India Diagnostic Testing Market Size, Share, Trends and Forecast by Test Type, Technology, Sample Type, Mode of Testing, Application, End User, and Region, 2025-2033

India Diagnostic Testing Market Overview:

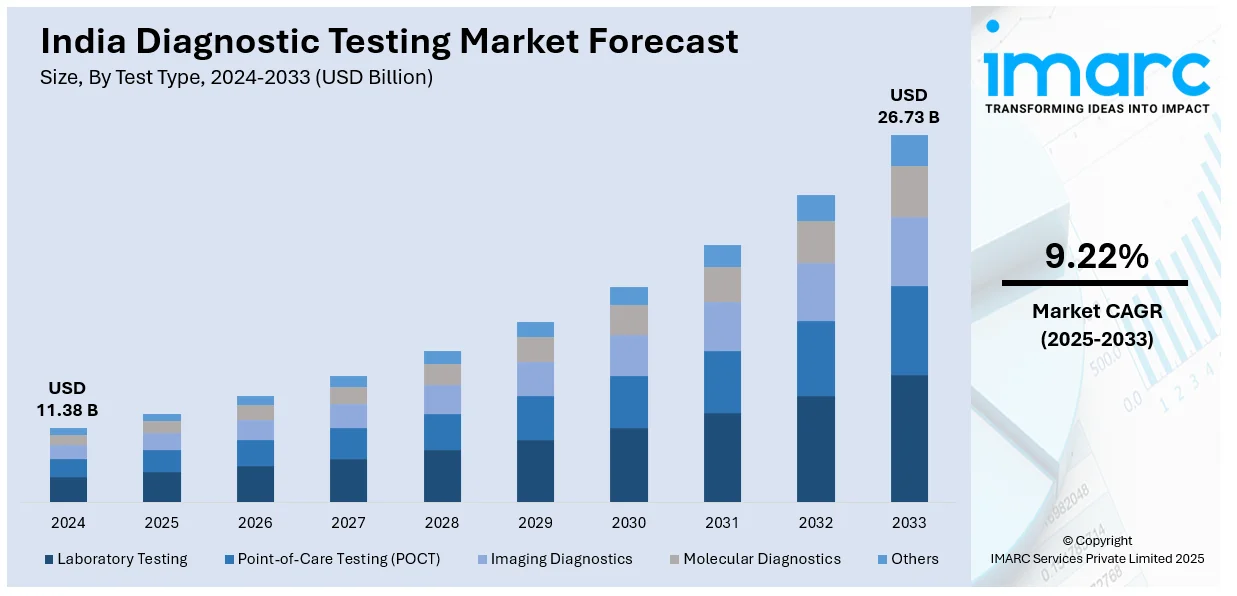

The India diagnostic testing market size reached USD 11.38 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.73 Billion by 2033, exhibiting a growth rate (CAGR) of 9.22% during 2025-2033. The market is experiencing significant growth due to increasing healthcare awareness, rising prevalence of chronic diseases, and advancements in testing technologies. The demand for both in-lab and point-of-care diagnostics is expanding, driven by government initiatives and private sector investments. This growth is further supported by innovations in molecular and genetic testing, influencing the India diagnostic testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.38 Billion |

| Market Forecast in 2033 | USD 26.73 Billion |

| Market Growth Rate 2025-2033 | 9.22% |

India Diagnostic Testing Market Trends:

Advancements in Testing Technology

Technological advancements in tests like molecular diagnostics, genetic tests, and Polymerase Chain Reaction are transforming the India diagnostic testing market. Molecular diagnostics enable detecting diseases at a genetic level and facilitating more accurate and early disease detection for cancers, infections, and genetic illnesses. For instance, in May 2024, MolBio Diagnostics, a leading molecular diagnostics firm, aims to enhance its global presence and launch new products in 2024 after achieving Rs 850 crore in revenue. CEO Sriram Natarajan highlighted plans for hepatitis C and HPV tests, TB innovations, and collaborations in women’s health through AI-driven technologies and partnerships. Genetic testing is increasingly popular, providing information on genetic diseases and personalized medicine, resulting in customized treatment plans. PCR technology, a versatile tool for the amplification of minute DNA or RNA samples, is a critical tool used to detect infectious diseases such as COVID-19, tuberculosis, and other viral infections with great accuracy. Such developments greatly enhance testing accuracy and speed, minimizing diagnostic errors and delivering quicker results. The improved reliability and effectiveness of these technologies are creating demand for sophisticated diagnostic solutions, thereby increasing the overall size of the diagnostic testing market in India.

To get more information on this market, Request Sample

Rising Demand for Point-of-Care Testing

Point-of-care (POC) testing is gaining significant momentum in India due to its ability to deliver quick, accurate, and cost-effective results outside of traditional clinical settings. The increasing adoption of POC diagnostic devices allows healthcare providers to conduct tests at the patient’s location, whether at home, in remote areas, or in healthcare facilities, reducing the need for laboratory visits. For instance, in January 2023, Cipla introduced Cippoint, a point-of-care testing device designed to provide quick diagnostic results for several conditions, such as heart problems, diabetes, and infectious diseases. This device, which has received approval under the European In-Vitro Diagnostic Device Directive, seeks to improve healthcare accessibility, particularly in rural regions, thereby facilitating accurate diagnosis and treatment. This is especially beneficial in rural areas where access to healthcare infrastructure can be limited. Devices such as glucose meters, rapid antigen tests, and portable ECG monitors enable timely diagnosis of conditions like diabetes, infections, and heart diseases. The convenience and speed of POC testing enhance patient outcomes, as early intervention is possible. With advancements in technology and the government’s focus on improving healthcare accessibility, POC testing is contributing to the India diagnostic testing market growth by expanding the reach of healthcare services and providing accessible, real-time results.

India Diagnostic Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on test type, technology, sample type, mode of testing, application and end user.

Test Type Insights:

- Laboratory Testing

- Point-of-Care Testing (POCT)

- Imaging Diagnostics

- Molecular Diagnostics

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes laboratory testing, point-of-care testing (POCT), imaging diagnostics, molecular diagnostics, and others.

Technology Insights:

- Immunoassay-Based

- PCR-Based

- Next Gen Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes immunoassay-based, PCR-based, next gen sequencing, spectroscopy-based, chromatography-based, microfluidics, and others.

Sample Type Insights:

- Blood

- Urine

- Saliva

- Sweat

- Hair

- Others

A detailed breakup and analysis of the market based on the sample type have also been provided in the report. This includes blood, urine, saliva, sweat, hair, and others.

Mode of Testing Insights:

- Prescription Based Testing

- OTC Testing

A detailed breakup and analysis of the market based on the mode of testing have also been provided in the report. This includes prescription based testing and OTC testing.

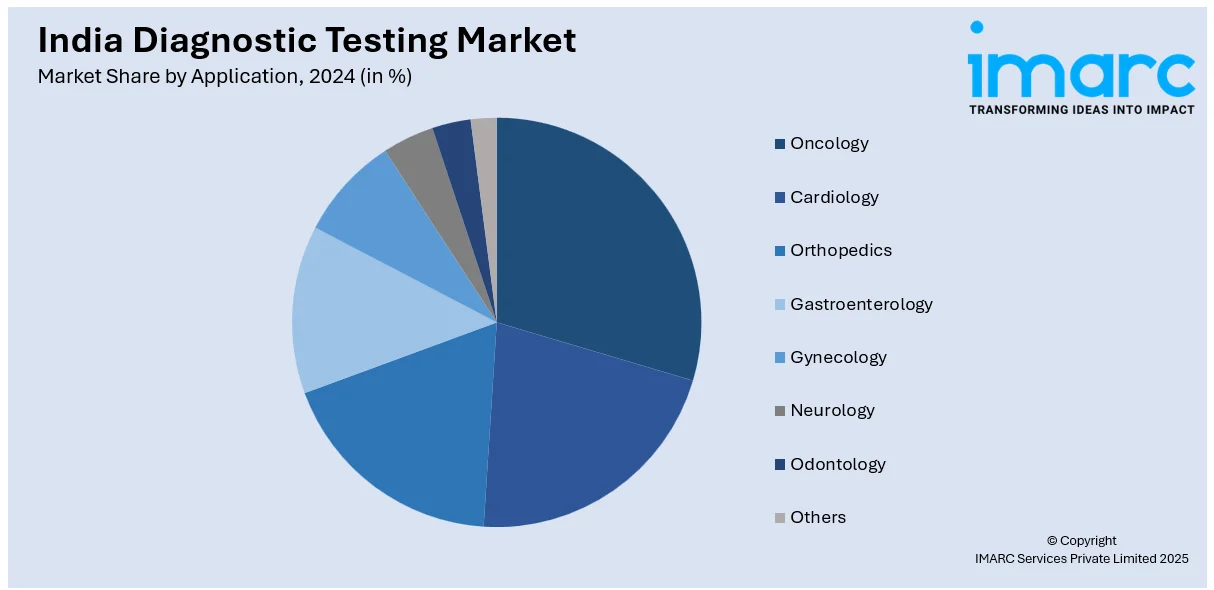

Application Insights:

- Oncology

- Cardiology

- Orthopedics

- Gastroenterology

- Gynecology

- Neurology

- Odontology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oncology, cardiology, orthopedics, gastroenterology, gynecology, neurology, odontology, others.

End User Insights:

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Homecare

- Blood Banks

- Research Labs and Institutes

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, diagnostic centers, ambulatory surgical centers (ASCs), specialty clinics, homecare, blood banks, research labs and institutes, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Diagnostic Testing Market News:

- In March 2025, HaystackAnalytics announced the launch of ‘TB One,’ a pre-sequencing kit aimed at enhancing tuberculosis (TB) diagnosis through Next-Generation Sequencing. This Make-in-India solution, featuring the Omega TB clinical reporting software, enables existing labs to conduct comprehensive drug resistance profiling efficiently, thus improving TB management and accessibility across India.

- In February 2025, Metropolis Healthcare and Roche Diagnostics announced their plans to launch a self-sampling HPV DNA test for cervical cancer screening in India, coinciding with World Cancer Day. The initiative aims to increase accessibility and early detection, particularly in underserved areas, amidst high cervical cancer rates in the country.

India Diagnostic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Laboratory Testing, Point-of-Care Testing (POCT), Imaging Diagnostics, Molecular Diagnostics, Others |

| Technologies Covered | Immunoassay-Based, PCR-Based, Next Gen Sequencing, Spectroscopy-Based, Chromatography-Based, Microfluidics, Others |

| Sample Types Covered | Blood, Urine, Saliva, Sweat, Hair, Others |

| Modes of Testing Covered | Prescription Based Testing, OTC Testing |

| Applications Covered | Oncology, Cardiology, Orthopedics, Gastroenterology, Gynecology, Neurology, Odontology, Others |

| End User Covered | Hospitals, Diagnostic Centers, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, Blood Banks, Research Labs and Institutes, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India diagnostic testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India diagnostic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India diagnostic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India diagnostic testing market was valued at USD 11.38 Billion in 2024.

The India diagnostic testing market is projected to exhibit a CAGR of 9.22% during 2025-2033, reaching a value of USD 26.73 Billion by 2033.

Rising prevalence of chronic diseases, improved healthcare access, and growing health awareness drive India’s diagnostic testing market. Expanding network of labs and hospitals, government health initiatives, and technological advancements in imaging and molecular diagnostics further boost demand. Urbanization, rising disposable incomes, and increased preventive care emphasis also support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)