India Digital Insurance Platform Market Size, Share, Trends and Forecast by Deployment, Organization Size, Application, and Region, 2025-2033

India Digital Insurance Platform Market Overview:

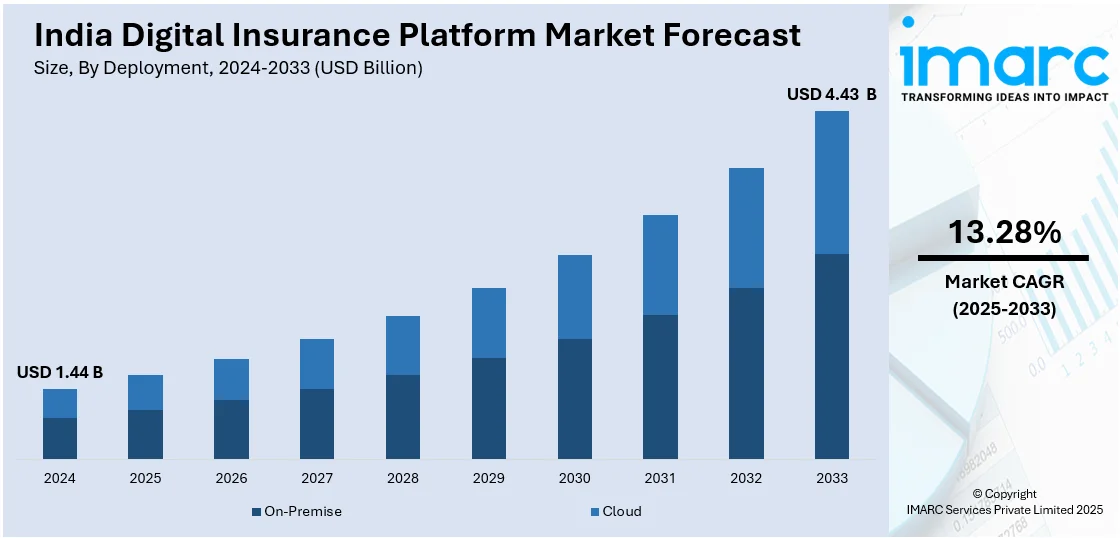

The India digital insurance platform market size reached USD 1.44 Billion in 2024. The market is expected to reach USD 4.43 Billion by 2033, exhibiting a growth rate (CAGR) of 13.28% during 2025-2033. The market growth is attributed to government initiatives, regulatory support, rapid digitalization, technological advancements, rising smartphone and internet penetration, growing financial awareness, substantial adoption of AI and blockchain, expanding InsurTech startups, simplified policy issuance, enhanced customer experience, and seamless claim processing.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of deployment, the market has been divided into on-premise and cloud.

- On the basis of organization size, the market has been divided into large enterprise and small and medium enterprise.

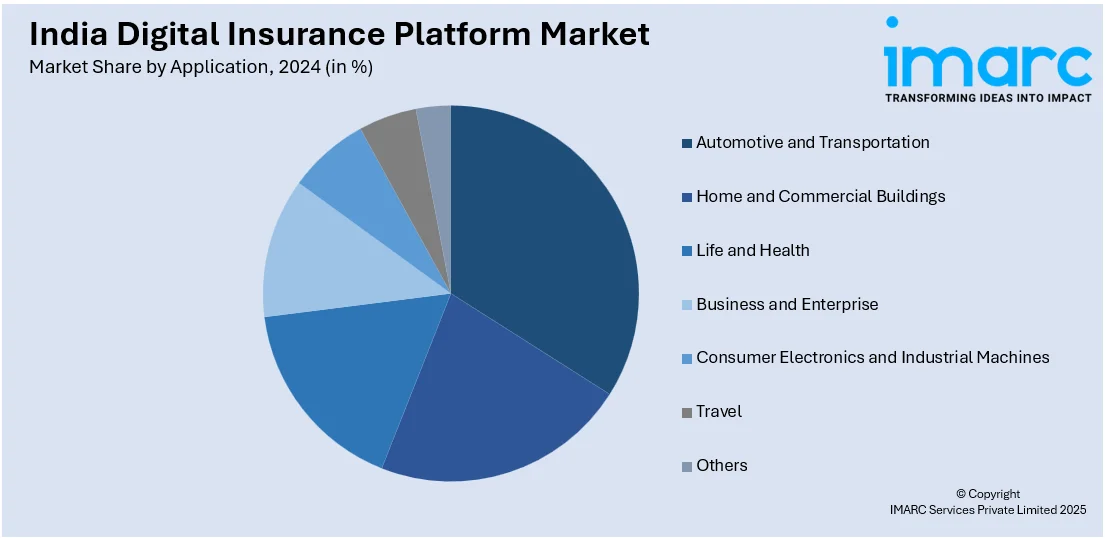

- On the basis of application, the market has been divided into automotive and transportation, home and commercial buildings, life and health, business and enterprise, consumer electronics and industrial machines, travel, and others.

Market Size and Forecast:

- 2024 Market Size: USD 1.44 Billion

- 2033 Projected Market Size: USD 4.43 Billion

- CAGR (2025-2033): 13.28%

India Digital Insurance Platform Market Trends:

Rising Consumer Awareness and Shift in Insurance Buying Behavior

One of the major reasons for the expansion of India's digital insurance platform market is the increase in consumer awareness regarding insurance and a change in purchasing behavior toward online channels. Conventionally, insurance penetration in India was low owing to financial illiteracy, intricate policy designs, and dependence on offline intermediaries. However, the trend has drastically altered in recent times, with increasingly more consumers actively searching and buying insurance via digital channels. The COVID-19 pandemic was the key driver that increased India digital insurance platform market share. During the pandemic, demand for health and life insurance propelled as individuals became more aware of financial security. Industry reports suggest that the number of online purchases of insurance policies in India upsurged by almost 30% between 2020 and 2023, with a large percentage of first-time buyers using digital channels. This shift in behavior has persisted even beyond the pandemic, with customers now opting for the transparency, ease, and efficiency of digital insurance products.

To get more information on this market, Request Sample

Increasing Internet Penetration and Smartphone Adoption

India's digital insurance platform market has progressed significantly on account of the rising penetration of the internet and smartphones. India possesses more than 900 million internet users as of 2024, and it has one of the world's largest online populations. Such widespread connectivity has enabled digital insurance platforms to penetrate more customers, especially in remote and rural areas where traditional insurance penetration was formerly low. Consequently, a large number of insurance companies are transforming their business models into digital-first strategies. Firms are introducing mobile apps, AI-facilitated chatbots, and smooth online policy management options to meet the escalating number of online customers. Digital-first companies like Acko and Digit have become highly popular by providing fully digital, paperless, and hassle-free insurance products. Such platforms offer real-time policy issuing, instant claim processing, and customized policy recommendations based on data analytics driven by AI.

Integration of Advanced Analytics and Big Data Technologies

The market is undergoing a rapid shift with the adoption of advanced analytics and big data technologies, which is enhancing the India digital insurance platform market outlook. Insurers are moving beyond traditional models and embracing machine learning (ML) and artificial intelligence (AI) to process massive datasets drawn from diverse sources like social media activity, wearable devices, telematics, health apps, and payment records. By tapping into these insights, companies can build more precise risk profiles, offer tailored policy recommendations, and improve claim settlement accuracy. Predictive analytics is playing a central role in detecting fraudulent claims early, reducing losses, and improving trust among policyholders. At the same time, real-time data processing allows insurers to make faster underwriting decisions, dynamically adjust policies, and respond instantly to changing customer needs. This shift is not only increasing operational efficiency but also helping insurers deliver seamless digital experiences. With rising internet adoption, regulatory support, and growing demand for personalized services, big data integration is becoming a defining factor in the evolution of India’s digital insurance platforms.

Growth, Opportunities, and Challenges in India Digital Insurance Platform Market:

- Growth Drivers: The rising adoption of smartphones and increased internet penetration are enabling wider access to digital insurance platforms in India. Regulatory initiatives promoting digital transformation in the insurance sector are further accelerating market growth. Growing consumer demand for personalized and convenient insurance solutions is pushing insurers to invest in advanced technologies. These drivers are significantly propelling the India digital insurance platform market growth.

- Market Opportunities: The integration of AI, big data, and machine learning offers insurers the chance to develop innovative products and enhance customer experiences. Expanding into tier-II and tier-III cities presents significant untapped potential due to rising digital literacy. Strategic partnerships with fintech firms and insurtech startups can open new distribution channels and broaden market reach.

- Market Challenges: High implementation costs of digital platforms and advanced analytics tools can limit adoption, especially among smaller insurers. According to India digital insurance platform market forecast, data privacy and cybersecurity concerns are expected to pose risks in handling sensitive customer information. Limited awareness and trust in digital-only insurance models still act as barriers in certain consumer segments.

India Digital Insurance Platform Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on deployment, organization size, and application.

Deployment Insights:

- On-Premise

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes on-premise and cloud.

Organization Size Insights:

- Large Enterprise

- Small and Medium Enterprise

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes large enterprises and small and medium enterprise.

Application Insights:

- Automotive and Transportation

- Home and Commercial Buildings

- Life and Health

- Business and Enterprise

- Consumer Electronics and Industrial Machines

- Travel

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive and transportation, home and commercial buildings, life and health, business and enterprise, consumer electronics and industrial machines, travel, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- August 2025: Binary Semantics’ InsurTech platform VISoF showcased its digital insurance innovations at the FinTech Festival India 2024 in New Delhi. The platform demonstrated end-to-end solutions for policy distribution, claims processing, and customer engagement, with integrations in AI, Big Data, and Blockchain to address India’s insurance penetration and last-mile delivery challenges. Industry leaders highlighted VISoF as a model for how digital platforms can expand accessibility, affordability, and security in India’s growing digital insurance market.

- July 2025: Angel One and Singapore-based LivWell announced a joint venture to establish a digital-first life insurance company in India with a capital infusion of INR 4 billion (USD 48 million), subject to regulatory approval. Angel One will hold a 26% stake, while LivWell Holding Company PTE Ltd will own 74%. The venture aims to address India’s underinsurance gap by offering affordable, protection-led digital products.

- June 2025: Star Health and Allied Insurance partnered with Medi Assist to implement MAtrix, an AI-powered digital claims management platform, marking a major step in modernising India’s health insurance claims ecosystem. The platform introduces intelligent automation, AI co-pilot support, fraud detection tools, and omnichannel engagement, enabling faster settlements, reduced manual intervention, and improved transparency.

- January 2025: The Bima Sugam project, a high-value initiative of the Insurance Regulatory and Development Authority of India (IRDAI), is likely to roll out the first phase in mid-2025. The e-platform will operate as a marketplace for purchasing, selling, and servicing insurance policies, thus raising accessibility and operational efficiency in the insurance industry. Through the rationalization of insurance processes and maintaining transparency, Bima Sugam will give an immense push to the digital insurance platform market of India.

- November 2024: Ideal Insurance Brokers partnered with insurtech firm Riskcovry to launch a digital insurance distribution platform in India. The collaboration shifts Ideal’s operations from offline-heavy processes to a fully digital model, offering real-time business tracking, streamlined workflows, and a customer-facing policy wallet for easier policy management. This initiative marks a significant step in modernizing distribution channels and sets a benchmark for customer-focused digital innovation in India’s insurance sector.

- September 2024: LIC chose Infosys to create its NextGen digital insurance platform, with an emphasis on integrated, cloud-native architecture for improved customer services and operational efficiency. This project improves digital accessibility, simplifies insurance processes, and enables quicker adoption of new technologies. These developments enhance India's digital insurance platform market by enhancing scalability and user experience.

India Digital Insurance Platform Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployments Covered | On-Premise, Cloud |

| Organization Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| Applications Covered | Automotive and Transportation, Home and Commercial Buildings, Life and Health, Business and Enterprise, Consumer Electronics and Industrial Machines, Travel, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital insurance platform market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digital insurance platform market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital insurance platform industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital insurance platform market in India was valued at USD 1.44 Billion in 2024.

The India digital insurance platform market is projected to exhibit a CAGR of 13.28% during 2025-2033, reaching a value of USD 4.43 Billion by 2033.

The growth of the digital insurance platform market in India is primarily influenced by several key factors, such as the growing availability of smartphones and internet access, a shift in consumer preferences toward online insurance purchasing, and supportive regulations that promote digital transformation. The increased convenience, quicker claim processing, tailored pricing options, and collaborations with financial technology firms are also contributing to the adoption of these platforms, especially in urban and semi-urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)