India Deodorants Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Distribution Channel, and Region, 2025-2033

India Deodorants Market Size and Share:

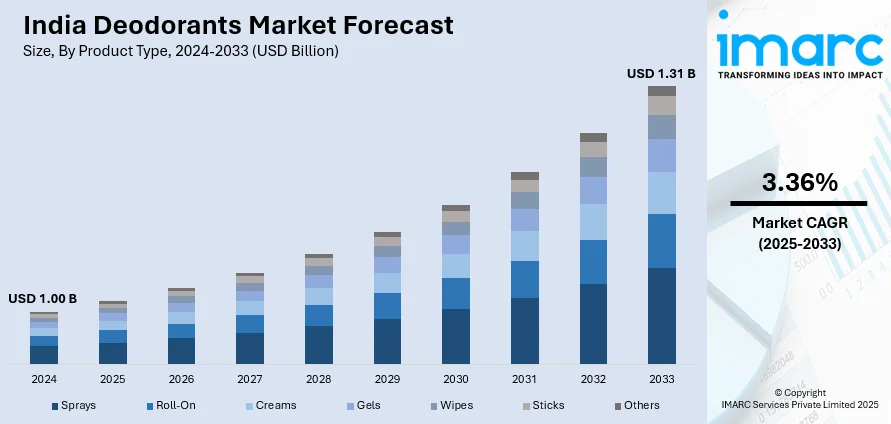

The India deodorants market size reached USD 1.00 Billion in 2024. The market is expected to reach USD 1.31 Billion by 2033, exhibiting a growth rate (CAGR) of 3.36% during 2025-2033. The market growth is attributed to growing product variety accommodating diverse consumer preferences, heightened demand for natural and organic ingredients reflecting health-conscious choices, swift growth of online retail expanding market accessibility, evolving consumer needs and growing awareness about personal hygiene, and consumers moving away from conventional sprays to new formats such as creams, sticks, and wipes while emphasizing skin-friendly, plant-based products.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product type, the market has been divided into sprays, roll-on, creams, gels, wipes, sticks, and others.

- On the basis of packaging type, the market has been divided into metal, plastic, and others.

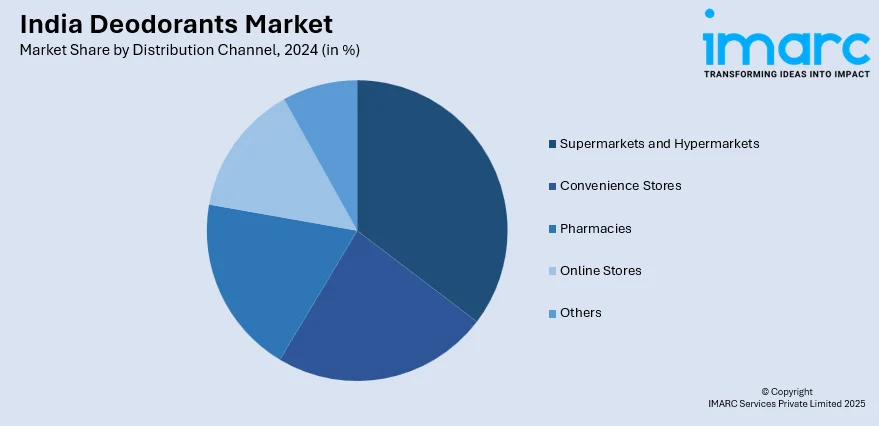

- On the basis of distribution channel, the market has been divided into supermarkets and hypermarkets, convenience stores, pharmacies, online stores, and others.

Market Size and Forecast:

- 2024 Market Size: USD 1.00 Billion

- 2033 Projected Market Size: USD 1.31 Billion

- CAGR (2025-2033): 3.36%

India Deodorants Market Trends:

Expansion in Product Variety

The India deodorant industry is observing a rapid increase in product variety, led by the evolving needs and desires of consumers and growing awareness about personal hygiene. Consumers today expect significantly more from personal care products than from traditional spray deodorants. As a result, there has been a growing demand for alternative formats such as roll-ons, creams, wipes, sticks, and gels. For instance, in May 2024, Dove introduced Whole Body Deodorants in India—aluminum-free, vitamin B3 and E-enriched, dermatologist-tested formulas with 72-hour odor protection for all-over external use. Moreover, this transition accommodates a broad range of tastes, from those in search of protection that lasts longer to users with sensitive skin. Additionally, the fact that specialized versions that provide additional benefits, including antibacterial activity or fragrance-free products, has helped grow the deodorant market. These innovations are closely linked to the growth of deodorants in India, with companies launching new fragrances, pack sizes, and products to cater to changing consumer demands from their diverse consumer base. As consumers become more advanced, the need for deodorants across a wider portfolio continues to spur India deodorants market growth, with variety forming the key trend among India's personal care market.

To get more information on this market, Request Sample

Shift Toward Natural and Organic Ingredients

Over the past few years, the Indian deodorant market has witnessed a significant trend towards natural and organic products, symptomatic of the larger consumer shift towards healthier and greener personal care. Heightening awareness regarding the use of chemicals in regular deodorants in the form of aluminum compounds and artificial fragrances has prompted consumers to turn to alternatives in the form of natural ingredients. Deodorants that have herbal extracts, essential oils, and plant-derived content are in demand as they are believed to have a kinder effect on the skin and the environment. This trend toward organic deodorants is especially being seen among the young, health-conscious population, which is highly choosing products that fit with their green and wellness lifestyle. The emphasis on organic ingredients is aiding the deodorant growth in India, which aligns with the need for cleaner, safer, and sustainable personal care solutions, opening opportunities for newfangled brands to enter the deodorant landscape with plant-based options.

Expanding Online Sales

The expanding role of online retail has completely transformed the market for deodorants in India, enabling shoppers to reach out to a much broader range of products than before. For instance, in April 2023, BELLAVITA Luxury introduced six MI and RCB-themed deodorants in India, marking the celebration of T20 cricket with long-lasting, summer-perfect fragrances, broadening its offline and online retail presence. Furthermore, with the growing internet and smartphone penetration, online buying has emerged as a convenient and preferred option for the purchase of personal care items. E-commerce websites offer the consumer the means to browse a wide variety of deodorant brands and forms, compare prices, and check reviews before finally making the purchase. This convenience is especially desirable in a nation like India, where geographical distance frequently restricts access to some brands or types of products in local stores. Additionally, shopping online has the added benefit of door-to-door delivery, which means that urban and rural consumers can readily obtain their choice of deodorant products. Consequently, the deodorant growth in India is also further boosted by growing online retailing channels, which are progressively extending the reach of the market as well as consumer access.

Technology Innovation and Holistic Market Evolution

The India deodorants market is experiencing transformative advancement through cutting-edge technological innovations in formulations, including microencapsulation technology that provides controlled fragrance release and smart, app-linked personalization features that allow consumers to customize scent intensity and longevity based on individual preferences and lifestyle patterns. Sustainability initiatives are extending far beyond natural ingredients to encompass comprehensive eco-friendly packaging solutions, refillable systems, and carbon footprint reduction strategies that resonate with environmentally conscious consumers seeking responsible beauty choices. Regulatory frameworks are increasingly shaping product development through evolving safety standards, enhanced labeling requirements, and stricter compliance protocols that ensure consumer protection while fostering innovation in formulation chemistry. Cultural and regional preferences are driving market diversification, with brands developing climate-adapted formulations for India's diverse weather conditions, festival-specific limited editions, and region-specific fragrances that reflect local traditions and aromatic preferences across different states. Health and wellness crossovers are manifesting through probiotic-infused deodorants that support skin microbiome balance, aromatherapy blends that provide stress relief and mood enhancement, and skin-nourishing formulations enriched with vitamins and moisturizing agents. The industry is prioritizing supply chain localization, ethical sourcing practices, and building resilience against global disruptions while leveraging social media and influencer ecosystems to drive user-generated trends, viral fragrance challenges, and micro-influencer campaigns that authentically connect with younger demographics. Inclusivity and diversity initiatives are expanding through gender-neutral product lines, sensitive-skin formulations, and broad-spectrum designs that cater to diverse skin tones and body chemistry variations, while post-pandemic hygiene behaviors are spurring demand for antimicrobial-focused deodorants and innovative hybrid deodorant-perfume products that combine protection with luxury fragrance experiences.

Growth, Opportunities, and Challenges in the India Deodorants Market:

- Growth Drivers of the India Deodorants market: The primary growth drivers include increasing urbanization and rising disposable incomes leading to enhanced personal grooming awareness, expanding youth population with heightened consciousness about personal hygiene and appearance, and growing women's workforce participation creating substantial demand for female-focused deodorant products. The penetration of modern retail formats and e-commerce platforms is improving product accessibility across tier-II and tier-III cities, while celebrity endorsements and social media influence are accelerating brand adoption among millennials and Gen Z consumers.

- Opportunities in the India Deodorants market: The market presents substantial opportunities through development of climate-specific formulations designed for India's diverse weather conditions, expansion into untapped rural markets with affordable pricing strategies, and creation of Ayurvedic and herbal variants that align with traditional Indian wellness preferences. The rising trend of premiumization offers potential for luxury and niche fragrance segments, while partnerships with fashion and lifestyle brands can create co-branded products that appeal to style-conscious consumers seeking holistic personal care solutions.

- Challenges in the India Deodorants market: The industry faces challenges including intense competition from both organized and unorganized sectors leading to price pressures and margin constraints, seasonal demand fluctuations affecting sales consistency throughout the year, and regulatory compliance requirements for ingredient safety and environmental standards. Consumer price sensitivity in price-conscious markets poses challenges for premium positioning, while counterfeit products and brand imitation threaten market share and consumer trust, requiring significant investments in brand protection and consumer education initiatives.

India Deodorants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, packaging type, and distribution channel.

Product Type Insights:

- Sprays

- Roll-On

- Creams

- Gels

- Wipes

- Sticks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sprays, roll-on, creams, gels, wipes, sticks, and others.

Packaging Type Insights:

- Metal

- Plastic

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes metal, plastic, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, pharmacies, online stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Deodorants Market News:

- In July 2025, Park Avenue Fragrances, part of Godrej Consumer Products Ltd (GCPL), launched its new Amazon Woods deodorant along with a TVC featuring actor Ishaan Khatter, conceptualized by Godrej Creative Lab. The campaign highlights the fragrance’s 4X Premium Perfume Spray, positioned to deliver four times the confidence through its long-lasting scent and affordable pricing.

- In July 2025, Tikitoro introduced India’s first alcohol-free Deo Mist designed specifically for teen skin, named Tikitoro Teens Deo Mist Aqua. The 100% water-based, non-aerosol spray offers 8-hour odour protection, free from alcohol, aluminium, silicones, and endocrine disruptors, and uses microbiome-balancing technology to target odour-causing bacteria while maintaining skin health.

- In May 2025, Jaipur-based scent company Fragway is to roll out its range of deodorants. The debut offering will be two fragrances, Elite and Power, and the company plans to introduce two more in six months' time. Fragway has strong marketing strategies and plans to go regional first and then national by 2025.

- In May 2024, Cupid has broadened its online presence with e-commerce through the partnership with top platforms such as Amazon, Flipkart, and 1mg. It aims to strengthen its health and wellness stance by making its personal wellness products, which range from deodorants to condoms and lubricants, available to more customers across India.

India Deodorants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays, Roll-On, Creams, Gels, Wipes, Sticks, Others |

| Packaging Types Covered | Metal, Plastic, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India deodorants market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India deodorants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India deodorants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The deodorants market in India was valued at USD 1.00 Billion in 2024.

The India deodorants market is projected to exhibit a CAGR of 3.36% during 2025-2033, reaching a value of USD 1.31 Billion by 2033.

The key factors driving the India deodorants market include increasing awareness about personal hygiene and the influence of social media promoting grooming products. Additionally, the demand for premium and innovative deodorants, along with changing lifestyles of people, further fuels the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)