India Dialysis Equipment Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Dialysis Equipment Market Overview:

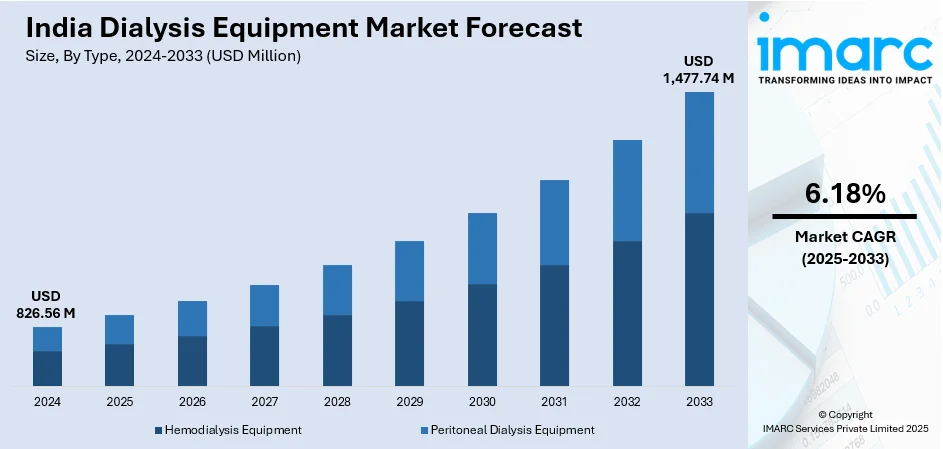

The India dialysis equipment market size reached USD 826.56 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,477.74 Million by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The market is driven by the rising prevalence of chronic kidney disease (CKD), fueled by diabetes and hypertension. Increasing healthcare investments, government initiatives, and expanding infrastructure enhance accessibility. Technological advancements, such as portable dialysis machines and digital integration, along with growing awareness of kidney health, further propel India dialysis equipment market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 826.56 Million |

| Market Forecast in 2033 | USD 1,477.74 Million |

| Market Growth Rate (2025-2033) | 6.18% |

India Dialysis Equipment Market Trends:

Increasing Prevalence of Chronic Kidney Disease (CKD) Driving Demand

The market is experiencing significant growth due to the rising prevalence of chronic kidney disease (CKD) across the country. Factors such as diabetes, hypertension, and lifestyle changes have contributed to the increasing number of CKD cases, creating a higher demand for dialysis treatments. On World Diabetes Day 2024, India reiterated the urgent need to further strengthen diabetes prevention, management, and equitable access to healthcare services, with this chronic non-communicable disease (NCD) affecting 10.1 crore (approximately 101 million) individuals, as revealed by the ICMR-INDAIB study. Government initiatives under the NP-NCD program include 6,237 community clinics and free essential medicines for the promotion of care for diabetes. Due to a rise in diabetes-related kidney complications, the demand for dialysis equipment in India is witnessing a significant increase. According to recent studies, India has one of the highest CKD burdens globally, with millions of patients requiring regular dialysis. This has led to a rise in the adoption of dialysis equipment, including hemodialysis and peritoneal dialysis machines, in both urban and rural areas. Therefore, this is positively influencing the India dialysis equipment market share. Additionally, government initiatives and private sector investments are expanding healthcare infrastructure, making dialysis more accessible. The growing awareness about early diagnosis and treatment of kidney-related ailments is further propelling market growth, positioning India as a key player in the global dialysis equipment industry.

To get more information on this market, Request Sample

Technological Advancements and Portable Dialysis Solutions

Continuous technological advancements are playing a critical role in India's dialysis equipment market outlook, with a focus on innovation and patient convenience. The introduction of portable and compact dialysis machines has revolutionized treatment options, allowing patients to undergo dialysis at home or in remote locations. These devices are designed to be user-friendly, cost-effective, and energy-efficient, catering to the diverse needs of India’s population. On 23rd November 2024, India fulfilled its commitment made during the FIPIC III Summit by sending another shipment of six reverse osmosis units mounted with portable dialysis machines to the Marshall Islands, Samoa, Solomon Islands, and Nauru. This comes after earlier delivery to Papua New Guinea and is intended to improve health care services in the Pacific region. In India, the need for compact dialysis equipment is growing, with further expansion of the market. Moreover, the integration of digital technologies, such as IoT and AI, into dialysis equipment is enhancing treatment accuracy and patient monitoring. Companies are also investing in research and development to create advanced filtration systems and biocompatible materials, improving the overall efficiency and safety of dialysis procedures. As healthcare providers and patients increasingly adopt these cutting-edge solutions, the market is witnessing a shift toward more personalized and accessible kidney care, driving further growth in the sector.

India Dialysis Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Hemodialysis Equipment

- Hemodialysis Machines

- n-Center Hemodialysis Machines

- Home Based Hemodialysis Machines

- Hemodialysis Machines

-

- Hemodialysis Consumables

- Dialyzers

- Dialysate

- Access Products

- Others

- Hemodialysis Consumables

- Peritoneal Dialysis Equipment

- Peritoneal Dialysis Equipment Type

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

- Peritoneal Dialysis Equipment Type

-

- Peritoneal Dialysis Product

- Cyclers

- Fluids

- Others

- Peritoneal Dialysis Product

The report has provided a detailed breakup and analysis of the market based on the type. This includes hemodialysis equipment (hemodialysis machines [n-center hemodialysis machines and home based hemodialysis machines] and hemodialysis consumables [dialyzers, dialysate, access products and others]), and peritoneal dialysis equipment (peritoneal dialysis equipment type [continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD)] and peritoneal dialysis product [cyclers, fluids and others]).

End User Insights:

- Dialysis Centers and Hospitals

- Home Healthcare

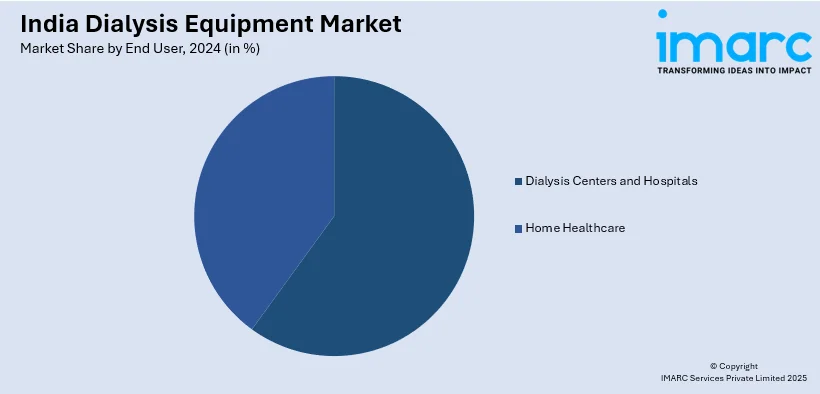

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes dialysis centers and hospitals, and home healthcare.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dialysis Equipment Market News:

- October 28, 2024: Nephro Care India announced working on an AI-based smart hemodialysis machine that can cut costs by 75%, to ₹2 Lakhs from ₹7.5-8 Lakhs. It aspires to improve access to renal care services in semi-urban and rural areas across India. Two hundred twenty thousand new patients are diagnosed with end-stage renal disease each year, and a shortfall of about 65,000 machines, so this innovation is designed to address the gap in the use of dialysis hardware across the country. Moreover, the incorporation of remote monitoring capabilities will facilitate access via remote monitoring, easing travel impediments for 60% of dialysis patients.

- March 14, 2024: Mitra Industries launched a first-of-its-kind triple-chambered peritoneal dialysis (PD) bag with near-neutral pH and low-calculated glucose degradation product, which will help improve the management of chronic kidney disease (CKD) patients in India. As the demand for dialysis grows due to the high incidence of diabetes and hypertension, these advanced PD solutions offer the potential for improved patient outcomes. This launch strengthens the dialysis business in India to meet the increasing need for effective renal care systems.

India Dialysis Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Users Covered | Dialysis Centers and Hospitals, Home Healthcare |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India dialysis equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India dialysis equipment market on the basis of type?

- What is the breakup of the India dialysis equipment market on the basis of end user?

- What is the breakup of the India dialysis equipment market on the basis of region?

- What are the various stages in the value chain of the India dialysis equipment market?

- What are the key driving factors and challenges in the India dialysis equipment market?

- What is the structure of the India dialysis equipment market and who are the key players?

- What is the degree of competition in the India dialysis equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dialysis equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dialysis equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dialysis equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)