India Diacetone Alcohol Market Size, Share, Trends and Forecast by Function, End User Industry, and Region, 2025-2033

India Diacetone Alcohol Market Overview:

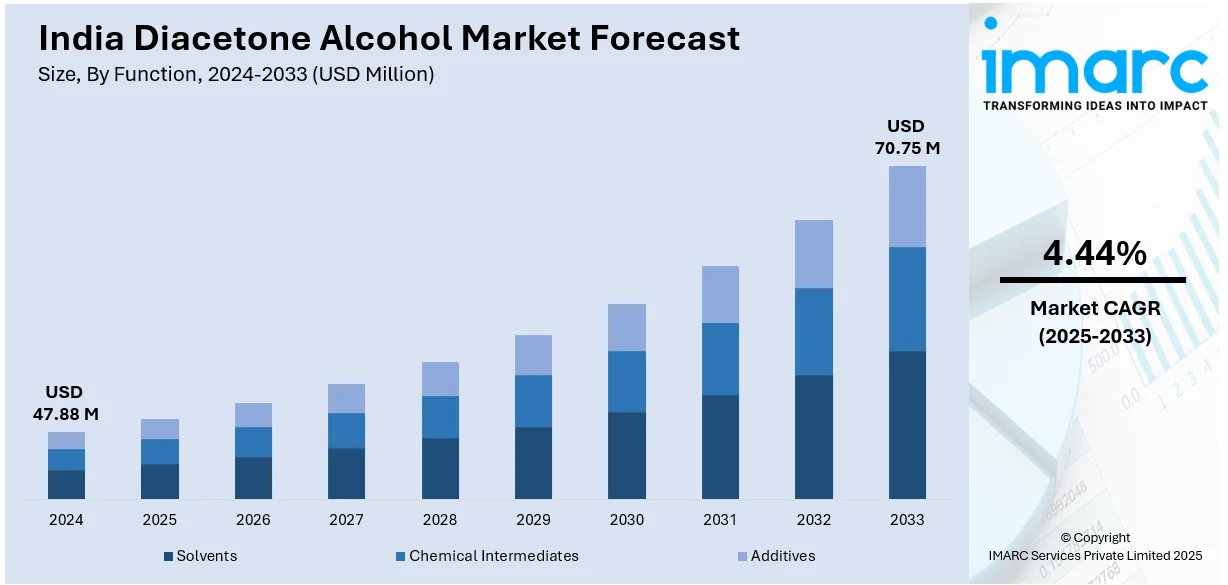

The India diacetone alcohol market size reached USD 47.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 70.75 Million by 2033, exhibiting a growth rate (CAGR) of 4.44% during 2025-2033. The rising demand in the paints, coatings, and adhesives industries, supported by construction and automotive sector growth, is one of the factors propelling the growth of the market. Increasing use in chemical intermediates, solvents, and industrial cleaners, along with expanding pharmaceutical and cosmetic applications, also fuels market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 47.88 Million |

| Market Forecast in 2033 | USD 70.75 Million |

| Market Growth Rate 2025-2033 | 4.44% |

India Diacetone Alcohol Market Trends:

Growth in Paints and Coatings Driving Demand

The increasing demand for diacetone alcohol in India is closely linked to the growth of the paints and coatings sector. Expanding infrastructure projects and rising urbanization are key drivers, leading to greater consumption of construction materials. Consumers are also showing a stronger preference for durable, long-lasting, and eco-friendly products. This shift encourages the adoption of high-performance solvents like diacetone alcohol, commonly used in paints, adhesives, and coatings. Additionally, manufacturers are focusing on sustainable solutions to meet regulatory standards and environmental expectations. As construction and renovation activities surge, diacetone alcohol remains essential in supporting the production of superior quality coatings and finishes, ensuring continued demand across the market. For example, the India paints and coatings market size reached USD 8.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.35% during 2025-2033. Market growth across the country is primarily driven by expanding infrastructure projects, growing urbanization, and shifting consumer preferences toward durable and eco-friendly solutions.

To get more information on this market, Request Sample

Rising Agricultural Demand Boosting Chemical Consumption

The growing demand for diacetone alcohol in India is influenced by the expanding agrochemical sector. Increasing agricultural activities, driven by the need for higher crop yields, have led to greater use of agrochemicals, where diacetone alcohol serves as a crucial solvent in pesticide and herbicide formulations. Technological advancements in farming practices, alongside government initiatives supporting agricultural productivity, further enhance the demand for effective and reliable chemical solutions. As farmers adopt modern techniques to maximize output and ensure crop protection, the role of diacetone alcohol in facilitating the formulation of agricultural products becomes increasingly significant. This ongoing reliance on high-performance solvents underscores its essential role in meeting the evolving needs of the agrochemical industry. The India agrochemicals market features robust growth, driven by increasing agricultural demand, technological advancements, and government support for farming practices. According to the latest report by IMARC Group, the market size reached USD 7.9 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 11.9 Billion by 2032, exhibiting a growth rate (CAGR) of 4.50% during 2024-2032.

India Diacetone Alcohol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on function and end user industry.

Function Insights:

- Solvents

- Chemical Intermediates

- Additives

The report has provided a detailed breakup and analysis of the market based on the function. This includes solvents, chemical intermediates, and additives.

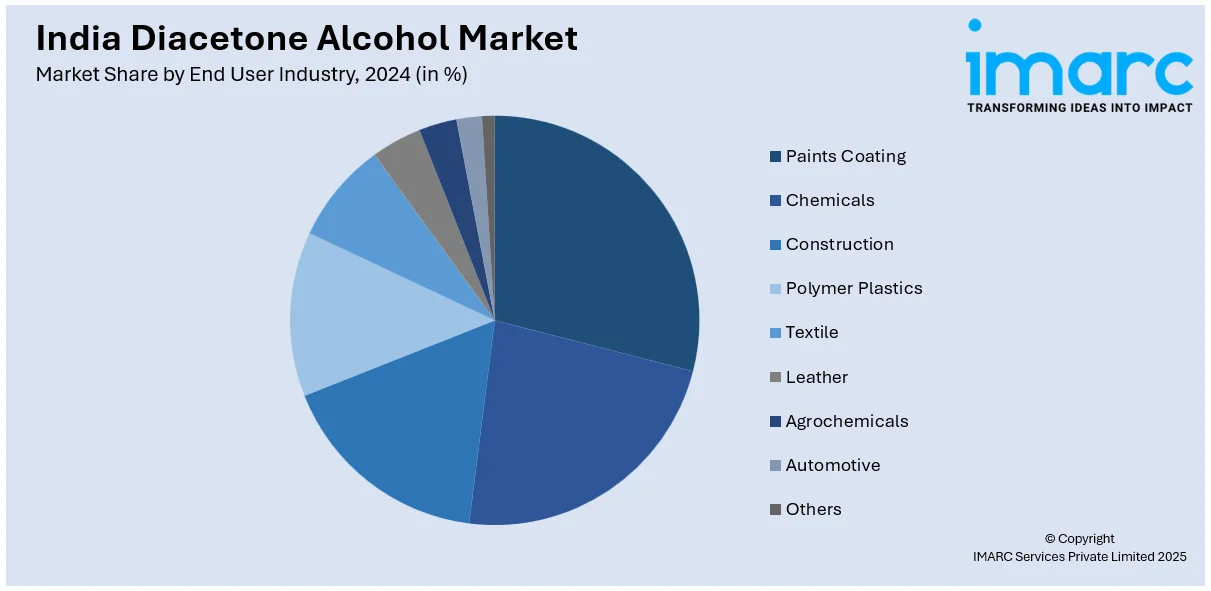

End User Industry Insights:

- Paints Coating

- Chemicals

- Construction

- Polymer Plastics

- Textile

- Leather

- Agrochemicals

- Automotive

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes paints coating, chemicals, construction, polymer plastics, textile, leather, agrochemicals, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Diacetone Alcohol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Solvents, Chemical Intermediates, Additives |

| End User Industries Covered | Paints Coating, Chemicals, Construction, Polymer Plastics, Textile, Leather, Agrochemicals, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India diacetone alcohol market performed so far and how will it perform in the coming years?

- What is the breakup of the India diacetone alcohol market on the basis of function?

- What is the breakup of the India diacetone alcohol market on the basis of end user industry?

- What are the various stages in the value chain of the India diacetone alcohol market?

- What are the key driving factors and challenges in the India diacetone alcohol market?

- What is the structure of the India diacetone alcohol market and who are the key players?

- What is the degree of competition in the India diacetone alcohol market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India diacetone alcohol market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India diacetone alcohol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India diacetone alcohol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)