India Dishwasher Market Size, Share, Trends and Forecast by Product Type, End User, Distribution Channel, and Region, 2026-2034

India Dishwasher Market Overview:

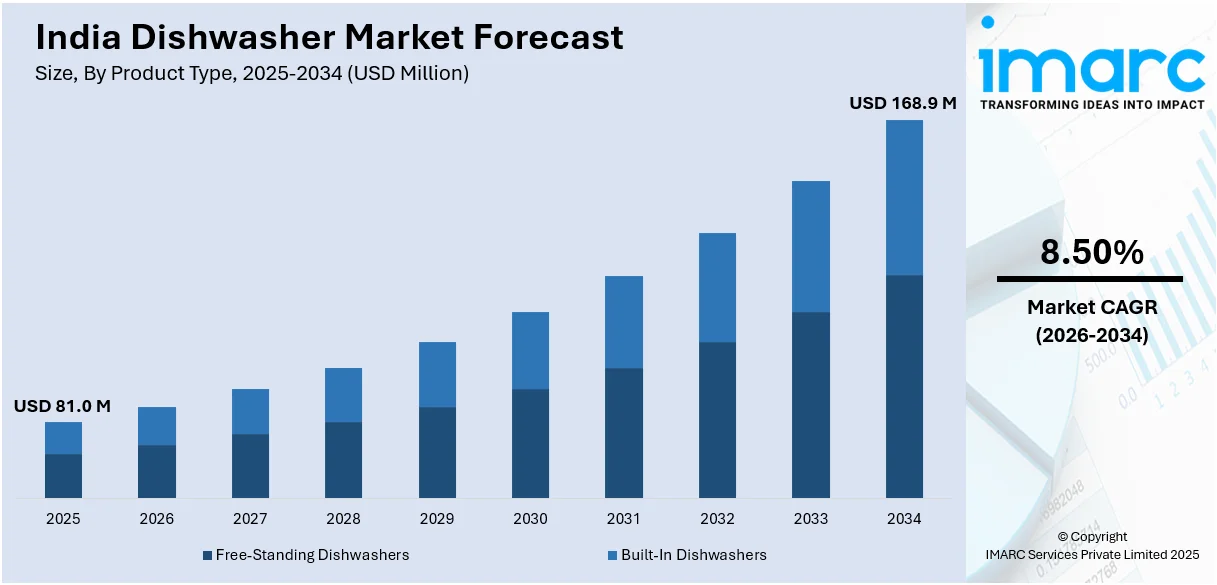

The India dishwasher market size reached USD 81.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 168.9 Million by 2034, exhibiting a growth rate (CAGR) of 8.50% during 2026-2034. Rising urbanization, increasing disposable income, growing nuclear families, expanding working population, changing lifestyles, higher hygiene awareness, surging smart kitchen adoption, e-commerce penetration, energy-efficient models, and government initiatives promoting water-saving appliances are driving the growth of the India dishwasher market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 81.0 Million |

| Market Forecast in 2034 | USD 168.9 Million |

| Market Growth Rate (2026-2034) | 8.50% |

India Dishwasher Market Trends:

Increasing Adoption of Smart and Energy-Efficient Dishwashers

The Indian dishwashing market is growing strongly amid rising consumer preference for smart, energy-efficient, and convenient kitchen appliances. While urban families choose convenience, dishwashers connected with IoT, Wi-Fi compatibility, and AI-enabled sensors are increasingly becoming popular. Such models let users remotely manage and track the dishwashing cycles, ensuring optimization of water and electricity usage. Additionally, rising awareness of sustainability has led to a high demand for Energy Star-rated dishwashers and water-saving technology dishwashers. New dishwashers consume no more than 9-12 liters of water per cycle compared to 60-80 liters consumed in traditional manual washing, which is largely contributing to growing demand. Apart from this, India's smart home business is expected to increase at 15.2% CAGR from 2023-2025, driven by smart kitchen appliances such as dishwashers. Furthermore, the drive toward energy-efficient appliances, backed by policies such as India's Perform, Achieve, and Trade (PAT) scheme, helps customers switch over to appliances that minimize electricity consumption. As technology continues to advance, dishwashers that support AI-based load sensing, energy-saving washing modes, and voice control compatibility will lead the way in sales, especially in urban cities.

To get more information on this market Request Sample

Changing Lifestyles and Increased Affordability in Tier-2 and Tier-3 Cities

The penetration for dishwashers was initially low in India because of cultural factors and the expense of appliances. But, changing lifestyles, nuclear families, dual-income households, and rising affordability have triggered adoption, particularly in smaller towns. As India's urban population is expected to grow to 675 million by 2035, professionals and nuclear families are increasingly choosing dishwashers to save effort and time, with encouraging prospects for market growth. Moreover, leading brands such as Bosch, LG, and IFB are launching entry-level dishwashers with a price tag of INR 25,000-30,000, which make them affordable for middle-class buyers. Concomitant with this, EMI payment through online portals has taken away initial cost hurdles, giving a boost to the market growth. Also, the online market for dishwashers has registered a growth of 40% in 2023 on the back of discounts and special web-exclusive models. Since brands are concentrating on India-specific designs like dishwasher hard water compatibility and Indian utensil adjustable racks, adoption in non-metro areas is likely to pick up speed.

India Dishwasher Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, end user, and distribution channel.

Product Type Insights:

- Free-Standing Dishwashers

- Built-In Dishwashers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes free-standing dishwashers and built-in dishwashers.

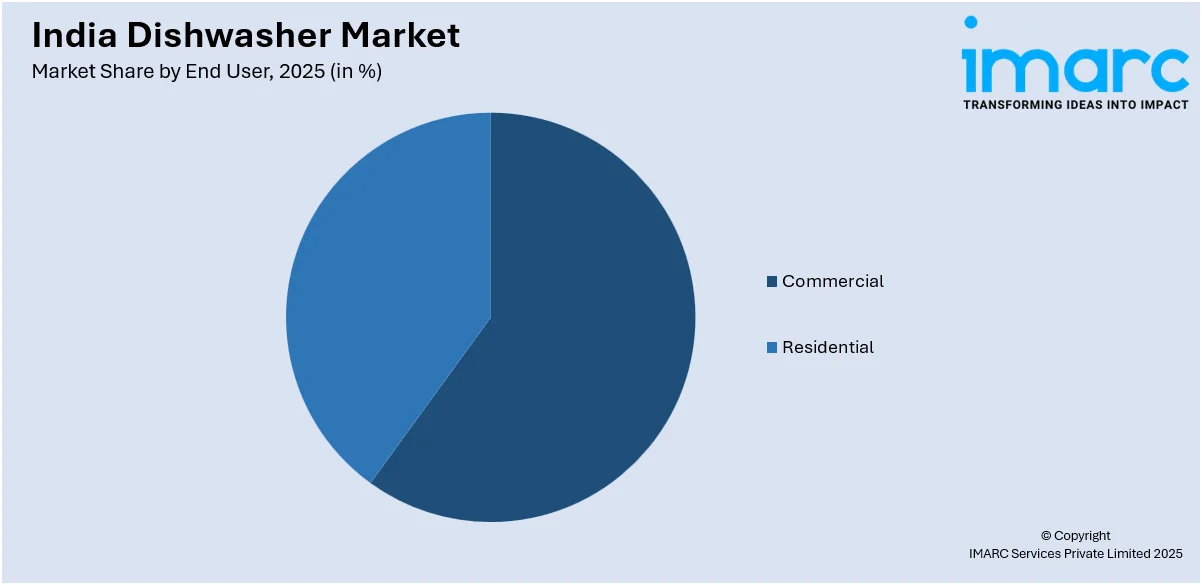

End User Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial and residential.

Distribution Channel Insights:

- Online

- Hypermarket/Supermarket

- Multi Branded Stores

- Exclusive Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online, hypermarket/supermarket, multi branded stores, exclusive stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dishwasher Market News:

- August 2024: BSH Home Appliances introduced a new line of Bosch and Siemens dishwashers geared for bigger Indian households. The cutting-edge versions include a 15-place setting capacity and a stylish stainless-steel base. The dishwashers include built-in Home Connect technology, which allows for remote monitoring and operation via smartphone.

- July 2024: Lufthansa released a new dishwasher series in India, with prices beginning at Rs 21,499, according to TOI Tech Desk. The series, which explores Milan's creative development, follows travel influencer Tanya Khanijow and Milanese art expert Elisabetta Roncati on a tour of the city.

India Dishwasher Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Free-Standing Dishwashers, Built-In Dishwashers |

| End Users Covered | Commercial, Residential |

| Distribution Channels Covered | Online, Hypermarket/Supermarket, Multi Branded Stores, Exclusive Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dishwasher market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dishwasher market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dishwasher industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dishwasher market in India was valued at USD 81.0 Million in 2025.

The India dishwasher market is projected to exhibit a CAGR of 8.50% during 2026-2034, reaching a value of USD 168.9 Million by 2034.

The market is driven by rising interest in automated kitchen solutions, busy urban schedules, and the desire for cleaner, hassle-free dishwashing. Growing acceptance of appliances that save water and time is shaping consumer decisions. Compact models and simplified features are encouraging first-time buyers, especially in nuclear households where domestic help may be inconsistent.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)