India Digital Camera Market Size, Share, Trends and Forecast by Product Type, and Region, 2026-2034

India Digital Camera Market Summary:

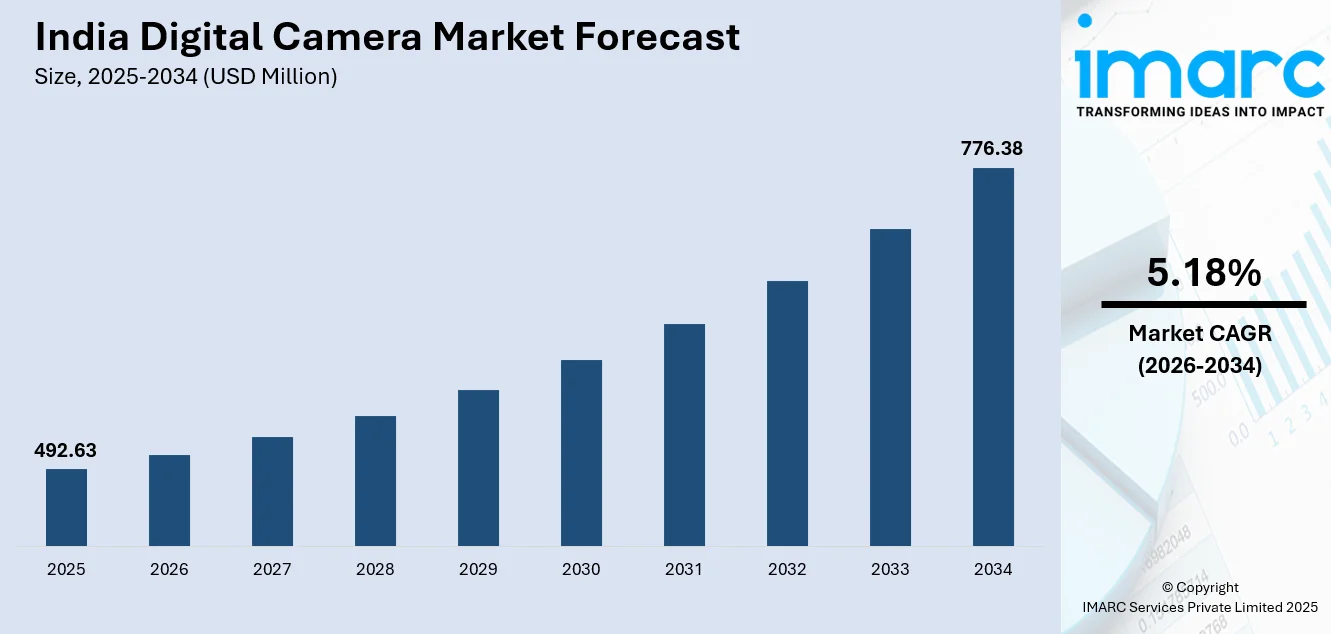

The India digital camera market size was valued at USD 492.63 Million in 2025 and is projected to reach USD 776.38 Million by 2034, growing at a compound annual growth rate of 5.18% from 2026-2034.

As professional photography and content creation continue to grow throughout the nation, the Indian digital camera market is gaining significant traction. Adoption is being strengthened by growing customer interest in high-quality visual documentation, which is backed by increased disposable incomes and better retail accessibility. India is growing as a center for cutting-edge imaging solutions and artistic expression as a result of technological advancements in imaging capabilities and the development of hybrid shooting features that are changing photographic practices.

Key Takeaways and Insights:

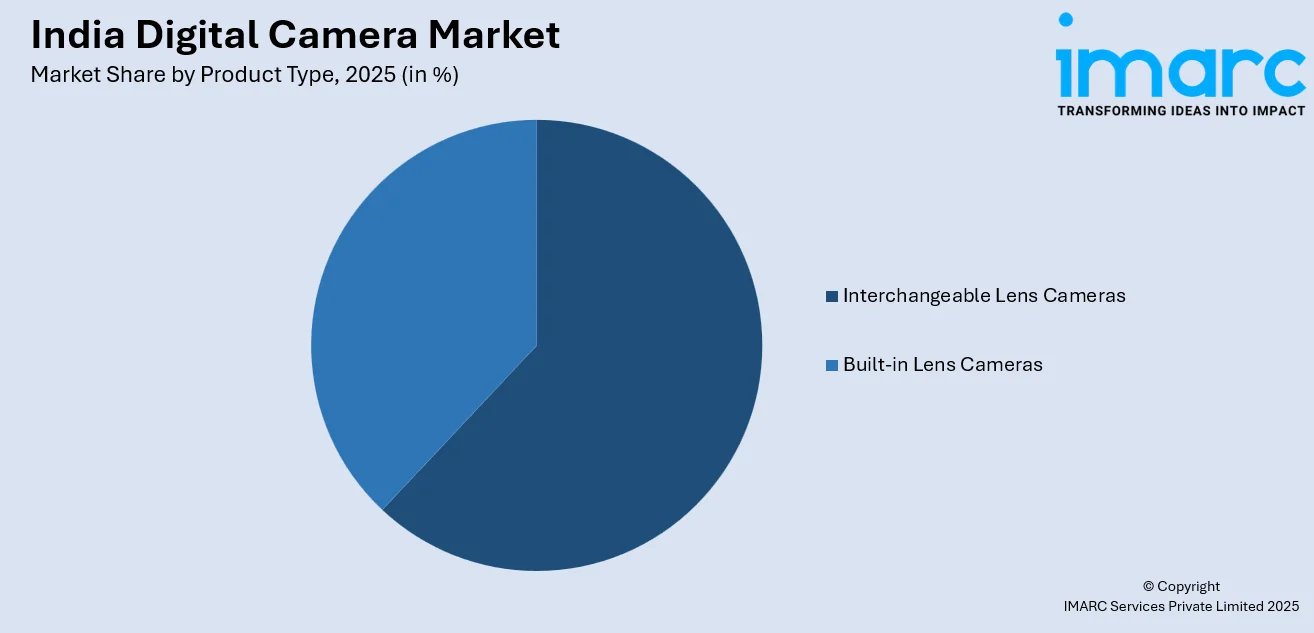

- By Product Type: Interchangeable lens cameras dominate the market with a share of 62% in 2025, owing to their superior image quality, versatility with multiple lens options, and advanced manual controls that appeal to professional photographers, enthusiasts, and content creators seeking creative flexibility.

- By Region: North India is the largest region with 30% share in 2025, driven by the concentration of major urban centers including Delhi and Chandigarh, higher disposable incomes among consumers, and a thriving community of professional photographers and content creators.

- Key Players: Key players drive the India digital camera market by expanding product portfolios, introducing mirrorless innovations, and enhancing autofocus technologies. Their investments in service networks, retail partnerships, and customer engagement programs boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The India digital camera market is advancing as professionals, hobbyists, and content creators embrace superior imaging solutions for diverse applications. The burgeoning creator economy, with over four million active content creators across the country, is driving substantial demand for high-performance cameras capable of delivering broadcast-quality visuals. India's thriving tourism sector, which welcomed 20 Million international visitors in 2024 according to the World Travel and Tourism Council (WTTC), further amplifies the need for professional-grade photography equipment as travelers seek to capture memorable experiences. The expanding middle class, supported by rising per capita disposable income, is enabling greater consumer access to premium imaging products. Additionally, the proliferation of e-commerce platforms offering attractive financing options, competitive pricing, and doorstep delivery is bridging the accessibility gap between metropolitan centers and smaller towns. Photography education initiatives, workshops, and online tutorials are cultivating a new generation of imaging enthusiasts who invest in quality camera systems to develop their creative skills.

India Digital Camera Market Trends:

Rising Demand for Mirrorless Camera Systems

Traditional DSLR systems are giving way to mirrorless alternatives in the Indian digital camera market. Innovations in electronic viewfinder technology and the increasing demand for small, light camera bodies that perform better are the driving forces behind this shift. Both professional photographers and consumers looking for versatility without bulk are drawn to mirrorless cameras with sophisticated focusing systems and faster shooting speeds. Consumer preferences in a variety of photographic disciplines are changing due to the adaptability of interchangeable lens systems and improved video capabilities.

Integration of Artificial Intelligence in Imaging

The landscape of digital cameras in India is changing due to artificial intelligence and computational photography. Intelligent subject detection, automated scene optimization, and improved low-light performance are now possible thanks to sophisticated algorithms that don't require a lot of manual modifications. These clever features give pros strong tools for faster processes while appealing to entry-level users. Indian customers looking for simple yet effective imaging solutions are starting to anticipate real-time image processing, predictive autofocus tracking, and AI-powered noise reduction.

Expansion of Hybrid Photography and Videography

In India, there is a significant need for hybrid camera systems due to the convergence of still photography and video production. Vloggers, social media influencers, and content producers are in greater need of gear that can record broadcast-quality video footage as well as high-resolution photos. Modern cameras with better stabilization technologies, higher video standards, and longer recording times are becoming more popular. The changing demands of India's digital content ecosystem, where flexible imaging technologies facilitate multi-platform content creation techniques, are reflected in this trend.

Market Outlook 2026-2034:

The India digital camera market is poised for sustained expansion as technological innovations and evolving consumer preferences reshape the imaging landscape. Increasing adoption of mirrorless systems, growing content creation activities, and expanding tourism infrastructure are expected to fuel market momentum throughout the forecast period. The market generated a revenue of USD 492.63 Million in 2025 and is projected to reach a revenue of USD 776.38 Million by 2034, growing at a compound annual growth rate of 5.18% from 2026-2034. Rising disposable incomes among urban populations, combined with improved retail accessibility through e-commerce channels, will continue to drive consumer adoption across diverse market segments. Strategic government initiatives supporting digital infrastructure development and creative industries are expected to further strengthen the market ecosystem.

India Digital Camera Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Interchangeable Lens Cameras |

62% |

|

Region |

North India |

30% |

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Interchangeable Lens Cameras

- Digital Single Lens Reflex (SLR) Cameras

- Digital Rangefinders

- Line-Scan Camera Systems

- Built-in Lens Cameras

- Integration Camera

- Bridge Cameras

- Compact Digital Cameras

Interchangeable lens cameras dominate with a market share of 62% of the total India digital camera market in 2025.

Interchangeable lens cameras maintain market dominance due to their unmatched versatility, superior optical performance, and extensive lens ecosystem compatibility. These systems cater to professional photographers, commercial studios, and serious enthusiasts who demand precise control over image quality and creative expression. The ability to swap lenses for different shooting scenarios ranging from wide-angle landscapes to telephoto wildlife photography makes these cameras indispensable for diverse applications. In July 2024, Canon India launched the flagship EOS R1 priced at INR 6,30,995 (only for the body), targeting professional sports and wildlife photographers requiring cutting-edge performance.

Because wedding photographers, commercial studios, and media organizations need dependable equipment that can produce consistent results under difficult circumstances, the professional photography industry continues to fuel demand for interchangeable lens systems. Professional customers justify higher price points with advanced features including weather-sealed bodies, high-speed continuous shooting, and complex autofocus tracking systems. Professional-grade interchangeable lens camera systems are in high demand throughout India due to the country's rising media and entertainment sector as well as the country's expanding corporate photographic needs for marketing and documentation.

Region Insights:

- North India

- West and Central India

- South India

- East India

North India leads with a share of 30% of the total India digital camera market in 2025.

North India commands the largest regional market share owing to the concentration of major metropolitan centers including Delhi, Chandigarh, and Jaipur that host substantial populations of professional photographers and content creators. The region benefits from higher disposable income levels among urban consumers who prioritize quality imaging equipment for both professional and recreational purposes. According to provisional government estimates, India's per capita disposable income reached approximately two lakh fourteen thousand rupees in the fiscal year ending March 2024, with northern metropolitan areas typically exceeding national averages.

The need for cameras in North India is mostly driven by the country's thriving wedding photography business, strong corporate sector that needs expert documentation services, and active social media influencer community. Easy product accessibility and dependable after-sales assistance throughout the region are guaranteed by a significant retail presence from authorized distributors. A steady stream of aspiring photographers who invest in high-quality equipment to hone their talents and build competitive portfolios is fostered by the concentration of photography schools, professional workshops, and training facilities in urban locations.

Market Dynamics:

Growth Drivers:

Why is the India Digital Camera Market Growing?

Expanding Content Creator Economy and Social Media Influence

The exponential growth of India's content creator economy is driving substantial demand for professional-grade digital cameras. With millions of active creators producing content across various platforms, the need for high-quality imaging equipment has intensified significantly. Content creators spanning entertainment, fashion, technology, and lifestyle categories require cameras capable of delivering superior visual output that distinguishes their work from competitors relying on smartphone photography. The rise of vlogging culture and video-centric content strategies has particularly accelerated demand for cameras offering advanced video capabilities alongside traditional still photography features. Creators increasingly recognize that investing in dedicated imaging equipment provides a competitive advantage in attracting audiences and securing brand partnerships. India's creator economy is projected to drive substantial economic activity throughout the current decade, with influencer-driven consumption patterns reshaping purchasing behaviors across multiple consumer categories. This evolving landscape positions digital cameras as essential professional tools rather than discretionary consumer electronics purchases.

Thriving Tourism Sector and Travel Photography Demand

India's robust tourism sector is generating significant demand for digital cameras as both domestic and international travelers seek to capture memorable experiences with professional-quality equipment. The country's diverse cultural heritage, architectural marvels, and natural landscapes attract photography enthusiasts who desire superior imaging capabilities beyond what smartphone cameras can offer. Government initiatives promoting tourism development, including infrastructure improvements at heritage sites and the launch of destination marketing campaigns, are enhancing India's appeal as a photography destination. The revival of international travel following global disruptions has restored tourist arrivals to record levels, with visitor spending reaching unprecedented heights. Travel photographers and tourism professionals require reliable camera systems capable of performing consistently across varied environmental conditions. Adventure tourism segments including wildlife safaris, mountaineering expeditions, and water sports activities demand rugged, weather-resistant camera equipment. The intersection of travel enthusiasm and photography passion creates a sustained market for cameras designed to document journeys and preserve visual memories.

E-commerce Expansion and Improved Retail Accessibility

The proliferation of e-commerce platforms is dramatically expanding digital camera accessibility across India, bridging traditional gaps between metropolitan centers and smaller towns. Online retailers offer attractive financing options including no-cost equated monthly installment plans that make premium camera purchases feasible for budget-conscious consumers. The ability to compare specifications, read detailed reviews, and watch demonstration videos before purchasing empowers buyers to make informed decisions without visiting physical retail locations. E-commerce channels provide access to comprehensive product catalogs that may not be available through local dealers, ensuring consumers can purchase their preferred camera models regardless of geographic location. Flash sales, festive promotions, and exchange programs further incentivize camera purchases through online platforms. Doorstep delivery, flexible return policies, and extended warranty options build consumer confidence in high-value electronics purchases. The continued digital transformation of India's retail landscape is democratizing access to professional photography equipment across socioeconomic segments and geographic regions.

Market Restraints:

What Challenges the India Digital Camera Market is Facing?

Intense Competition from Advanced Smartphone Cameras

The India digital camera market faces significant pressure from smartphones featuring increasingly sophisticated camera systems. Modern smartphones incorporate multi-lens configurations, advanced computational photography algorithms, and high-resolution sensors that satisfy casual photography needs for most consumers. The convenience of having capable cameras integrated into devices carried daily reduces the perceived necessity of dedicated camera purchases. Smartphone manufacturers continuously enhance imaging capabilities through software updates and AI-powered features, further narrowing the performance gap with entry-level digital cameras and challenging market expansion prospects.

High Price Points Limiting Mass Market Adoption

Premium pricing of advanced digital cameras presents a substantial barrier to mass market penetration in India's price-sensitive consumer landscape. High-end interchangeable lens cameras, professional-grade lenses, and essential accessories require significant financial investments that exceed budget constraints for average consumers. Economic uncertainties and fluctuating household finances often compel potential buyers to delay discretionary purchases of expensive imaging equipment. The cumulative cost of building a comprehensive camera system including multiple lenses and accessories can discourage entry-level photographers from transitioning beyond smartphone photography.

Rapid Technological Obsolescence Concerns

The continuous pace of technological innovation in the digital camera industry creates concerns about product obsolescence that influence consumer purchasing decisions. New camera models featuring significantly upgraded specifications are introduced frequently, potentially rendering existing products outdated within short timeframes. Consumers aware of impending product announcements may postpone purchases awaiting newer technology releases. This perpetual innovation cycle complicates buying decisions and can suppress immediate market demand as prospective customers evaluate whether current offerings justify investment against anticipated future improvements and enhanced capabilities.

Competitive Landscape:

The India digital camera market features intense competition among established manufacturers striving to capture market share across diverse consumer segments. Market participants are focusing on expanding product portfolios encompassing entry-level, enthusiast, and professional categories to address varied customer requirements and budget ranges. Innovation in autofocus systems, image stabilization technologies, and video recording capabilities serves as key differentiators among competing products. Manufacturers are strengthening retail networks through authorized dealer partnerships and exclusive brand stores to enhance customer experience and after-sales support accessibility. Strategic investments in service infrastructure covering major cities and tier-two towns build consumer confidence in product reliability and longevity. Marketing initiatives including photography workshops, ambassador programs, and social media engagement campaigns are fostering brand loyalty among Indian photographers. Competitive pricing strategies, attractive financing options, and exchange programs help manufacturers maintain market relevance against smartphone alternatives while cultivating new customer bases among aspiring photographers and content creators.

Recent Developments:

- In January 2025, FUJIFILM India launched the FUJIFILM X-M5, the newest addition to its acclaimed X Series of mirrorless cameras, through a multi-city event offering interactive experiences across the country. The camera features a compact design, advanced imaging technology, and superior image quality, serving as a versatile tool for both professional photographers and hobbyists seeking creative flexibility.

India Digital Camera Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India digital camera market size was valued at USD 492.63 Million in 2025.

The India digital camera market is expected to grow at a compound annual growth rate of 5.18% from 2026-2034 to reach USD 776.38 Million by 2034.

Interchangeable lens cameras dominated the market with a share of 62%, driven by their superior image quality, extensive lens compatibility, advanced manual controls, and versatility that appeals to professional photographers and enthusiasts.

Key factors driving the India digital camera market include expanding content creator economy, thriving tourism sector, rising disposable incomes, improved e-commerce accessibility, growing photography education initiatives, and technological advancements in imaging capabilities.

Major challenges include intense competition from advanced smartphone cameras, high price points limiting mass market adoption, rapid technological obsolescence concerns, economic uncertainties affecting discretionary spending, and limited brand awareness in tier-two and tier-three cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)