and digital guide systems. The company aimed to expand across major Indian markets and strengthen its presence through seminars and partnerships.

The report provides a comprehensive analysis of the competitive landscape in the India dental implants market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Sadar Hospital in Ranchi launched specialized and ultra-specialized facilities in its dentistry section. Additionally, the hospital announced that it would launch an advanced dental implant clinic.

- March 2025: Clove Dental expanded to 600 clinics across the country. The clinics offer a comprehensive range of treatments, including dental implants, laser dentistry, root canal treatments (RCT), and wisdom teeth removal.

- November 2024: The government launched an INR 500 crore program to aid domestic manufacturers of medical equipment, including dental implants, diagnostic imaging, and various other items, in order to revitalize domestic manufacturing within the medical equipment sector.

India Dental Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Titanium Dental Implants, Zirconium Dental Implants |

| Products Covered | Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants |

| End Uses Covered | Hospitals, Dental Clinics, Academic and Research Institutes, Others |

| Regions Covered | North India, West and Central India, East India, South India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dental implants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India dental implants market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dental implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dental implants market in the India was valued at USD 148.1 Million in 2024.

The market expansion is driven by rising awareness about oral health, an aging population, increased disposable income, advancements in dental technology, and a growing preference for cosmetic dentistry. These factors, coupled with better healthcare infrastructure, are boosting the market growth.

The India dental implants market is projected to exhibit a CAGR of 6.80% during 2025-2033, reaching a value of USD 268.1 Million by 2033.

Titanium dental implants lead the market in 2024, due to their superior biocompatibility, durability, strength, and successful long-term integration.

In 2024, South India holds the biggest market share because of its robust healthcare infrastructure, high awareness of oral health, skilled dental professionals, and a growing demand for cosmetic and restorative dental treatments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)