India Digital Weighing Scale Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, End User, and Region, 2025-2033

India Digital Weighing Scale Market Overview:

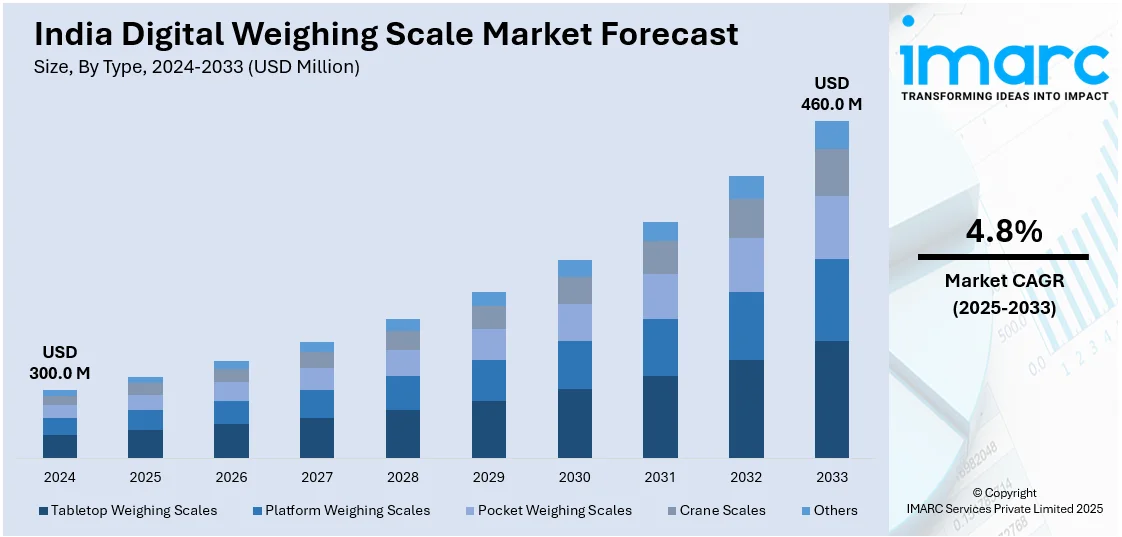

The India digital weighing scale market size reached USD 300.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 460.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.8% during 2025-2033. The market is witnessing significant growth, driven by the increasing adoption of smart digital weighing scales and surge in e-commerce sales of digital weighing scales.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 300.0 Million |

| Market Forecast in 2033 | USD 460.0 Million |

| Market Growth Rate 2025-2033 | 4.8% |

India Digital Weighing Scale Market Trends:

Increasing Adoption of Smart Digital Weighing Scales

Increasing adoption of smart and digital weighing scales is an important trend for the India digital weighing scale market these days, as technology has achieved further advancements and along with that more consumers are demanding connectivity with such digital devices. The weighing scales have been made smarter and are capable of being Bluetooth-enabled, integrated using applications in phones, and even have features for data analytics for checking weight and different health measurements over some time. The trend is particularly earmarked for health-savvy, fitness-oriented customers and those who aspire to monitor their weight in combination with other wellness routines. However, digital weighing scales are getting more popular among consumers due to the increasing smartphone penetration and increasing availability of health-based applications. For instance, in 2024, Indians spent a record-breaking 1.1 trillion hours on smartphones, highlighting the nation's growing digital engagement and deep reliance on smartphones. This shift towards smart scales is also being encouraged by healthcare professionals who recommend continuous weight monitoring for disease prevention and management. Furthermore, the integration of Internet of Things (IoT) technology into digital weighing scales offers enhanced user experiences, such as personalized health suggestions, goal setting, and automated data storage, making these devices an appealing choice for individuals looking to maintain or improve their health. As these technologies become more affordable, the demand for smart digital weighing scales is expected to continue to grow in India.

To get more information on this market, Request Sample

Surge in E-commerce Sales of Digital Weighing Scales

India digital weight balance market has an e-commerce surge in sales as another major trend. This change is a product of the increasing digitalization of the retail landscape and changing consumer purchasing behavior. More and more people now prefer buying digital weight scales through popular e-commerce platforms such as Amazon or Flipkart or specialized online health-related retailers. There is a lot of convenience in online shopping, featuring lower prices, a much broader product range, and easy access to consumer information about the products, making it a preferred option for buying digital weight balances in India. For instance, the Indian electronic weighing machine market is projected to reach $301.5 million by 2032, with the online segment expected to grow to $11.5 million during the same period. Furthermore, the rapid expansion of e-commerce has allowed manufacturers and retailers to reach a wider audience, particularly in tier 2 and tier 3 cities, where access to brick-and-mortar stores may be limited. Online platforms also provide an opportunity for brands to offer detailed product information, demonstrate features, and run promotional campaigns, making it easier for consumers to make informed purchasing decisions. With the increasing penetration of the internet and smartphones in India, coupled with the rise of online payment systems and doorstep delivery services, e-commerce will likely continue to play a significant role in shaping the digital weighing scale market in the country. This trend is further supported by the growth of the fitness and wellness industry, which is driving demand for health-related products through digital retail channels.

India Digital Weighing Scale Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, distribution channel, and end user.

Type Insights:

- Tabletop Weighing Scales

- Platform Weighing Scales

- Pocket Weighing Scales

- Crane Scales

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes tabletop weighing scales, platform weighing scales, pocket weighing scales, crane scales, and others.

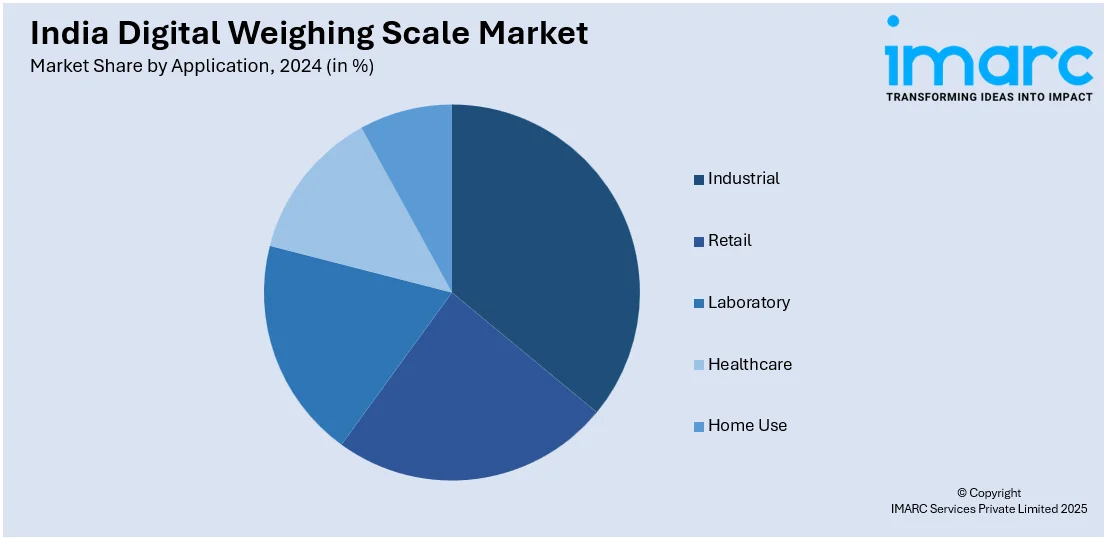

Application Insights:

- Industrial

- Retail

- Laboratory

- Healthcare

- Home Use

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, retail, laboratory, healthcare, and home use.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Digital Weighing Scale Market News:

- In December 2023, The Legal Metrology Division, under the Department of Consumer Affairs, directed all state and UT Controllers of Legal Metrology to verify and stamp airport weighing machines. This follows passenger complaints about discrepancies in luggage weight. The Centre has ordered nationwide inspections and recalibration to ensure accuracy and consumer trust.

India Digital Weighing Scale Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tabletop Weighing Scales, Platform Weighing Scales, Pocket Weighing Scales, Crane Scales, Others |

| Applications Covered | Industrial, Retail, Laboratory, Healthcare, Home Use |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital weighing scale market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digital weighing scale market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital weighing scale industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital weighing scale market in India was valued at USD 300.0 Million in 2024.

The digital weighing scale market in India is projected to exhibit a (CAGR) of 4.8% during 2025-2033, reaching a value of USD 460.0 Million by 2033.

India digital weighing scale market is driven by growth in health consciousness, technological innovations, and industrial automation. The demand from retail, healthcare, logistics, and fitness centers drives the growth of the market. Customers prefer digital and app-enabled scales for precision and ease of use. Online availability and product diversification with smart functionality add more robustness to market demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)