India Die Casting Components Market Size, Share, Trends and Forecast by Component Type, Material Type, Process Type, Sales Channel, End Use Industry, and Region, 2025-2033

India Die Casting Components Market Overview:

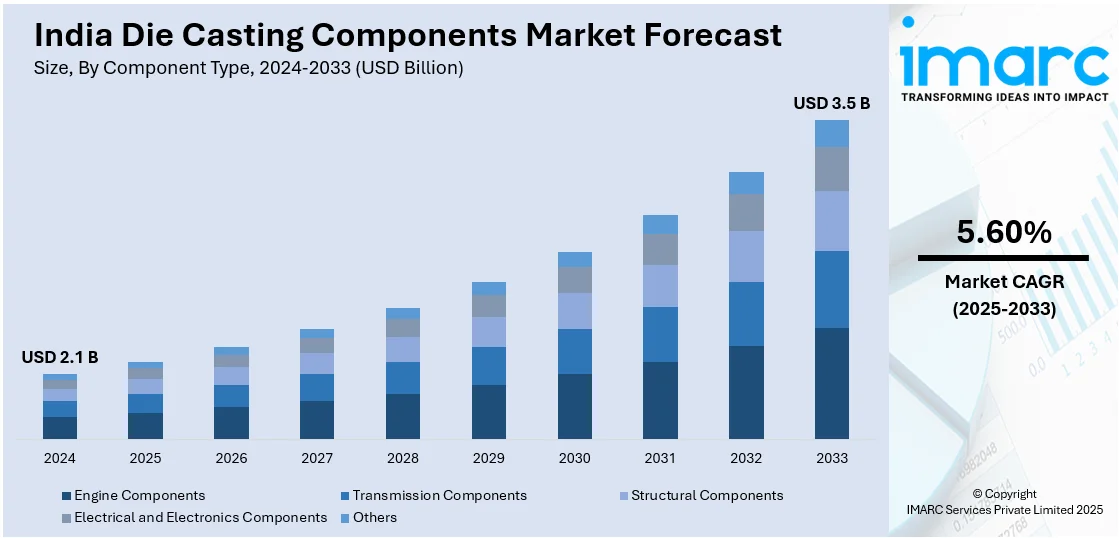

The India die casting components market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The increasing demand for lightweight components in automotive manufacturing, growing industrialization, continual advancements in casting technology, and the rising focus on energy-efficient production processes across various end-use industries are some of the major factors augmenting the India die casting components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Market Growth Rate 2025-2033 | 5.60% |

India Die Casting Components Market Trends:

Rising Demand for Lightweight Components in the Automotive Sector

The increasing focus on fuel efficiency and emission reduction is leading to a growing demand for lightweight die-cast components, particularly in the automotive industry. With government regulations pushing for sustainability and efficiency, manufacturers are adopting advanced die-casting processes to produce high-strength, lightweight components. According to a Press Information Bureau report published on March 25, 2025, since its launch in 2014, the 'Make in India' campaign has profoundly changed India's automotive sector, increasing vehicle manufacturing from 2 Million units in 1991-92 to almost 28 million units in 2023-24. Exports reached 4.5 Million units in FY 2023–2024, and the sector has drawn USD 36 Billion in foreign direct investment over the last four years, contributing around 6% of the country's GDP. The electric vehicle market has also grown, with 4.4 Million registered EVs in the first eight months of 2024, representing a 6.6% market share. The growing adoption of electric vehicles (EVs) is also driving the need for aluminum and magnesium die-cast parts, as they help reduce vehicle weight and enhance energy efficiency. Additionally, advancements in high-pressure die casting (HPDC) and low-pressure die casting (LPDC) technologies are enabling mass production of precision-engineered components, thereby fostering India die casting components market growth. As a result, the industry is witnessing a surge in investments in die-casting facilities and technological innovations. The demand for structural and transmission components is expected to rise, contributing significantly to overall market expansion.

To get more information on this market, Request Sample

Technological Advancements and Expansion Across End-Use Industries

The integration of automation and advanced manufacturing technologies is transforming the production of die-cast components across multiple sectors. With industries such as aerospace, electronics, and industrial machinery increasingly relying on precision die-cast parts, manufacturers are focusing on improving production efficiency and minimizing material wastage. The shift toward Industry 4.0 practices, including smart manufacturing and real-time monitoring, is further streamlining operations and enhancing product quality. According to an industry report, the combination of machine learning (ML) and artificial intelligence (AI) solutions is driving a significant transformation in India's manufacturing sector, accelerating the transition to smart factories. By 2025, digital technologies are expected to account for 40% of manufacturing spending, up from 20% in 2021, reinforcing India's position as a competitive hub for advanced die-casting solutions. Additionally, the increasing use of recycled materials in die-casting aligns with sustainability goals, reducing the environmental impact of production, which is positively impacting India die casting components market outlook. The electronics industry, in particular, is witnessing a rise in demand for die-cast components due to the miniaturization of devices and the need for durable, high-performance materials. With ongoing technological advancements and market diversification, the industry is set to experience sustained growth in the coming years.

India Die Casting Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component type, material type, process type, sales channel, and end use industry.

Component Type Insights:

- Engine Components

- Transmission Components

- Structural Components

- Electrical and Electronics Components

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes engine components, transmission components, structural components, electrical and electronics components, and others.

Material Type Insights:

- Aluminum Die Castings

- Zinc Die Castings

- Magnesium Die Castings

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes aluminum die castings, zinc die castings, magnesium die castings, and others.

Process Type Insights:

- High-Pressure Die Casting (HPDC)

- Low-Pressure Die Casting (LPDC)

- Gravity Die Casting

- Others

The report has provided a detailed breakup and analysis of the market based on the process type. This includes High-Pressure Die Casting (HPDC), Low-Pressure Die Casting (LPDC), gravity die casting, and others.

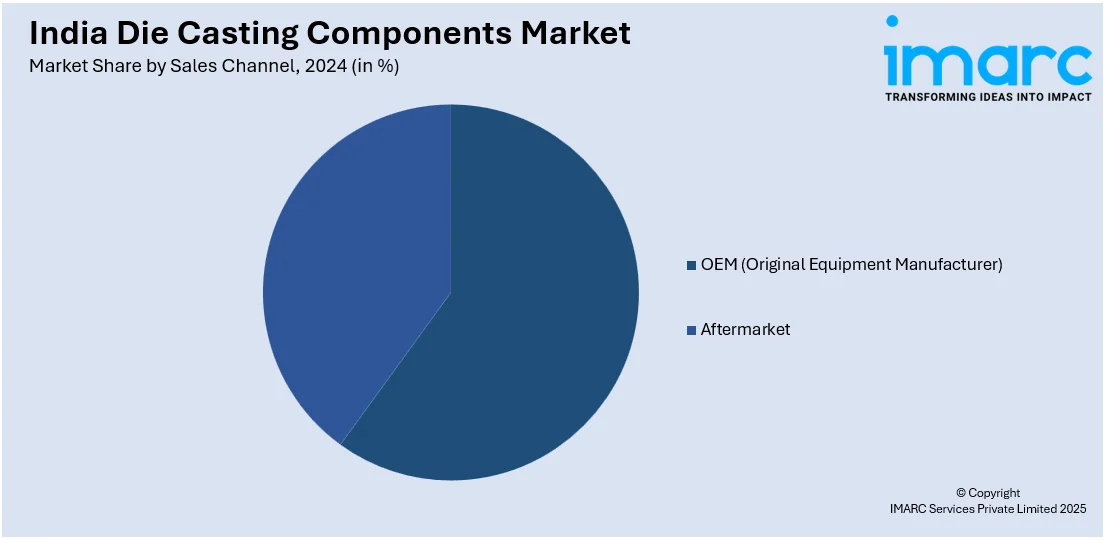

Sales Channel Insights:

- OEM (Original Equipment Manufacturer)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM (Original Equipment Manufacturer), and aftermarket.

End Use Industry Insights:

- Automotive

- Aerospace and Defense

- Industrial Machinery

- Electrical and Electronics

- Consumer Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes aerospace and defense, industrial machinery, electrical and electronics, consumer goods, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Die Casting Components Market News:

- On December 23, 2024, Jaya Hind Industries Pvt Ltd, a division of the Dr. Abhay Firodia Group, installedthe largest 4,400-ton high-pressure die-casting machine in India at its Urse facility near Pune. The machine was manufactured by Buhler-Switzerland. This sophisticated machine allows for the fabrication of heavy-duty gearbox and flywheel housings for commercial vehicles, parts for electric cars, and intricate aluminum structural elements like cradles, shock towers, and housings. This development demonstrates the company's commitment to innovation and puts them in a position to address the increasing need for large, complex structural elements.

- On January 31, 2025, Sundaram Clayton Limited, started operations at its

sophisticated manufacturing facility in Thervoy Kandigai, near Chennai, Tamil Nadu. Precision aluminum die-cast components for next-generation automotive applications, such as sophisticated engine parts, structural components, and lightweight electric vehicle solutions, are the specialty of this cutting-edge facility.

India Die Casting Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Engine Components, Transmission Components, Structural Components, Electrical and Electronics Components, Others |

| Material Types Covered | Aluminum Die Castings, Zinc Die Castings, Magnesium Die Castings, Others |

| Process Types Covered | High-Pressure Die Casting (HPDC), Low-Pressure Die Casting (LPDC), Gravity Die Casting, Others |

| Distribution Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Aerospace and Defense, Industrial Machinery, Electrical and Electronics, Consumer Goods, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India die casting components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India die casting components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India die casting components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The die casting components market in India was valued at USD 2.1 Billion in 2024.

The India die casting components market is projected to exhibit a CAGR of 5.60% during 2025-2033, reaching a value of USD 3.5 Billion by 2033.

The India die casting components market is driven by growing automotive and aerospace sectors, rising demand for lightweight and high-strength components, industrial automation, increasing use of aluminum and zinc alloys, and expanding manufacturing activities across electronics, construction, and consumer goods industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)